Solana and its ecosystem have been one of the unforgettable pieces in the DeFi & Layer 1 summer of 2021. FTX & Sam officially went bush, also marking that Solana Ecosystem must truly stand on its own feet. self. So in the past time, have there been any talented people produced on Solana’s ecosystem? Everyone, let’s find out through this article.

To better understand Solana and its second generation projects, people can refer to some of the articles below:

- What is Solana (SOL)? Solana Cryptocurrency Overview

- Series 7: Real Builder in Winter | Solana – An arduous Construction Journey

- What is Proof of History (PoH)? Factors That Make Solana Fastest

Background of the Solana Ecosystem After the Collapse of FTX

Implications from the collapse of FTX

It cannot be denied that the collapse of FTX and Alameda Research did not affect Solana and its ecosystem. For a long time, names like FTX, Sam Bankman – Fried or Alameda Research have guaranteed the development and success of one of the ecosystems known as Ethereum Killer.

The collapse of the above organizations not only makes users worried about the fate of Solana, but also has direct implications. For example, Alameda Research owns a large amount of SOL and Native Tokens in Solana Ecosystem

Statistics on Alameda Research’s investment portfolio as of November 9, 2022

The above numbers show that 60% of the total assets in FTX Wallet are Solana and projects in the Solana ecosystem. According to numbers from the second quarter of 2022, Alameda Research also holds $1.2B SOL and the remaining $2.2B are many projects in the Solana ecosystem.

In a context where FTT collapsed strongly due to Binance selling FTT and also contributing to Panic Sales, to save FTT, of course Alameda Research will not sell FTT but must sell assets in the SOL ecosystem and SOL itself. And this triggered the SOL ecosystem to collapse from the sharp drop in SOL price. Remember that most DeFi projects on Solana Ecosystem accept SOL as the form of asset with the highest collateral, so with the sharp decrease in SOL price, many protocols, especially Lending & Borrowing, have suffered.

We won’t go too deeply into this event, let’s reiterate to know that Solana Ecosystem experienced the biggest shaking in history in 2022. And what doesn’t kill you will make you stronger. . If Solana Ecosystem is not dead, it will certainly return in the future.

The cool breeze comes from NFT

With the characteristics of a Layer 1 platform with fast speed and extremely cheap transaction fees, in addition to extremely successful hackathon events plus the increasingly popular Rust, Solana is accidentally an impossible destination. more suitable for NFT projects. Polygon has problems with its network being constantly congested, BNB Chain has problems with decentralization, there is no better location for Solana.

It can be seen that after Ethereum, Solana is the only platform that has created a huge trend on its own, Move to Earn with StepN. However, after the incident from FTX and Alameda, many projects left Solana Ecosystem but many names continued to stay like Mad Labs. With what Solana has shown, it is completely possible to return, just that this will be a project that creates a trend on Solana.

Potential Next Generation Projects on Solana Ecosystem

Marginfi – Lending & Borrowing platform with new Liquidity Mining mechanism

Before learning about Marginfi, we need to understand MRGN. MRGN is an ecosystem of many different entities and projects, it includes:

- MRGN, Inc: The company has developed Marginfi along with several related Web interfaces, software development kits (SDKs), data analytics and risk management systems.

- The Marginfi Protocol: Is a protocol with many different activities aimed at developing DeFi.

- Mrgnlend: Is a Lending & Borrowing platform and also the first project operating in the Marginfi ecosystem.

- The Marginfi Interface: Web interface allows users to easily interact with the Marginfi protocol.

The special point that has attracted users to Marginfi recently is mrgn points. Mrgn points are credit points that represent user activities on the Marginfi platform, meaning that when users interact with products such as Lending or Borrowing, they will receive points. Some features of mrgn points include:

- All mrgn points are equal.

- The bigger the better. Of course, a $100,000 loan will yield more mrgn points than a $10,000 loan.

- The longer the better. Borrowing $100,000 in 10 days will yield more mrgn points than in 5 days.

Not stopping there, Marginfi also encourages users to borrow $1 to receive 1 point/day while borrowing $1 to receive up to 4 points/day.

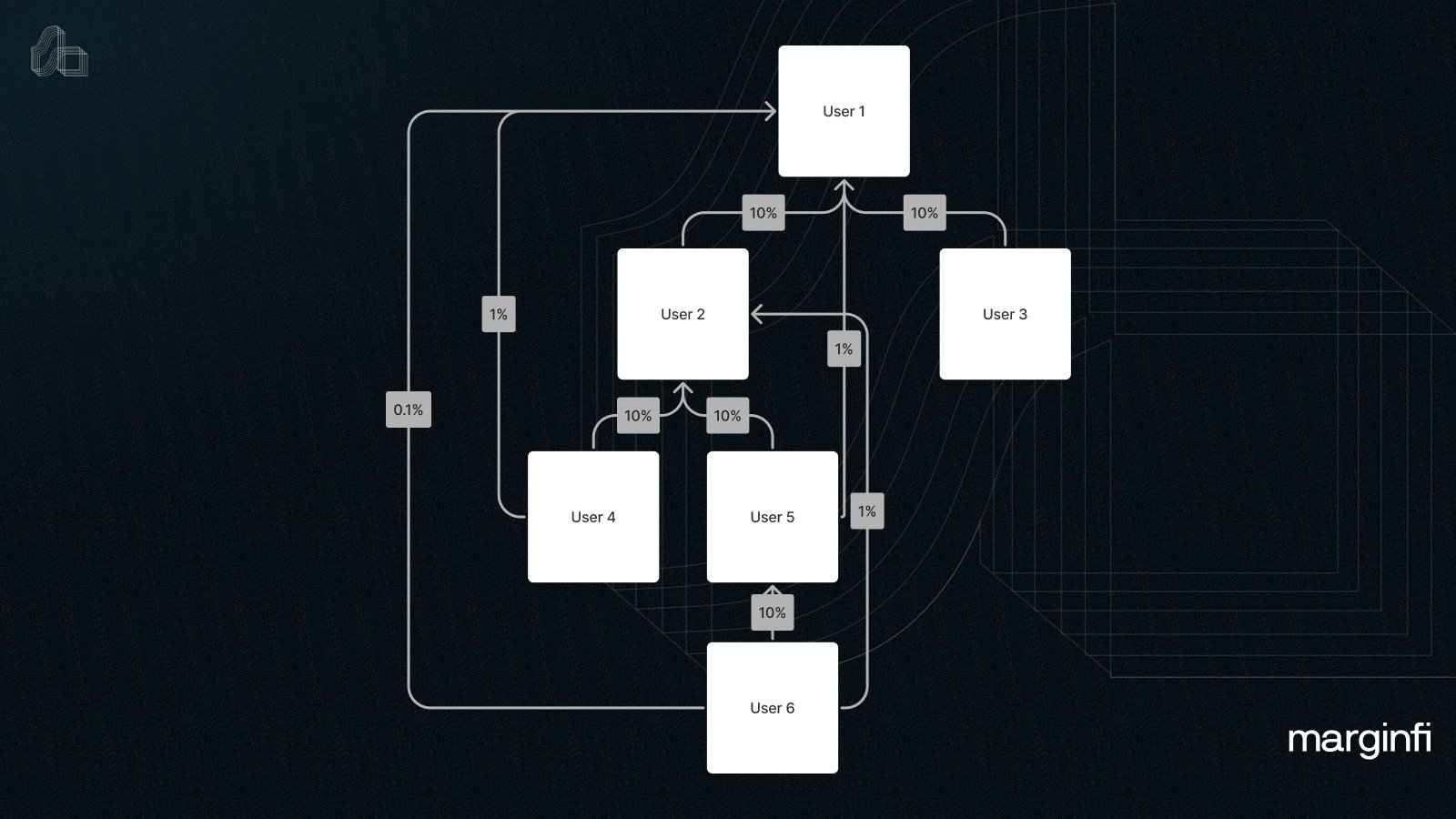

Especially with Marginfi’s referral program, not only does user 1 get a percentage from user 2, but if user 2 continues to refer users 3, 4, 5, 6, user 1 still benefits. Because of these factors, Marginfi’s TVL grew strongly to $31M and ranked 6th. Seeing this, Solend – the largest Lending & Borrowing platform on Solana also launched a similar program.

Scoring points when users join the platform is increasingly popular, this helps the platform gain a number of users from the very beginning without economic constraints. Gradually over time with small projects, this is the way to help the project grow through the first period of time. However, if the points are converted into inappropriate tokens, the project can turn its own users into antifans. Therefore, the project should have a clear economic problem when applying this model.

Besides the mrrgn point program, the development team also integrates many more products such as AMM, integrating Jupiter – the best DEX Aggregator on Solana today, Bridge – integrated with Mayan.

I hope that MRGN, Inc. will soon launch more groundbreaking products in the future and will not stop at the Lending & Borrowing puzzle. Some products that can be expected in the future are Earn or Omnichain.

Jito – The platform that promises to open up the future of LSD on Solana

Jito is the only Liquid Staking Derivatives (LSD) platform on Solana that not only distributes Reward Staking and MEV. Jito allows users to stake SOL in the protocol to receive LST as jitoSOL. Jito sword works specifically through 2 different ways:

- Jito offers additional rewards from MEV on Solana.

- Jito participates in exclusive staking on a number of validators designed to improve network performance.

The key word in Jito’s operating mechanism is that Jito has developed a client for validators to eliminate spam. The proposed solution is auction. Traders will submit bids for the series of trades they believe are profitable. The bid will then be checked to the validator. With Jito, spamming on the Solana network will be improved while Validators will have more profits and will lead to more profits for those who bet on that Validator.

At present, Solana is a Blockchain without Mempool so extracting MEV is relatively difficult. So the main profit of Validators is Reward Staking or block completion reward. Because there is little profit from MEV, Liquid Staking Derivatives on Solana are not developed strongly compared to Ethereum. With Jito, not only will users gain more profit from staking, but it can also lead to a wave of LSD and even LSDfi in the near future on Solana.

Similar to other LSTs, jitoSOL can also participate in DeFi and help users gain more profits. Thanks to this difference, Jito has risen to become one of the largest LSDs on Solana Ecosystem, only after Marinade Finance or Lido Finance.

Sanctum – Ambition to build Deep Liquidity

Sanctum is a Stability Protocol platform with the ambition to solve the liquidity problem for LSTs such as mSOL, JitoSOL or stSOL on the Solana ecosystem. The problem Sanctum poses is relatively simple and it comes from events that have happened including:

- Too many LSD projects lead to too many versions of SOL stakes and a limited number of SOLs, leading to SOL – SOL stake liquidity pairs that are not deep and easily leading to SOL stakes being depeg. When SOL stakes are depeg, there will be massive liquidation on Lending & Borrowing platforms, which can cause a domino to collapse the entire ecosystem or cause bad debt for the protocol. The lessons from Solend are still there.

- When Solana allows anyone to become a Validator on the network, the supply of SOL in the market decreases, resulting in SOL – SOL staking liquidity pairs becoming even more vulnerable.

Sanctum builds the Sanctum SOL Reserve Pool (SOL reserve fund) that allows converting from SOL stakes to SOL quickly and easily and collects a fee from 0.01 – 3% of the amount of SOL that users take out of the pool. Not only that, Sanctum allows users to exchange SOL stakes with each other, even operating as a Liquid Staking platform but allowing users to exchange SOL stakes of other protocols.

Some Projects Remain But Still Growing Strong

UXD Protocol – Stablecoin protocol continues to find new directions

UXD Protocol is a Stablecoin issuance protocol that has been operating strongly in recent times. At the new stage of development, UXD Protocol uses the “Delta Neutral” strategy to ensure assets are not liquidated when users mortgage to mint the project’s Stablecoin. Does that mean:

For example: If you want to min 100 UXD using SOL, you will go through the following steps:

- Step 1: User deposits $100 SOL into the protocol.

- Step 2: UXD Protocol will mint 100 UXD for users.

- Step 3: UXD Protocol will send the user’s BTC to Derivatives to short with the same volume.

- Step 4: If the user returns 100 UXD, the Short order will be closed.

- Step 5: UXD Protocol will return $100 SOL to users and burn 100 UXD.

Not stopping there, UXD Protocol has introduced a new product, ALM, which will be a group of different strategies to generate profits for the protocol while still having insurance to protect against unexpected risks. ALM includes strategies such as:

- Delta Neutral.

- Excessive collateralization to 3rd parties like Maker DAO’s D3M.

- Invest in assets in the waking world through platforms such as Credix, Maple, Goldfinch and Clearpool. This gives UXD Protocol access to higher returns and also higher risks.

DrActually, this is a reasonable move because the Delta Neutral strategy will have problems with too much liquidity and Perp DEXs will not be able to handle it, leading to the protocol being limited in expanding its own liquidity. partner. Along with the UXD Protocol strategy, it also expands its cooperation with platforms such as Flux Finance, Maple Finance, Rage Trade,…

This move was right through the numbers as the protocol’s TVL started to grow again from $4.5M to $14.53M.

Drift Protocol – Perp DEX has miraculous recovery

Drift Protocol is a Perp DEX platform built on inspiration from Perpetual. However, with the change of time Drift has officially launched version V2 with many changes such as:

- Upgrading Perpetual’s vAMM model to integrate more AMM helps increase user experience and the protocol also receives more profits.

- Increase leverage ratio from x5 to x10.

- Launched the Drift Liquidity Provider (DLP) model.

It is the above factors that have fueled the strong resurgence of Drift Protocol with TVL growing from $1M to $11.7M and about to return to the ATH level before FTX collapsed. Not only that, the number of users on Drift Protocol reached an ATH level recently.

The Future of Solana Ecosystem

If a normal investor looks at the TVL level of the entire Solana ecosystem, it will be easy to ignore it because since the beginning of the year when the whole market recovered the Solana ecosystem. But if we go deeper into the Solana ecosystem we can still find real Builders. The remaining projects continue to build and develop since then, achieving many achievements, although not great, but it is a positive sign.

With Solana’s infrastructure being jointly resolved by all parties, Jump Crypto’s Fire Dancer promises to bring Solana to Mass Adoption. I believe that with improvements in network infrastructure combined with real Builders remaining, Solana’s return will only happen sooner or later.

We just don’t know what trends Solana and the developers on Solana Ecosystem will create in the future.

Summary

Solana will return to the Layer 1 race with a stronger and more sustainable ecosystem. Do people believe that?