GMX is a decentralized derivatives exchange – Perp DEX, the flagship of the Arbitrum ecosystem. After about 11 months of mainnet with the first version, the project has researched and released GMX V2 version in early August 2023 with many important changes.

So how does GMX V2 work? Why does GMX need a model change and is V2 more efficient than V1? Everyone, let’s find out together in this article!

Before getting into the main content of the article, readers can refer to the following documents to easily grasp the updates of GMX V2:

- What Are Derivatives? Powerful Profit Tool for Crypto Winter

- What is GMX (GMX)? Overview of GMX Cryptocurrency

- GMX 2.0 Review: Changes to Overthrow dYdX

- Why Was GMX V2 Not as Successful as Expected?

Isolation of Liquidity Pools

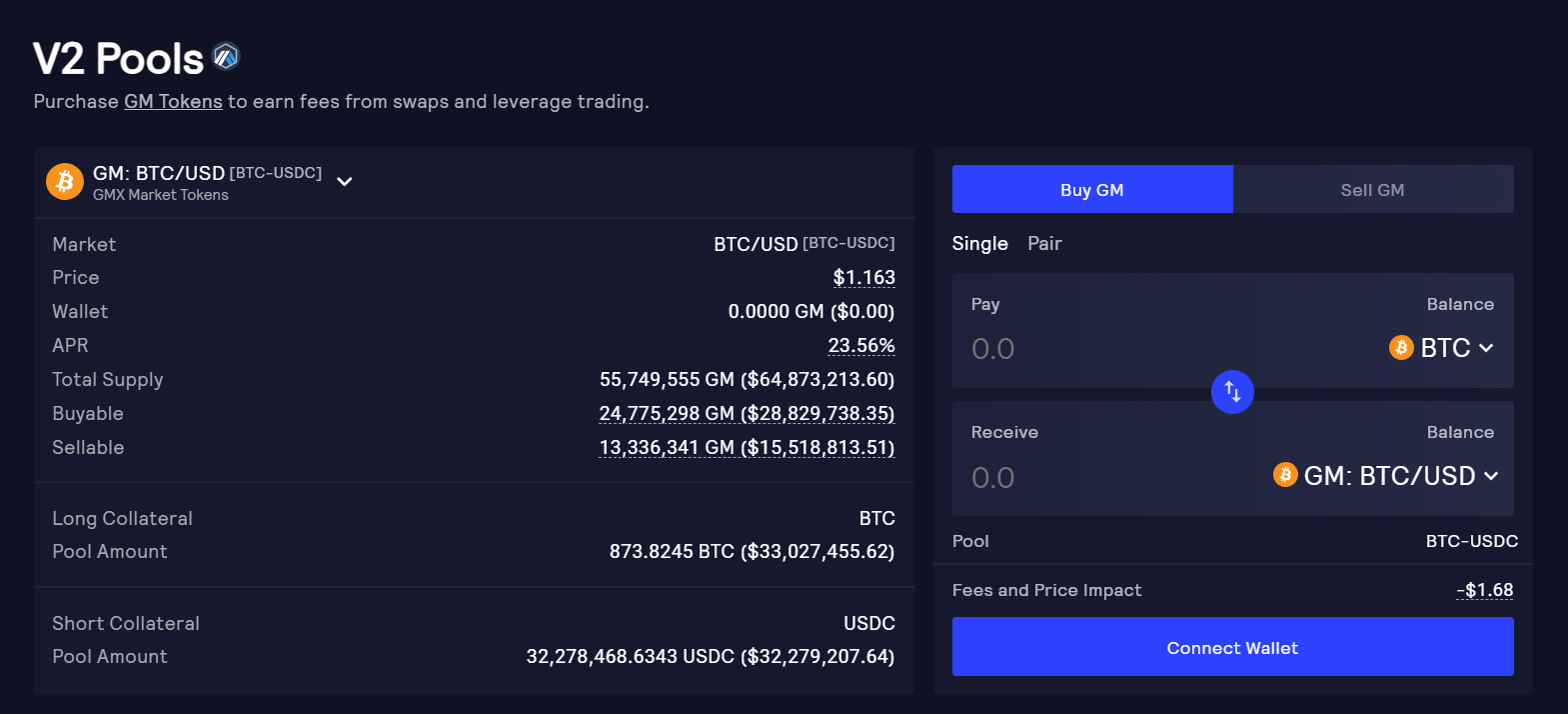

GMX V2 no longer uses GLP’s old design of putting all different asset types into a single pool as liquidity for swap transactions. Instead, each different asset type will have its own pool created with USDC.

For example, instead of buying GLP with different assets like wBTC, ETH, LINK, UNI, … and stuffing them all into one pool, GMX Pool has its own pools like BTC – USDC, ETH – USDC, .. .

When providing liquidity to such pools, users will receive the corresponding GM tokens in return. On the GMX UI, providing liquidity is denoted as “buying GM” with tokens in the pool. Corresponding to each pool will be a separate GM eg: GM: BTC – USD; GM: ETH – USD,…

Accordingly, the structure of a pool includes 2 components:

- Long Collateral Token: Volatile assets, in addition to being used as liquidity for swaps, this is also an asset used as a margin for traders to open long (perpetual) positions.

- Short Collateral Token: Stablecoin, used as liquidity to swap and margin for short orders.

There are three types of pools:

- Blue Chips: Currently, only BTC-USDC pool and ETH-USDC Pool are counted as blue chips. LP will deposit wBTC/ETH or USDC to buy GM. wBTC and ETH are Long Collateral Tokens as mentioned above. These pools are used for both spot and perp transactions.

- Mid-cap assets: These are (LINK/UNI/AVAX/ARB/SOL)-USDC pools. LP uses corresponding tokens to buy GM. These pools are used for both spot and perp transactions.

- Mid-cap Synthetic Assets: These are (DOGE/LTC/XRP)-USDC pools. Instead of using DOGE to buy GM, LP will use ETH or USDC to buy GM. ETH and USDC are still collateral for traders to long and short DOGE/USD, LTC/USD, XRP/USD pairs. These pools are used for Perpetual trading only.

When LP buys GM, it uses a single asset, but when LP sells GM, it will receive back a pair of that pool’s assets. For example, an LP buys GM: ETH/USD for a total of 1000 USDC. Assuming the LP sells immediately, it will receive ~$1000 including about 500USDC and $500 of ETH value.

With the new structure of liquidity pools, the essence of the Perptual game on GMX V2 remains unchanged: LPs and Traders will still compete against each other. If the trader makes a profit, that loss directly reduces the balance of the tokens in the pool, thereby reducing the GM price and causing LPs to suffer losses. On the contrary, if the trader’s PnL is negative, the price of GM will automatically increase, recording a profit for the LPs.

Funding Rate and Price Impact Fee

The fee categories in GMX are relatively complex. If compared to other top tier Perp DEX on the market, it can be seen that GMX V1 has a rather uncompetitive fee structure.

From V1 to V2, transaction fees on GMX will change as follows:

- Reduced order opening and closing fees by half from 0.1% to 0.05%.

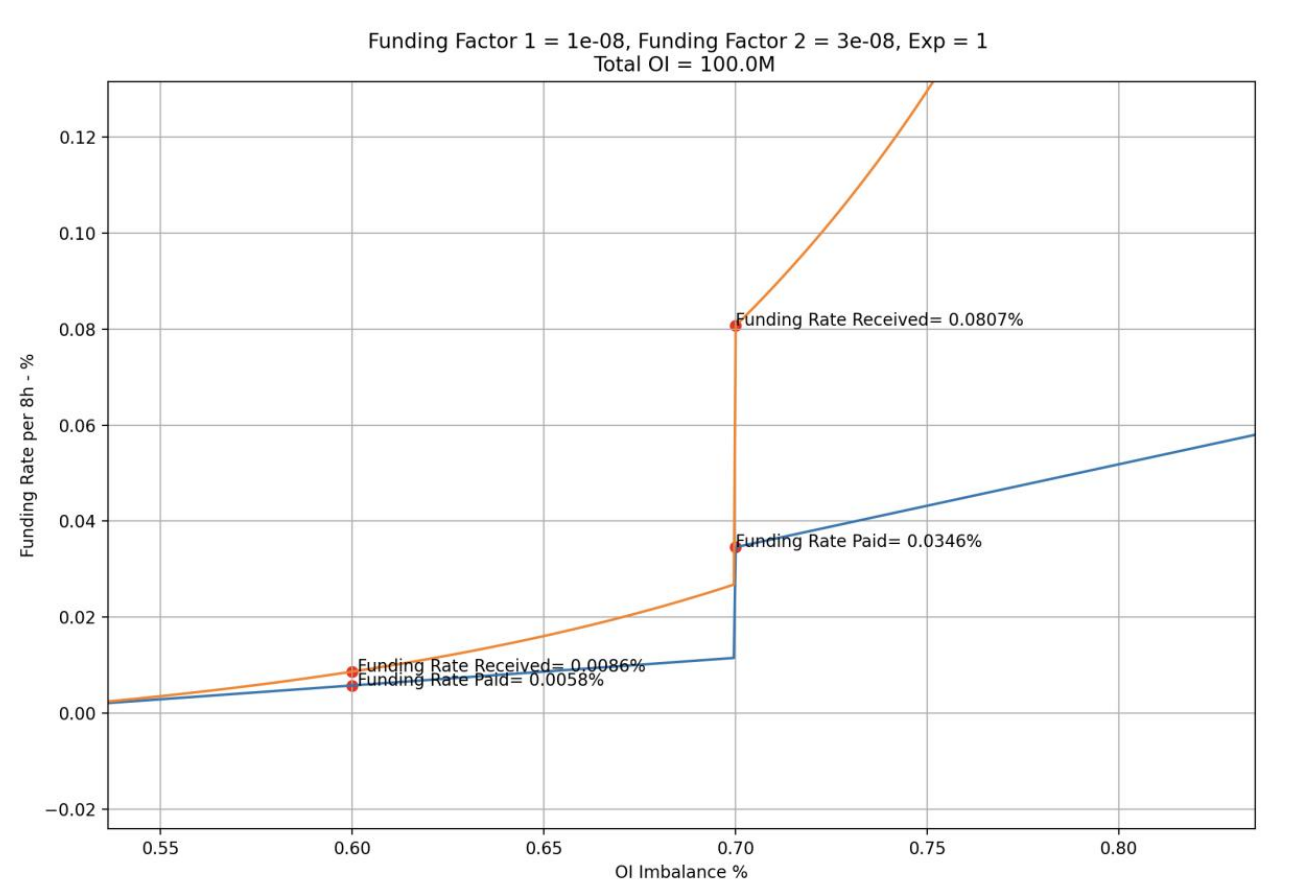

- Add funding rate to help balance long and short sides in the market.

- Keep the borrow fee (order leverage fee), this fee is calculated hourly.

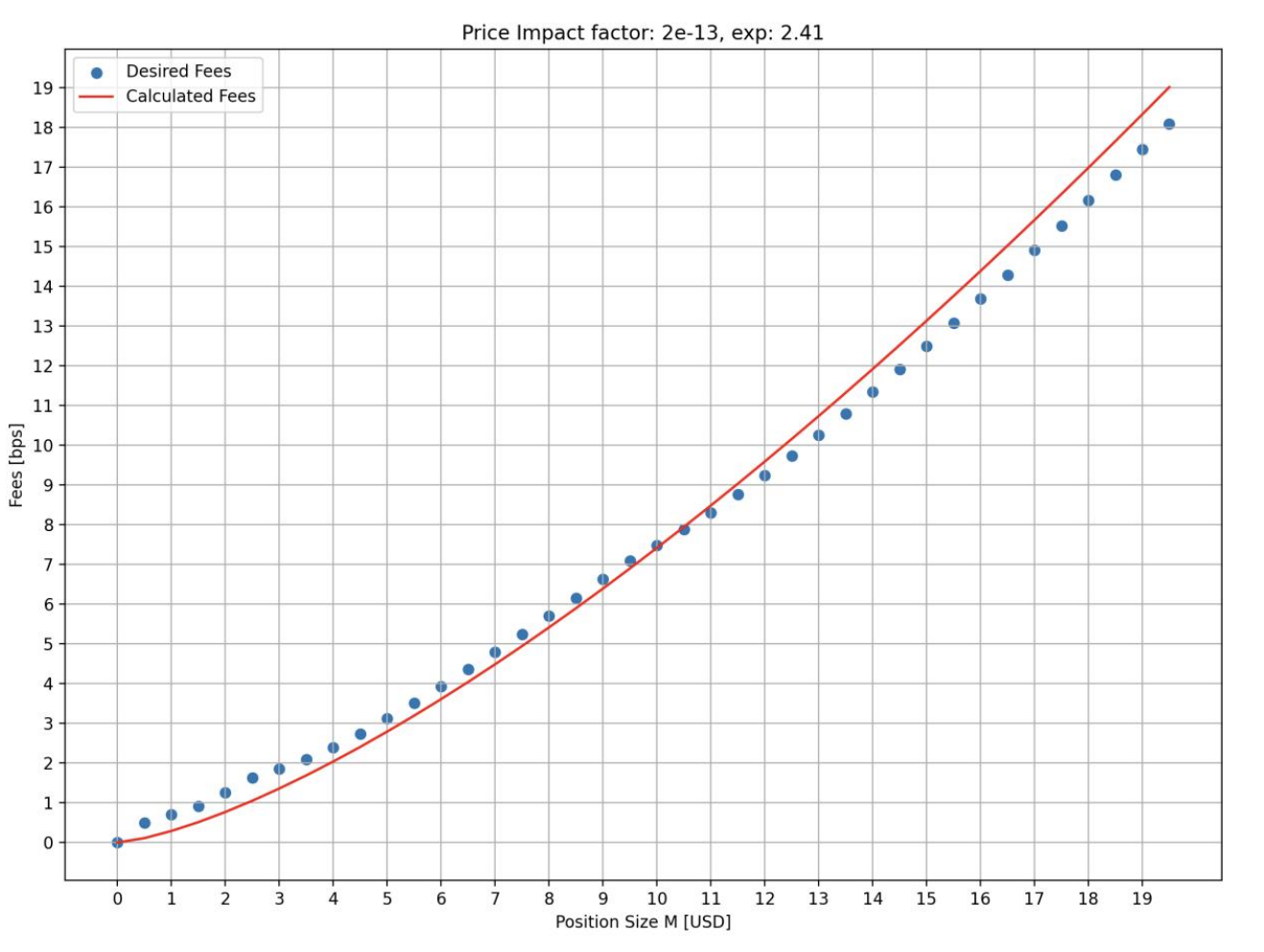

- Add price impact: The larger the position’s volume and the more imbalance between buying and selling volume in the pool, the higher this fee will be charged.

Specifically, the funding rate will depend on the ratio of long and short order volume in the market (OI Imbalance in %).

Adding price impact will limit oracle price manipulation. The price impact fee (bps) according to the volume of the position is shown in the chart below.

After the trading fee changes as described above, one can compare the fee structure of GMX V2 with other top tier Perp DEXs on the market:

- GMX V2: (0.05% order opening – closing fee) + funding fee + borrow fee + price impact

- dYdX: (0.02% maker/0.05% taker), the larger the volume, the higher the discount

- Kwenta: 0.02% maker/ from 0.06% – 0.1% taker

- GNS: (0.08% order opening – closing fee) + 0.04% spreads + price impact

- GMX v1: (0.1% order opening and closing fees) + borrowing fees

- LVL (Binance): (0.1% order opening and closing fees) + borrowing fees

It can be seen that transaction fees on GMX V2 have the most complex structure. Accordingly, this mechanism will be more suitable for retail traders. This change is because in version V1, the fees for all traders, small or large, are the same, while large traders benefit a lot from the possibility of price slippage = 0%. So GMX V2 has paid more attention to balancing the benefits between large traders and small traders.

summary

Above are updates on the operating mechanism of GMX. To understand the content of the article, readers should carefully understand the operating mechanism of GMX V1 first. GMX V1 version is still being operated in parallel with GMX V2.

If GMX V2 is truly more effective, this may be the end of GMX V1’s GLP, and GMX’s ecosystem of projects built on realyield games may change.