OIympus DAO is a protocol that has taken the DeFi market by storm during the market boom of 2021. Perhaps everyone thinks Olympus DAO has gone into the past like many other DeFi platforms but in reality it is not. it has to be like that.

The OlympusDAO ecosystem is starting to be seeded to wait for the next growth cycle, so let’s find out which projects belong to the Olympus DAO ecosystem in the article below.

To better understand the Olympus DAO ecosystem, people can refer to some of the articles below:

- Tetranode – The Powerful Whale Behind a Series of Potential Projects

- What is Vesta Finance (VST, VSTA)? Vesta Finance cryptocurrency overview

- What is Jones DAO (JONE)? Jones DAO Cryptocurrency Overview

- What is Midas Capital? Midas Capital Cryptocurrency Overview

Overview of Olympus KNIFE

Definition of Olympus DAO

Olympus DAO is a decentralized currency management platform around building a stablecoin called OHM. However, OHM is not a Stablecoin anchored at a price of $1 but Olympus DAO is built in a different direction. This means that for every $1 OHM in the market, there will be $1 guaranteed asset in the treasury, which can be DAI, FRAX, ETH,…

Olympus DAO will always guarantee that $1 OHM in the market will have $1 in the secured treasury.

Olympus DAO in 2021 emerged as one of the first Bond selling platforms and attracted the entire crypto market by offering APY levels up to tens of thousands of percent and the price of OHM also increased by hundreds, thousands of times. However, after that, when APY gradually decreased, the value of OHM also divided dozens of times, causing Olympus DAO to fall into oblivion.

The direction of Olympus DAO at the present time

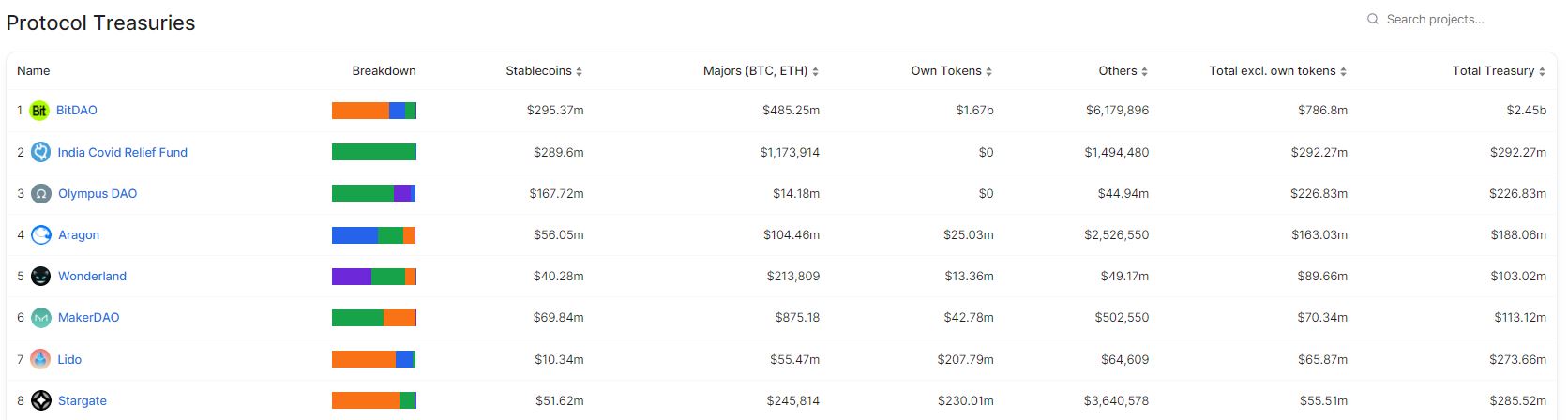

But after that hot period, Olympus DAO also quickly built a strong Tresury, owning a Tresury with a total value of up to $226M with $167M in stablecoins. Olympus DAO itself must also use this Tresury source effectively, that’s why Olympus DAO decided to invest in many small & potential projects.

A little on the sidelines, everyone can see that BitDAO, Wonderland, Maker DAO, Lido Finance, Stargate Finance, Parrot Protocol,… are among the DAOs that own the most assets in terms of USD value.

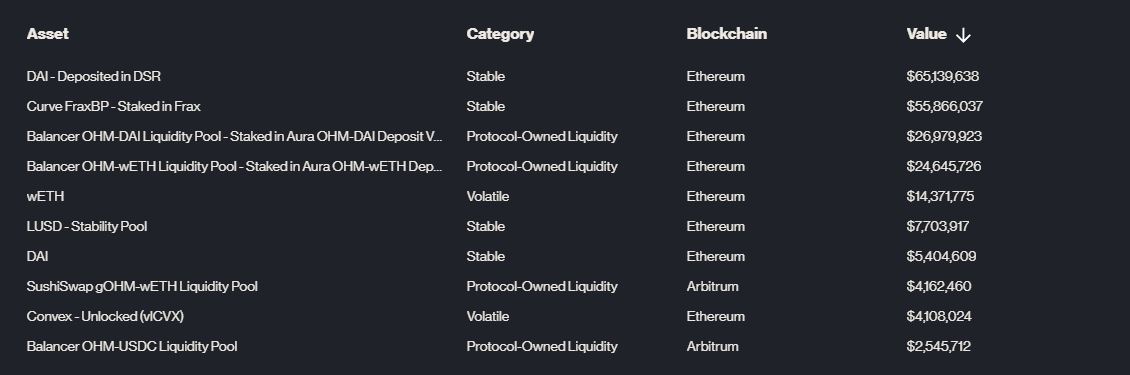

Olympus DAO’s Treasury has a number of outstanding assets such as DAI, FXS locked on Frax Finance, CVX locked on Convex Finance, wETH, LUSD,…

It is the above assets that will determine the projects that Olympus DAO invests in and supports. Because it holds quite a lot of CVX and FXS, Olympus DAO will have an advantage when bootstrapping liquidity on Curve Finance, so the projects that Olympus DAO targets will be more or less related to Curve Finance.

Recently, Olympus DAO has begun to share about projects that receive support & investments, or more broadly, are part of the Olympus DAO ecosystem. We continue to dive deeper into the ecosystem of Olympus DAO.

Projects in the Olympus DAO Ecosystem

Vest Finance – The first CDP platform to participate on HST Olympus DAO

Vesta Finance is a CDP platform that allows users to mortgage many different types of assets to borrow VST – Stablecoin pegged 1 to 1 with USD built and developed on the Arbitrum ecosystem. At present, Vesta Finance allows users to pledge ETH, OHM, GMX, DPX and renBTC and GLP as collateral on Vesta.

Vesta Finance owns a large number of prominent Angel Investors such as 0xMaki, DCFGod, Lau Brother, Tetranode, Sam Kazemian, 0xmons, Wangarian, OmniscientAsian, PopcornKirby, Nick Chong, Calvin Chu, Jae Chung, Anthony Sassano,… all of them individuals who are “lucky” in the crypto market.

However, I see a problem with Vesta Finance in particular and Olympus DAO in general: they are a bit extreme about decentralization, so they do not accept USDC or USDT as collateral. That’s why Vesta Finance lost a large amount of liquidity and TVL.

In the upcoming development roadmap, Vesta Finance has some highlights as follows:

- Accept more types of collateral.

- Orientation for multichain development such as Solana, Sui, Aptos or Near Protocol.

- Accept NFTs as collateral.

- Build thick liquidity and large use cases for VST.

Jones DAO – Yield Farming Platform on HST Olympus DAO

Jones DAO is a Yield Farming platform that allows users to put idle assets into vaults and then use their own strategies to earn maximum profits with minimum risk and then share. a share of profits with users. Currently, Jones DAO is opening vaults such as RDPX – ETH, DPX – ETH, Gamma Neutral USDC, Leverage Delta GLP and jAURA.

One notable point is that Jones DAO successfully called for $52M in just 24 hours, which is truly an extremely large number for a DeFi protocol. Some updates worth waiting for from Jones DAO in the near future include:

- Integrating more protocols into your platform helps diversify investment strategies.

- Launching more vaults for different asset types.

- Launching the veToken model is considered a huge growth driver for JONES.

Midas Finance – Lending & Borrowing Platform on HST Olympus DAO

Midas Finance is a Lending & Borrowing project created to handle some outstanding problems with P2Pool Lending platforms such as AAVE or Compound as follows:

- Users have no control over the liquidation rate and liquidation rewards.

- Only assets with large liquidity can become collateral on AAVE & Compound.

- Operating according to the 1 pool model, if it is hacked, all assets will be evaporated.

Midas Finance allows users to create independent pools (Isolated Pool) with their own parameters and diverse asset types. With this operating mechanism, Midas Finance helps users take advantage of most of their idle assets. Besides, if one pool is hacked or has problems, it will no longer affect other liquidity pools.

Aura Finance – “Convex Finance” platform on Balancer

If we are familiar with the StableSwap Curve Finance platform, when launching veToken, Curve Wars was created with the participation of many protocols and the victory belonged to Convex Finance. Besides Curve Wars, we also have Balancer, a very early AMM platform that also owns the veToken model. Aura Finance is leading with a veBAL ownership rate of nearly 30%.

Similar to Vesta Finance, Aura Finance also owns a group of extremely quality Angel Investors such as 0xMaki, Daniel Matuszewski – Co-founder of CMS Capital, Sami – Founder of Redacted Cartel, Tetranode, Darren Lau, 0xMaha, Stefan George, …

Summary

The above article is about some of the projects in the Olympus DAO ecosystem, however it will not stop at the names above but will always be updated and changed. Weakhand will always look for the latest information to update everyone.