The Optimism ecosystem has recently had active activities in promoting its ecosystem with the goal of regaining its original position. Besides, projects in the Optimism ecosystem also have many changes. And in this article, everyone will join us in looking back at the Optimism ecosystem last March.

To better understand this article, people can refer to some of the articles below such as:

- What is Layer 2? Complete Guide to Layer 2 Solutions

- What is Optimistic Rollup? Overview of Optimistic Rollup

- What is Optimistic Rollup? Overview of Optimistic Rollup

- Optimism Ecosystem: Bedrock Update Nearing Prepares for Growth Scenario?

On-chain Parameters Optimism Ecosystem

Overview number of wallet addresses & transactions

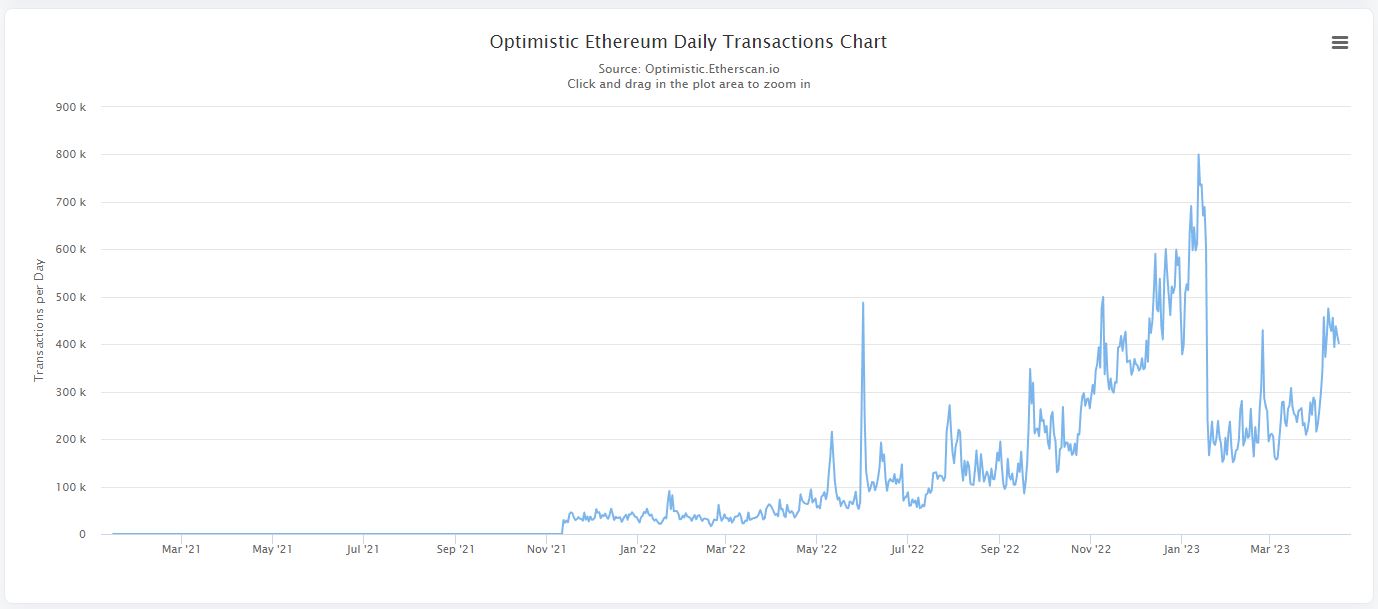

Optimism had a boom at the end of the year when the event of 18 quests on Galxe brought the number of transactions to a peak of 800K trans within 1 day. After that, the number of trans dropped sharply to around 200K per day and it can be seen that the 200K trans per day is based on the actual number of users of the platform.

Entering the new year and in the last March, the number of trans on Optimism increased slightly and hovered around 200K – 300K trans per day. It wasn’t until early April that the number of trans on Optimism skyrocketed to nearly 500K trans per day and maintained until the time of writing.

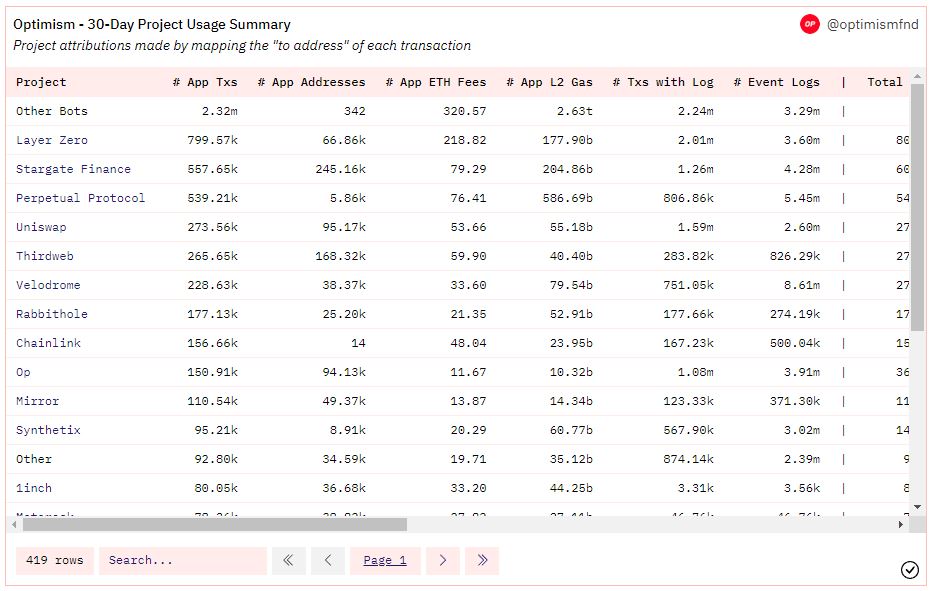

According to statistics from an account on Dune Analytics, the number of projects contributing to the number of transactions on Optimism in the past 30 days is as follows:

- Bots: 2.32M trans

- LayerZero: 800Km trans

- Stargate Finance: 557K trans

- Perpetual: 539K trans

- Uniswap: 274K trans

- Thridweb: 265K trans

- Velodrome: 228K trans

- Rabbithole: 177K trans

- Chainlink: 156K trans

- Mirror: 110K trans

It seems that Optimism is also benefiting users who are farming retroactive on LayerZero and Stargate Finance’s platforms. It is highly likely that this is also the main reason why the number of trans people on the Optimism ecosystem in the period after Arbitrum launched the token had such an incredible growth.

Going deeper into the Synthetix ecosystem, we have some numbers as follows:

- Synthetix: 95K trans

- Thales: 34K trans

- Lyra: 7.52K trans

- dHEDGE: 6.2K trans

- Kwenta: 18.79K trans

It can be seen that despite placing a lot of trust in Synthetix’s ecosystem, Optimism has not yet paid off. However, Perpetual is still doing its job relatively well with Kwenta, but both Kwenta and Perpetual are showing signs of being out of breath before Arbitrum’s GMX. However, in the long term Synthetix is still a notable name.

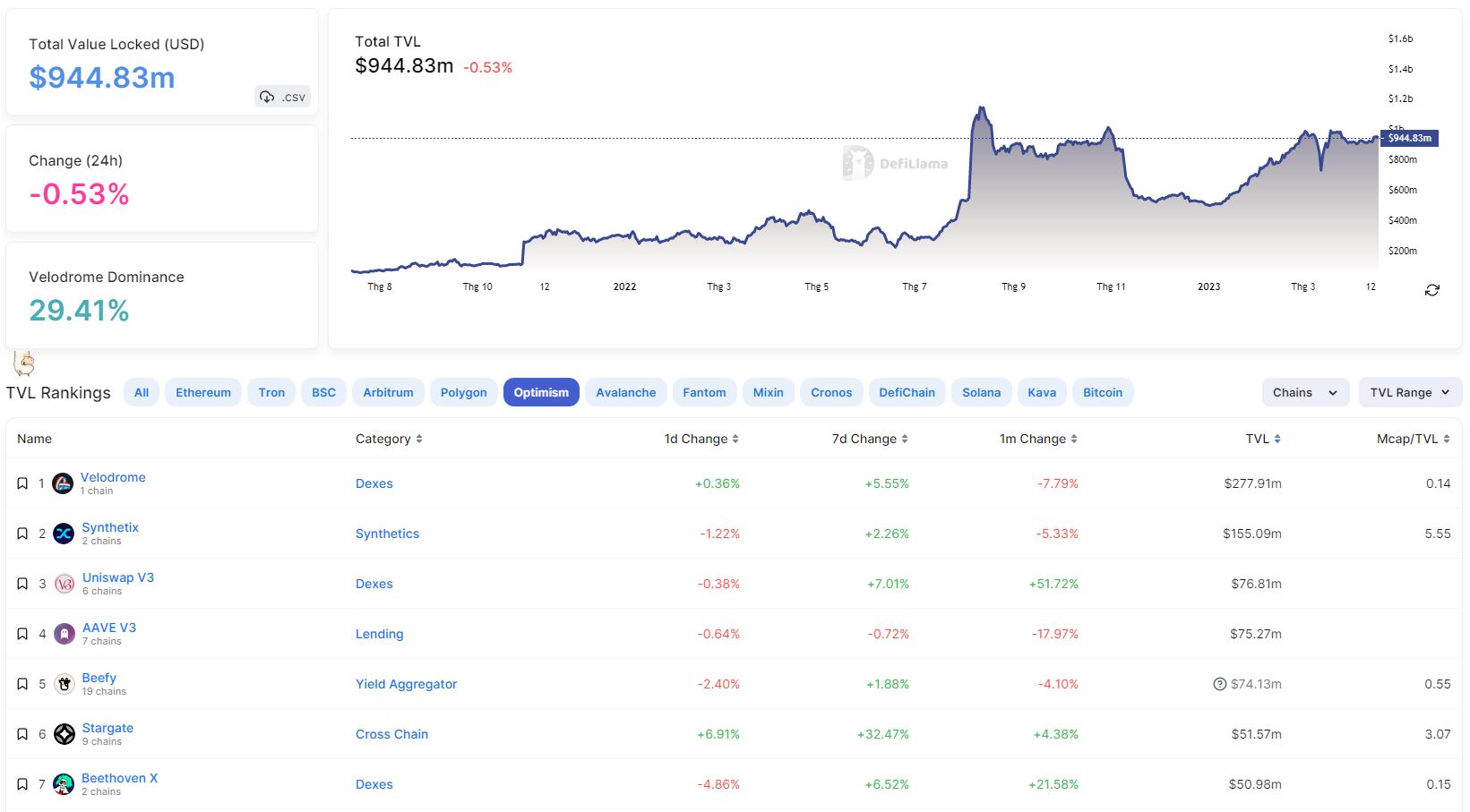

About Total Value Locked (TVL)

Optimism and Arbitrum still share the 2nd and 3rd positions in the top platforms with the largest 2-way TVL Bridge from Ethereum to Layer 2. However, Optimism is far behind Arbitrum, up to a distance of more than $1B, but with the right strategy, Optimism can completely surpass Arbitrum in the near future.

The TVL of the entire Optimism ecosystem did not have any special changes in March. Besides, Velodrome continues to serve as the largest TVL project on Optimism’s ecosystem. Some of the protocols with incredible growth in March on the Optimism ecosystem include: Gamma Strategist, Exactly Protocol, Arrakis Finance, Polynomial Protocol,…

Optimism Promotes Ecosystem Development Using RetroPGF 2

Overview of RetroPGF 2

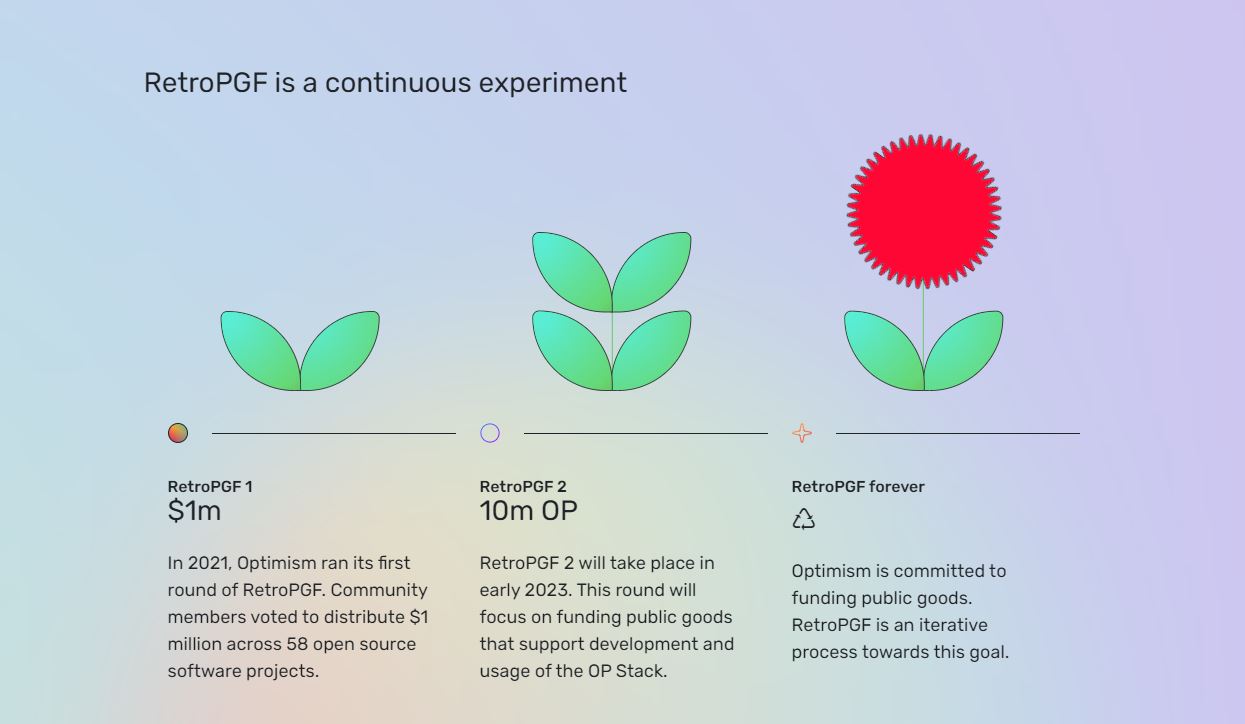

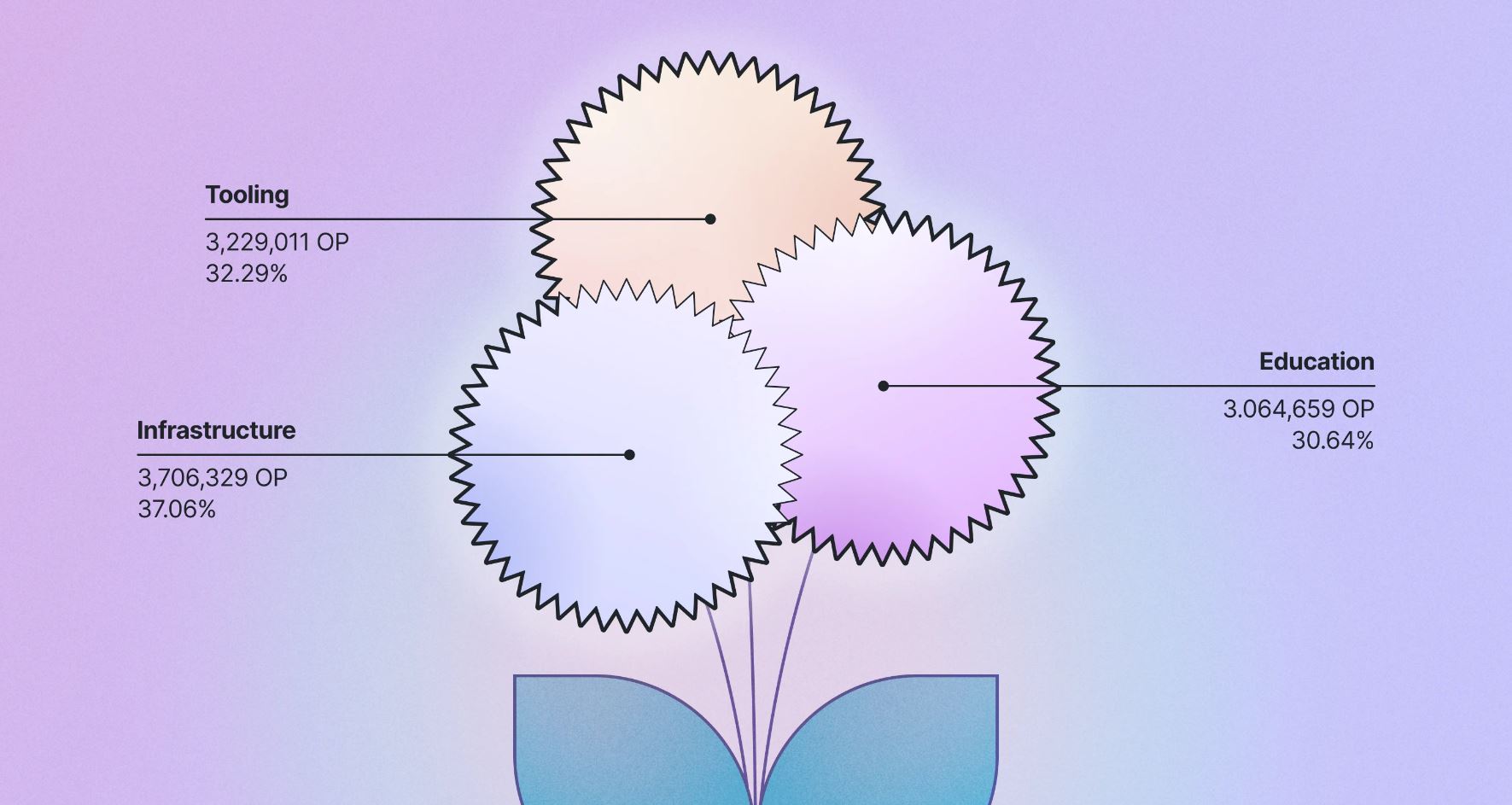

The Citizens’ House was established with the purpose of promoting the development of the entire Optimism ecosystem called Retroactive Public Goods Funding Abbreviated as RetroPGF. Optimism Foundation is committed to distributing 20-% of OP’s total supply through the RetroPGF program. RetroPGF 2 was introduced in January 2023 with the allocation of 10M OP to qualified projects.

Note: Participating in the voting community review in RetroPGF 2 are 90 active and vocal members of the Optimism community who will vote.

RetroPGF 2 has had results and has a lot of positive information such as:

- 10M OP is used for RetroPGF 2 program and is 10 times more than RetroPGF 1.

- 195 people, organizations and projects were nominated for the RetroPGF program.

- The average number of OPs divided among all is 22,825 OPs.

- Top 10% projects

Details of projects receiving incentives from the Optimism Foundation

- Infastructure: Ankr, beaconcha.in, Blobscan, BwareLabs, Create-Crypto, Erigon, Etheres, Lodestars, Flexible Hashing, Lighthouse, Solidity, Teku, Orbiter Finance,…

- Education: cp0x, IC3, Layer2DAO, Node Guardians, OAYC, Rollup Economics Dashboard, Seed Latam, Small Brain Games, TE Academy, Polynya, Optimism FM, L2Beat,…

- Tooling & Utilities: Fire, Snekmate, Dm3 Protocol, Cannon, Cadide Wallet, Boardroom, NFTEarth, Questbook, Praise, Optimism Prices Contracts, Hop Protocol, Flipside Crypto,…

Immediately after RetroPGF 2 is successful, Optimism allows everyone to mint Mirror Subscriber NFT to celebrate the successful event, besides all the mint NFT amount will be transferred to the winning projects, individuals & organizations in the event. RetroPGF 3.

General review of RetroPGF 2

Actively deploying incentive packages for Educate or Developer support channels, I rate this very highly of Optimism. Instead of just incentivizing the ecosystem, RetroPGF 2 for me is a long-term step and creates sustainability. sustainable for the future ecosystem.

Currently, if readers are building useful information and toolkits for Optimism, please sign up to receive newsletters from Optimism to get the latest information about the RetroPGF 3 program: https://optimism. us6.list-manage.com/subscribe/post?u=9727fa8bec4011400e57cafcb&id=ca91042234

Overview of Ecological Optimism in March

Outstanding projects on the Optimism ecosystem

Velodrome – The largest AMM on Optimism

aVelodrome is one of the AMM and StableSwap that operates extremely prominently in the Optimism ecosystem when recently all parameters such as TVL, Volume, Active User or Revenue. Acting as a Liquidity Hub on Optimism and the fact that Optimism also benefits from people plowing retroactively on LayerZero, it is understandable that Velodrome increases.

April 19, 2023: Stargate Finance is voting on joint development cooperation with Velodrome in the near future. If the proposal is approved, Velodrome’s position in the Optimism ecosystem will certainly be strengthened in the long term.

However, after the event of using OP to create a Liquidity Mining program on the protocol to bootstrap liquidity, Velodrome has not had any new updates on new products or activities to attract liquidity.

Synthetix – Continue to develop the ecosystem on Optimism

Synthetix is expected to launch the Perps Optimism Trading Incentives event which will start voting on April 19, 2023 and there is a high possibility that the SIP – 2003 proposal will be successful. Synthetix Perps will use a total of 300,000 OPs over 17 weeks to accelerate the development of the protocol:

- Week 1: 10,000 OP

- Week 2 – 3: 100,000 OP

- Week 4 – 20: 300,000 OP

This is expected to be a strong bootstrap volume and TVL program on Synthetix’s ecosystem and it is likely that the price of SNX – Synthetix’s native token will have positive fluctuations. Besides, we will take a look at some of the outstanding updates of the Synthetix ecosystem in the past month.

- Kwenta: Kwenta has many updates when listing ARB, launching smart Margin Beta Tester, upgrading the system and according to proposal KIP – 70, Kwenta will also deploy Liquidity Mining using OP in the near future to bootstrap the protocol.

- Lyra: To promote the development of Options in particular and Protocols in general, Lyra is preparing to launch the Trading Reward V2 program with rewards of nearly 80K ARB, 30K OP and 300K Lyra for those in the top trading positions.

- Thales: After officially deploying on Arbitrum in early March, Thales has not had many outstanding updates.

- dHEGDE: In order for users to be able to create strategies automatically, dHEDGE has also introduced a new product called Automate Your Strategy and dHEDGE will also launch the staking product V2

It can be seen that the Synthetix ecosystem is relatively busy, especially in the high possibility that Synthetix, Lyra and Kwenta will deploy Liquidity Mining with the amount of OP and ARB received from the two-sided foundation to bootstrap liquidity for the protocol and the entire system. Ecosystem.

Perpetual – Perp is the most active on Optimism

In March, Perpetual launched a new product called Hot Tub – based on arbitrage with low risk and high profits and in the first month, Perpetual’s product was not really popular. It’s possible that Perpetual hasn’t made a big media splash yet, and with the product being ETH, the price difference between exchanges isn’t really high.

In addition, Perpetual continues to implement the GrantDAO program to fund projects being built on Perpetual’s ecosystem. Some of the protocols that have received grants from Perpetual include:

- Teahouse: Is a Yield Farming platform based on providing liquidity on Perpetual to earn profits.

- Trading View

- Rust CLI: A project that provides tools for projects to easily integrate Perpetual.

- PerpSim: Is a project that evaluates the risks of protocols in the DeFi market and predicts future protocols based on the current and past project situation.

- Party Finance: Party Finance is a financial platform that allows users to open Long – Short orders based on abundant liquidity from Perpetual. The project is currently deployed on Perpetual’s ecosystem.

It can be seen that Perpetual is trying to build a sustainable ecosystem that can grow in the long term. Currently, Perpetual’s position is quite far behind that of dYdX or GMX.

Summary

Besides, it can be seen that at the present time, projects on Optimism’s ecosystem are quite quiet after a period of boom and ceding Spotlight to Arbitrum. However, with long-term orientations and roadmaps, I am quite confident that Optimism will soon return in the near future.