If you have been in the DeFi market for a long time, you will surely be very familiar with Lending platforms like AAve and Compound. Those are big projects in the DeFi segment, but they are not necessarily the most complete.

Indeed, although the DeFi market has been growing very quickly, proving its effectiveness. But because it is a young market, there are still many problems. These issues are factors to promote development.

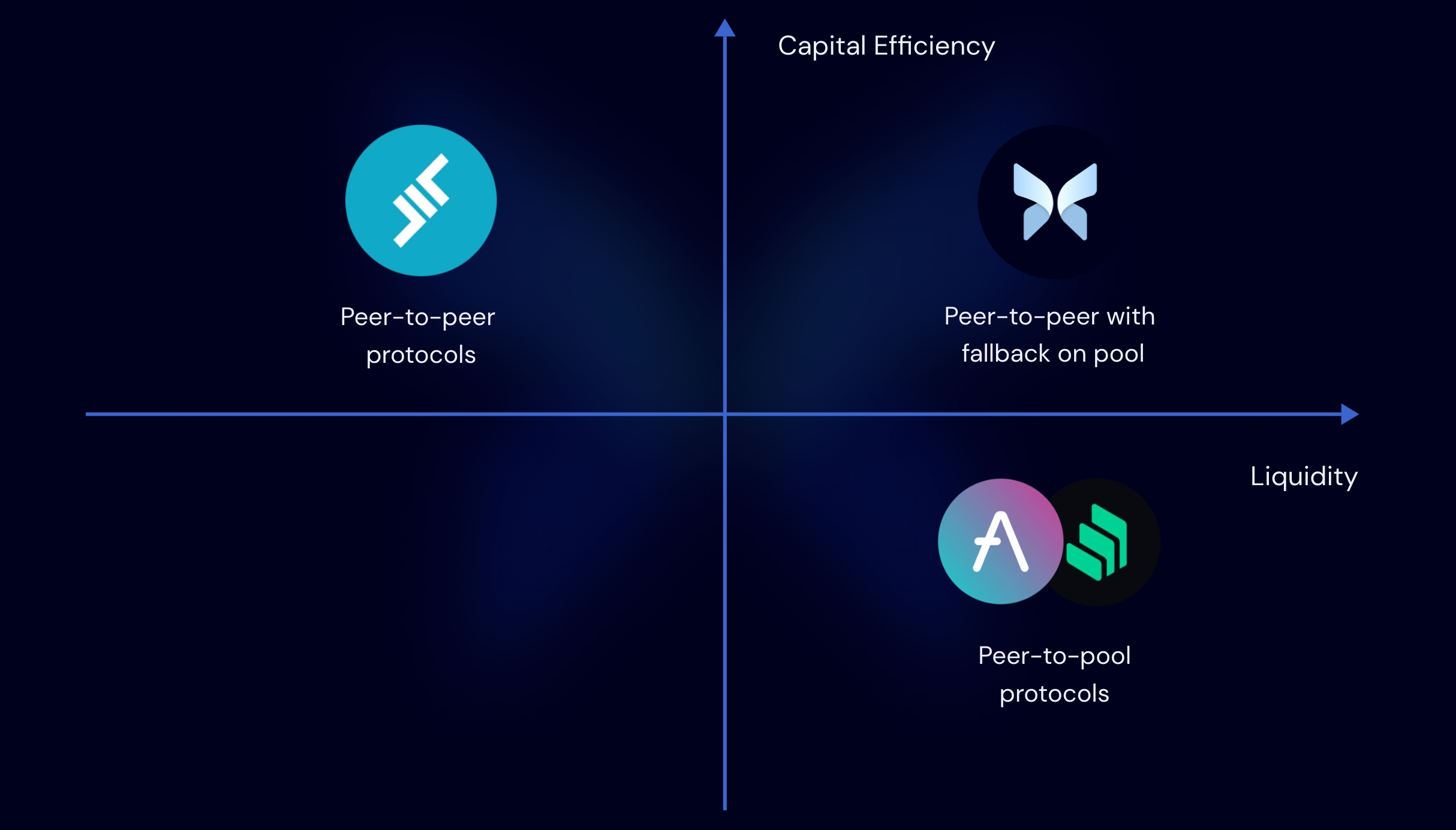

Thanks to that, Morpho, a P2P Lending protocol was born to solve some of the industry’s major problems. Morpho offers a solution that is a combination of Lending “Peer to Peer and Pool to Peer”. Take advantage of the massive liquidity available from AAve and Compound. Combined with the Peer to Peer Lending model to bring good profits to both borrowers and lenders.

So, how does Morpho work? Let’s find out in this article!

Morpho Overview

Morpho is a Lending, Borrow protocol built on Ethereum. Morpho offers borrowers and lenders the best APY rates. Thanks to the combination of Peer to Peer and Pool to Peer.

See Morpho as a layer on top of the AAve, Compound platform. It leverages available liquidity and helps users connect to that liquidity when Peer to Peer orders cannot be matched on Morpho.

Morpho also offers 2 products which are Morpho-AAve and Morpho-Compound. When interacting with Morpho-AAve it is like the user is interacting with AAve. The same thing happens with Compound.

Morpho highlights: offers good APY, intuitive and unified user interface, users can withdraw assets at any time.

It sounds great, but how does Morpho work and does it cover all risks? I think you are wondering that problem when reading this. And I will explain in great detail the working mechanism of Morpho in the next section. Please read it carefully!

To understand more about Morpho, you can read more here!

Mechanism of Action of Morpho

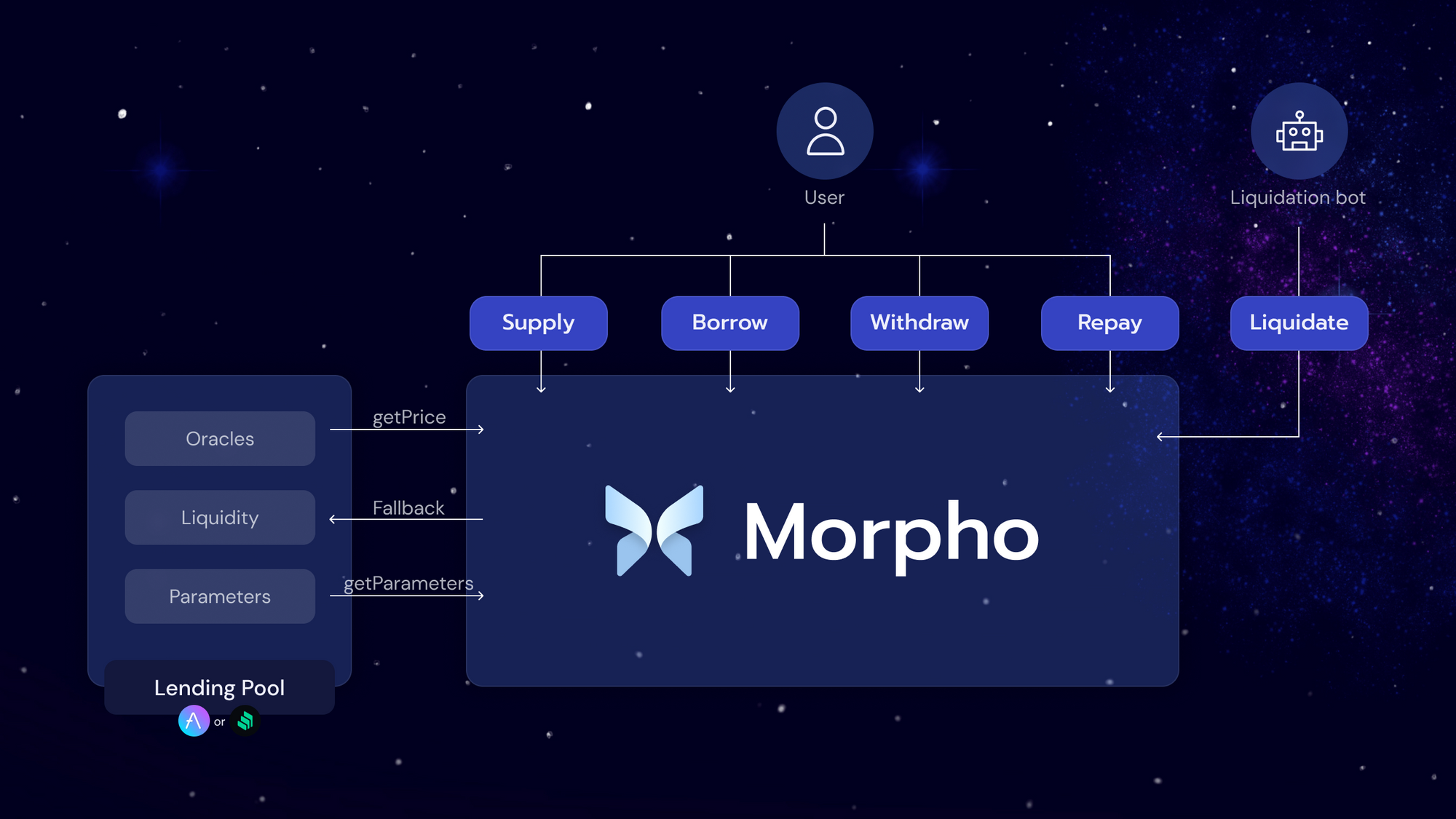

Architecture by Morpho

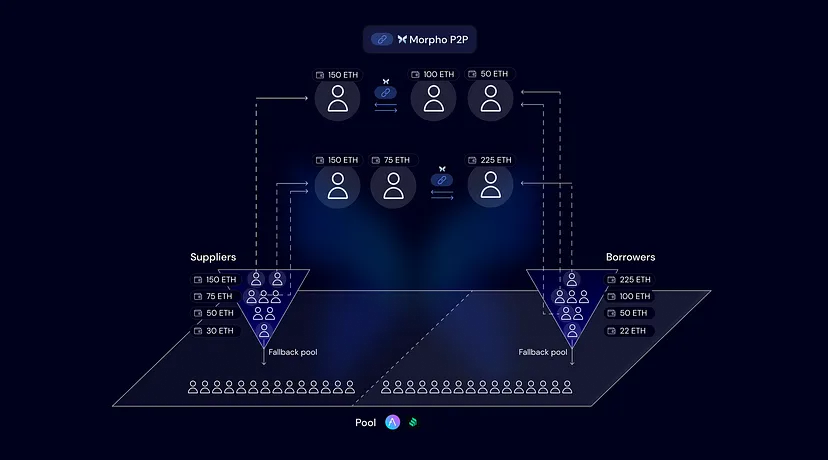

Morpho is a layer that helps users match P2P orders, the upper layer of the AAve, Compound platform. On one hand, Morpho connects with users, and on the other hand, it connects with AAve and Compound to use liquidity. In addition, other protocols can be integrated to use the products and services Morpho provides.

Mechanism of action

When users interact, place orders on Morpho. If there is P2P liquidity, orders will be matched with P2P APY. If there is no liquidity to match orders on P2P, Morpho will send the user’s order for execution on AAve or Compound, depending on the user’s initial choice. Then, if someone orders the opposite of the original order (i.e. initially the borrower then the lender or vice versa). The initial order in the Pool will be withdrawn for P2P matching. And more specifically each activity below.

Matching mechanism

Users using Morpho, they must choose to interact with Morpho-AAve or Morpho-Compound. Then let’s say the user chooses to execute the command on AAve (the way it works on AAve and Compound is the same).

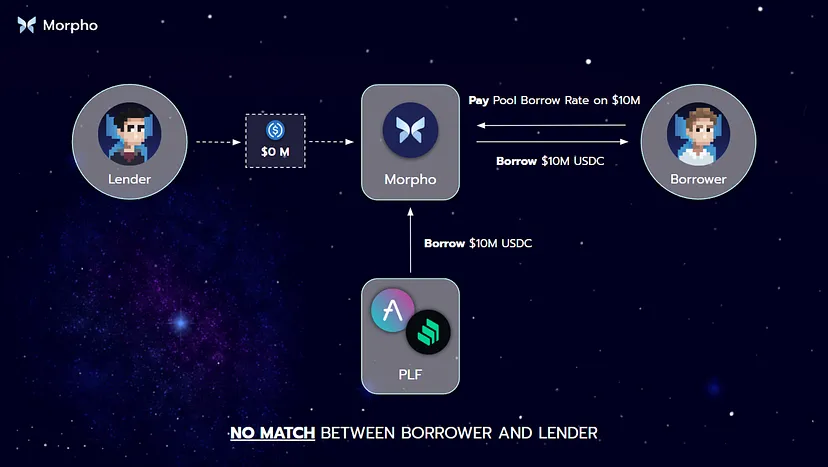

In case of P2P order mismatch

For example: A user comes to Morpho wanting to borrow $10M USDC, but there is no one lending USDC. Morpho automatically borrows USDC from AAve Pool to execute borrower orders. The borrower pays the APY Pool Borrow.

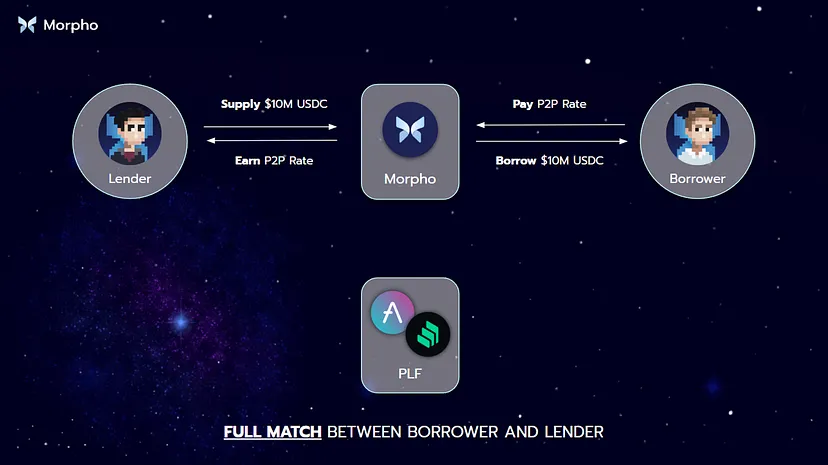

In case of full P2P order matching

For example: A user came to Morpho wanting to borrow $10 million USDC and exactly $10 million was offered by another user to AAve’s Pool. This tool will remove the supplied USDC from the underlying Pool and P2P match borrowers and lenders. At this point both parties receive P2P APY.

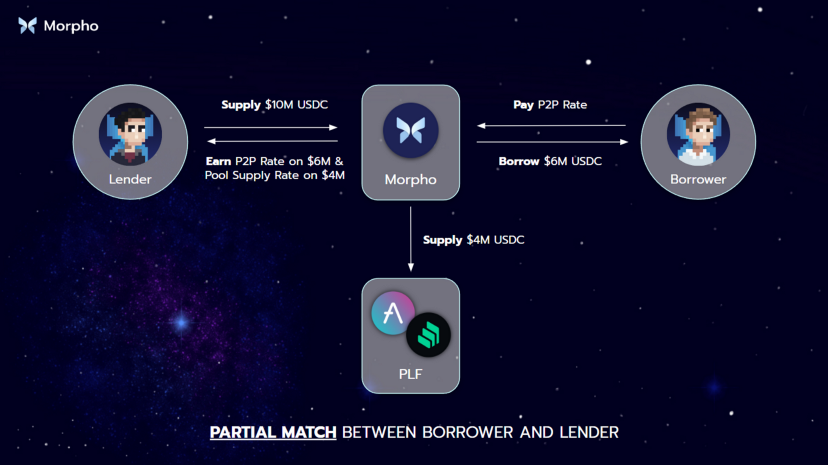

Partial P2P matching

For example, 10 million USDC USDC is offered on Morpho, but only 6 million USDC is borrowed. Here, the protocol matches $6 million to peer while forwarding the remaining $4 million to the underlying pool. Providers earn a combined rate — P2P APY above $6 million and Group Offering APY above $4 million. Meanwhile, borrowers only pay P2P APY.

P2P operating mechanism

On Morpho, the user’s order book is always recorded and will be matched from the order with the highest volume. After matching the P2P order, both the borrower and lender are charged the P2P APY. That APY is the average between the borrowing and lending APYs on AAve or Compound. It is the best APY for both borrowers and lenders.

What if the borrower or lender wants to exit the position after order matching? Morpho still meets this need smoothly as follows:

- For borrowers: Borrowers only need to repay the loan with interest and will receive the mortgaged property back. At the same time, that P2P order will be canceled and the lender’s assets will be transferred to the underlying Pool to continue lending. And earn interest according to the basic Pool.

- For lenders: Lenders want to withdraw their assets. But that same asset was transferred to the borrower when matching the P2P order. So Morpho will use the borrower’s collateral in the underlying Pool to pay the lender. At the same time, from then on the borrower will pay the interest rate calculated according to the basic Pool provided.

Liquidation mechanism

Liquidation on Morpho works just like liquidation on AAve and Compound’s basic pools. When a user’s position is not fully collateralized, the liquidator will pay part of the user’s debt and receive part of the user’s collateral.

Summary

Morpho has solved the remaining limitations in the DeFi market. By intelligent operating mechanism, offering the best APY level for people. I believe this is one of the potential projects.

So I have clarified the working mechanism of Morpho. Hope this article provides you with a lot of useful knowledge!