Suppose you have the superpower of the world-famous prophet Vanga and can predict when the market will fluctuate strongly, how can you make money from it with the lowest risk? GammaSwap will be a reliable address for you to submit your predictions and profit from it. So how does GammaSwap work? Let’s find out through the article.

First, to understand GammaSwap’s operating model, let’s learn about the concepts: What is an options contract, what are buy options and sell options? What is the Long Straddle Strategy? What is the Short Straddle Strategy? GammaSwap’s operating model

Overview of Options Contracts (Options)

What is an options contract?

An option contract is a contract in which the buyer will have the right to buy or sell an asset at a predetermined price at a specified time in the future. The point to note here is that the buyer can exercise the right to buy or not buy the asset at maturity.

For example: Hua Thanh buys an ETH options contract at $2,000/ETH, exercise date is May 4, 2023. When May 4, 2023, the price of ETH is $1,800, Hua Thanh can now exercise her right to buy ETH or not. If she does not do so, Hua Thanh will lose a premium.

Classification of Options

Call Option and Put Option

- Buying options: An option in which you can buy an asset at a predetermined price at a specified time in the future.

- Sell option: An option in which you can sell an asset at a predetermined price at a specified time in the future.

Based on the classification of options, we will have the following terms:

- Buy a call option (Long call)

- Sell call options (Short call)

- Buy put options (Long put)

- Sell put options (Short put).

Components of an Options Contract

Options contracts include the following components:

- Order size: refers to the number of contracts executed.

- Exercise price: is the price at which a buy or sell option is exercised.

- Expiry date: maturity date is the time when the contract is performed.

- Contract performance fee: is the fee that the contract buyer must pay to obtain the contract

Options Trading Strategies

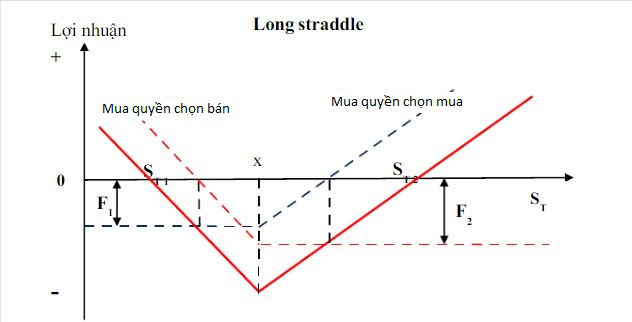

Long Straddle Strategy

This is when you buy both types of options at the same time: a call option and a put option, at the same price and the same expiration date. This strategy is often applied when you predict that the market will have strong fluctuations, so whether the market fluctuates in price up or down, you will make a profit.

For example: You implement the Long Straddle strategy with the asset being ETH at a strike price of $2,000. The fee for each contract is $200, so you will have to spend $400 for both buying and selling contracts. On the expiration date, let’s say the ETH price is $3,000. At this time, you only need to exercise the option to buy ETH and earn a profit of: $3,000 – $2,000 – $400 = $600 and vice versa if the price of ETH drops to $1,000, you will exercise the option to sell ETH and earn profit: $2,000 – $1,000 – $400 = $600.

So you will see that using the Long Straddle strategy will be very beneficial when the market fluctuates strongly.

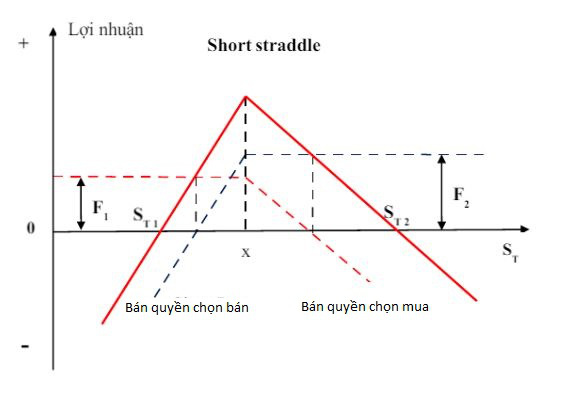

Short Straddle Strategy

This is when you simultaneously sell a buy option and a sell option at the same price at the same time. This strategy is often used when you predict market fluctuations with a small amplitude.

For example: You implement the Short Straddle strategy with the underlying asset being ETH with a strike price of $2,000. The fee for each contract is $200, so you will receive $400 in transaction fees for both buying and selling contracts. On the day of contract execution, the price of ETH is $2,200. At this time, the buyer will exercise the buy option, so the profit you will earn will be: $2,000 – $2,200 + $400 = $200. Similarly, if the ETH price at maturity is $1,900, the option buyer will exercise the right to sell, the profit you will earn will be: $1,900 – $2,000 + $400 = $300.

So you can see that the Short Straddle strategy will be very attractive if the market fluctuates with a small amplitude.

GammaSwap uses Option to remove IL

And another concept that you need to keep in mind before learning how GammaSwap works is temporary loss. When you provide liquidity to token pools on decentralized exchanges like Uniswap, you will receive a transaction fee from the pool and also bear a risk from the so-called temporary loss. time.

Temporary loss is the loss that comes from depositing tokens into the pool compared to not depositing and keeping tokens in the wallet. Temporary losses will become real losses when you withdraw liquidity and the losses will be larger if the market fluctuates more.

Do you see anything familiar with the Short Straddle strategy? In AMMs, you provide liquidity into the pool to receive transaction fees and bear temporary losses. In Short Straddle, you sell your options to receive transaction fees and also accept risks when the market fluctuates more.

Thus, we can now temporarily consider liquidity providers for AMM as options sellers.

Once there is someone selling the options, who will buy those options? In fact, currently in AMMs, no one is buying options, so option sellers cannot receive additional fees from buyers.

Realizing that limitation of AMM, the GammaSwap project was born to create a trading marketplace to help buyers and sellers of options meet.

How GammaSwap Works

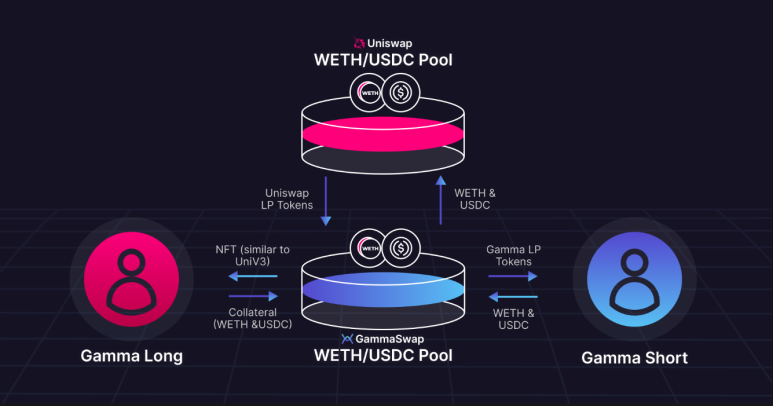

Regarding the operating mechanism of GammaSwap, there are two following concepts that everyone needs to understand:

- Short Gamma: Only option sellers on Gamma, specifically liquidity providers – Liquidity Providers (LPs).

- Long Gamma: Only those who buy options on Gamma, specifically here are my brothers, users who participate in the project without wanting to provide liquidity.

GammaSwap’s mechanism of action

Step 1: LPs will participate in providing liquidity to pools on the project. Here you can directly provide 2 tokens to the project or provide LP tokens you receive when providing liquidity on Uniswap.

If you provide 2 tokens directly into the pool, GammaSwap will send it to Uniswap and receive LP tokens in return. Thus, GammaSwap’s pools will contain LP tokens and will send you GS-LP tokens from the project to represent your position in the pool.

So what is the advantage of providing liquidity into GammaSwap compared to Uniswap? That is, when providing liquidity into GammaSwap, in addition to the transaction fee you receive, you will receive additional fees from Long Gamma => Profit received from GammaSwap >= Uniswap.

Step 2: After receiving LP Token from liquidity providers, GammaSwap will lend this number out. Long Gamma are brothers who predict the market will fluctuate strongly so they will borrow LP tokens from GammaSwap. This is done in the following order:

- Gamma Longs will deposit an amount of tokens into GammaSwap as collateral to position LP tokens. The maximum loan ratio is 90%. If you exceed this amount, your mortgaged assets will be liquidated. The protocol will charge a liquidation fee of 5%.

- After depositing tokens as collateral, you can borrow LP tokens. When you borrow LP tokens, GammaSwap will send a corresponding amount of LP tokens back to the pool on Uniswap to receive the corresponding pair of tokens and send them to Long Gamma, and will monitor whether the transaction fee received is the same as before withdrawing the tokens. out of the pool and calculate the loan interest rate. This calculation is to reimburse Short Gamma (the payer will be Long Gamma).

- If the market fluctuates strongly, the temporary loss in the pool on Uniswap will be exactly as large as the amount of profit Long Gamma earned. Let’s explore the following example:

In a pool on Uniswap there are 50 Solana and 1,000 USDC, equivalent to a price of $20/Sol. According to Uniswap’s operating mechanism, we have a constant K in the pool = 50 x 1,000 = 50,000.

- Nhi Nguu predicted that turbulence was about to happen in the market, so he boldly deposited an amount of collateral into GammaSwap to borrow 10% of the Sol-USDC pool.

- GammaSwap will deposit its LP tokens into the pool on Uniswap and receive the Sol-USDC token pair in return and send it to Nhi Nguu. So the number of Nhi Nguu tokens received at this time will be: 5 Sol and 100 USDC.

- Assuming the market price of Sol tokens increases to 35$/Sol, the total number of tokens in the Sol/USDC pool on Uniswap is 37.8 Sol and 1,322.9 USDC respectively. A 10% rate in the Pool will correspond to 3.78 Sol and 132.29 USDC.

So Nhi Nguu’s debt will be 3.78 x $35 + 132.29 = $264.6. The actual amount of money Nhi Nguu holds is 5 x 35 + 100 = $275. And Nhi Nguu will earn a profit of 275$ – 264.7$ – the transaction fee that would have been received for providing liquidity – the LP token borrowing fee.

Summary

From the above example, we can see that when the market fluctuates large enough, the temporary loss will be larger. When the temporary loss is larger, the incentives for Long Gamma to participate (because the temporary loss is the amount of profit Long Gamma receives), the more Long Gamma participates, the more profit it generates for Short Gamma thus stimulating them to provide more liquidity.

This makes GammaSwap an ideal place for you when the market fluctuates strongly. Hopefully the recent article about GammaSwap’s operating mechanism will help you understand more about the project.

If you are interested in any project and want to learn how it works, please leave a comment below to let me know.