Known as the fastest Blockchain, faster than Solana, but where is Aptos now when the Crypto market needs it? After a period of quite generous Mainnet and Airdrop, Aptos fell into a deep state with an undeveloped ecosystem. The Aptos ecosystem has many projects and a full range of products but why hasn’t it exploded yet? To answer this question, let’s find out in this article!

To understand more about Aptos, people can refer to some of the articles below:

- What is Blockchain Layer 1? The Importance of Layer 1 in the Crypto Market

- What is Aptos (APT)? Aptos Cryptocurrency Overview

- What is Parallel Execution? Advantages, Disadvantages & Working Mechanism of Parallel Execution

Overview of On-Chain Metrics on Aptos

TVL

Since the Mainnet launch on October 21, 2022 and after taking about 3 months Aptos has reached a peak TVL of $63 million. With this TVL, Aptos is ranked 30th compared to other platforms. Aptos’ TVL has also had a slight decrease at the present time.

Aptos’ ecosystem is also quite large but there is still no breakthrough during this period. This is also understandable since from the time Aptos launched until now the market has always been gloomy and less exciting. But maintaining this stability is also a success compared to an emerging Layer 1 and difficult market like now.

Because it was born first, Aptos has a TVL more than double that of its direct competitor, Sui Network. Although this does not say anything as the Sui ecosystem is still developing day by day.

Bridge TVL

It is difficult to calculate TVL statistics on Aptos Bridge because it uses many bridges. In particular, the two largest bridges on Aptos, LayerZero and Wormhole, both use a locking mechanism on the source chain and Mint wraps on the destination chain (Aptos).

The TVL of Bridge Aptos using LayerZero alone is locking up about $5.2 million. With the use of Mint-Burn mechanism, users will easily transfer assets without liquidity but the problem is that it fragmented liquidity.

Unlike Sui Network, which only focuses on Wormhole bridges, Aptos focuses on providing much support for LayerZero. Although any bridge is huge, LayerZero can connect to many networks, especially Layer 2, the future of the next Uptrend season.

DApps

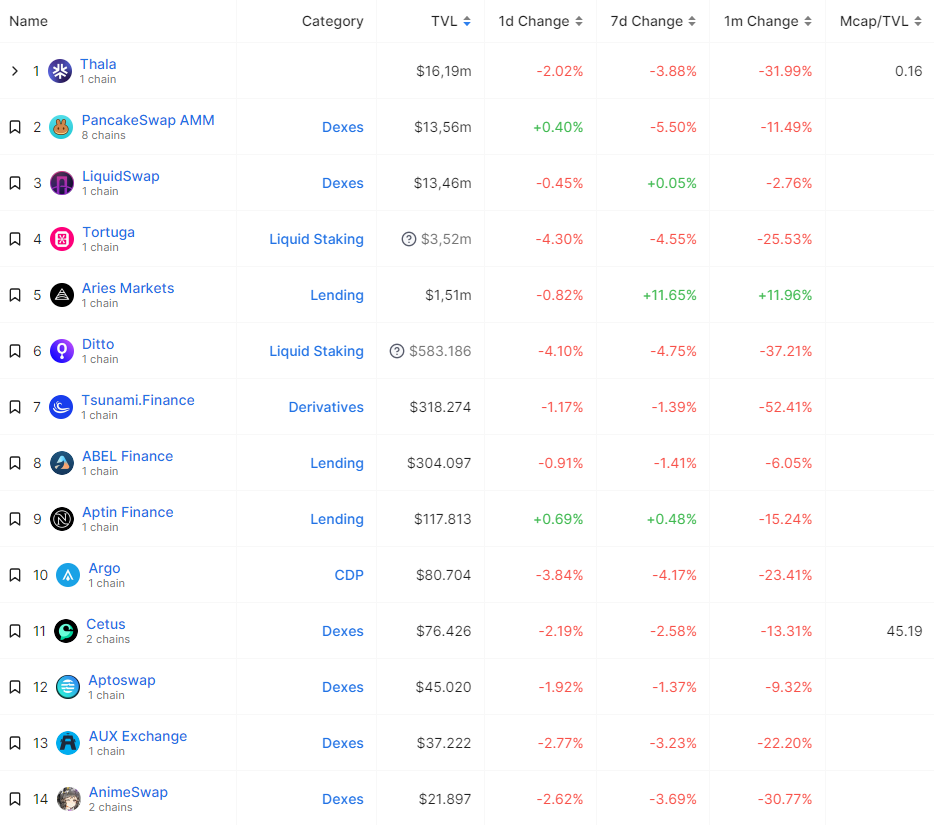

There are about 300 dApps being built and developed on Aptos with a full range of arrays. Of these, there are about 24 active DeFi dApps. Because the number is small and there are not many outstanding or market-attracting projects, Aptos is not very exciting at the present time.

Thala is the protocol with the highest TVL at the moment with a TVL of $16 million. Because Aptos is also a non-EVM, the projects are all Native. But most notable is PancakeSwap, an AMM DEX on BNB Chain that moved to support the Aptos network and is taking the leading DEX position in the Aptos ecosystem.

And another point that we need to pay attention to is another new generation AMM being developed on Aptos. Cetus is a new generation AMM and Sui Network’s leading DEX, so it is also considered a quite special project. But the Aptos ecosystem seems closer to BNB Chain with support from Pancake as well as investment from Binance Labs.

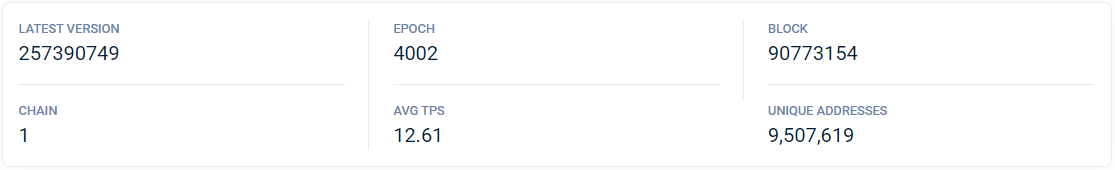

Total Address

Aptos Network has about 9.5 million addresses on the network. This is not a small number and it is large compared to Sui Network, which only has about 6.3 million addresses. Incredibly, this number is also comparable to Layer 2 Optimism’s 9.5 million addresses and Layer 2 Arbitrum’s 12.3 million addresses.

When the Mainnet was new, Aptos had hundreds of wallet addresses that had previously joined the Testnet. That’s why Aptos has developed so quickly.

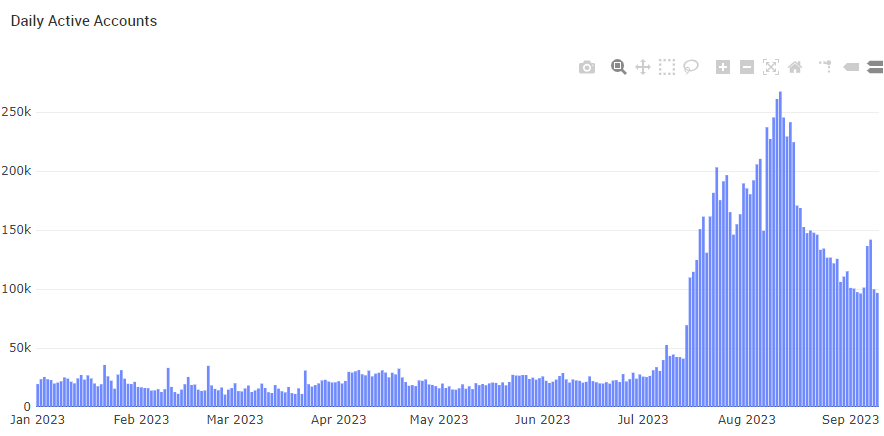

Active Users

Currently, there are about 100,000 active users on the Aptos network every day, this number is quite impressive. Previously, the amount of activity was not much, less than 40 thousand addresses. But after mid-July, the number of active people on the network began to increase, at its peak there were more than 267 thousand active people.

Transactions

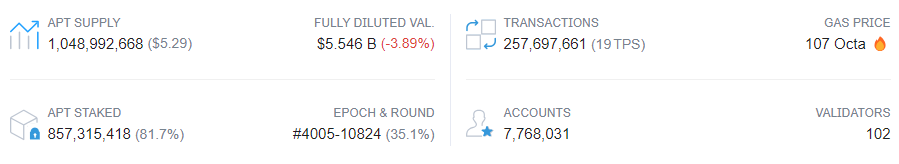

Since its launch, the Aptos network has processed more than 250 million transactions. At present, every day there are about 450 thousand Transactions processed on Aptos Network. At its peak, there were millions of Transactions performed.

TPS

Aptos is known as the fastest network with the ability to process hundreds of thousands of transactions per second and this is true when Testnet. But in reality, Aptos’s daily TPS is only a few dozen, at the highest it reaches more than 6 thousand TPS, this is the lowest number of Solana.

Thus, both Sui and Aptos are far behind Solana in terms of speed. Haven’t seen many updates to their upcoming technology yet, but compared to the original goal of surpassing Solana, they have failed.

Updates Revolving around the Aptos Ecosystem

- Aptos World Tour’s Seoul Hack takes place from February 1 to 3, 2023. 400 people have registered with a total prize pool of $500k, along with continued support of the valuable ecosystem and incubator $2.5 million for projects that continue to build from the Hackathon.

- April 20, 2023: Aptos launches an update that allows APT Token holders to authorize Validators to earn more income as well as increase network security.

- May 2, 2023: Aptos announced that more than 50 projects in the ecosystem have received funding. With $3.5 million awarded to projects in four areas such as developer tools, infrastructure, education and ecosystem.

- May 4, 2023: Announcing the next stop of the Aptos World Tour is Amsterdam. Hackathon takes place on June 5 to 7, 2023 with first prize $30k, second prize $20k, third prize $10k sponsored by Jump, Flow Traders, Syntropy.

Some Outstanding Projects in the Aptos Ecosystem

Thala Labs

Thala is a DeFi protocol developed by Thala Labs on Aptos. The project provides the main product CDP, allowing users to mortgage assets to Mint to issue MOD, which is a Stablecoin pegged to USD. Thala is currently the protocol with the leading TVL on Aptos and is the most important project in the Aptos ecosystem.

Thala also provides products such as Swap via AMM, this AMM provides Pool types for Altcoin-MOD, Stablecoin-MOD pairs and Liquidity Startup Pools. Having many types of liquidity pools will help support many types of assets when paired for trading.

Thala has a liquidity startup pool, so it is a reputable launch pad for new projects issuing Tokens. And use the veToken model by locking THL and MOD-THL LPT at a ratio of 20-80 to share revenue, receive Airdrop from projects participating in the launch pad, bribery market,…

LiquidSwap

LiquidSwap is an AMM DEX developed by Pontem Network, a project that previously built a connection for Diem Blockchain and Polkadot but is currently developing a DeFi ecosystem for Aptos Network such as DEX, Wallet,…

LiquidSwap’s AMM DEX is written in Move language on Aptos, so it has very fast processing speed thanks to the network’s parallel execution ability. Liquid uses both Uniswap V2 and Solidly models to support both Stablecoin-Stablecoin pairs and Altcoin-Stablecoin pairs.

On LiquidSwap there is also a bridge connecting Aptos to networks such as Ethereum, Polygon, BNB Chain, Avalanche, Optimism, Arbitrum built by LayerZero and Pontem Network. This bridge uses a liquidity lock mechanism on the source chain and Mint wrap on the Aptos chain. Although this method helps transfer liquidity easily, does not require liquidity, does not slide prices, it has the problem of liquidity fragmentation.

Aries Markets

Aries Markets is a DeFi protocol that also offers many products such as Lending, Borrow, Swap, Perp. Aries is built on Aptos so transaction processing speed is quite fast. Aries Markets’ orientation is to support the Aptos and Sui Network networks.

Aries Markets’ Lending product uses a liquidity pool to create a borrowing and lending market. With an LTV of 80%, that means a $100 mortgage can borrow a maximum of $80. The loan coefficient also depends on each type of asset, the lower the risk the asset has, the larger the coefficient.

Aries Markets Swap Engine is an Aggregator consumed from the Hippo Labs API. Therefore, Aries offers good trading prices without the need for liquidity depositors on the protocol. In the near future, the protocol will launch a leveraged trading market, also known as Perp DEX, based on the order book.

Aptos Ecosystem Projection

Aptos is a project spun off from Diem Blockchain developed by Facebook. With such great power behind it, we have no doubt that this is a big project. Aptos was born with the mission of solving the speed problem of most current Blockchains and has the ability to surpass Solana.

But until now, Aptos is still far behind its senior, Solana. Aptos’ technology is not yet complete, so it needs time to develop further. With a project that has many talented people from Facebook and Google and has raised hundreds of millions of dollars, the development potential is still huge.

However, the non-EVM direction has never been easy. There are many Blockchains developing in this direction, but only Solana is the most successful. Most dApps, Devs and users are operating on EVM so non-EVM is a barrier for them.

Aptos is developing a non-EVM ecosystem that is also considered successful with a growing number of dApps. Compared to its direct competitor Sui Network, Aptos is more prominent. But the way Sui develops and builds a better ecosystem is through many quality project support programs. On Aptos, there are many Scam projects, especially in the NFT segment.

Summary

The Aptos ecosystem is growing over time thanks to many resources and support from Aptos. But we haven’t seen a niche where Aptos is really strong, to become a key niche competing with other platforms. But anyway, Aptos is also a non-EVM ecosystem that we need to pay attention to to find many investment opportunities.

So I have given the most general overview of the Aptos ecosystem. Hope this article provides a lot of useful and valuable information!