As one of the extremely successful protocols in the DeFi 2.0 trend with the Protocol – Own – Liquidity model, Olympus DAO is currently using the amount of liquidity it owns to build an ecosystem of its own. In this article, I and everyone will continue to review the projects being supported or built by Olympus DAO.

To understand more about this article, people can refer to some of the articles below:

- What is Olympus Knife (OHM, gOHM)? Overview of Cryptocurrency Olympus Dao

- Olympus DAO Ecosystem: Sowing the Seeds for the Next Growth Cycle

Overview of the Olympus DAO Ecosystem

Overview of Olympus DAO

At the time of its inception, DeFi faced unsustainable liquidity problems when LPs ran on incentives, causing projects to have headaches with how to attract liquidity and retain LPs with its foundation. At that time, Olympus DAO was born with the concept of Protocol – Own – Liquidity which caused a storm in the market.

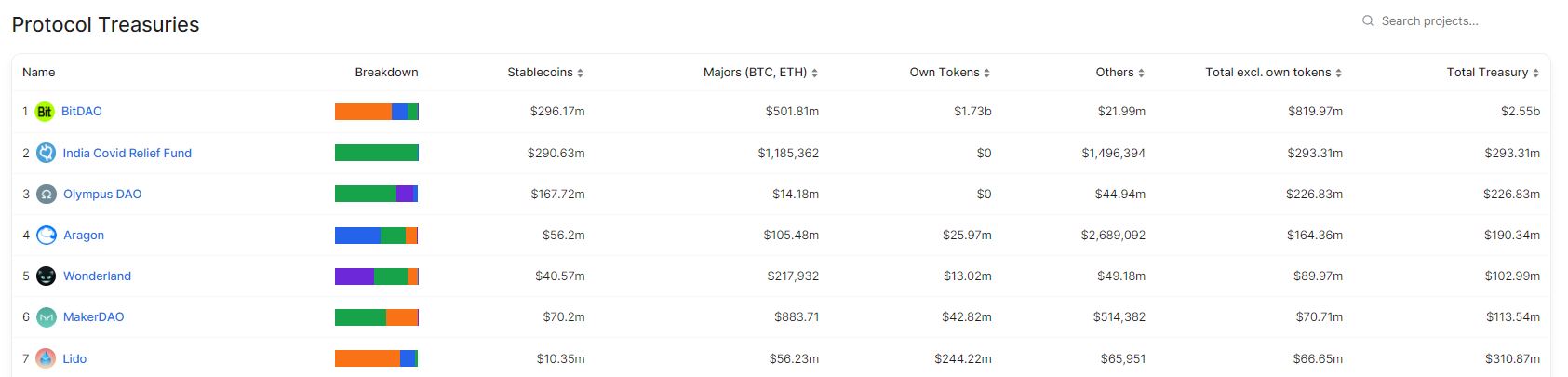

Up to now, although the Olympus DAO model is no longer effective when the model has problems with the bear market, the direction of Olympus DAO has changed. Up to now, Olympus DAO has a large Tresury in the TOP 5 crypto markets and Olympus DAO has to think about how to use POL effectively, the answer is to build an ecosystem.

Currently, Olympus DAO’s Tresury has a total value of $226.83M, of which nearly $167.72M is stablecoin.

Sentiment – Undercollateralized Borrowing platform built on Arbitrum

Sentiment is a platform that allows users to borrow up to 5 times the collateral through the use of Margin Account. To put it simply, Sentiment has many similarities with Leverage Yield Farming platforms. Sentiment’s operating mechanism is quite simple, including steps such as:

- Step 1: Lenders will deposit their assets into a common pool. This common pool will ensure abundant liquidity for borrowers and lenders will receive LToken representing their assets in the pool.

- Step 2: The borrower will open a Margin Account and put collateral there and then borrow the asset he wishes to borrow.

- Step 3: Borrowers will make profits through the Trade and Invest sections on the platform itself,

However, it seems that projects in this trend are not widely accepted by the community. I think there are a number of reasons why projects in the Leverage Yield Farming or Undercallateralized Borrowing segments have not exploded:

- Using too much leverage, especially on DeFi, is relatively risky as liquidation can happen at any time.

- The protocols integrated into major platforms are not really that diverse and have high profit margins.

- Most are new projects so users are quite hesitant about projects that can be hacked.

Gamma Strategies – Management platform that makes liquidity provision easier

Gamma Strategies makes providing liquidity on Uniswap V3 easier than ever. Everyone can see that, to provide liquidity on V3 and make a profit, LPs must have knowledge and must monitor the market regularly to always adjust the price range to provide the most optimal liquidity.

Gamma Strategies operates with the following mechanism:

- Step 1: Users deposit a pair of tokens into Gamma Strategies’ vault and then receive LP Tokens representing assets in the user’s pool.

- Step 2: Gamma Strategies has many different strategies such as wide range strategy, narrow range strategy and stable strategy on Uniswap V3. Each strategy will have its own advantages and disadvantages.

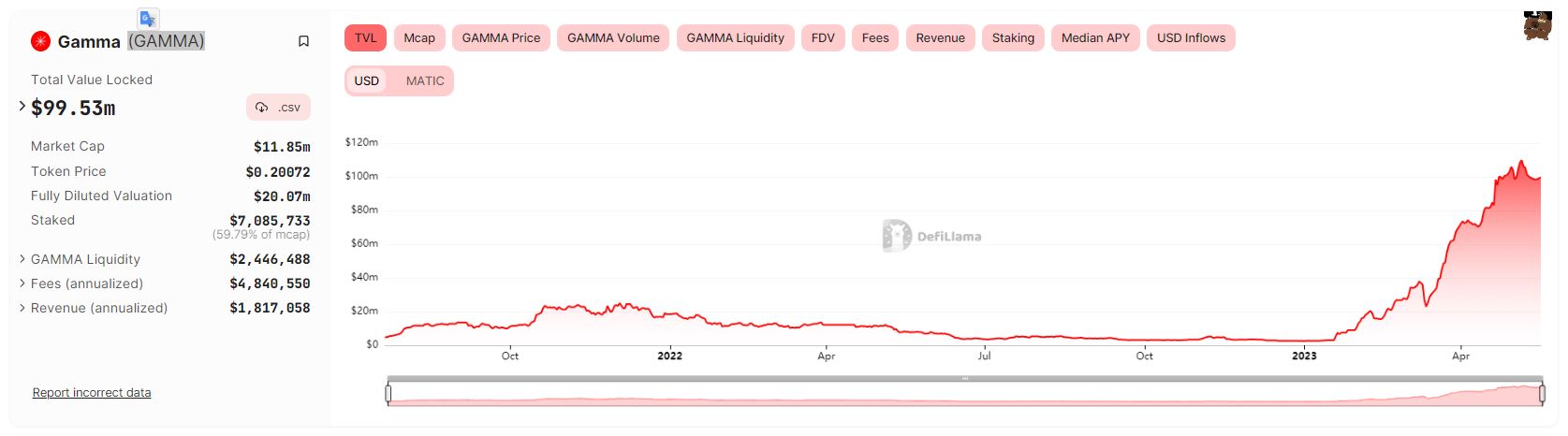

It can be seen that the ecosystem built on Uniswap V3 has a quite bright future and Gamma itself also receives great support from users when

At the time of writing, Gamma Strategies had a large amount of TVL and had recently reached ATH. Besides, the project has also proven to solve a relatively large problem in providing liquidity in the market when both Fees and Revenue have grown in parallel with TVL.

Silo Finance – Lending & Borrowing platform has many potential innovations

It can be said that Silo Finance is an extremely ambitious Lending & Borrowing platform as the project targets both models: Lending Pool and Lending CDP. Mean:

- Lending Pool: Not following the path of AAVE and Compound, Silo Finance decided to follow the Isolated Pool direction – building independent liquidity pools to limit risks and have more diverse types of collateral.

- CDP: The platform also released its own Stablecoin, XAI, which means routing between pools when borrowing with ETH, besides users can use XAI in DeFi.

Currently, after a period of development Silo Finance has made changes such as:

- Integrate with Chainlink, use Oracle service from the market leading unit.

- Deploy on Arbitrum to reach more customer groups.

When the project started deploying on Arbitrum, the amount of TVL on Silo Finance increased by 100% as of the time of writing. However, Silo Finance still has a very long road ahead that needs to be monitored and observed before making investment decisions.

Vendor Finance – P2P Lending Platform

Vendor Finance is a P2P Lending platform built on multi-chain and currently Vendor Finance is present on the Ethereum and Arbitrum ecosystems. Vendor Finance with its products brings the following differences to the crypto market:

- Assets are not afraid of being liquidated.

- Fixed interest rates do not fluctuate like Lenidng P2Pool platforms.

- Loan conditions are set and adjusted depending on the lender’s needs.

- Diverse loans help borrowers have more choices.

- Fixed loan terms help borrowers be proactive in cash flow.

- The Rollovers feature helps borrowers set up demand loans.

Although Vendor Finance’s model is nothing new and has many outstanding improvements, most of the major Lending & Borrowing protocols today mainly follow the Lending Pool model. Recently, a project combining P2P Lending and Lending Pool that is quite popular is Morpho Labs.

Summary

Above are the next 4 projects in the Olympus DAO ecosystem. In the immediate future, there are still many other projects that we hope everyone will continue to accompany Weakhand.