The phrase Sell In May & Go Away has become popular not only in the crypto market but is also spread and considered a truth in the financial market. Sell In May & Go Away implies that the financial market will have bad developments in May and advises investors to remove part of their investment assets before returning in the following months.

In this article we will go through some of the main points as follows:

- Looking back at the crypto market in the first 4 months of the year.

- Things that help us continue to be bullish in May.

- What should we be careful about in May?

Looking Back at the Crypto Market in the First 4 Months of the Year

Price of Bitcoin in the first 4 months of the year

Bitcoin is off to an impressive start in 2023 after a 2022 mired in the collapse of the CeFi empires. At the beginning of the year, Bitcoin was priced at about $16,500, but recently Bitcoin has risen to more than $31,000 and is currently trading around $28,000. Besides, there are some noteworthy points on the Bitcoin chart according to my personal observations:

- Currently on both the weekly and daily frames, BTC price is above the 200 EMA – a long-term indicator for Bitcoin. Normally Bitcoin will grow after breaking out of the 200 EMA and vice versa.

- Golden Cross appears when EMA 50 crosses above EMA 200. Not all but Golden Cross is often a positive indicator opposite to Death Cross.

However, regarding technical analysis, there will be countless different indicators and the above information is only based on indicators that we often observe and should not be considered investment advice.

Things that drive Bitcoin growth

There really hasn’t been any clear growth driver in recent times with the crypto market. When the market recovers, some trends return such as:

- LSD with Shanghai Upgrade

- Token lines from China such as Coinflux

- Arbitrum launches token to create traction for the market. People who do airdrops contribute to bringing cash flow back to the market.

- Meme coin returns to the story of PEPE & AIDOGE.

The fact that the market recovered without a clear cause is a story that is not too difficult to understand and is not too necessary to go into in depth. Our job is to choose an investment method that matches the market trend, thereby saving more money to prepare for a bigger battle ahead in 2024 – 2025.

Things That Help Us Stay Bullish In May

Looking back at 2019

Based on some general information about the recent Bitcoin cycle, we have some of the following parameters:

- Bitcoin Halving: 2016

- Uptrend: 2017

- Downtrend: 2018

- Recovery: 2019

- Bitcoin Halving: 2020

- Uptrend: 2021

- Downtrend: 2022

- Recovery: 2023

- Bitcoin Halving: 2024

- Uptrend: 2025

- Downtrend: 2026

- Recovery: 2027

Note that the items I highlighted are timeline events that are or have not yet taken place.

The Weakhand team has shared very carefully about Bitcoin’s recovery in 2023 in the article Crypto Market Forecast 2023: The Market Will Have a Big Rebound Wave. I will summarize it based on the history that has happened in the past. In the most recent cycle, the current year 2023 will be similar to 2019.

In 2019, Bitcoin grew strongly from a price of about $3,700 to $15,000, equivalent to an increase of about 5 times compared to the bottom created in 2018. Up to now, Bitcoin’s bottom at about $15,500 was set in By November 2022, if Bitcoin price 2023 is the same as 2019, Bitcoin will increase to about $50,000 – $60,000.

However, due to concerns from Macroeconomics, FED interest rate increases, inflation, the Russia-Ukraine War, energy shortages in Europe,… so Weakhand only temporarily provides forecasts. Bitcoin will grow to $40,000 – $50,000 and currently we still predict that the final growth phase of Bitcoin will take place between May and June.

Note: According to Weakhand team’s on-chain analysis, many Whales are currently locking in their principal and even their profits when they have collected a lot of BTC, ETH & Altcoin in the late 2022 period.

Some narrative for the crypto market in May

Remember that the market always has growth drivers to help investors believe in the future based on expectations created by large forces to sell goods and then collect goods. again. So even though everything is extremely positive, it’s time for everyone to take precautions.

Some events will definitely happen this coming May:

- Protocols in the Arbitrum ecosystem will launch incentives to bootstrap liquidity for the project and the entire ecosystem. Please refer to the article Optimism Ecosystem Overview in 2022.

- Sui Blockchain will launch mainnet in the first days of May.

- Coinlist returns with CyberConnect.

- Curve Finance will update more information about crvUSD in May. Will crvUSD be officially deployed in May?

- AAVE is expected to deploy on Metis. Can Metis return?

Some uncertain events that everyone can refer to and then dig deeper:

- Will LSDfi create a fever in the crypto market?

- NFTFi has become a craze this summer.

- Will Convex Wars return before a series of detonators such as Stablecoin and LSD Wars?

What Should We Be Careful In May

The Return of Meme Coins

Obviously AIDOGE took advantage of the airdrop for Arbitrum’s airdrop winning accounts and from there AIDOGE began to grow, explode and be listed on many major exchanges. After AIDOGE is the story of PEPE Coin.

The return of Meme Coins shows that investors are showing signs of excitement and excessive optimism when they think they can buy low, sell high and get rich thanks to the crazy growth of Meme Coins.

The growth of unsustainable trends

Some trends that I personally feel are not too sustainable but have had strong growth in recent times such as LSDfiChinese Coin aka China Coinprojects in the AI industry,… According to my observation, users pouring money into unsustainable trends also shows the optimism of the market.

Recently, there has also been a trend of BRC – 20 being the standard for issuing tokens on the Bitcoin network. According to my check, most of the KOLs who write or tweet about BRC – 20 are mainly those who write in Chinese.

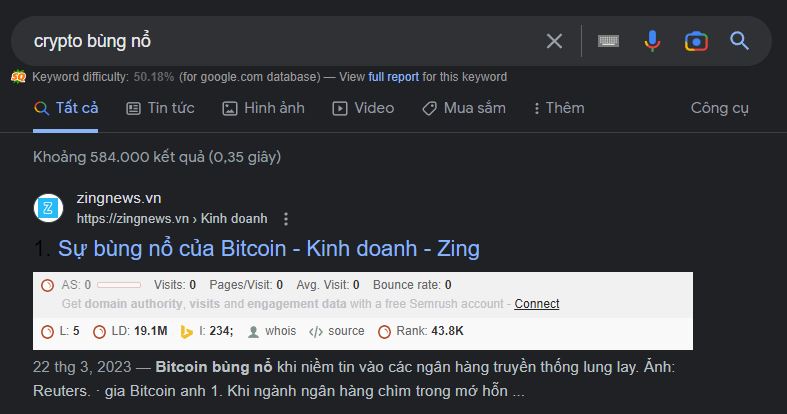

Return of interest in traditional journalism

The press’s interest in the crypto market is often something that crypto people think is not good because when the press only mentions Bitcoin or Crypto, the market at that stage has undergone a growth spurt. The press mentioning Bitcoin is also considered one of the signs of fomo.

Summary

In a market there are always factors that make us believe that the market will continue to increase, continue to decrease or reverse. But from my perspective, the most important thing is that each individual must have a specific and clear plan.

If the market goes down, what plan will be implemented, and if the market goes up, what plan will be implemented. Proactively forecasting and making plans is essential in a market that increases and decreases by 10% every day.