What is Trader Joe’s? For Defi enthusiasts, especially those interested in the Avalanche ecosystem, they are no stranger to the name Trader Joe – a decentralized exchange similar to Uniswap and integrated with many additional utilities such as Yield. Farming, Lending & Borrowing, Staking and NFT trading support.

It can be said that on Avalanche, along with its elder brother Pangolin, Trader Joe is the pioneering platform to build the Defi ecosystem and takes the lead in bringing cash flow to Avalanche. So if there’s anything interesting about Trader Joe’s, let’s find out in the article below!

Trader Joe’s Overview

What is Trader Joe’s?

Trader Joe is an outstanding AMM platform first built and developed on the Avalanche ecosystem. Trader Joe later developed towards multichain and Arbitrum is the next ecosystem that Trader Joe set foot in. Trader Joe aims to be an All in One DeFi platform with a variety of different products such as AMM, Lending & Borrowing, NFT Marketplace,…

The platform operates and ensures regular liquidity through the following profit making methods:

- Swap Fee: 0.05% per user swap transaction – this amount is converted to USDC and divided among stake holders.

- Lending: Lending through the Banker Joe platform.

- Protocol Owned Liquidity: Trader Joe holds 27.5% of the JOE-AVAX liquidity pool and receives 0.25% trading fees.

- NFT Marketplace Fee: Trader Joe earns 3% on every NFT transaction on its platform.

The Trader Joe’s Difference

AMM – Products with a difference

It can be said that of all the products that Trader Joe is providing to the Crypto market, up to now, AMM is the most prominent product and also brings the highest revenue to the protocol. AMM on Trader Joe has undergone several updates such as:

- AMM: Trader Joe’s first AMM version is somewhat similar to Uniswap V2 and does not yet stand out or be different from other AMMs on the market.

- Liquidity Book: A product that marks a turning point in Trader Joe’s development when this platform is one of the rare platforms to build a CLMM (Centralized Liquidity) by itself along with Uniswap – the initiator of the movement and Orca on Solana.

- Auto Pool: Is a product that simplifies the process of providing liquidity on Trader Joe, making it possible for anyone to become an LP even without knowledge of liquidity provision.

Some of the included products

Aiming to be an All in One DeFi platform, Trader Joe also provides a variety of DeFi products to the community including:

- Lending & Borrowing: Trader Joe provides a borrowing and lending platform to the community.

- NFT Marketplace: Is a platform that allows users to buy and sell their own NFT collections. Projects can also list their NFT collections on Jpepeg.

- Bridge: Allows users to move JOE across different Blockchains to participate in Staking. JOE is built on LayerZero’s OFT.

- Yield Farming: Users can Farm on Trader Joe to make profits.

- Staking: Users can stake JOE in many different ways to receive different rewards.

The difference comes from the tokenomics model

From the very beginning, Trader Joe has built a very diverse use case for participants who stake JOE to receive a number of RTOs.

- sJOE: Share protocol revenue but will receive Stablecoin.

- veJOE: Is a model similar to veCRV on Curve Finance to create Joe Wars. However, after a period of ineffective operation, the project team decided to discontinue veJOE from May 2023.

- rJOE: Is a regular staking program to receive JOE inflation rewards.

- xJOE: Protocol revenue shares are different tokens that cannot be converted to Stablecoins like sJOE.

However, after a period of ineffective operation, Trader Joe’s officially stopped the veToken model program.

Development Roadmap

Trader Joe launches Merchant Moe

December 11, 2023, Trader Joe’s development team officially launched Merchant Moe – an AMM platform similar to Trader Joe on the Mantle Network ecosystem. It can be said that Merchant Moe is a better version of Trader Joe’s on Mantle in a number of ways as follows:

- Merchant Moe has a new Bribe and voting system.

- Put MOE into stake to receive sMOE and then receive profit sharing as Stablecoin.

MOE will be distributed to JOE holders divided into several phases.

Investor

- September 2, 2021: Trader Joe successfully raised $5M with the leadership of DeFiance Capital, GBV Capital & Mechanism Capital, with participation from Three Arrows Capital, the Avalanche Foundation, Delphi Digital, Coin98 Ventures, Not3Lau Capital,…

Core Team

The team building Trader Joe’s is mostly anonymous, but we still have a little information about these members like Crypto Fish or 0xMurloc.

Crypto Fish: Co Founder

- Crypto Fish earned a Master’s degree in Computer Science from a top American university.

- Crypto Fish is a Software Engineer who has worked at Google and a Perpetual exchange.

- Crypto Fish has many contributions to the first projects on the Avalanche ecosystem such as Snowball or Shera Cash.

0xMurloc: Co Founder

- 0xMurloc earned a Bachelor’s degree in Electrical Engineering from a top US university.

- The highest position that 0xMurloc has ever held is Senior Product Manager at Grab company.

Tokenomics

Overview information about JOE token

- Token Name: Trader Joe

- Ticker: JOE

- Blockchain: Avalanche

- Token Standard: ARC-20

- Token Type: Governance Token

- Contract: 0x6e84a6216eA6dACC71eE8E6b0a5B7322EEbC0fDd

- Total Supply: 500,000,000 JOE

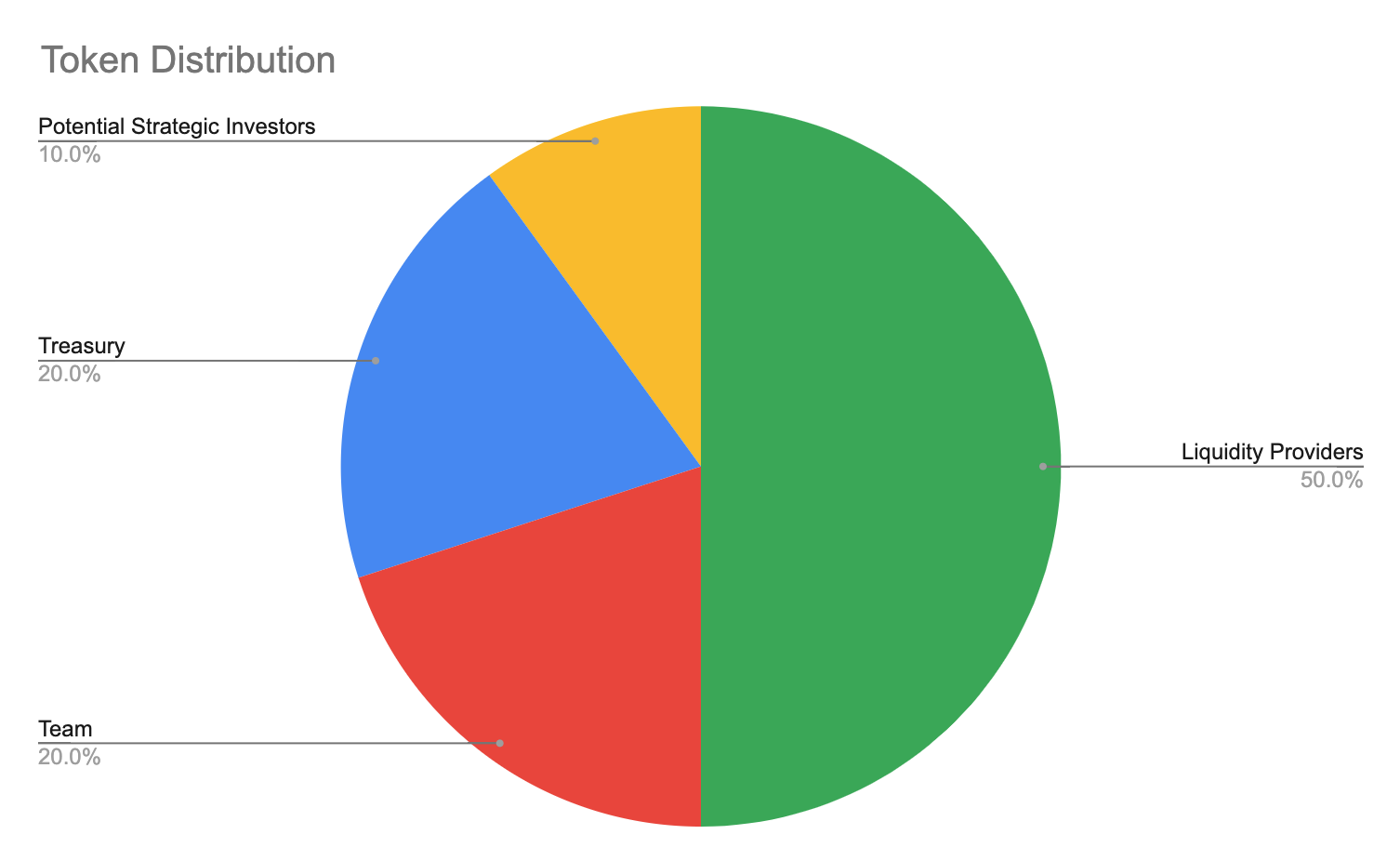

Token Allocation

- Liquidity Provider: 50%

- Treasury: 20%

- Dev Team: 20%

- Future Investors: 10%

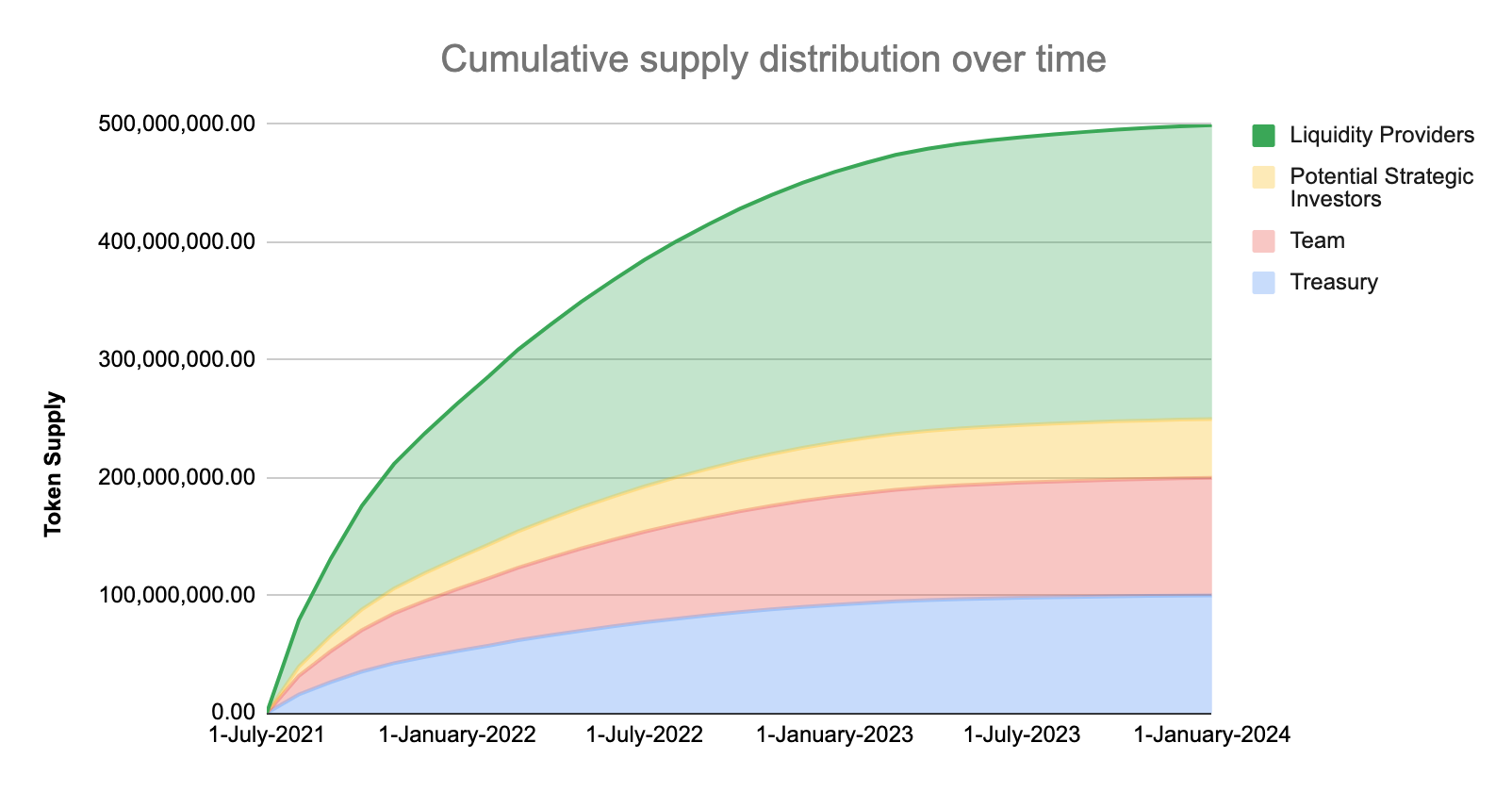

Token Release

There is no pre-sale, private sale or pre-listing allocation of the JOE token. All tokens are distributed according to an emission schedule.

Exchanges

Currently, you can trade JOE on major exchanges such as: Binance, OKX, FTX,…

Trader Joe’s Information Channel

- Website: https://traderjoexyz.com/

- Discord: https://discord.gg/GHZceZhbZU

- Twitter: https://twitter.com/traderjoe_xyz

- Github:

Summary

With the development of new Layer 1s like Avalanche and attracting inflows of money, Trader Joe has great potential when leading the DeFi segment in this ecosystem.

Although it is young compared to previous platforms such as Uniswap, with the advantage of taking advantage of the Avalanche blockchain’s capabilities in terms of scalability and speed, Trader Joe’s will most likely attract cash flow when This ecosystem is growing strongly.