Blockchain has rapidly become popular over the past few years, with an increasing demand for on-chain data that will provide investors with the necessary information from which to make investment decisions. respectable. Let’s see with Weakhand what is Token Terminal? And Instructions for Registering to Use Token Terminal, this is one of the popular on-chain analysis tools today.

Before starting the article, I have listed some other articles that people may be interested in:

- 20 Essential Crypto Websites for Beginners

- 5 Best On-chain Crypto Tools

- 5 Crypto Portfolio Management Tools

What is Token Terminal?

Token Terminal is a leading financial data analysis and aggregation platform in the DeFi market. It allows investors to measure and evaluate the potential and risks of Blockchains and Dapps through financial metrics. Token Terminal was established in 2020. Up to now, this tool has provided information to many users and always updates new projects every week.

Grasping the profits and revenue of the projects that people are interested in, then evaluating performance and comparing with competitors helps people make more accurate decisions. Currently, Token Terminal’s Partners are famous names in the Crypto market such as: Blockworks, Coinbase Ventures, Chainlink Labs, CoinDesk, Polychain Capital, Mutilcoin Capital.

Token Terminal’s interface is intuitive, friendly and allows free lookup, so it is popular with many people. Alternatively, people can choose the Pro version and pay a monthly fee to access all functions on the platform.

Total Value Locked and Revenue

Before getting to the tutorial, Weakhand will analyze the basic concepts of two important indicators: Total Value Locked and Revenue so that everyone can use the Token Terminal tool. in the most complete and effective way.

Total Value Locked (TVL) is a term used in the crypto market to measure the total value of assets locked in the DeFi Protocol. This number will typically correspond to the amount of assets that have been deposited in each protocol. It allows users to review and evaluate the level of community interest in the project.

Revenue is an important indicator in the project’s business activities. Simply put, it is the total amount of money the project earns through business activities. Revenue is also a factor to evaluate project performance.

From here we can deduce that TVL is the amount of money users deposit into DeFi protocols and Revenue is the profit based on the amount users have deposited into the protocol. It’s similar to people saving money in a bank. A basic example for everyone to imagine is that when TVL is the source of money users deposit into a project is high but Revenue does not increase, it means the project is using capital ineffectively.

Instructions for Registering Token Terminal

- Visit: https://tokenterminal.com/terminal/signup

- Everyone, please enter your Email and Password to be able to Create Account on Token Terminal

- Verify Email is completed

Instructions for Using Token Terminal

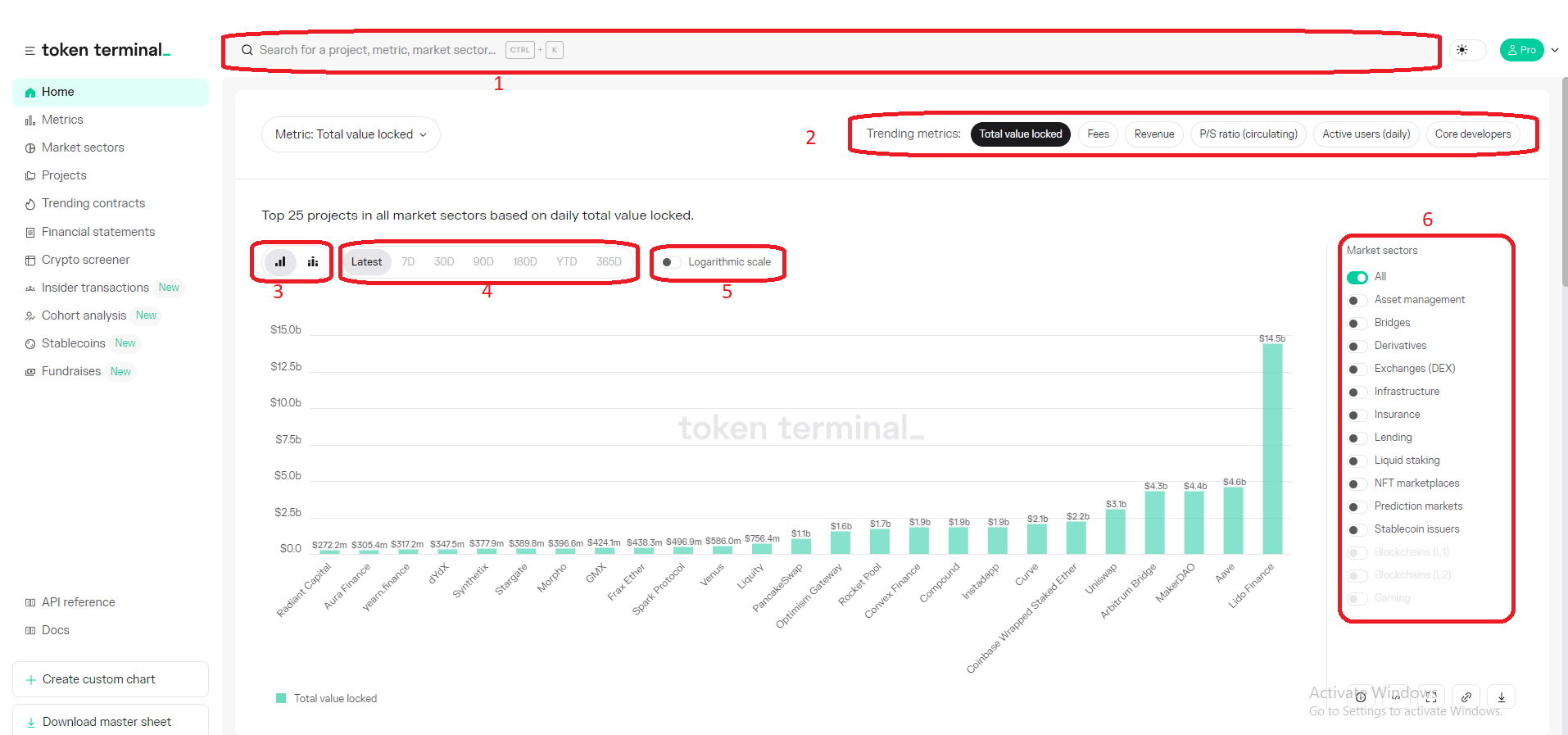

Basic features

- This is the place to find projects that people are interested in.

- General information about project metrics such as: number of assets locked in the protocol, fees, revenue, price-to-revenue index, daily users, active developers.

- Allows users to change the chart shape to suit the intended use.

- Customize time.

- Coming to the overlay chart, this is the function to view the % of projects in the entire market

- Different areas of the market that users can view include Liquid Staking, Blockchain(L1) (L2), NFT marketplaces,…

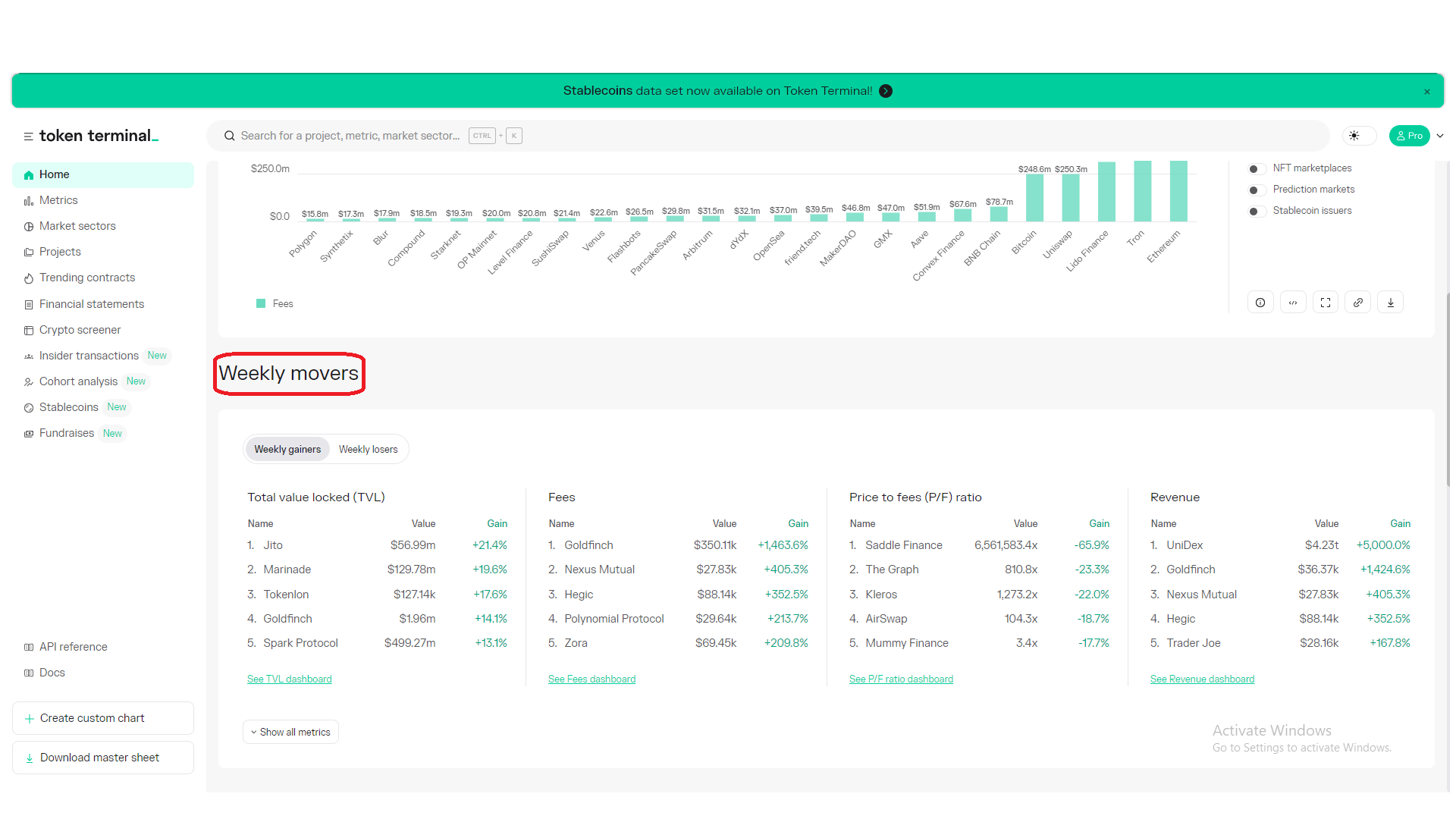

Weekly movers

- In this section, the tool allows us to view rising and falling projects in the market on a weekly basis with indicators such as TVL, Fee, Price to fees (P/F), Revenue.

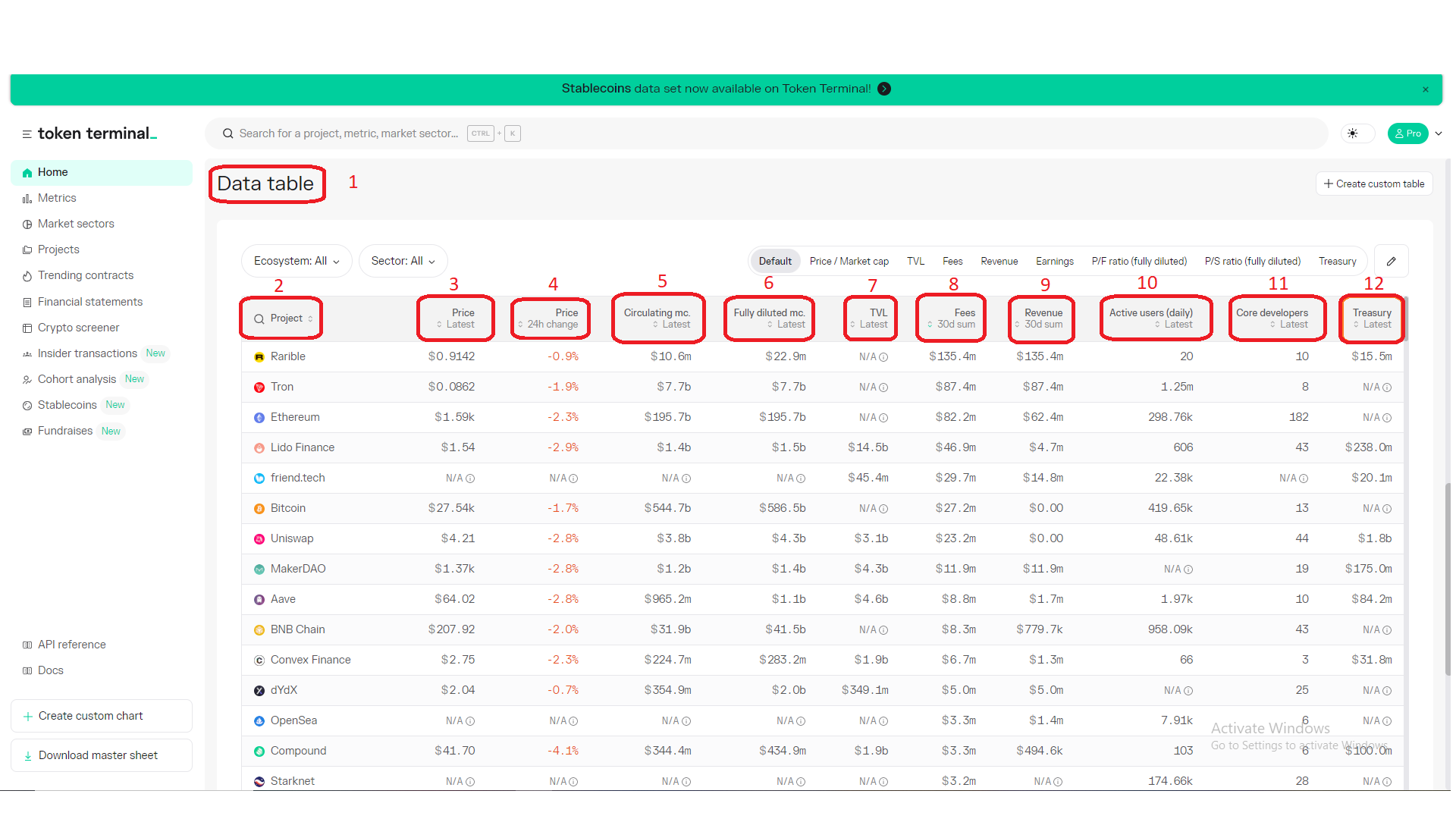

Data Table

- True to its name, it is a summary table of data.

- Provide names of some projects available on the tool.

- The slowest price that the token terminal can update.

- Token price fluctuations after 24 hours that the token terminal can update.

- Circulating market capitalization (calculation = circulating supply * token price).

- Market capitalization is completely diluted (calculation = maximum supply * token price).

- Users deposit funds into protocol’s smart contracts

- Transaction user fees for blockchains and dapps over a 30-day period

- Project revenue over a 30-day period

- Derived based on wallet addresses that use the protocol’s services every day

- The number of commitments by the Dev team to help users better understand the project’s development speed, sourced based on the Dev team’s public GitHub.

- Assets in the protocol treasury, used for marketing or redistributing fees to users.

Information about a project on Token Terminal

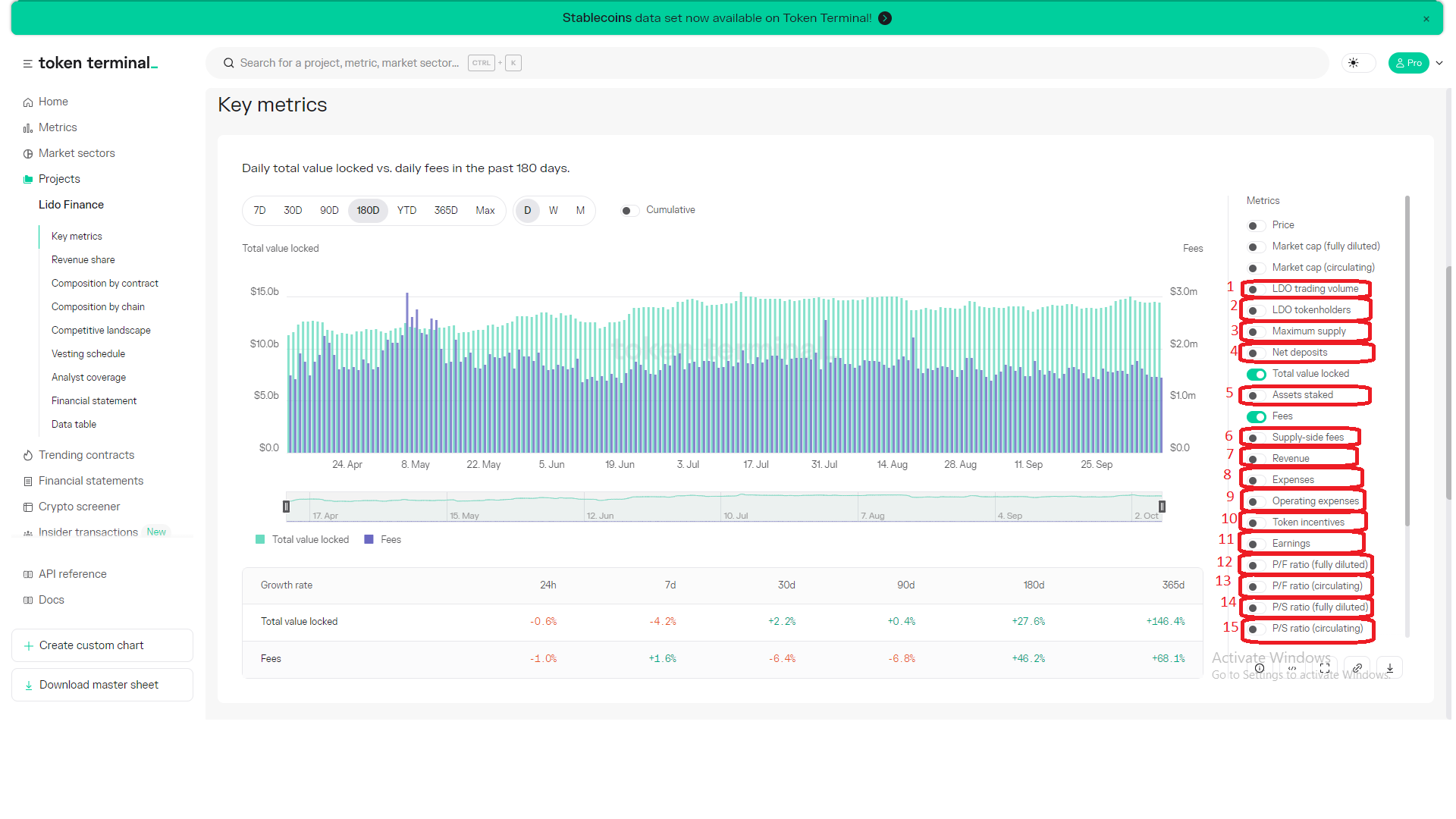

LIDO Finance parameter data sheet

- Shows the trading volume of that token on CEX and DEX exchanges

- Number of wallets that own only one type of token

- Maximum total supply of that token

- The amount of money users deposit into the protocol, from which it can be seen whether the project attracts the community or not.

- The value of the amount staked on the protocol’s smart contracts shows whether users trust the project to stake on a large scale.

- This displays the fees paid to the project

- Revenue

- Total fees paid by the protocol, sourced from onchain data (including token incentives)

- Total fees paid by the protocol (excluding token incentives)

- Shows the protocol’s level of support for its usage by issuing Governance Tokens to its users.

- Protocol revenue does not include expenses incurred during operation

- Indicates how long it takes for the fees to “repay” their value to be completely diluted

- Indicates how long it takes for fees to “repay” their circulating value

- Indicates how long it takes for the revenue to ”repay” its value to be completely diluted

- Indicates how long it takes for revenue to ”repay” its circulating value.

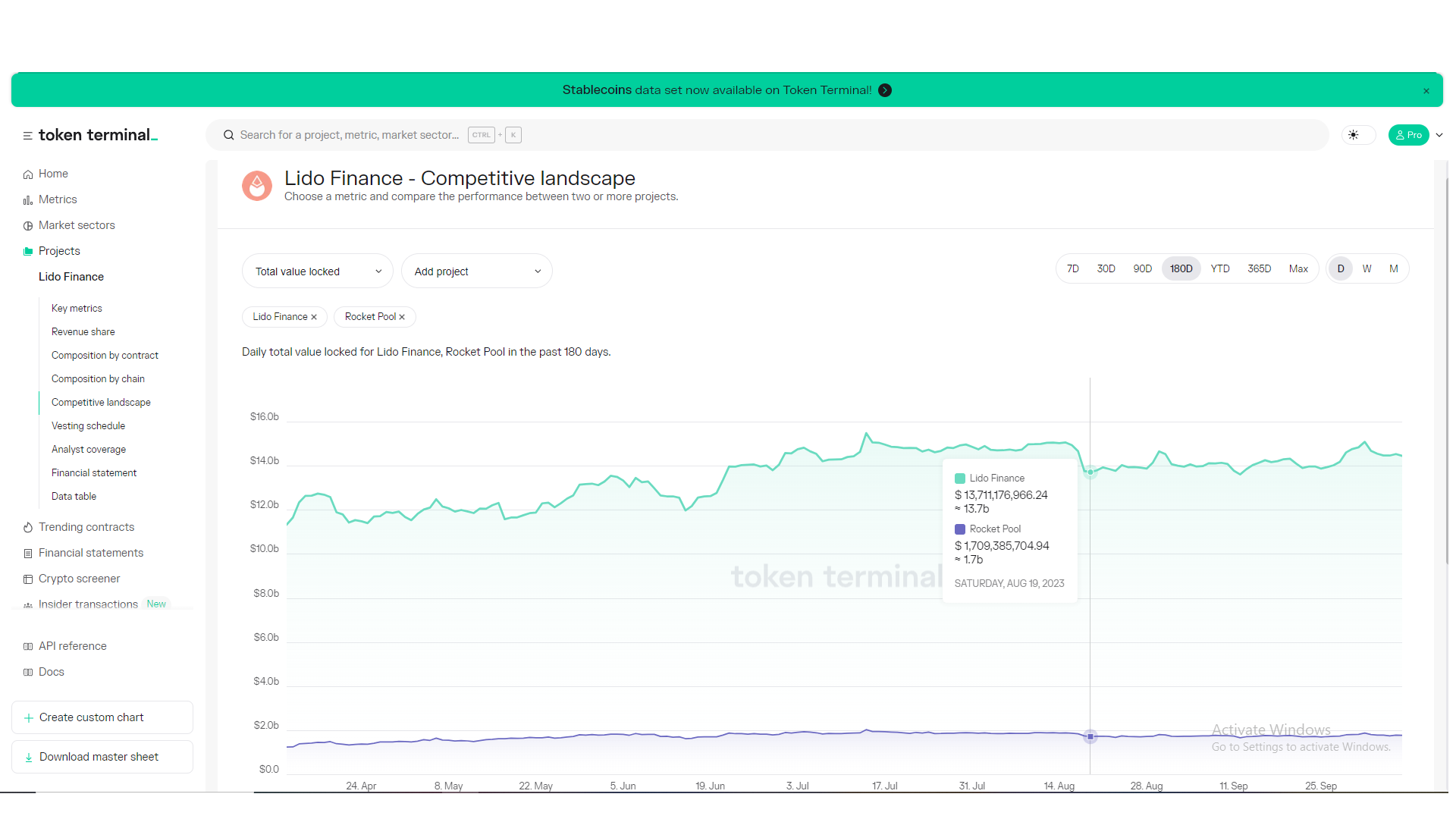

Competitive landscape

This is almost the most attractive feature of the tool when it comes to allowing users to compare different blockchains and Dapps. Taking an example for ease of use, Weakhand will compare two projects working in the same Liquid Staking segment on the market.

- LIDO Finance’s TVL (August 19, 2023) is 13.7B USD

- TVL of Rocket Pool (August 19, 2023) is 1.7 USD

Depending on everyone’s needs, other comparison functions can be added such as fees, staked Assets, Revenue, Token trading volume, Tokenholders,… so that you can review and evaluate. development potential of projects in the most effective way.

Summary

Above is the information to help people understand what Token Terminal is? And registration instructions as well as detailed instructions on using Token Terminal from Weakhand. Hopefully this article can bring everyone useful content.