The year 2023 has passed with many fluctuations and new market trends. It can be seen that the market in 2023 is much more positive than 2022, but in the general context, we are still facing many risks in TradFi such as economic recession, rising inflation, war,… But Let’s temporarily put those factors aside and look back at the 5 most outstanding innovations in 2023.

What are you waiting for? Everyone, please follow me!

The 5 Most Outstanding Innovations of 2023

LSDfi – Post-Shanghai Upgrade trend

Shanghai Upgrade is an important update for investors on the Ethereum network, especially those who staked on Beacon Chain in the first days (early 2021) and was officially successful on April 13. /2024. With Shanghai Upgrade, users can withdraw their ETH from the Beacon Chain at a 1 to 1 ratio, similar to users putting ETH into the LSD protocols.

Shanghai Upgrade has helped users realize that they can reclaim their ETH from Beacon Chain and LSD platforms at a 1 to 1 ratio, thereby promoting staking to grow stronger than ever. The increased demand for staking has since increased the number of LSD projects. In the period after Shanghai’s success, many new LSD protocols were born such as yEARN Finance, Frax Finance, Swell,…

In the context of too many LSD protocols, a similar number of LST Tokens will be produced by projects such as Lido Finance with stETH, Rocket Pool with rETH, Swell with swETH, Stader Labs with ETHx, Stakewise with sETH, … Therefore, the need for a dedicated market for these types of assets is extremely urgent and from there we witness the birth of a completely new industry in the market, LSDfi.

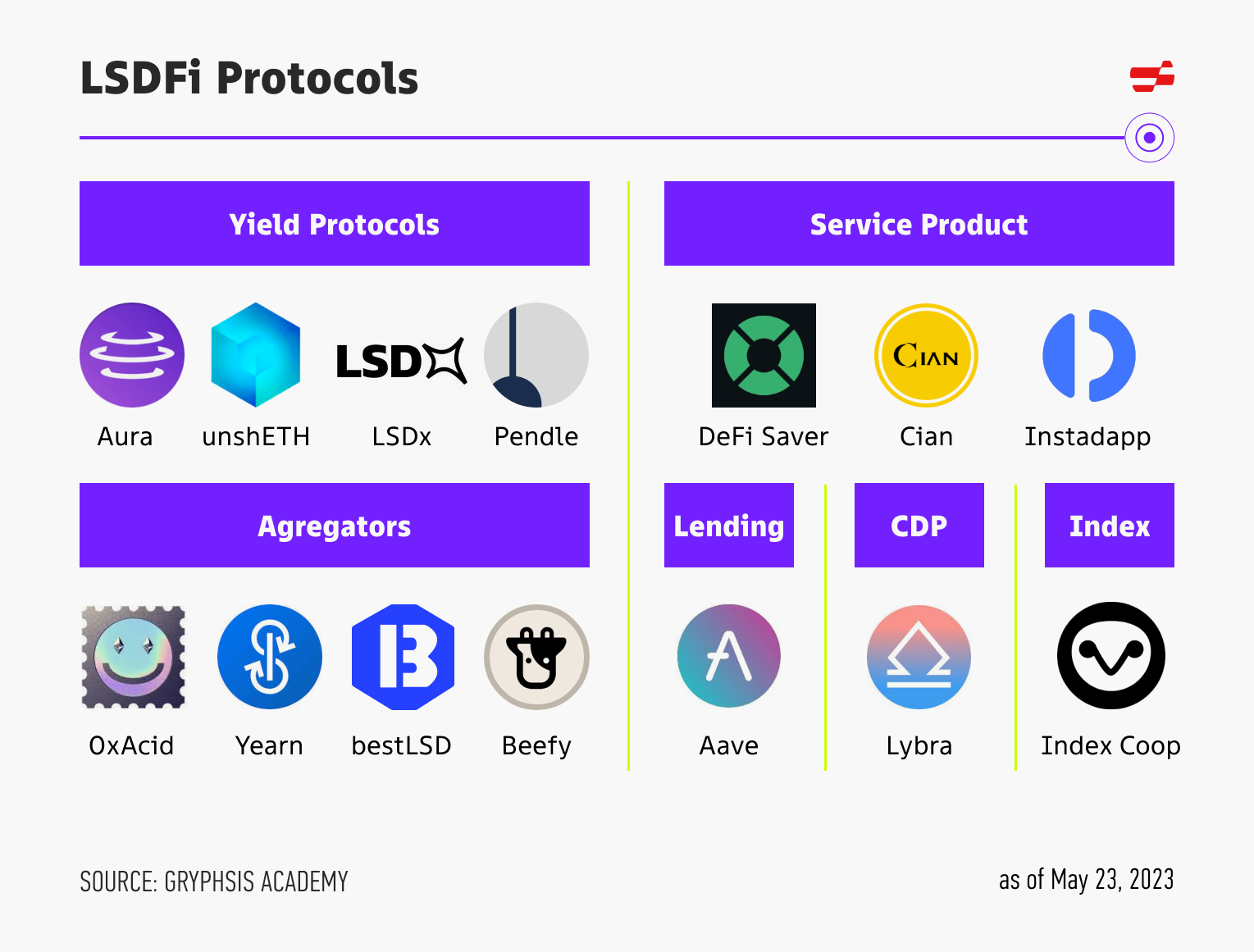

LSDfi sees many different pieces of the puzzle with different projects including:

- CDP allows users to mortgage LST Tokens to issue Stablecoins, thereby using Stablecoins to participate in the DeFi market to get more profits. Some typical projects such as Lybra Finance, Liquidty, Raft, Gravita Protocol, crvUSD of Curve Finance,…

- Centralized decentralized exchange (DEX) platforms for LST Token assets. Some typical projects are Curve Finance or Maverick Protocol.

- Yield Stragetic allows users to profit from LST Tokens. Some typical projects such as Pendle Finance, Agility, Asymetrix, Flashstake,…

- Restaking allows users to continue staking LST Tokens into the EigenLayer protocol to earn additional profits. EigenLayer is the project that introduced the concept of Restaking. The birth of Restaking also opened up new trends in this industry such as Liquid Restkaing and Liquid Native Restaking.

- Diversified Stake is an index fund of LSD projects that helps users put their assets into many different LSD protocols to allocate risk and optimize returns. Some typical projects include unshETH, Index Coop, LSDx Finance.

- Layers are layers operated by Validators with collateral assets of LST Tokens. Some typical platforms such as EigenLayer, Tenet,…

It can be seen that we have seen a miniature DeFi in the ecosystem of LSDfi projects. LSDfi has exploded with a number of names leading investments in Lybra Finance or Pendle Finance.

It can be seen that every update of Ethereum has the potential to create a new trend in the Crypto market and Ethereum is still the cradle of the trend in this market.

Bitcoin Ordinals and the Inscriptions wave

Bitcoin Ordinals was born in the early days of 2023 by Casey Rodarmor, when he launched Bitcoin Ordinals as a method to attach multiple information such as images, videos, sounds, etc. to a single satoshi on the Bitcoin blockchain. origin. It can be said that Bitcoin Ordinals laid the foundation for NFTs on Bitcoin. However, NFTs on Bitcoin have many differences compared to NFTs on Ethereum such as:

- NFT on Bitcoin is 100% on-chain while NFT on Ethereum only has the URL & ID on-chain but images, videos,… are all stored off-chain.

- NFTs on Bitcoin do not support Smart Contracts like NFTs on Ethereum. NFT’s Smart Contract on Ethereum solves many problems such as allocation, staking,…

However, the birth of Bitcoin Ordinals must come from updates Segregated Witness (SegWit) and Taproot for the Bitcoin protocol, which took place in 2017 and 2021, respectively. But at that time neither of these updates was with the goal of creating NFTs on the NFT network. The core element in the two updates that later created Bitcoin Ordinals was the increase in the amount of arbitrary data that can be stored on-chain in a block.

Bitcoin Ordinals gradually developed and was divided into 2 segments:

- BRC 20: These are texts attached to each Satoshi.

- Ordinals NFT: Are images, videos, sounds,… attached to each Satoshi.

To generalize BRC 20 and Ordinals NFT we have the concept of Inscriptions. With the first boom of Bitcoin Ordinals in April 2023, it quickly subsided, making users think this was just a passing trend. By the end of 2023, it flared up again with the support of many exchanges. Large exchanges like Binance or OKX.

From here, the wave of Inscriptions began to move across different ecosystems. Wherever the Inscriptions go, they cause the network there to stagger like:

- Gas fees on Avalanche push up to $5 per transaction with Trader Joe’s Inscriptions BEEG.

- The Arbitrum network had to stop working due to overload for many hours.

- The zkSync network has also encountered certain problems.

- The Polygon network was hit with gas fees and the number of Polygon transactions reached a record high of nearly 16.45 million on November 16, 2023.

It can be seen that this wave reaches all different Blockchains from Layer 1 to Layer 2, from old Layer 1 to newly created Layer 1s. However, this trend quickly fades on new ecosystems due to the model being too simple.

The return of GameFi projects

One of the things that was not too surprising that was predicted to return soon but came back sooner than people thought was the GameFi trend. It can be seen that during the period 2021 – 2022, the number of GameFi and Studio Games projects receiving investments of up to hundreds of millions of dollars with valuations of billions of dollars by investment funds is very large. Therefore, most investors are looking forward to GameFi’s return.

The next generation GameFi projects have been officially launched with beautiful interfaces, attractive gameplay and of course there is still the Earn element but it is no longer mainstream. The two projects leading GameFi’s return are Big Time – a multiplayer action role-playing game, developed in the direction of Play To Earn and Shrapnel – a AAA first-person shooting game. (FPS), built on the Avalanche Blockchain.

Games like Big Time or Shrapnel have brought completely new experiences to participants. Now, to be able to win in these games is not as simple as the 2021 – 2022 games, players must use skills, experience, weapons and especially the power of friendship. .

However, during this period, some games that followed the old development path such as Pixels still attracted a large number of players. However, we still need to play when Pixels’ Governance Token is born and the Airdrop is over, will the project continue to attract players? As for Big Time or Shrapnel, it has affirmed its position with a full economic model.

Friend.tech & spearhead ecosystem trends

Friend.tech represents a mindset of “Think backwards and do things differently” in the Crypto and Social market. For the most part, all social networking platforms aim to be open where everyone can interact with each other. Besides, there are also a few social networking platforms that bring the opposite experience when Users have to pay to get information from their favorite artists, KOLs, Streamers, etc.

Friend.tech may not be too new in creating a closed social networking platform, but it is also creative in many other unique ways such as:

- Build a Key model – where users must hold the room owner’s Key to know what the room owner shares. From there, a Key investment and speculation economy is created by famous people.

- Attract new users with a huge Backer + Hint Airdrop strategy.

Friend.tech has also created a SocialFi wave across ecosystems. Friend.tech forks appear on many different ecosystems such as Tomo on Linea, Post Tech on Arbitrum, Stars Arena on Avalanche, New Bitcoin City on Bitcoin,…

Friend.tech also provided another proof that if an ecosystem wants to attract users or, in the long run, be successful, it must have a spearhead like the successful Arbitrums with the Perp DEX and Solana projects. rising thanks to NFT or Avalanche returning to the track with GameFi projects. The days of platforms having a few pieces of the puzzle about DEX, Lending & Borrowing, Yield Aggregator,… have passed and now much more is needed.

Friend.tech’s strategy of attracting users with huge Backer + Hint Airdrop was later also commonly applied in many different projects such as Blast, Manta Network,…

CCIP, CCTP & Omnichain Trends

Omnichain is a concept that was first introduced by LayerZero in September 2021. However, it was not until 2023 that it became truly popular when it witnessed the participation of many big players. In the context of Blockchain, each Blockchain typically operates independently and has its own rules and protocols. This creates barriers when wanting to interact between chains. Omnichain technology solves this problem by providing a way for chains to “talk” and “understand” each other, allowing for the smooth and secure transfer of data and assets between them.

Some applications of Omnichain include:

- Transfer of Assets: Allows crypto assets like tokens or NFTs to be transferred from one chain to another easily.

- Chain Application: Applications can be developed to operate on many different chains, providing flexibility and scaling for developers and users.

In the history of development of the Crypto market, LayerZero is one of the first projects that laid out the concept and focused on the development of Omnichain. But in 2023, the market witnessed many giants entering this industry with Chainlink’s CCIP and Circle’s CCTP.

- Chainlink’s Cross-Chain Interoperability Protocol (CCIP) was first announced in August 2021 and officially mainnet on July 17, 2023.

- Circle’s Cross-Chain Transfer Protocol (CCTP) was first announced at the Converge22 event on September 28, 2022, and it was not until April 26, 2023 that this product was mainneted.

The two infrastructure giants met unexpectedly when they mainneted Omnichain products in 2023, making the community extremely excited about DeFi, NFT projects,… applying technology. This. Although not a completely new concept, with many big players sharing the same vision, investors believe in the Omnichain trend soon becoming popular in the Crypto market.

Summary

The year 2023 will witness more creativity and innovation in the Crypto market. There are many trends that have emerged but have not really exploded yet and there are still many trends that are smoldering waiting to explode. Hopefully through this article, everyone will have more perspective on the 5 most outstanding innovations in 2023.