What is Minimax Finance (MMX)?

Decentralized finance (DeFi) has provided investors with new sources of revenue. Minimax.finance is an aggregator of betting, lending and profit opportunities with stop loss and take profit. This platform allows you to enjoy the great benefits of DeFi (high APY and easy asset liquidity) and not worry about its risks (total loss or sharp devaluation). However, is it a fair trade for investors? Let’s find out in this article about the Minimax Finance project!

What is Minimax Finance (MMX)?

Minimax Finance is a decentralized application that allows you to get the benefits of DeFi while avoiding or at least minimizing the risks. With Minimax Finance, users will be able to set stop loss and take profit parameters for their staking and farming deposits, causing them to be instantly removed from staking/farming zones and converted to stablecoins if The value of deposits suddenly decreases or skyrockets. Additionally, Minimax will expand to other blockchains in the near future, starting with the integration of the Aave platform on Polygon.

What’s special about Minimax Finance (MMX)?

Advantage

Defect

Minimax Finance does not have a mobile app (but can be accessed through dApp browsers, such as Trust Wallet).

Mechanism of Action

We have briefly learned what Minimax Finance is? So how does this project work? Continue watching below:

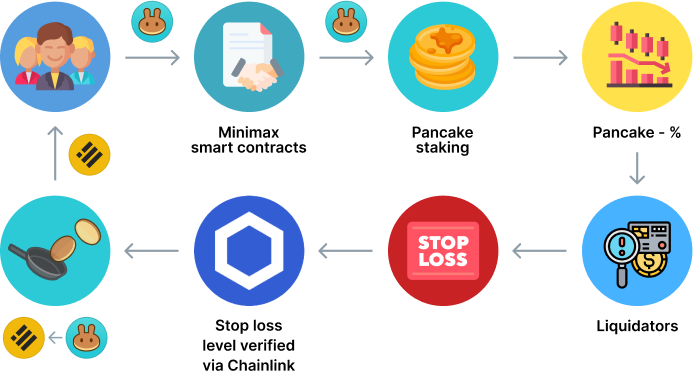

- First, customers create a position by depositing their cryptocurrency into a vault. When creating positions, clients can specify stop loss and take profit levels (optional).

- Locations are continuously monitored. When a position reaches the stop loss or take profit level, liquidation is initiated. Minimax Finance’s platform uses Chainlink price feeds to verify that stop loss and take profit orders are executed correctly.

- Once verified, stop loss or take profit events are processed with the help of the Gelato Network – tokens are converted into stablecoins (currently BUSD, more options to come later).

- After conversion, the stablecoin is transferred to the customer’s wallet.

- Minimax smart contracts can be upgraded to provide new features and resolve minor bugs.

- The DAO will be deployed once the platform matures. MMX is a governance token; it will be compatible with standard DAO features like proposals etc. The voting rights of each client will be determined by the amount of MMX staked.

Core Team

Updating…

Minimax Finance Tokenomics

Token ticker: MMX

- MMX will be a native token on Binance Smart Chain.

- On launch day, 25% or 25,000,000 MMX tokens are pre-minted to the IDO, liquidity, team and protocol investors.

- There will not be more than 100,000,000 MMX in existence.

- MMX emissions rates will be halved 12 months after launch and then halved again post-launch.

Pre-minted MMX tokens

- 10% of the maximum supply (10,000,000 MMX) is allocated to the Minimax team. This allocation is subject to a 6-month vesting, followed by a 24-month equal vesting.

- Another 10% of the supply will belong to Minimax investors and advisors. Vested monthly for over 24 months.

- 2% of the maximum supply is allocated to IDO

- 2% of maximum supply is allocated to marketing.

- 1% – for the initial liquidity pool at Pancakeswap.

MMX Token Allocation

With each additional BSC block mined, new MMX tokens enter circulation. Every 2 newly minted MMX will be allocated as follows:

- 72% of MMX will be distributed as rewards for staking MMX on MMX single asset pools

- 24% of MMX will be distributed as rewards for providing liquidity in the MMX-BNB Pancakeswap pool

- 4% of MMX will be used for airdrops. 0.4% of tokens will be airdropped every 3 months. The airdropped tokens are distributed among MMX’s platform clients based on the amount deposited during the previous three-month period.

MMX Staking Rewards

MMX stakers will have the option to lock their staked MMX for 3 predetermined time periods in exchange for higher rewards. 72% of MMX designated for MMX staking, will be distributed as follows:

- Unlocked – 8%

- 7 day lock – 14%

- 30 day lock – 20%

- 90 day lock – 30%

Development Roadmap

Q1 2022:

-

Launch on BSC (Pancakeswap integration)

-

Stop loss and take profit for single-asset vaults

-

Multiple positions per vault

-

Optimized smart contract architecture

-

Beefy and Venus integrated

Q2 2022:

-

Launch on Polygon network (AAVE integration)

-

Alpaca Finance integrated

-

Launch on Fantom (AAVE integration)

-

Yearn Finance integration (on Fantom blockchain)

-

Ability to enter any vault with any liquid token

-

Launch on Arbitrum (Beefy and AAVE integration)

-

Stop loss and take profit for LP-tokens

Q3 2022 – Q4 2023:

-

Launch on Aurora

-

‘Tokens’ section

-

Ability to withdraw a position into any token

-

Cross-chain swaps

-

Launch on Moonbeam

-

Optimize the application performance

-

UI/UX improvements

-

Launch on Ethereum blockchain

-

Lido Finance integrated

-

Launch on Moonriver

-

Trailing stop loss

-

Combination of yield farming and algorithmic trading

-

Display and easy migration of positions from other protocols

-

Automated management of rewards to increase yield

-

Telegram bot for position notifications

-

Ability to claim rewards without closing the position

-

Mobile experience improvements

-

APR to APY conversion to increase clients’ gains

-

Launch on other blockchains

-

Release DAO

Partner

Updating…

Exchanges

Updating…

Information Channels of Minimax Finance

- Telegram: https://t.me/MinimaxFinanceChat

- Twitter: https://twitter.com/MinimaxFinance

- Linkedin: https://www.linkedin.com/company/minimaxfinance/

- Medium: https://blog.minimax.finance/

- Discord: https://discord.gg/A6GJ6Qktwm

Total keh

Together we learned what Minimax Finance is and detailed information about the MMX project. The main concern for yield framers is the significant decrease in the value of their staking positions. Minimax Finance, a decentralized application has come up with a solution that provides users with an easy interface to set up staking positions with stop loss/take profit features to protect their assets, allowing they enjoy high APYs without worrying about risk. Minimax Finance is developing solutions to help investors more easily generate risk-free profits. Because it is a new platform, predicting the reliability, legitimacy and trustworthiness of Minimax Finance is not really clear at this time.