Pendle Finance is becoming one of the revolutionary protocols in the Yield Farming industry with the introduction of a completely new concept called Yield Trading. So are there any ways to make profits with Pendle Finance? Let’s learn about strategies for making profits with Pendle Finance in the article below.

To understand more about Pendle Finance, people can refer to some of the articles below:

- Overview and Liquidity Flow in LSDfi

- What is Pendle Finance (PENDLE)? Overview of Cryptocurrencies Pendle Finance

- Pendle Finance Bright Spot Amid Cold Crypto Winter

- Pendle Wars Becomes Center of LSDfi

Overview of Pendle Finance

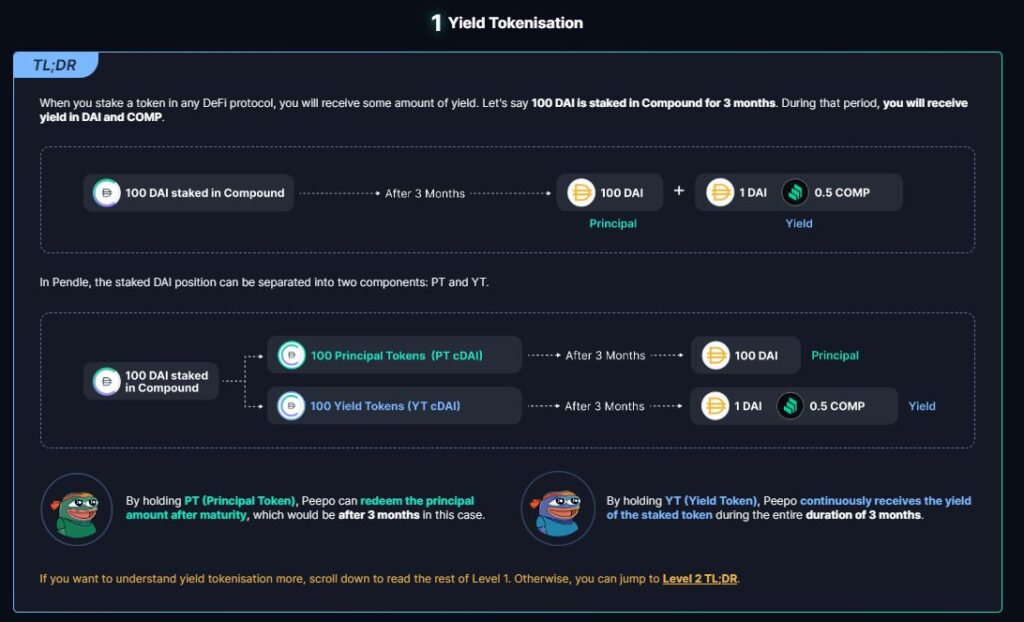

Pendle Finance is a Yield Trading Protocol platform that allows users to earn additional profits from Yield-bearing Tokens by dividing the user’s underlying assets into YT and PT through inclusion. Wrap Yield-bearing Token into SY Token. In there:

- PT Token: Principal Token – Principal Token.

- YT Token: Yield Token – Yield Token.

For example: You have 100 DAI and you can deposit this amount into Compound to earn more profit and the expected profit after 3 months is 10 DAI + 0.5 COMP (Compound’s Native Token). Instead, users can deposit this amount into Pendle Finance, the process will be as follows:

- Step 1: Users deposit 100 DAI into Pendle Finance to mint PT Token and YT Token.

- Step 2: User receives 100 PT DAI Token and 100 YT DAI Token.

- Step 3: Users holding 100 PT DAI Token after 3 months will receive 100 DAI as their principal amount and users holding 100 YT DAI Token will receive 10 DAI and 0.5 COMP after 3 months.

Because of the separation between the original assets into PT and YT, Pendle Finance becomes attractive to investors through many different profit-making strategies in Pendle Finance.

Strategies to Make Profits with Pendle Finance

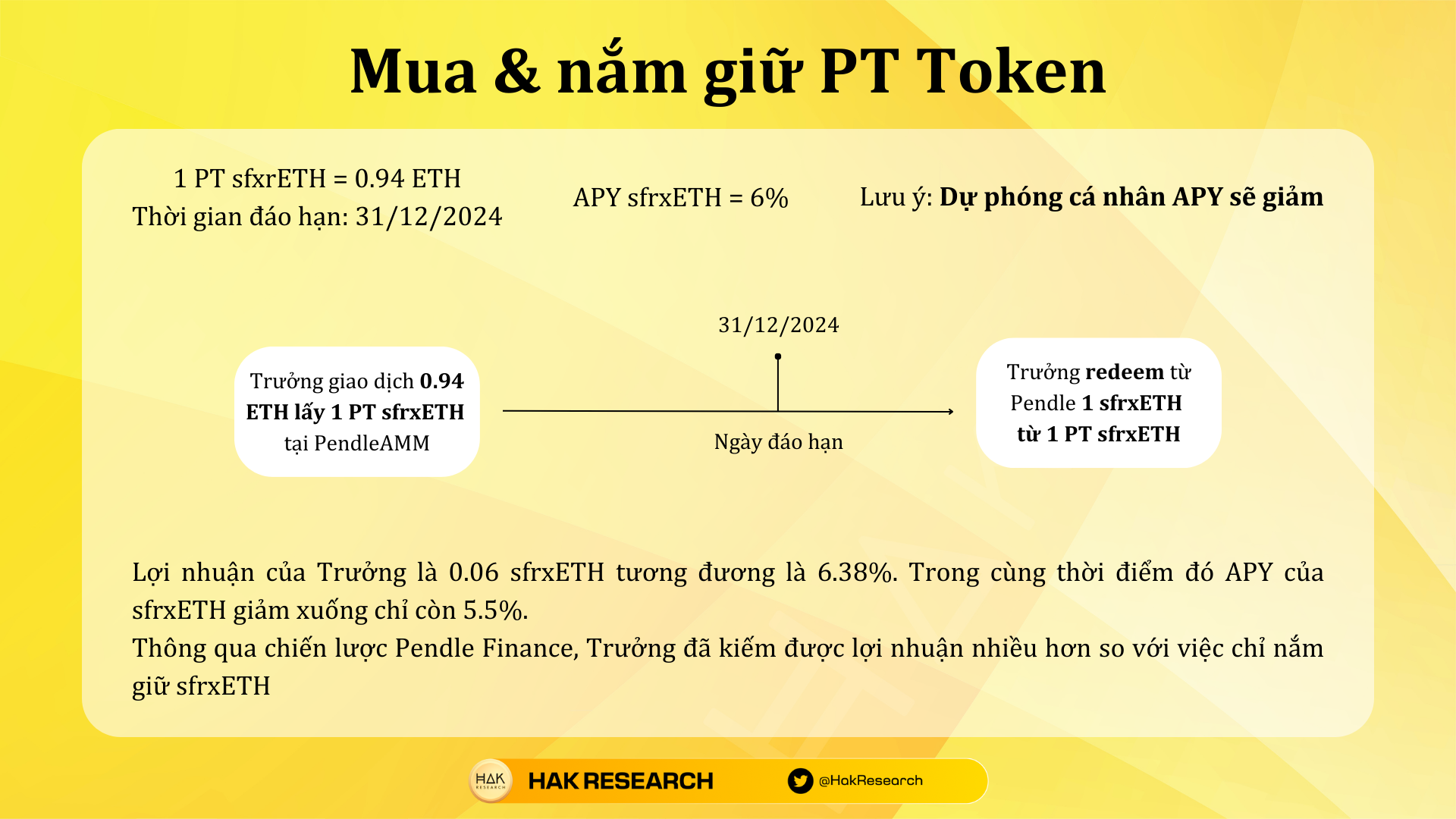

Buy & hold PT Token

At the time when 1 PT sfrxETH = 0.94 ETH with a maturity date of December 31, 2024 and at that time the APY of sfrxETH was 6%. Truong predicts that in the future there is a possibility that this APY will decrease, so Truong decided to spend 0.94 ETH to buy 1 PT sfxrETH.

At maturity, Truong redeems 1 PT sfrxETH to get 1 sfrxETH equivalent to a profit of 0.06 sfrxETH about 6.38% and at this time the APY has decreased to 5.5%. So, based on his forecast, Truong has earned a higher profit than the average.

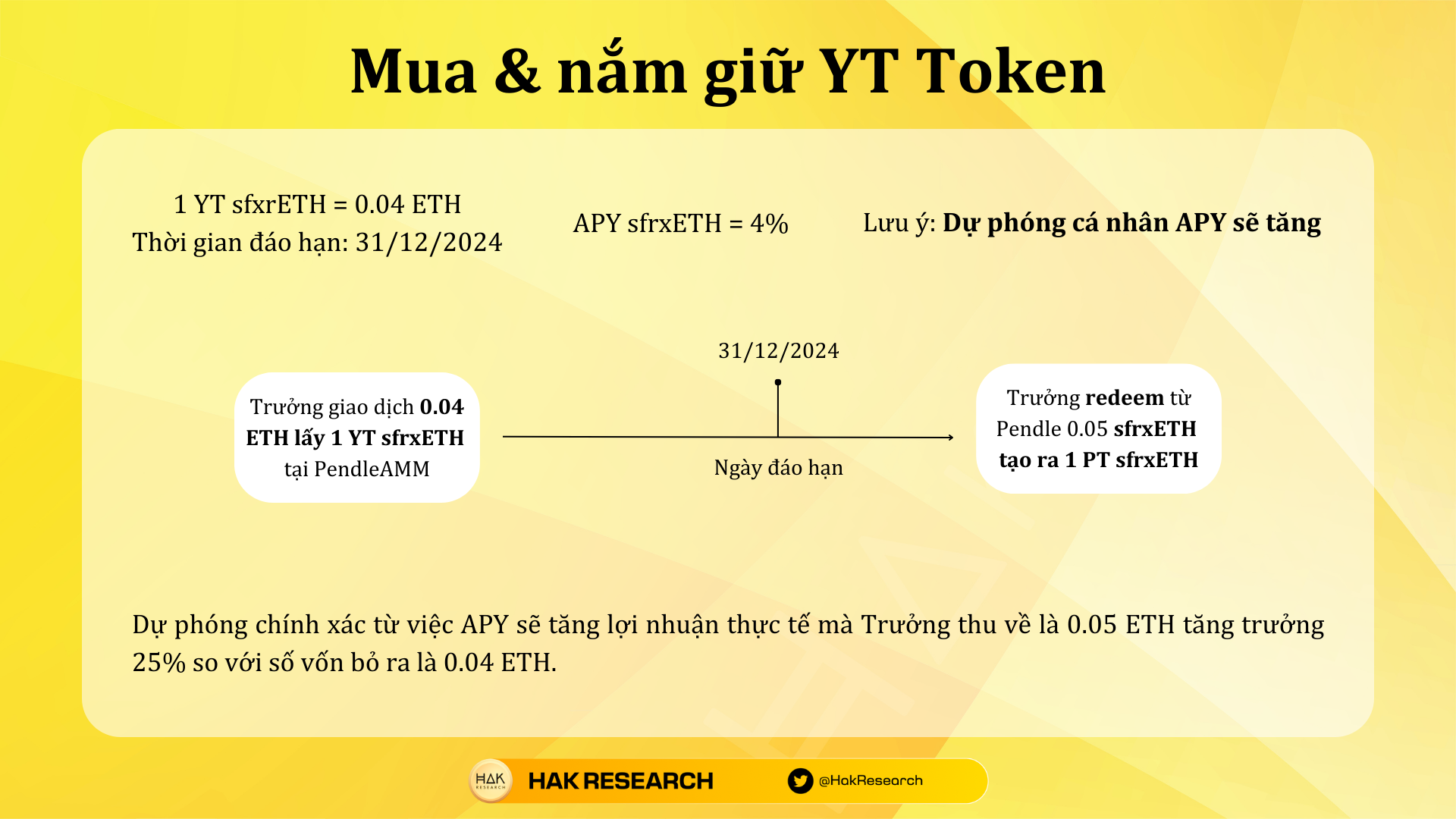

Buy and hold YT Token

At the time when 1 YT sfrxETH = 0.04 ETH means the expected profit when holding 1 YT sfrxETH at maturity December 31, 2024 is 0.04 ETH with APY at that time of 4%. Truong forecasts that this APY will increase in the future and if it increases, profits will be 0.04% higher.

Truong decided to spend 0.04 ETH to buy 1 YT sfrxETH and in fact, by the maturity date, the APY had grown and the actual profit Truong earned was 0.05 ETH, higher than the expected time of 0.04 ETH, so Truong had a profit. The profit is 0.01 ETH, equivalent to a profit rate of 25%.

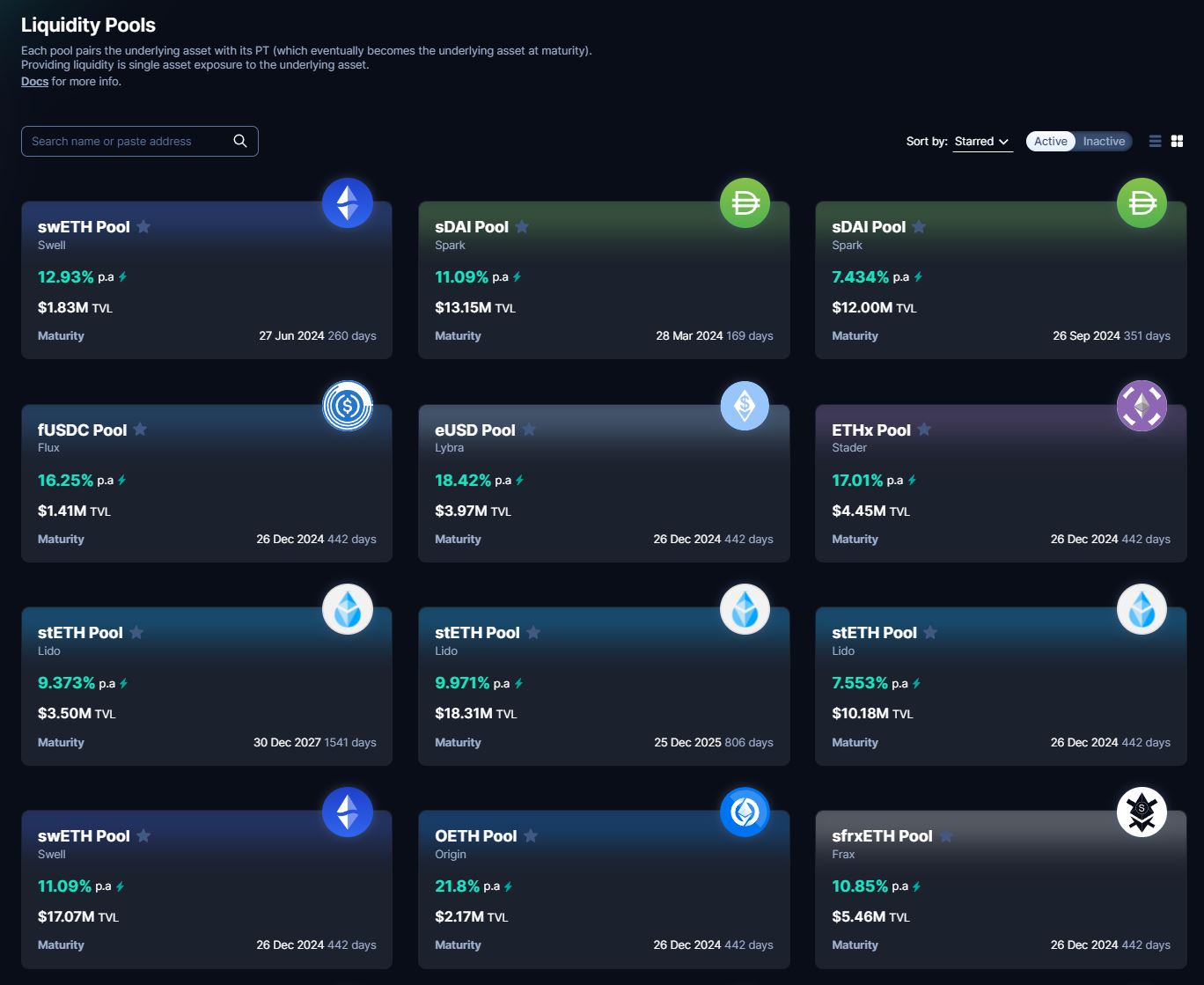

Become a liquidity provider

Users can become a liquidity provider on Pendle Finance to receive more benefits from Pendle including:

- Up to 4 sources of profit for liquidity providers (interest from the underlying asset, fixed interest of the PT, transaction fees of the pool and Pendle token).

- Owning vePENDLE allows users to vote to help increase the amount of emision for the liquidity pool they provide.

- Pendle Finance has also become an important protocol on many Layer 2 platforms such as Optimism or Arbitrum, helping Pendle Finance receive OP or ARB from DAO, thereby deploying Liquidity Mining for liquidity providers on its platform. .

Besides, Impermanent Loss when providing liquidity in Pendle Finance according to maximum research data will be 0.85%. However, if users do not withdraw liquidity until the pool’s maturity date, they will not incur any losses related to Impermanent Loss.

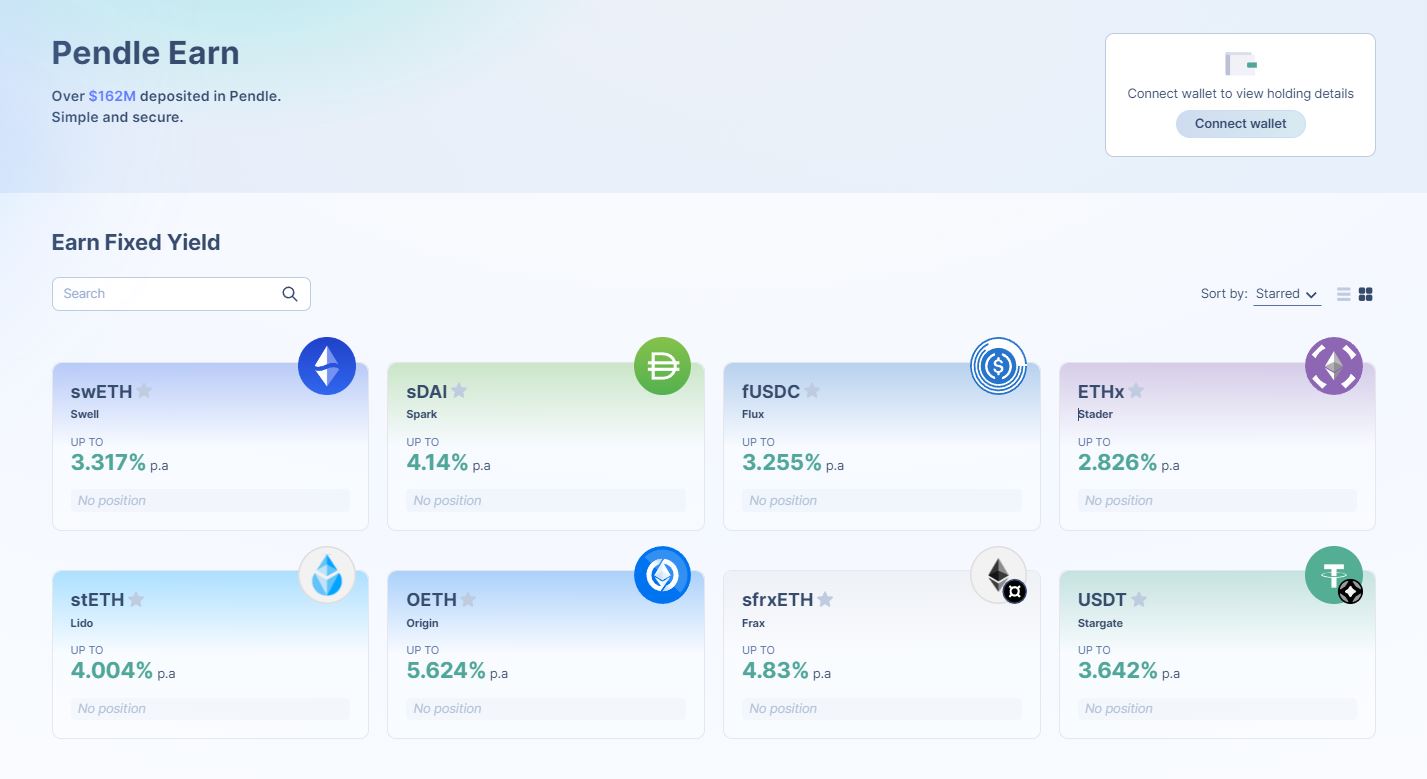

Invest easily with Pendle Earn

To simplify the user experience Pendle Finance has developed Pendle Earn to help users simply deposit their idle assets into the protocol and thereby earn fixed profits through the protocol’s inclusion. These assets go to provide liquidity to traders. With this version, users do not need to care about YT or PT or even know how the project works.

Currently, Pendle Earn has been integrated into wallet applications such as OKX Wallet, Bitget Wallet and Coin98 Super App. It can be said that Pendle Earn will be like a gateway between DeFi and centralized applications thanks to the fixed interest rate mechanism.

This solution is completely reasonable for Pendle Finance because with the Yield Trading model, not all users can read and understand it easily.

Summary

There are many different ways to make profits with Pendle Finance. However, we should choose methods that suit our own position and risk appetite. If you don’t want too much of a headache but just want to receive a fixed profit, Pendle Earn is the best choice, and if you have experience in the market, buying and selling YT, PT or becoming a payment provider is the best choice. are all possible options.