Solana and its ecosystem are experiencing strong revivals, making investors recall a dynamic ecosystem in the period 2021 – 2022. One of the notable revivals is Raydium. and could we see the terrible Launchpad platform on the Solana ecosystem come back and regain its position?

What are you waiting for? Let’s find out together whether Raydium can regain its position or not?

Raydium & Past Position

Throughout the history of formation and development of the Solana ecosystem, Raydium has always played an extremely important role in building a rich source of liquidity for the network. When Serum was first born and acted as a giant liquidity pool for the ecosystem, Raydium was one of the first AMMs built on Solana.

At that time, besides Raydium, users had many other choices in the same industry, but in the end Raydium was still the winner and the reason came from the product AcceleRaytor – the first Launchpad on the Solana ecosystem.

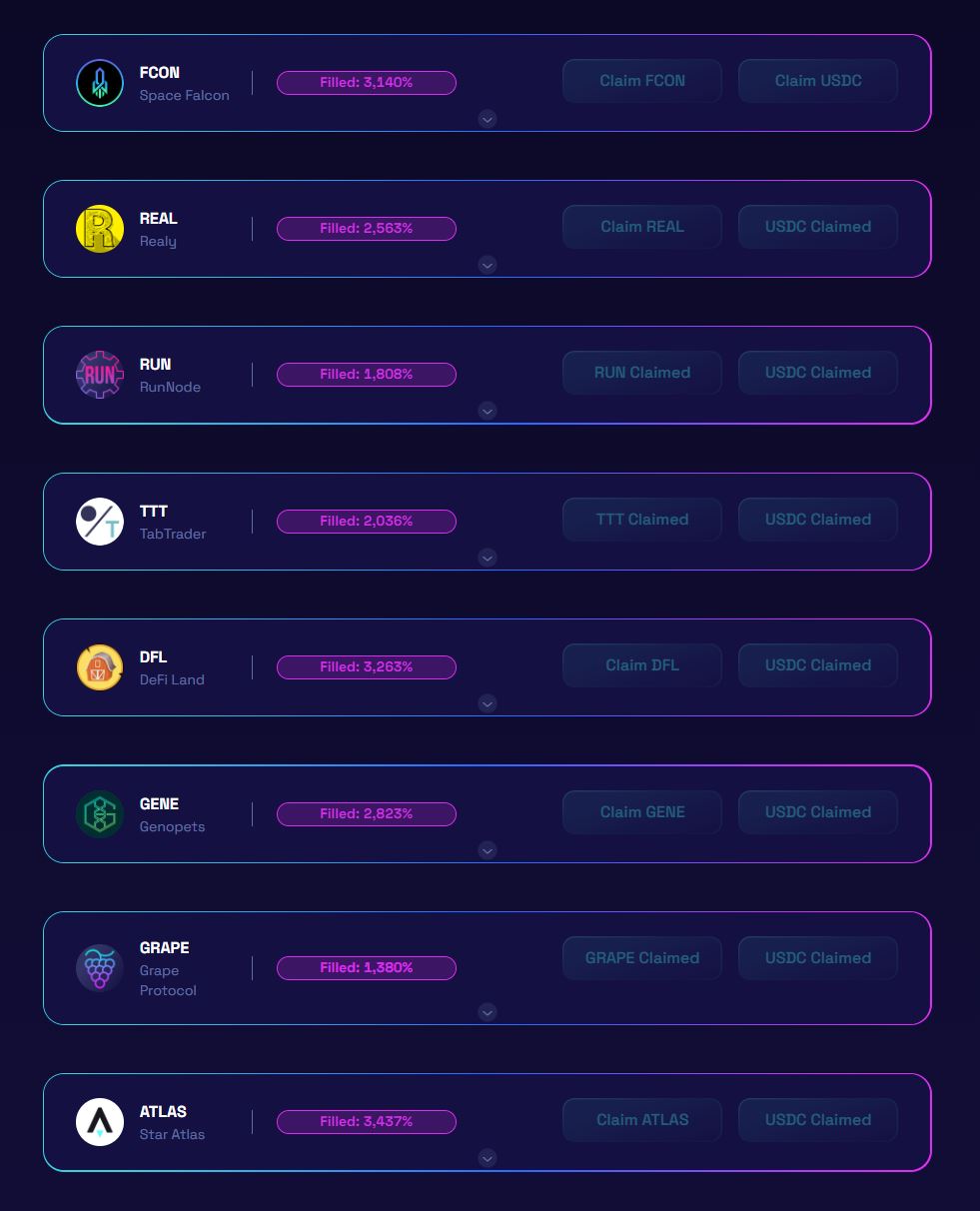

Since launching AcceleRaytor, Raydium has attracted a huge number of projects to its platform and most of them are of extremely high quality. Projects that grew hundreds of times on Raydium began to appear such as:

- Projects that have successfully launched and grown hundreds of times include Star Atlas, Genopets, DeFi Land.

- Projects that have successfully launchedpad and grown at a lower rate of about 10 – 30 times, most projects on Raydium have achieved this level of ROI such as Synthetify, Solrise, Only1, Grape Protocol, Tab Trader, Run Node, Realy, Space Falcon,…

With the AcceleRaytor platform and abundant liquidity, Raydium has quickly become one of the mainstay DeFi platforms in the Solana ecosystem. At the same time, there were many Launchpad platforms launched on Solana such as Solanium, Solstater, Solsster, Star Launch,… but there was not any platform that gained the popularity of Raydium.

When the Solana ecosystem reached its peak of $10B TVL, Raydium reached $2.5B, equivalent to about 25% of the total TVL of the entire ecosystem. At the same time, the number of DApps and Protocols on Solana also reached 3 digits, so the fact that Raydium accounts for 25% of the total TVL of the entire system can show how much influence Raydium has on Solana?

However, with the collapse of FTX and Alameda Research, the TVL of both Solana Ecosystem in general and Raydium in particular both plummeted in TVL. At this point people began to believe that the entire Solana ecosystem would quickly collapse!

Raydium & Current Position

AcceleRaytor is not deployed in 2023

All the projects deployed on AcceleRaytor such as Space Falcon, Yawww, Zebec, Nirvana and Hawksight took place before May 2022 and not long after that we witnessed the collapse of Terra – UST in mid-May then FTX – Alameda Research in November of the same year. From then April 2022 to now December 2023 means that for nearly 2 years there has not been any project implemented IDO on Raydium.

Another bad signal for Raydium is that recent projects deploying tokens on the Solana ecosystem such as Pyth Network, Jito Labs and most likely Jupiter will not launch Public Sales on the Raydium platform or any other projects. No other platform has Airdrops for those who supported the project early on.

Updates and innovations

The last time we saw upgrades, innovations and new product launches from Raydium took place in November 2022 when the development team launched the centralized liquidity model (CLMM). However, that point does not make Raydium different from its competitors on the same platform,

The last time there was information from Raydium in July 2022, Raydium officially introduced Token 2022 – a new token standard on the Solana network.

The product lags behind Orca

In fact, Orca is also one of the first generation AMMs on the Solana ecosystem that was born not long after Raydium. However, Launchpad’s huge shadow makes Raydium almost overshadow all competitors such as Orca, Saber, Atrix, etc. In its early days, Orca emerged as the AMM platform with the friendliest UI and UX in the ecosystem. Solana also has NFT and Token Airdrop programs for its users.

In the winter of 2022, unlike Raydium’s silence, Orca still persists in developing, but the good thing about Orca is that instead of expanding into many different industries to have more users, Orca still diligently develops products. your product. More importantly, Orca always shows off to its users by updating the rewards of the liquidity pools on their platform every two weeks.

Obviously, in the winter of the Solana ecosystem, wherever there are Rewards and Incentives, there will be users and liquidity providers. Orca can do it and Raydium can’t do it. This factor causes Raydium’s liquidity to gradually flow to Orca.

So, although the product does not have too many differences because over time Raydium’s UI and UX have also improved a lot, but the difference in a long-term strategy, Raydium’s AMM product has also officially announced. lost to Orca.

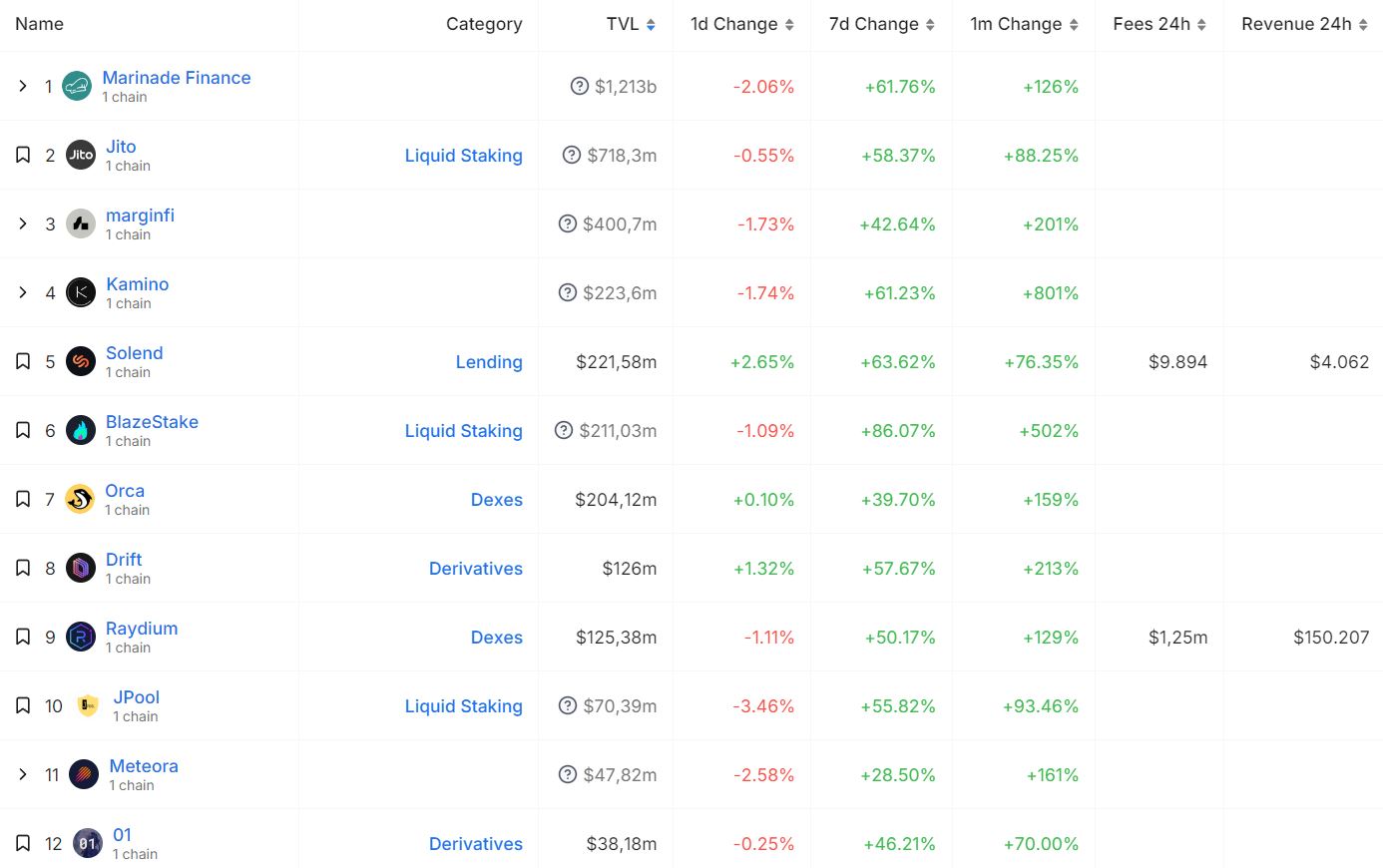

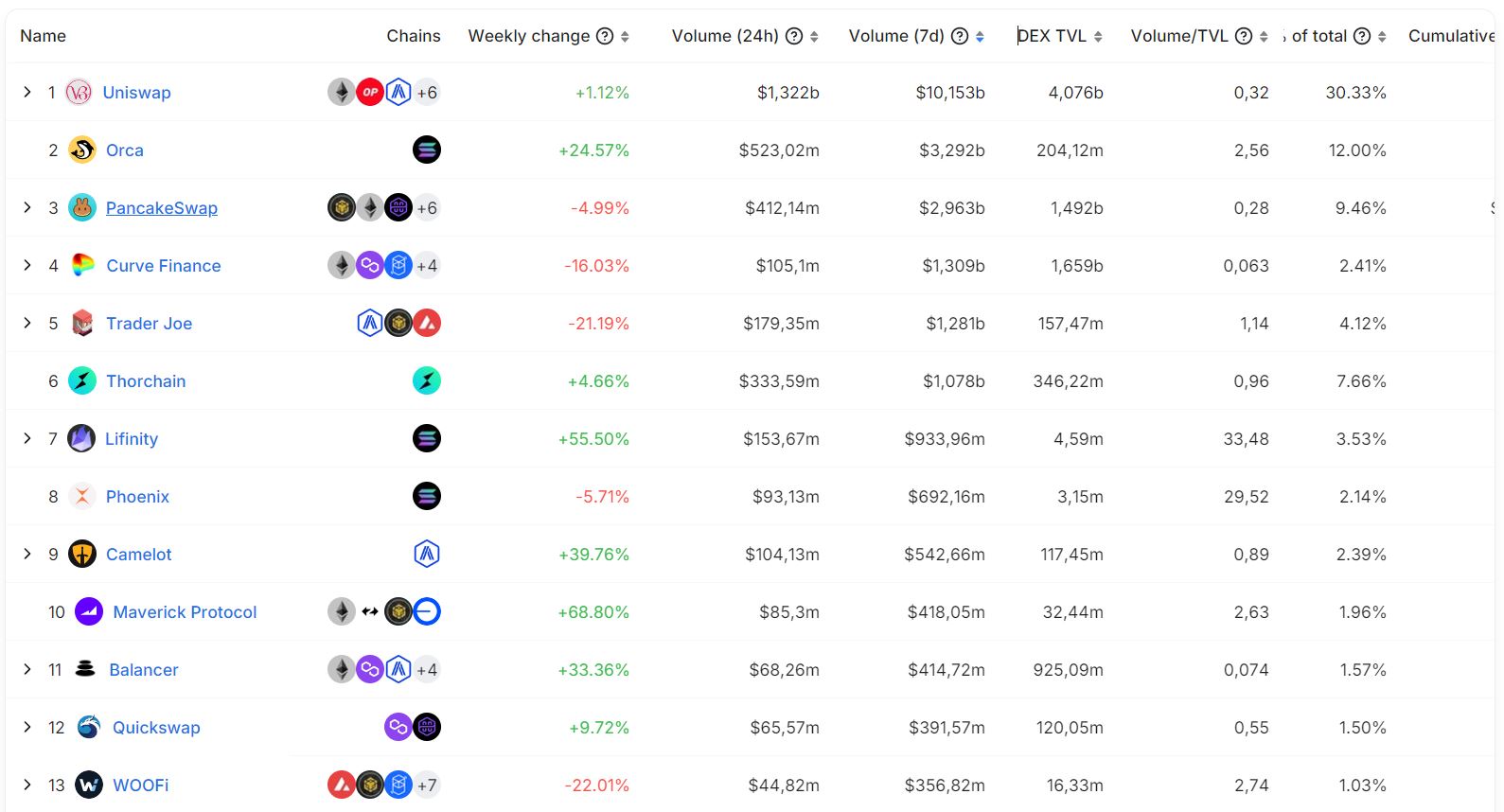

Reality has also shown that during the recent growth period when Orca grew and reached more than $200M TVL, Raydium only had about less than $130M (according to DeFiLlama), however according to Raydium’s own website, the project This currently has a TVL of $200M (but if you subtract about $50M RAY is staking, Raydium’s TVL is only about $150M). So comparing back and forth, Orca has officially surpassed Raydium.

In terms of trading volume, in the past 7 days (from the time of writing), Orca’s trading volume has surpassed many names such as PancakeSwap, Curve Finance, Trader Joe to rank TOP 2 in the entire DEX industry and below that there are Some of Solana’s DEXs such as Lifinity, Phoenix, OpenBook,… It’s a bit unfortunate that Raydium is not present in this ranking for unknown reasons.

However, based on the Coingecko platform, in the past 24 hours (at the time of writing), when Raydium’s trading volume was only about $156M, Orca’s figure was up to nearly $500M while Raydium supports many people. Crypto types and trading pairs are more than double or triple that of Orca. If compared to one of the major DEXs on Solana at the present time, Jupiter is also quite far behind Orca with only about $200M Volume.

Completely lost to AMM from Raydium.

Raydium & Position in the Future

Raydium AcceleRaytor meets a challenge from Jupiter

It can be said that AcceleRaytor is Raydium’s most successful product ever. However, AcceleRaytor may lose its position in the near future as Jupiter recently launched the Jupiter Start program, which specifically includes two products:

- Launchpad: The project has not introduced details yet, I will update everyone as soon as possible. But hearing the name, everyone already guessed 99%.

- Atlas: Allows small investors to access Seed investment rounds of newly launched projects.

Jupiter Start: Educate is an initiative to help qualified users engage in great projects within the @solana ecosystem, growing the pie for everyone!

Our first participant is @ZetaMarkets, an awesome perps protocol who is one of the OGs of the ecosystem! Jupiter users can earn… pic.twitter.com/k7045cYAWZ

— Jupiter

(@JupiterExchange) December 19, 2023

Immediately, Jupiter was the first to participate in Jupiter Educate with the Zeta Markets project – the famous Perp DEX platform on the Solana ecosystem. It is highly likely that this will be one of the first projects deployed on Jupiter Launchpad.

In addition, Jupiter Community Intro is also welcoming many participating projects such as Samoyedcoin – a project about Meme Coin, Ovols – a project about NFT Fractional and Myro The Dog – a project about Meme Coin.

From my perspective, there is a high possibility that if Raydium does not have many changes, the next generation Launchpad platform on Solana will be Jupiter. However, Raydium will still have its own advantages in the Launchpad segment such as:

- AcceleRaytor has been so successful and left a strong mark on both users, investors and projects.

- As one of the first DeFi platforms, Raydium’s relationship and the project’s influence across the entire ecosystem is still huge.

- Because as one of the first and mainstay DeFi platforms, Raydium certainly has a deep relationship with the Solana Foundation. It is relationships like these that will help Raydium regain its position if they want.

However, there is a lot of information on the sidelines that Raydium was one of the first products of the Solana ecosystem development team because at that time there were so few developers that they had to build the pieces themselves. basic graft and now they are ready to pass on the responsibilities to the next DeFi platforms built by the community.

Summary

It can be seen that Raydium is gradually losing its position in next-generation DeFi projects. Perhaps we are witnessing a royal transfer event or a surprise will come when Raydium changes its mantle and then returns, taking back what was lost.