The Earn Point trend rose strongly after the huge Jito Labs Airdrop event to its users. Immediately after that, most current DeFi projects simultaneously launched the Earn Point program to attract users. However, in the role of an Airdroper/Retroactiver, we still have to have a suitable and effective way to play to avoid getting involved in unnecessary projects.

Earn Point Trend Rises

Development history

In fact, Earn Point is not a new model in the Crypto market, it has been around for a long time and is considered one of the solutions to help the platform attract user liquidity without the need for the Liquidity Mining program. . It has also gone hand in hand with Airdrop/Retroactive from the beginning until now, but it has never attracted users because often projects using the Earn Point model do not bring good results.

However, the Earn Point trend has simultaneously occurred on the Solana ecosystem with second generation projects on this platform. First, Marginfi is the leading project in bringing the Earn Point model to the Solana ecosystem and this model really worked when the project’s TVL threatened the position of Solend – the Lending & Trading platform. Biggest Borrowing. Solend itself also had to launch the Earn Point program to compete with its competitors.

Next, Jito Labs is the name that used the Earn Point model to compete with larger projects than Marinade Finance in the Liquid Staking war and in fact this model continues to prove effective.

Earn Point continues to be more popular on the Solana ecosystem with a series of applied and deployed projects such as:

- Zeta Markets: A Perp DEX platform that allows users to Long Short with high leverage to maximize profits for many popular assets in the Crypto market.

- Parcl: A Real World Assets platform that brings DeFi and TradFi closer together.

Earn Point trends and tipping points

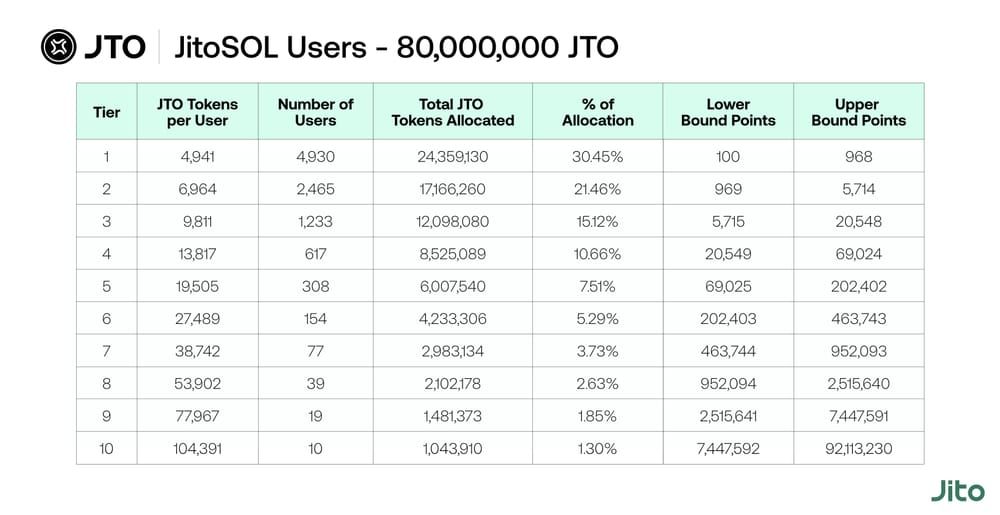

Earn Point only really exploded when Jito Labs announced an Airdrop for users with a low rate for those in the TOP 10,000 or more who will receive up to 5,000 JTO. 5,000 JTO at the time of TGE was worth up to $5,000 and if the user held until the next day, this number had increased to $15,000. Because of this, people have rushed to do Airdrops on the Solana ecosystem and especially projects with Earn Point programs such as Zeta Markets, Parcl, Marginfi,…

Another factor that has also made the Earn Point model famous is Blur. Blur is one of the famous NFT Marketplaces in the Crypto market and also has an Earn Point program. With volumes bought and sold on Blur, users will receive Points and be converted to Airdrop in the future. Pacman – Founder of Blur also took advantage of this model with Blast and it continued to be more successful than expected.

The Earn Point trend has since not stopped only on the Solana ecosystem but has begun to spread across many other ecosystems such as:

- Sui Network: Navi Protocol

- Ethereum: Swell

- Layer 2: Manta Network. Neon Labs,

- Starknet: Nostra Finance, Ekubo, StarkDeFi,

- NFTs: Mocaverse

Play It Right

The problem of the Earn Point model with Airdroppers

When the Earn Point trend takes over, it has a number of advantages such as:

- Almost 96.69% of the project will have to Airdrop to those who supported the project early on.

- This model helps us easily know where we are compared to everyone and then know how to coordinate liquidity and assets accordingly.

However, knowing where you stand in the rankings also leads to other people seeing this and the race to the top begins. From here, the disadvantages of the Earn Point model begin to appear for Airdroppers as follows:

- The Earn Point trend exploded with so many projects using this model being born. Players start to become restless and don’t know where to put their money.

- The Earn Point trend causes the race for cash flow to explode as everyone wants to climb higher to the TOP, so the resources spent on projects with the Earn Point model are also much higher than regular Airdrop projects. .

Play properly & avoid getting carried away

Of course, the way to play Airdrop with projects using the Earn Point model will not be too different from projects that do not use this model. However, at this time we must slow down to return to the basic criteria for evaluating a project. When the number of projects using the Earn Point model is too much, we must now be selective based on the following basic criteria:

- Basic analysis of the project including overview, operating mechanism, differences and development team.

- Analysis of project capital calls and participating investment funds.

- Analysis of the Earn Point model. Destination from where? What’s the ratio? How long has the program been going on?

From the above criteria, we will select the project that suits us and start participating. When starting to participate in the project we need to determine:

- Target: For users with large capital, they should aim to be in the TOP 5% – 10% of the entire number of participating users. As for users with thinner capital, the target should be TOP 30%. Of course, with projects that have too many participants, those with thin capital must have a plan to leverage or choose other projects.

- Measure: When determining what percentage you should be in the TOP, you must calculate how much you will have to spend and how long it will take. If the project is in the final stage, capital must be increased to reduce time, and if the project is still early, capital can be reduced to increase time.

- Prepare: Based on the goal of reaching the TOP, the user must use a number of assets that can be Stablecoin or Altcoin to achieve their goal. Preparation can be moving money from offchain to on-chain or moving from many different Blockchains to the destination Blockchain.

- Act: After setting goals and preparing carefully, users must take action. Besides action, you have to monitor the rankings every 2-3 days to know where you are? Increase TOP quickly or slowly, or even decrease TOP, then adjust your goals, re-plan and continue to act.

One thing that is especially important for users with not much capital is that the criterion is still to focus and not spread out. The focus here is to avoid FOMO on all projects that are trending Earn Point because it is easy for users to fall into a state where when they see a new project that is better, they quickly liquidate their stocks. old platform to move to the new platform.

Summary

The growing Earn Point trend in the ecosystem opens up many opportunities for investors, but it also contributes to investors’ strategic confusion. That’s why it’s necessary to have a clear strategy when this happens.