Optimism is showing signs of slowing down in the context of Superchain growing strongly with the participation of many giants in the industry. So let’s dig deeper into what problems the Optimism ecosystem is facing in this article. Let’s update the Optimism ecosystem in August 2023 now.

To understand more about Optimism, people can refer to some of the articles below:

- What is Layer 2? Complete Guide to Layer 2 Solutions

- What is Optimistic Rollup? Overview of Optimistic Rollup

- What is Optimism (OP)? Overview of Cryptocurrency Optimism

- What is Superchain? Overview of Optimism’s OP Stack, OP-Chain & Superchain

Overview of On-chain Metrics on Optimism

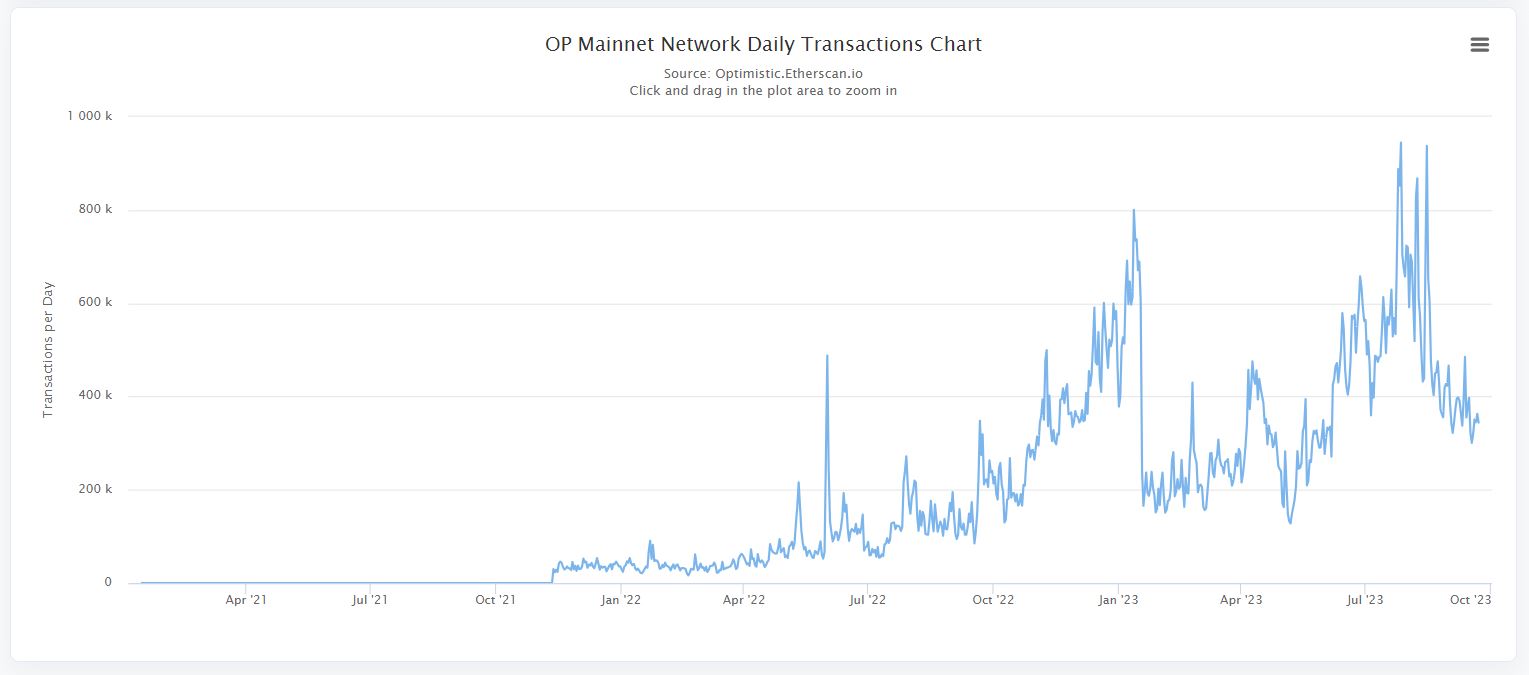

The total number of transactions on the Optimism network has decreased sharply after reaching an ATH in late July and early August with nearly a million transactions per day. Up to now, the number of transactions is fluctuating at less than 400K per day. This could come from a few reasons as follows:

- The amount of Incentive on Optimism is increasingly depleted, currently there are only a small number of projects giving Liquidity Mining OP but the number is relatively small.

- The Optimism ecosystem still does not have many new and worthy names.

- Optimism Foundation is focusing on Superchain and encouraging users to participate in DAO rather than using projects on Optimism Foundation. Demonstrated by Airdrop to DAO participants, not users on the platform.

Number of transactions on the Optimism network

It can be said that if the Optimism Foundation does not take steps to stimulate the development of the ecosystem, the above indicators may continue to fall further and may completely return to the level of 200K transactions per day as at the beginning of the year. .

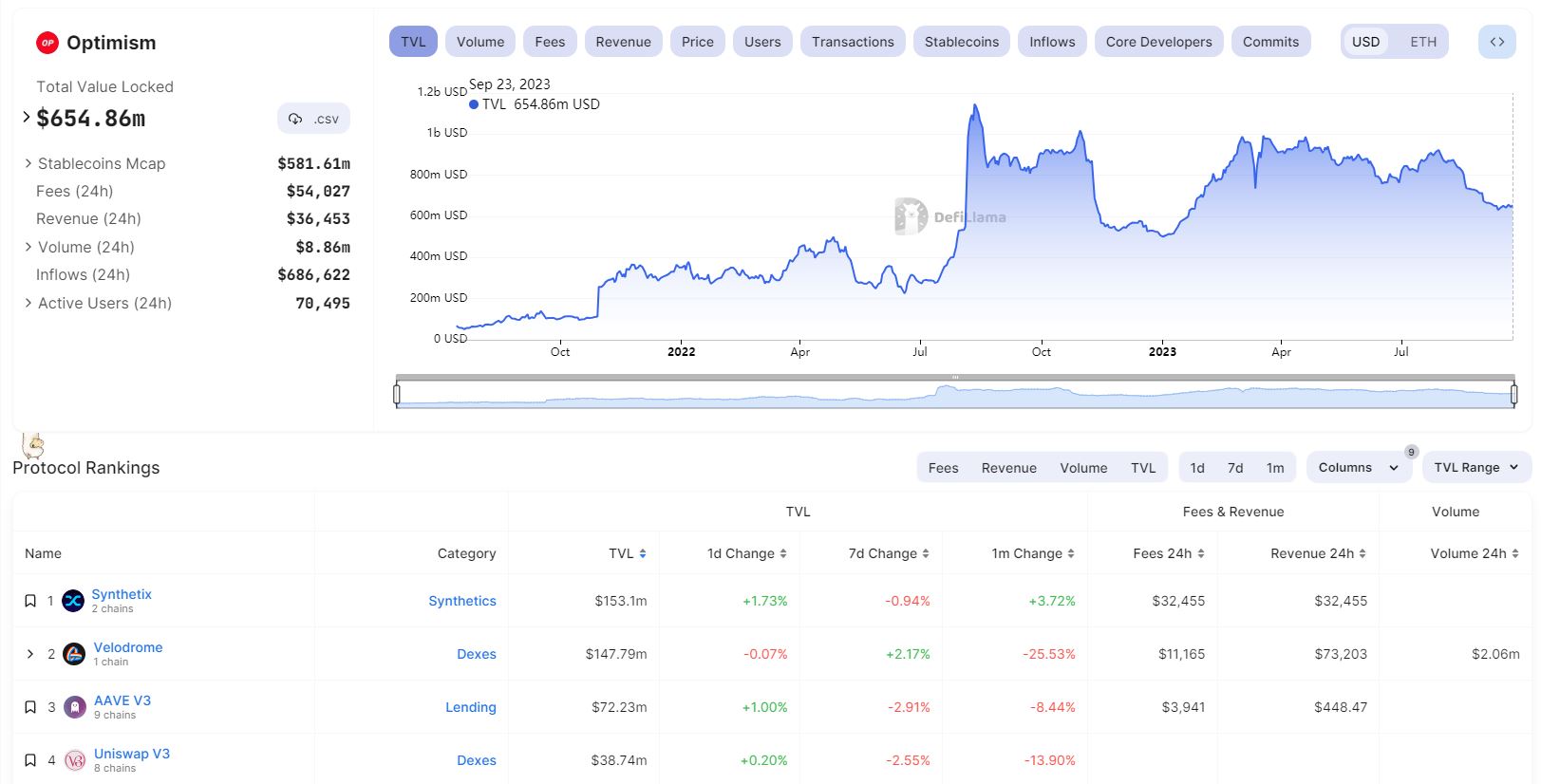

In just 1 short month, the TVL of the entire Optimism ecosystem has decreased from $922M to only about $654M, equivalent to a decrease of about 30%. This number of TVL decreased mainly in some protocols such as Velodrome, Sonne Finance, Yearn Finance or Uniswap.

This is relatively easy to understand, when Base and Aerodrome had an extremely brilliant August, so it is relatively understandable that the cash flow left Velodrome and Optimism to their neighbors. In the past month, there have also been a few protocols with TVL growth such as Stargate Finance, KyberSwap,…

Number of old and new users on the Optimism network

Number of Stablecoins on the Optimism network

Indicator of how active developers are on the Optimism network

Based on some indicators from Optimism we can make some additional comments such as:

- The number of Stablecoins on the Optimism network is still maintaining a high level. What is this amount of Stablecoin waiting for?

- The number of users on the current network is mainly old people, the number of new people joining the platform is non-existent some days.

- The developers on Optimism are still working and developing. However, based on indicators such as Core Developers or Commits, it is not possible to confirm much.

In summary, the Optimism ecosystem is going through a rather boring period when money flow shows signs of flowing to other Layer 2 platforms because of Airdrop/Retroactive.

Optimism Ecosystem Update August 2023

Optimism Foundation’s activities

Today, we are transferring 130M OP tokens between wallets for treasury management purposes. This is an internal, planned transaction and we’re sharing a heads up to keep our community informed.

— Optimism (

_

) (@optimismFND) September 14, 2023

At the beginning of September, Optimism Foundation announced the transfer of 130M OP between different wallets with the goal of treasury management. The fact that 160M OP left the Treasury without going through the community created a wave of outrage because people thought that the Optimism Foundation was going against the spirit of decentralization that they often called for.

Starting today, there will be several transactions totaling approximately 116M OP tokens. We’re sharing as a heads up to our community that these are planned transactions.

— Optimism (

_

) (@optimismFND) September 20, 2023

Just a few days later, Optimism Foundation announced a Private Sale round with 116M OP raising $160M from 6 different investment funds but did not disclose the information. This makes Optimism the Layer 2 platform that has raised the most capital in recent times. So OP was sold to VCs at a price of $1.38 with a 2-year lock-in period, at this price Optimism was valued at $5.9B. This valuation is only $8B lower than StarkWare and much higher than the most recent Arbitrum round in 2021 of $1.1B.

Previously, Optimism successfully called for $178.5M from a few focused investment funds such as Paradigm, IDEO CoLab Ventures, A16Z and Nascent. In the Series B round that the platform called in March 2022, Optimism is being valued at $1.5B.

Announcement

The remainder of unclaimed OP from Airdrop #1 is being distributed directly to eligible addresses.

If you were eligible for Airdrop #1, but you haven’t claimed your tokens yet, you will receive OP directly at your address.

— Optimism Governance (@OptimismGov) September 15, 2023

The amount of OP that has not been claimed by users in round 1 will be sent directly to those users’ wallets without claiming. This equates to 88M OP for over 88,000 wallet addresses. With most of these wallets having most likely lost their Private Keys, this number of OPs is likely to be burned into Optimism’s network.

Today Optimism is announcing OP Airdrop #3.

19M OP allocated to over 31k unique addresses to reward positive-sum governance participation in the Collective.

Read on for details on eligibility criteria and allocations.

— Optimism (

_

) (@optimismFND) September 18, 2023

Optimism’s 3rd Airdrop has officially been launched with 19M OP distributed to more than 31K different addresses as a reward for participating in governance in the Optimism Collective. However, there are also some conditions such as the number of OPs allowed to vote or the delegate time for people in the community.

With this Airdrop, it is clear that the Optimism Foundation is trying to promote DAO’s strong development by building a united Optimism community. However, with the story of 160M OP being transferred out of the Treasury without going through the DAO, it shows that Optimism is not consistent in its approach. Obviously, they could create a 160M OP proposal to sell to VCs for more development capital or Airdrop to supporting members, I believe DAO will support them, but unfortunately they cannot do that.

Applications for RetroPGF Round 3 are open!

In this round 30M OP will be allocated to the builders, artists, creators, and educators who have demonstrated their impact in building the Optimism Collective.

Sign up now: https://t.co/X9BEPzuqap

— Optimism (

_

) (@optimismFND) September 19, 2023

RetroPGF program round 3 has been opened. RetroPGF is a program for Builders, content creators, community educators,… participating in building Optimism’s influence on social networking sites. This continues to be a move that shows that Optimism is still promoting the process of building its own community in the context that Arbitrum also started looking for round 1 Ambassadors who are university students.

Some outstanding information about Optimism in recent times can include:

- USDC Native issued by Circle is officially available on the Optimism ecosystem. This makes Stablecoins on Optimism more efficient, secure and liquid.

- AltLayer – the Rollup As a Service platform, has also officially integrated Optimism’s OP Stack for their Layer 2 scaling solutions.

- Optimism has provided 118M OP to Base within 6 years so that Base can participate in DAO development, in return Base must share 2.5% of profits or 15% of revenue from Base.

- At the ETH Global event, Optimism also sought developers for the ecosystem through the OP Prize in SuperHack.

Activities in the Optimism ecosystem

Velodrome is one of the most active protocols in the Optimism ecosystem. Over the past month, Velodrome has launched Aerodrome extremely successfully on Base when the TVL of this project has rapidly increased from 0 to the highest level of $200M then gradually decreased and is currently at $97M. However, the volume on Velodrome is relatively low, less than $4M per day in the context of Base being attractive, this is an inadequate number.

Besides launching Aerodrome, Velodrome also launched a new AMM, Velodrome Slipstream. Currently, Velodrome is providing a number of products such as:

- sAMM: For peer-to-peer assets such as Stablecoin, Synthetic,…

- vAMM: For volatile assets such as Altcoins BTC, ETH,…

Realizing that centralized liquidity (CLMM) is a market trend, realizing that Uniswap V3 on Optimism ignores some trading pairs with large liquidity, the focus of Velodrome Slipstream is cAMM towards asset types that Uniswap is forgetting like wETH – USDC or OP – USDC,… In many ways, Incentive Velodrome is expected to become the center of Liquidity and Volume on Optimism.

With the launch of cAMM, Velodrome’s model is aiming to be a combination of Curve Finance, Convex Finance, Uniswap V2 and Uniswap V3.

Pika Protocol – Native Derivatives platform on Optimism also launched many new features and updates, including:

- Launched the Position Sharing feature where users can share their positions via social networking sites.

- Listing a series of new products with leverage up to 50x such as Polkadot (DOT), Bitcoin Cash (BCH), Thor Chain (RUNE), Aptos (APT),… In addition, Pika can also deploy other assets. real world assets such as stocks, gold,…

- Some future updates that Pika is aiming for include Referral Program, SDKs for trading bots, Trader Leaderboard,…

Although continuously developing, Pika Protocol is still quite far behind Synthtix’s Kwenta, the reason is because Kwenta currently has quite a lot of OP to do Incentive.

Kwenta is the largest Perp DEX platform on Optimism and is also contributing to Optimism and has many updates such as:

- Supports more assets such as USDC and DAI.

- Launch of Staking V2 program to improve early transaction fee distribution to staking participants. V2 also provides a better infrastructure for future protocol upgrades.

Some potential new projects on Optimism that people can pay attention to early include:

- Aktionariat AG: Real World Assets project allows users to Tokenize many types of assets on a single platform.

- Lemma Labs: Lending & Borrowing platform built by a team that has built several previous DeFi products such as LemmaSwap or Infinity Pools.

- Extra Finance: Launched the Airdrop program for early supporters and officially deployed multichain on Base.

- Sonne Finance: The large Lending & Borrowing platform on Optimism has also had some small updates such as replacing Warrped USDC with Native USDC and improving user experience.

Summary

Through updates, we can easily see that the Optimism ecosystem is going through a relatively boring period. Hopefully, through the August 2023 Optimism ecosystem update, everyone can have more perspectives on this ecosystem.