What is Stader Labs? Stader Labs is a multichain Liquid Staking platform. With Stader Labs, users can both participate in staking and take advantage of the derivative assets they receive.

Liquid Staking is the current and future trend of the crypto market. Let’s learn about this Stader Labs project

What is Stader Labs?

Stader Labs was born with the aim of simplifying the user’s staking experience and bringing profits. Simply put, if users hold coins on an L1 platform, instead of staking directly, they can stake through Stader Labs and receive profits like when staking normally. Besides, they receive a large token. represent their assets in Stader Labs. This token can be used for many different things in DeFi.

Operating Mechanism

For example: Buu is holding Near and wants to stake his idle Near for profit but does not want his Near locked in a smart contract. So Stader Labs was born.

Instead of staking Near directly on Near Wallet, they will stake Near because NearX is priced into Near.

With NearX, Buu can be used as collateral on Lending Protocol platforms or can be traded on DEXs to optimize his assets.

The Stader Labs Difference

Stader Labs has made certain improvements for its users compared to some other platforms such as:

- Users are free to choose the validators they desire instead of the platform being the one to choose.

- Users can monitor how validators operate and generate profits, thereby deciding whether to stick with this validator or look for a better validator.

- Improve UX/UI through improved products, tools and interfaces.

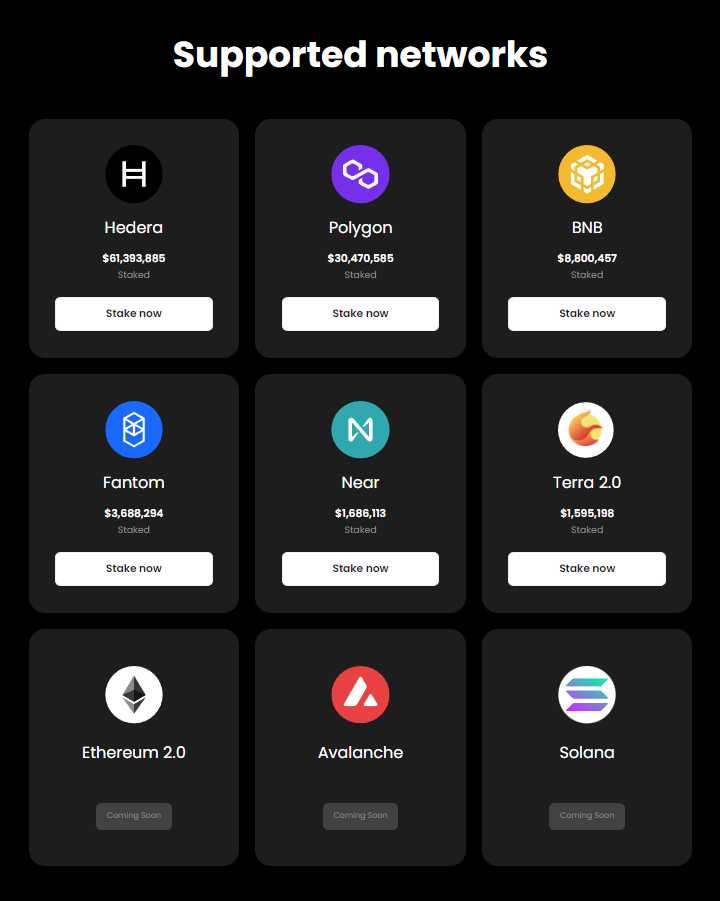

Up to now, Stader Labs is supporting products such as Hedera, Polygon, BNB Chain, Fantom, Near Protocol, Terra 2.0, Ethereum, and the upcoming Avalanche and Solana will be part of Stader Labs’ supported products.

Core Team

Stader Labs’ development team has many years of experience from non-traditional corporations such as LinkedIn, Blend Labs, PayPal, Facebook, Deloitte,…

Investor

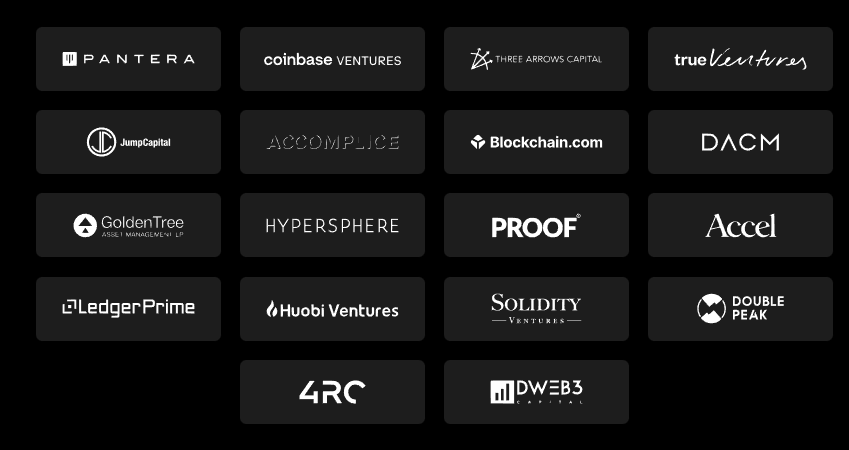

Stader Labs has gone through 2 rounds of capital raising with a total successful funding of $16.5M led by Three Arrow Capital and Pantera Capital in addition to Coinbase Venture, Accomplice, Jump Capital, Ledger Prime, Blockchain.com , Golden Tree Asset Management,…

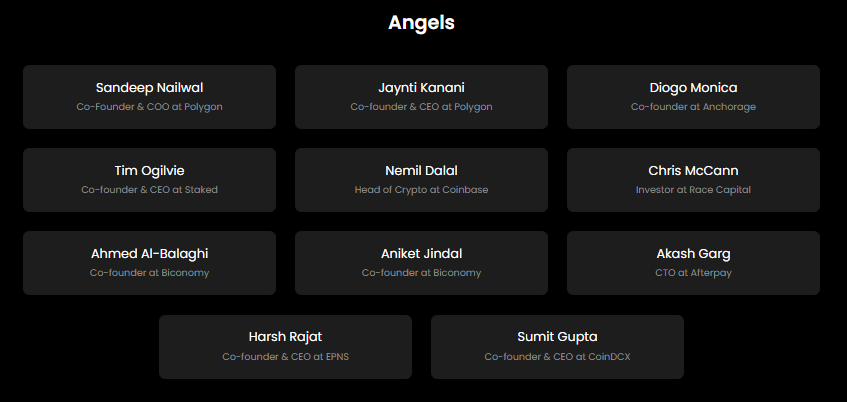

Besides, there are many famous individuals investing in Stader Labs such as Sandeep Nailwall (Co Founder & COO of Polygon), Jaynti Kanati (Co Founder & CEO of Polygon),…

Tokenomics

Basic information about SD tokens

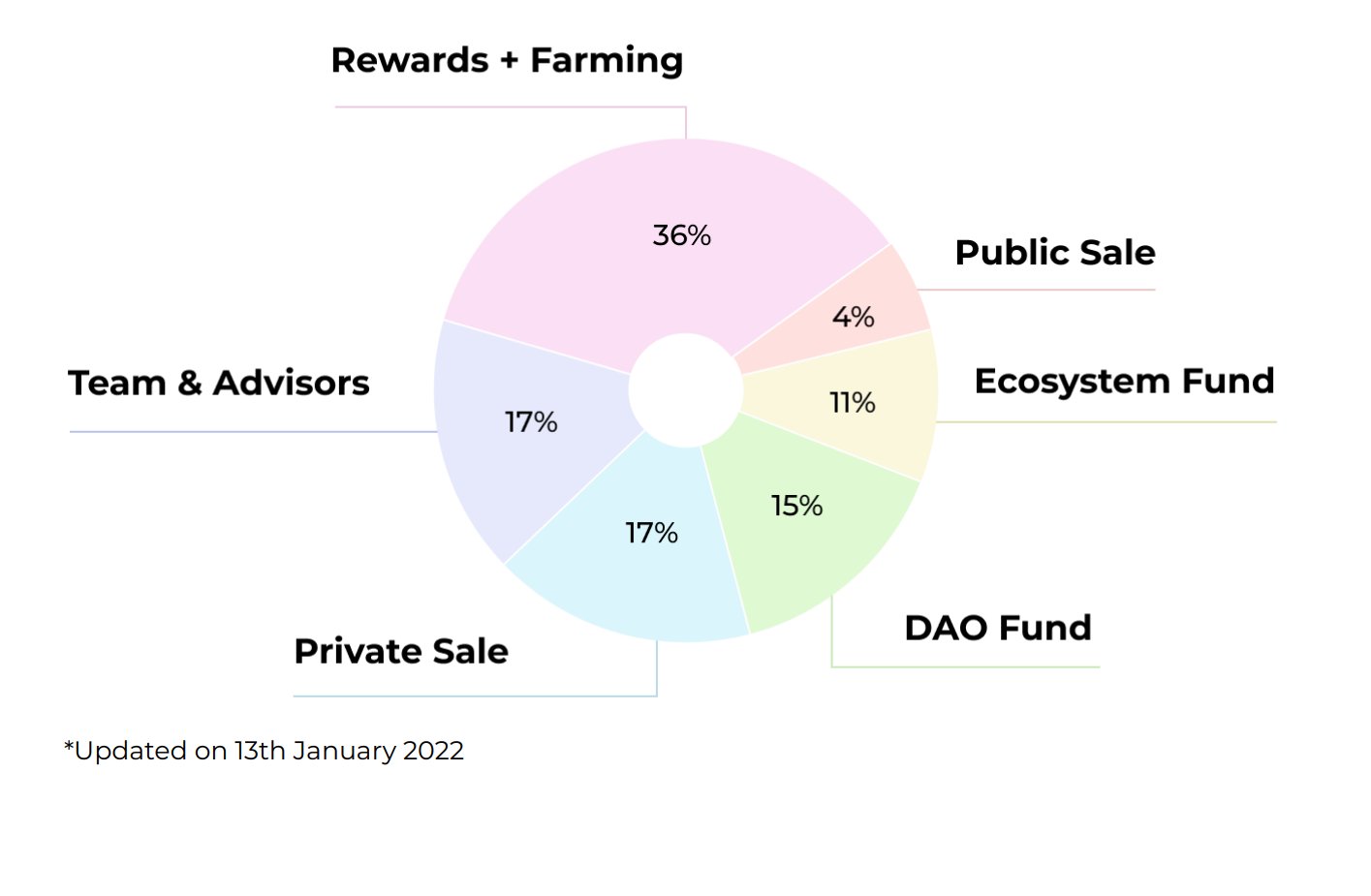

Token Allocation

- Rewards + Farming: 36%

- Team & Advisors: 17%

- Private Sale: 17%

- DAO Fund: 15%

- Ecosystem Fund: 11%

- Public Sale: 4%

Token Use Case

Users who hold Stader Labs’ SD tokens can participate in voting to decide the project’s development direction.

Exchanges

Currently, you can trade SD at many exchanges such as: Uniswap, Gate.io, Bitget, OKX, Quickswap, Houbi Global, CoinEx,…

Stader Labs’ Information Channel

- Website: https://staderlabs.com/

- Twitter: https://twitter.com/staderlabs

- Telegram: https://t.me/staderlabs

- Youtube: https://www.youtube.com/channel/UCqcjZuZo124yUwxNMzwnuCw

- Discord:

Summary

Stader Labs has come back strong after the fall of Terra and the project continues to move forward. Let’s follow this project together!