As we have discussed all about Solana cryptocurrency in the previous article, Solana is a high-performance Blockchain platform targeting hundreds of thousands of TPS with almost zero transaction costs. And Raydium is considered one of Solana’s first DEXs. Let’s learn together in detail what Raydium (RAY) is? What is noteworthy about the RAY project?

What is Raydium?

Raydium is a platform operated on the Solana Blockchain and operates under an Automated mechanism Market Maker (AMM) and Liquidity Provider Built (liquidity provider). for decentralized exchange Serum (DeX).

Raydium will support on-chains liquidity (on-chain liquidity) for Limit Orderbook (Limited order book) in the center. Raydium LPs have access to the entire ordering and liquidity process on Serum.

What is RAY token?

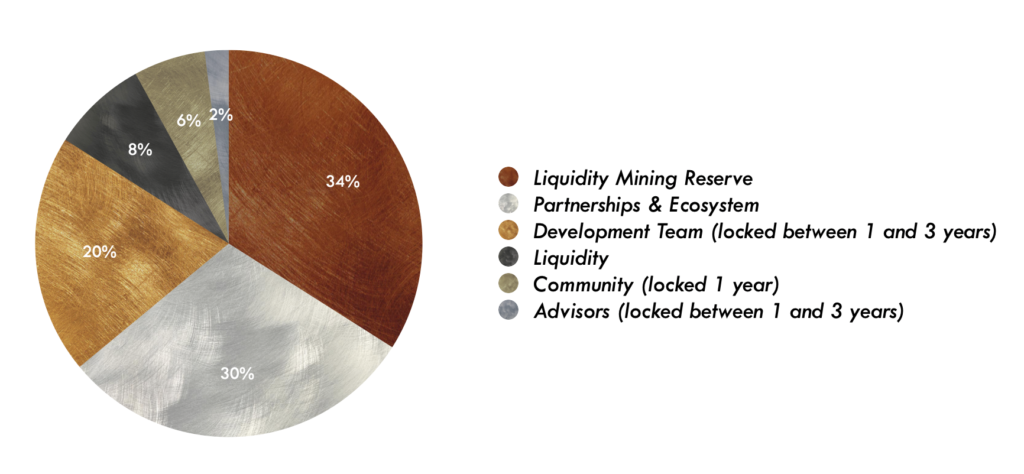

RAY is the native utility token of the Raydium ecosystem. Its initial supply (launched on February 21, 2021) is limited to 555 million tokens. The development team has been allocated 20% of the total supply, locked for up to three years so developers cannot sell them.

One-third of the supply of RAY tokens (188 million) can be mined. The block reward is expected to be halved every six months. At the same time, 0.03% of transaction fees made on the platform will be sent as rewards to stakers.

Special Spot on Raydium: Market Making

Raydium has some advantages below:

- Fast transaction speed thanks to being built on the Solana blockchain. Ability to double scale every 2 years.

- Average fees for each transaction extremely low.

- Ability Good compatibility with Ethereum.

How Does Raydium Work?

Let’s find out what RAY is. So how does it work?

With Solana’s high scalability allowing Raydium to match algorithms and perform much better than other AMMs, the platform clearly balances decentralization with operational efficiency. Let’s explore how it works!

Constant Function AMM

As mentioned above, Raydium provides on-chain liquidity to the central limit order book, meaning that both users and liquidity pools have access to the order flow and liquidity of the entire ecosystem. Thai Serum.

As a result, instead of using dedicated market makers, anyone can literally provide liquidity to backed pools by staking the assets represented in the pool. For example, if you want to be a liquidity provider for the SOL/USDC pool, you need to stake a specific amount of SOL and USDC.

Additionally, to eliminate inconsistencies and ensure the asset ratio in liquidity pools is balanced, Raydium uses a mathematical function K = Y * X to provide unlimited liquidity to users. Here, Y represents the value of Asset A, while X represents the value of Asset B, and K is a constant.

The formula is claimed to feature unique anonymity, allowing two tokens to coexist without sharing information such as price and value. Raydium is using this constant function in line with the Fibonacci sequence to offer up to 20 orders at different prices with spreads as low as around 20bps.

Development Team

Raydium’s ecosystem was launched in February 2021, developed by a group of anonymous founders using pseudonyms with the “ray” suffix:

Raydium’s team of experts come from diverse backgrounds in marketing, algorithmic trading, blockchain development, mathematics and more.

Tokenomics

Overview Information About RAY Token

- Token name: Raydium

- Token code: RAY

- Network: SPL – ERC-20

- Total supply: 555,000,000 RAY

Token Allocation

Token Use Case

Currently, we can use RAY tokens for the following purposes:

- Staking to earn protocol fees

- Staking to receive IDO allocation

- Governance through votes on protocol decisions

Raydium ecosystem

Thanks to Solana’s powerful capabilities, the ecosystem built around the Raydium project offers a decentralized trading experience, liquidity, and low costs. Raydium achieves this by combining Serum’s order books with their AMM protocol.

Yield Farming

Raydium rewards liquidity providers with 0.03% of all trading fees. Raydium issues a token that allows tracking the percentage of the pool each user owns.

Yield farming allows anyone to invest their tokens by taking advantage of the advantages of DeFi. Of course, you can deposit your newly acquired LP tokens into the pools first to maximize your profits. This process is called yield farming or liquidity mining. When a liquidity provider (LP) provides liquidity on the platform, Raydium issues LP tokens that represent that specific LP’s share of a pool. Certain pools decided by the Raydium community can farm these tokens to return RAY tokens as a reward.

To bring liquidity to Raydium, you will need a functional Solana wallet for the tokens you want to stake in the pools. The native version of USDT is now available on Solana. So, if you want to transfer USDT to Solana wallet, you can withdraw USDT from your wallet without fees. Once your wallet has enough USDT, you need to connect it to Raydium to proceed to the next step.

AcceleRaytor

The AcceleRaytor feature has been added to the Raydium platform, serving as support for new projects to further expand on the Solana ecosystem. Thanks to this system, projects that have obtained initial liquidity and sufficient capital can easily complete the sale.

Raydium’s AcceleRaytor, like PancakeSwap’s IFO (Initial Farm Offering), allows projects to launch and raise funds directly on their protocol. AcceleRaytor provides Solana-affiliated project leaders with the ability to access financing quickly and efficiently. It is designed to operate on a two-pool model, rewarding projects that take advantage of the program. The model allows the project to reach the broader crypto community while still being able to reward RAY token holders.

Raydium and the Solana blockchain

As mentioned above, Raydium is built on the Solana blockchain, allowing it to interact seamlessly with other DApps in the Solana ecosystem. It benefits from the Serum decentralized exchange’s fast transactions, shared liquidity, and other features.

Raydium uses PoH to ensure network security and continuity, resulting in a very low cost per transaction.

Exchanges

Presently at Raydium is traded on many different exchanges such as Binance, FTX, Kraken, OKX, Gate.io, MEXC,…

Information Channels About Raydium

- Website: https://raydium.io/

- Twitter: https://twitter.com/RaydiumProtocol

- Medium: https://raydium.medium.com

- Telegram:

Conclude

Together we learned what RAY is and information related to the Raydium cryptocurrency.

Thanks to the speed of the Solana blockchain and the liquidity of Serum, Raydium can process a large number of transactions per second. With its outstanding features, Raydium promises to have more room for development in the near future.

Hopefully this article has given HakResearch readers the necessary knowledge about the Raydium DEX exchange as well as the RAY token.