The Wormhole ecosystem is backed by Jump Crypto and has almost entirely bet on the Solana ecosystem recently. Perhaps when talking about Wormhole we are forced to spend a lot of time on Jump Crypto – the VCs behind this platform. In this article we will learn about Wormhole’s ecosystem after a long period of development.

In this article we will go through the following main ideas:

- What is Jump Crypto? How is Jump Crypto backing Solana and Wormhole?

- Overview of Wormholes

- Attendance on the Wormhole ecosystem

- Investment opportunity with the Wormhole ecosystem

To understand more about this article, people can refer to some of the articles below including:

- What is Wormhole? Wormhole Cryptocurrency Overview

- What is Hashflow (HFT)? Hashflow Cryptocurrency Overview

- What is Stargate Finance (STG)? Stargate Cryptocurrency Overview

- What is LayerZero? LayerZero Cryptocurrency Overview

- Bridges: Design, Trade-offs, and Opportunities

Jump Crypto – The Power Supporting Wormhole & Solana

Overview of Jump Crypto

Jump Crypto is a branch specializing in venture capital investment in the crypto market of Jump Tradding LLC. Jump Tradding LLC was founded in 1999 in Chicago as a proprietary trading company focusing on high-frequency trading strategies. Currently, the company has about 700 employees in many major cities such as Chicago, New York, Austin, London, Tel Aviv, Singapore, Shanghai, Bristol, Gurgaon,…

Jump Tradding LLC has been operating in financial fields such as Futures, Options, Stocks and Crypto worldwide.

Jump Crypto Portfolio

Jump Crypto’s investment portfolio spans many areas such as Infastructure, DeFi, NFTs and Web3.

|

Category |

Project |

|---|---|

|

Infastructure |

MSafe, Ulvetanna, Martian, Skip Protocol, Mysten Labs, Injective, Aptos Labsm Oasys, Cetora, Push Protocol, Meta Engine, Phantom, Celestia,… |

|

NFTs |

StemsDAO, Dust Labs, Open Blox, Aradena, Derby Stars, Metaplex, Perion, Fancontrolled Sports,… |

|

DeFi |

3Commas, Hashflow, MoHash Protocol, Orderly Network, Skolem Technology, Euler Labs, Satori, 0x, Bastion, Wombat Exchange, Trisorlis, Burrow Cash, Ref Finance, Maverick Protocol, Aurigami, Prism, Folks Finance, Frikkton, Conduit,… |

|

CeFi |

Kucoin, FOMO Pay, Iconic Market,… |

|

Web3 |

Outdefine, Elusiv, Juno, Coral, Sweat Economy, AltLayer, Common Wealth, Snack Club,… |

Jump Crypto spreads its investments in many different areas, but Jump invests quite a lot in important pieces of the Crypto market such as Infastructure, Web3 and DeFi.

Why is it said that Jump Crypto is backing Wormhole and Solana?

Why do you say Jump Crypto supports Wormhole?

February 2, 2022: Wormhole was hacked with a loss of up to $326M, equivalent to 120,000 ETH. This is the second largest hack in crypto history, only after the Poly Network incident with losses of more than $600M.

Immediately afterwards, Jump Crypto agreed to spend the entire amount of money that was hacked to compensate users who lost their assets. And offered the hacker a deal worth $10M but the hacker didn’t agree and wanted to take the entire amount.

However, by early 2023, there was quite reliable news that Jump Crypto had coordinated with many parties to recover all the money that was previously stolen.

So we have to ask a question: “Why do VCs have to spend more than $300M to save a Bridge project when with that amount of money they can invest in many other projects?”

Why do you say Jump Crypto supports Solana?

It can be said that up to now Jump Crypto and Solana Foundation have had many connections with each other on many points including:

- Jump Crypto built a project called Firedancer with the goal of increasing transaction speed on Solana.

- Jump Crypto also supports a validator service on Solana with a smaller capital outlay to help the network promote decentralization.

- Jump Crypto is committed to accompanying Solana Foundation to solve outstanding problems in this ecosystem.

- Jum Crypto has accompanied Solana Foundation to organize Hackathon Global, HakcerHouse,… events to help the Solana ecosystem grow.

Although Jump Crypto invests in many other blockchain platforms such as Sui Blockchain, Aptos, Celestia,… but with the activities between Jump Crypto and Solana, it is clear that the two sides have made clear commitments in support and cooperation. cooperate and develop together.

Wormhole Overview

Introducing Wormhole

Wormhole is a message passing protocol between various cross-platform blockchains including Ethereum, Solana, BNB Chain, Polygon, Avalanche, Algorand, Fantom, Karura, Celo, Acala, Aptos and Arbitrum.

Wormhole does this through Core Bridge contracts mounted on different chains as a point of transmitting and receiving messages. Emission of messages from a chain is observed by the network of Guardians nodes and verified there. Once verified, this message is sent to the target chain for processing.

Wormhole’s mechanism of action

Wormhole is composed of 3 main components as follows:

- Core Bridge Contract: Act as smart contracts mounted on many different blockchains with the main function of transmitting and receiving messages between blockchains.

- Guardian: Includes 19 nodes that play the role of verifying the correctness and validity before messages are transmitted from one blockchain to another.

- Relayer: With the goal of helping turn all users’ money into transaction fees instead of ETH or platform coins.

Unlike LayerZero that only accepts ETH as a fee, accepting all types of assets as fees makes Wormhole truly different.

Overview of the Wormhole Ecosystem

The Wormhole ecosystem is gradually growing

It can be said that because Jump Crypto has supported Wormhole and Solana so much, it is also the “father and mother” of Wormhole and Solana. At the present time, it can be said that Solana’s ecosystem is Wormhole’s ecosystem. Projects in the Wormhole ecosystem include:

|

Category |

Project |

|---|---|

|

DEX |

Algofi, AptoSwapm, Anime Swap, Atrix, Jupiter, Cetus, DeltaFi, DeepWaters, DexLab, Dradex, Magpie, GFX, Mayan Swao, Orca, Pangea, Serum, Stellar Swap, Ubes Swap,… |

|

Lending & Borrowing |

Aries Market, Apricot, Port Finance, Jet Protocol, Klap,… |

|

Yield Farming |

Tulip, Francium, Frikktion, Katana,.. |

|

Stablecoins |

Frax Finance, Tapio,… |

|

Derivatives |

01 Protocol, Psy Options, Mango Market,.. |

|

Wallets |

XDefi,… |

|

Bridge |

Allbridge, Hashflow, Carrier,… |

|

Infastructure |

Aleph.im, Biconomy, Brave, Chain,… |

|

NFTs |

Audius, DeGods, Dust Labs, EverDragons, LiqNFT, MobLand, Unlockd, y00ts,… |

We can see that Wormhole’s ecosystem is diverse in many different pieces in DeFi, NFT and Infastructure. Besides, besides focusing on supporting the Solana platform ecosystem and blockchain, Wormhole also supports a few other blockchains such as Ethereum, Aptos, Celo, Moonbeam, Kalytn,…

The number of projects using Wormhole’s technology is very large, but the number of quality projects using Wormhole’s technology can still be counted on the fingers of one hand with a few names such as Lido Finance, Uniswap, Hashflow, Jupiter and NFT DeGods collection, other than that, the remaining names are not too prominent.

Some prominent projects in the Wormhole ecosystem

DeGods & y00ts: The first NFT collectibles using Wormhole technology

DeGods is an NFT collection of deities that combines modern and ancient styles with the goal in mind of building utility for these NFT holders with a total supply of 10,000 NFTs. Besides, DeGods is also a set of NFTs that gradually deflate over time. Similar to other NFT collections, DeGods also come in many different rarities.

According to the project shared on the community, DeGods will be available on Ethereum through Wormhole technology in the first quarter of 2023 and currently the project is on track with its proposed roadmap.

Besides DeGods, y00ts is also an NFT collection that aims to use Wormhole’s technology for multichain development. y00ts with 15,000 NFTs issued on the Solana blockchain and also built by the same people who have been very successful with DeGods and Dust Labs.

After Solana encountered many problems, y00ts officially announced the move to the Polygon ecosystem. According to the project, NFTs on Solana will be burned through Wormhole’s smart contract and will mint a new NFT including all the old data of the NFT on the new chain. However, as far as I know, NFTs will be moved one bridge and settled on the new blockchain forever.

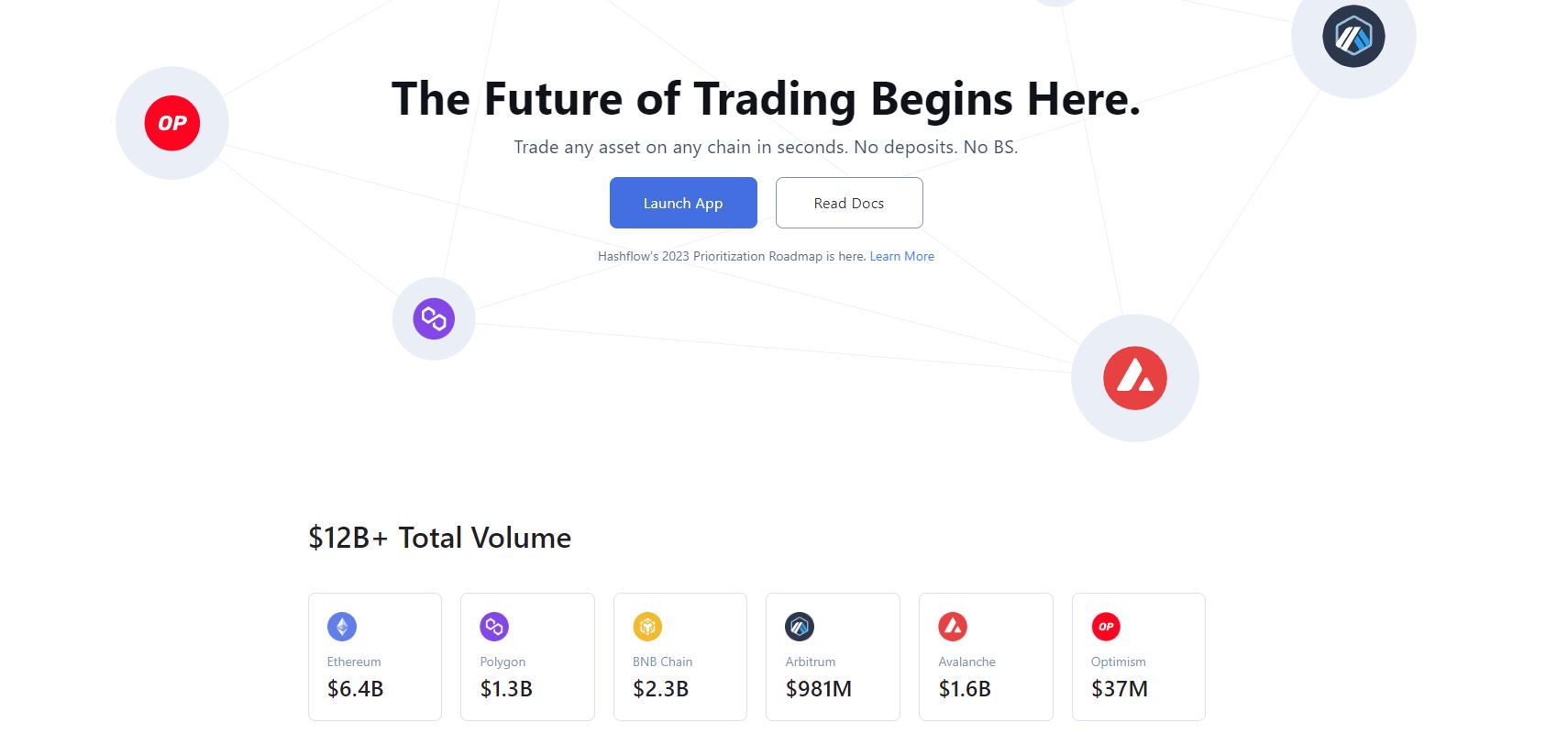

Hashflow – Wormhole’s Stargate

Similar to Stargate using LayerZero’s technology, Hashflow uses Wormhole’s message transmission technology. As the project shares, Hashflow is a Cross-chain DEX platform that allows transferring native crypto from this blockchain and receiving native tokens from that blockchain. Up to now, Hashflow is supporting many blockchains such as Ethereum, Polygon, BNB Chain,…

Up to now Hashflow has supported users to transfer more than $18B of assets between blockchains including:

- Ethereum: $6.4B

- BNB Chain: $2.3

- Avalanche: $1.6B

- Polygon: $1.3B

- Arbitrum: $981M

- Optimism: $37M

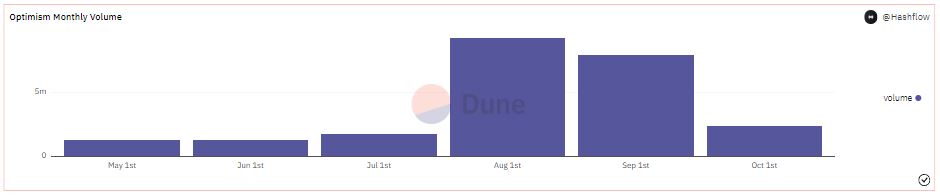

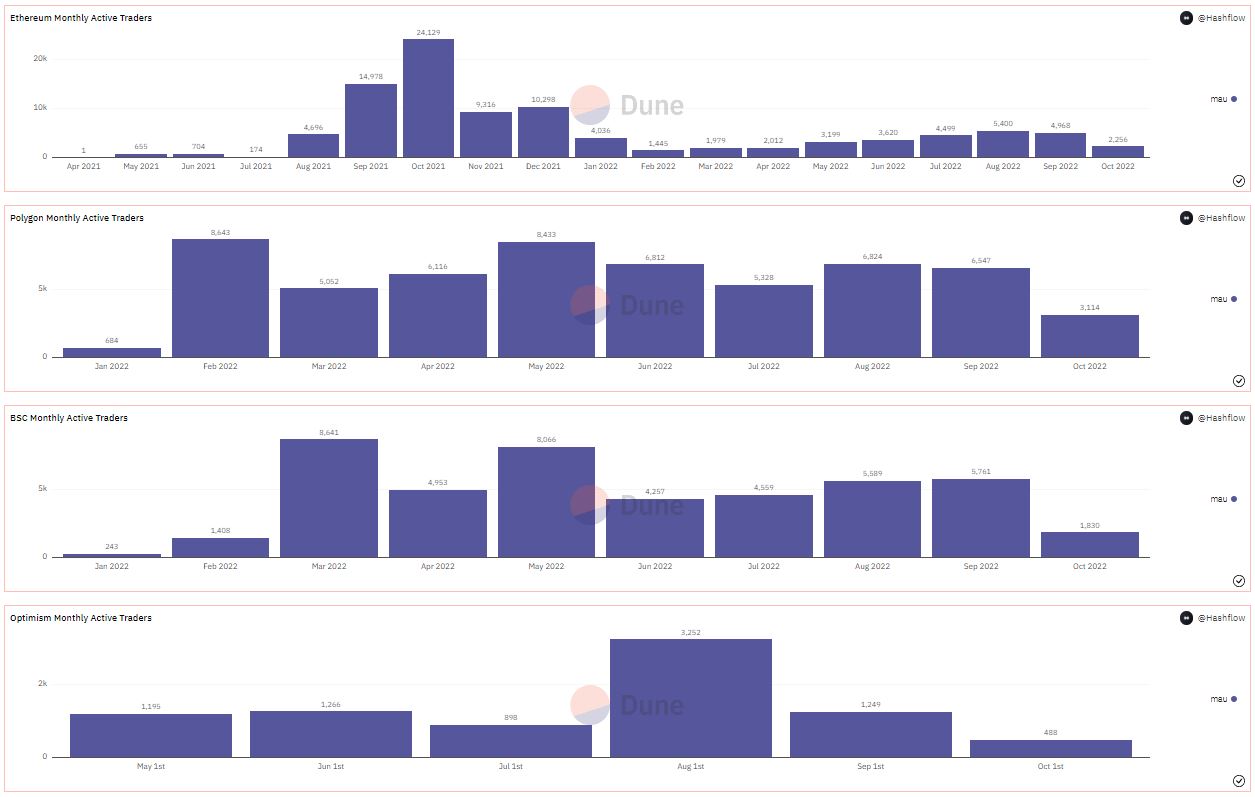

Voluem trades on Hashflow chains via monthly charts

Number of monthly users on the Hashflow platform

Through the two charts above, we see that on Polygon and BNB Chain, the number of monthly users and monthly transaction volume still maintain a slow growth rate. But the remaining blockchains such as Ethereum, Optimism or Avalanche are showing signs of decline. One surprising thing is that Solana is not supported by Hashflow.

It can be seen that despite a turbulent 2022, Hashflow is still on the rise. However, from my perspective, if you want to develop further in the future, Hashflow can research some of the following points:

- Supports a variety of asset types.

- Supports more blockchain platforms.

- There are incentive fields to attract new users.

Investment Opportunity With Wormhole Ecosystem

Retroactive with Wormhole

Similar to LayerZero, decentralization is a weakness of Wormhole as this platform only has about 19 Guardians and in the spirit of crypto in general and DeFi in particular, it is necessary for Wormhole to be decentralized in the future. . And in order to be decentralized, this platform is required to launch a native token so that anyone can become a Guardian.

Retroactive on Wormhole will be relatively affected from our perspective. We should focus on the largest projects being built on Wormhole such as Hashflow, Portal,…

Invest in the Wormhole ecosystem

Same thoughts in the article LayerZero Ecosystem: The Number of Projects Is Continuously Growing. Will It Open Up New Trends? that in the future when omnichain becomes a trend, leading projects on Wormhole’s ecosystem can benefit from this trend.

Besides, when Wormhole launches a token, it can use that token to incentivize its ecosystem to use as Liquidity Mining to attract liquidity and TVL from its competitors. I believe that whether LayerZero or Wormhole issues tokens first will be relatively important in terms of developing our ecosystem in the future.

Summary

The Wormhole ecosystem is too closely tied to Solana, which is both an advantage and a disadvantage. Wormhole should expand its ecosystem to accept many opportunities in other platforms. Besides, this is an extremely potential ecosystem in the future.