What is Tether (USDT)? In any financial market, there is always a need for stable assets that investors can hold when the market fluctuates strongly. Especially in the Crypto market, a market always known for its split-second Dumps and Pumps, an asset with high stability is needed.

USDT was born to solve this problem. This article will provide detailed information about Tether (USDT) for everyone!

What is USDT?

USDT, also known as Tether Coin, was released by Tether Operation limited in 2014. USDT is backed by USD at a 1:1 ratio. People can convert 1 USD (US Dollar) to 1 USDT and vice versa.

USDT was initially issued through the Omni protocol layer of the Bitcoin Blockchain. Then with the development of many different Blockchains such as: Ethereum, BNB Chain, Solana… USDT has gradually appeared on most of these Blockchains. It can be seen that wherever USDT is present, there will likely be a big boom.

Tether products

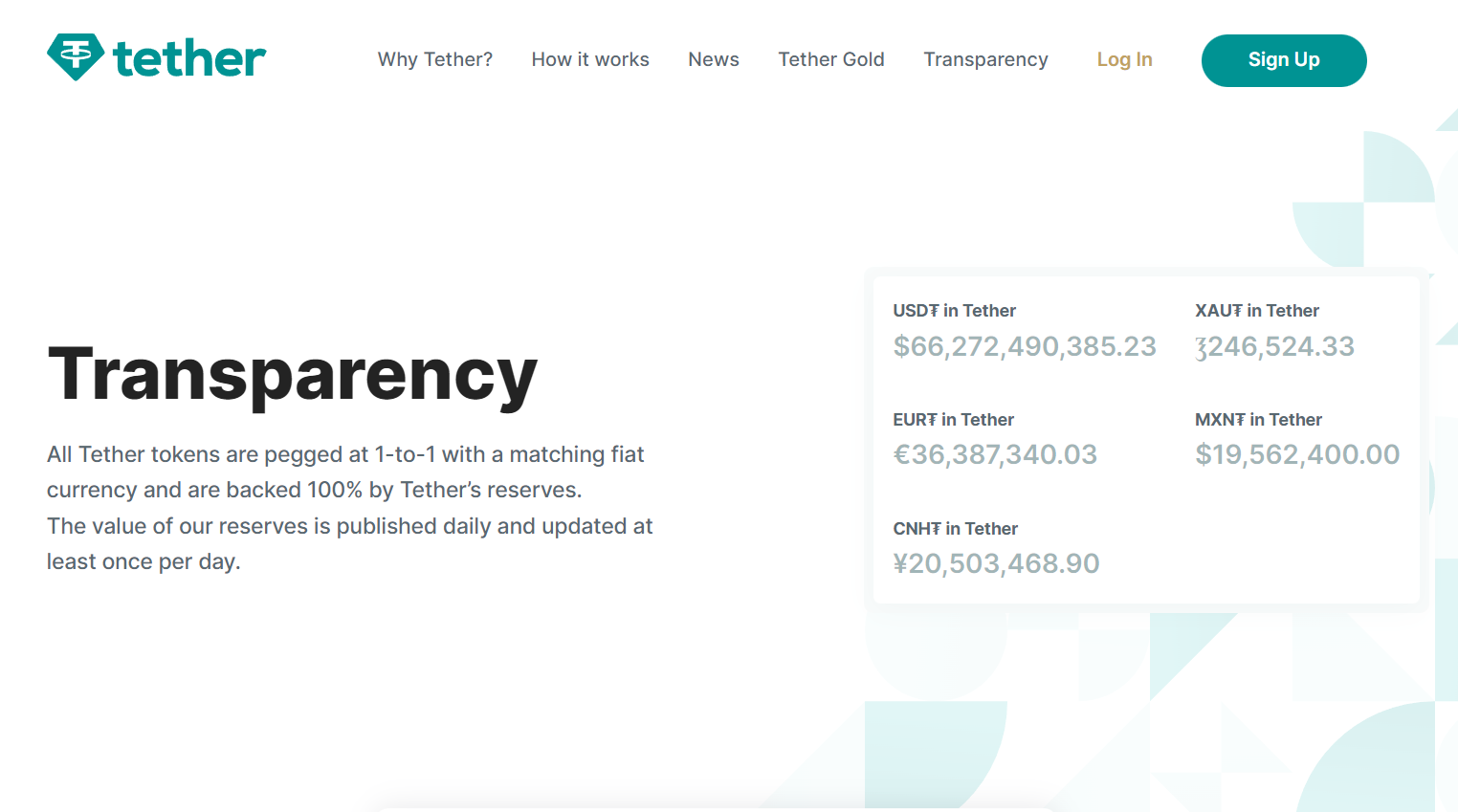

In addition to USDT products, Tether also issues a number of other Tokens such as: XAUT (Tether Gold), EURT (Euro Tether), MXNT (Mexican peso Tether), CNHT (CNH Tether). These products are 100% backed by Fiat currencies and corresponding assets.

What Are The Highlights Of USDT?

- The Crypto market is not as stable as other financial markets, often highly volatile, so USDT is used as a safe haven when people are hesitant about their investment decisions.

- When transferring money from one country to another, many problems arise such as: high transaction fees, slow transaction speed, low security because personal information is made public. USDT solves this problem thanks to the application of Blockchain technology with low transaction costs, fast speed, and high security.

How USDT works

- Step 1: Users deposit USD into Tether Limited’s bank account.

- Step 2: Tether Limited will create and deposit into the user account USDT with a value equivalent to the amount of USD the user deposits.

- Step 3: Users can send and exchange their USDT.

- Step 4: When there is no longer a need to use USDT, users can convert USDT to USD through Tether Limited’s platform.

- Step 5: Tether Limited will burn that USDT and send USD back to the user.

What Are the Limitations of USDT?

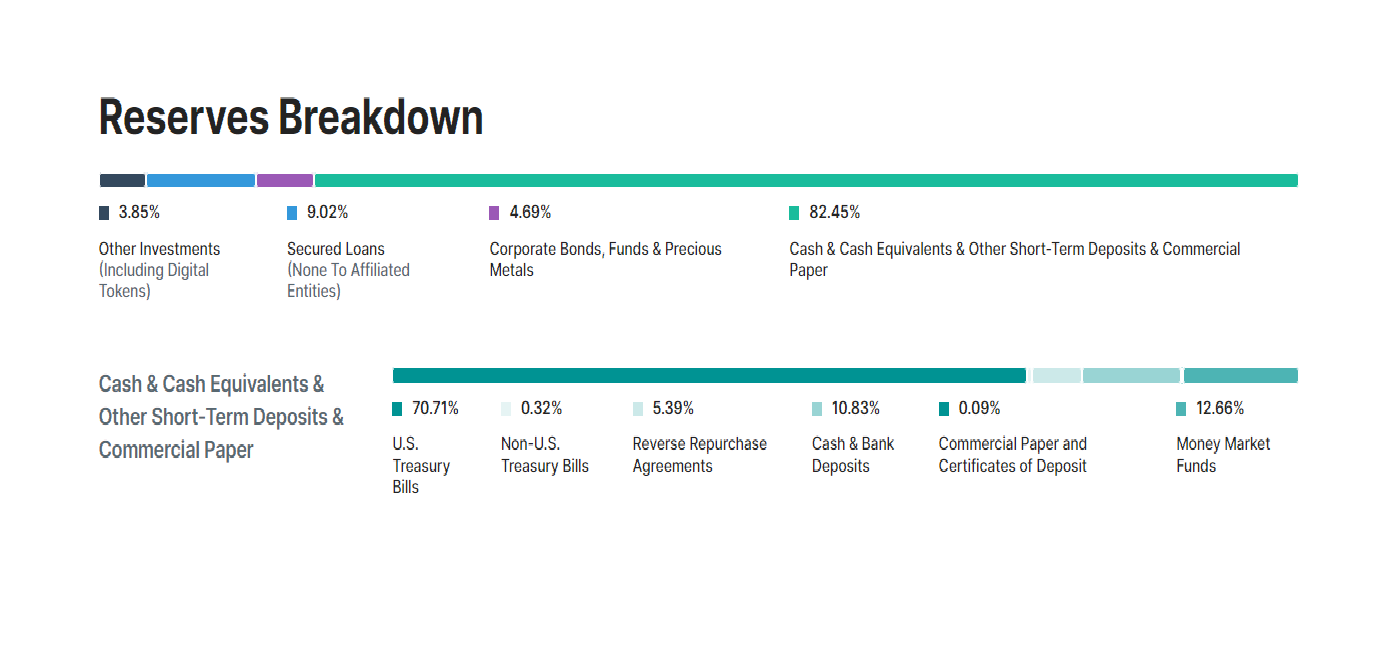

Although Tether Limited always introduces to everyone that USDT is completely backed by USD (US Dollar). However, looking at Tether Limited’s asset reserve table shows that this is not true because the reserve asset is not entirely USD.

- Only 82.45% is cash and certificates have cash equivalent value. The remaining bonds, secured debt and other investments carry many financial risks.

- Of that 82.45%, only 10.83% is cash in the bank. The remainder are treasury bills, commercial paper, certificates of deposit, and deposits in money market funds. These certificates also hide a lot of financial risks.

- Tether Limited also does not clearly disclose the origin of these certificates and bonds, and whether they guarantee safety or not.

Core Team

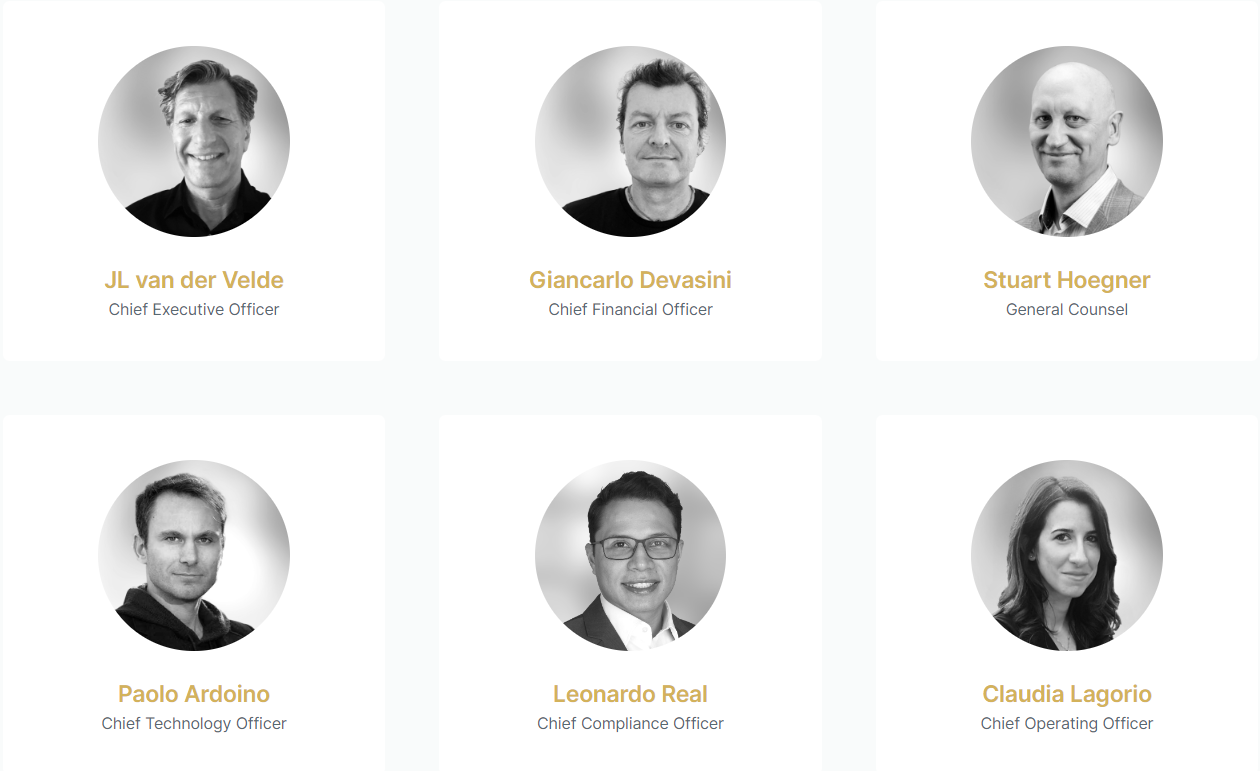

JL van der Velde – CEO: He speaks 5 languages and has more than 30 years of experience in technology and finance. He is Co-Founder of several hardware design and software development companies in Asia. Also held many senior management positions in many fields such as distribution, production, and fund management in China. In particular, he is also the CEO of Betfinex, a long-standing cryptocurrency exchange in the cryptocurrency market.

Giancarlo Devasini – CFO: He has a doctorate from the University of Milan majoring in medical doctor but then switched to working in the technology field. He was the founder of Solo SpA in 1997 – a company with more than 100 employees and annual revenue of more than 100 million Euros. Currently, he also holds the position of CFO of Betfinex.

Stuart Hoegner – General Counsel: He has a law degree from the University of Toronto, and worked for 8 years at M&A Tax Group – a company providing tax services. He also has more than 16 years working at Gaming Counsel Professional Corporation – a law firm in the field of betting and cryptocurrency.

Paolo Ardoino – CTO: Before joining Tether, he spent 3 years as CTO at Fincluster – a financial technology company. In 2014, he joined Bitfinex as a Senior Software developer, then 5 months later held the position of CTO. In 2017, he continued to hold the position of CTO at Tether Limited.

Leonardo Real – CCO: Before joining Tether, Leonardo spent more than 4 years working at BMO Financial Group – a financial corporation with nearly 50,000 employees. Here he held many different positions from analyst to manager.

Claudia Lagorio – COO: Claudia has 7 years of Freelance experience in the field of UI/UX Designer, Frontend Developer. 2016 Claudia joined Bitfinex as Frontend Developer/Mobile Application. By 2019, she held the position of COO at Bitfinex and Tether.

Tokenomics

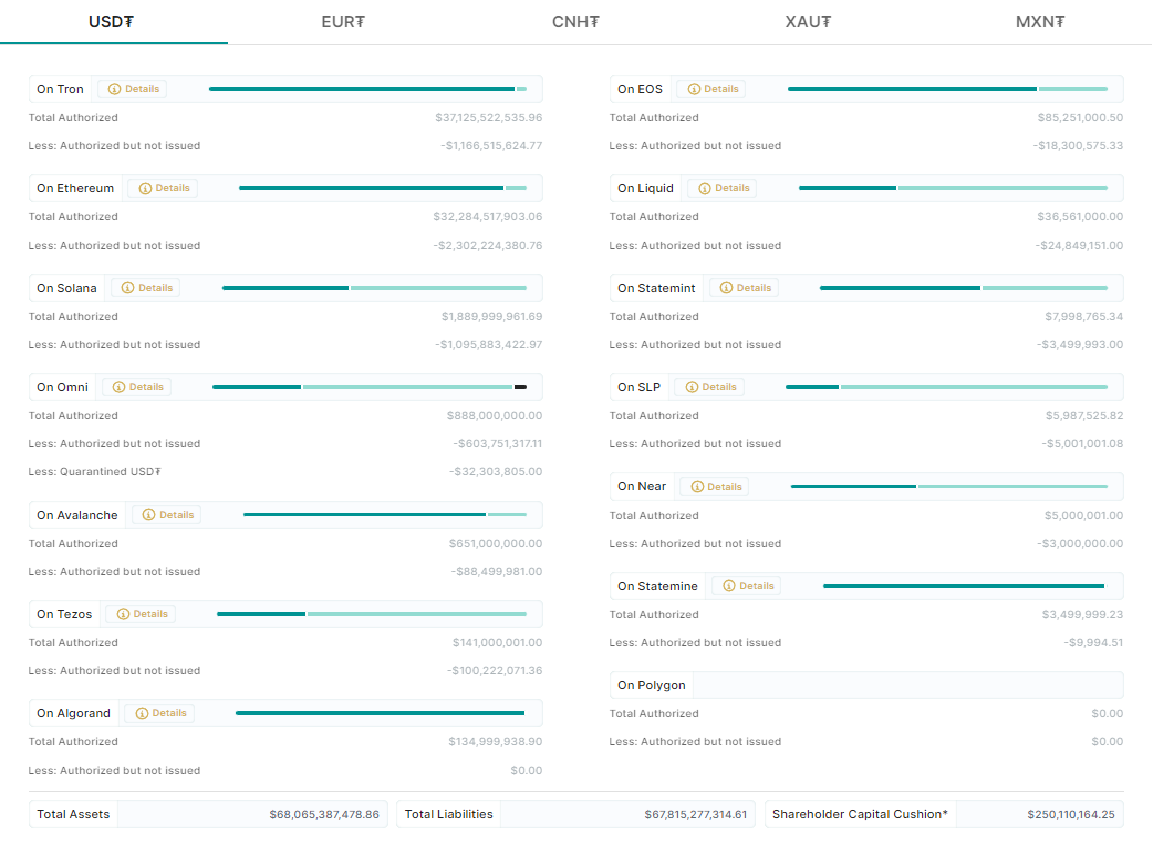

Tether (USDT) is available on most large and small Blockchains. Especially TRON Blockchain and Ethereum Blockchain account for about 97% of the amount of USDT on the entire Blockchain where Tether (USDT) is present.

- Name: Tether (USDT)

- Ticker: USDT

- Blockchain: Ethereum, BNB Smart Chain, Solana…

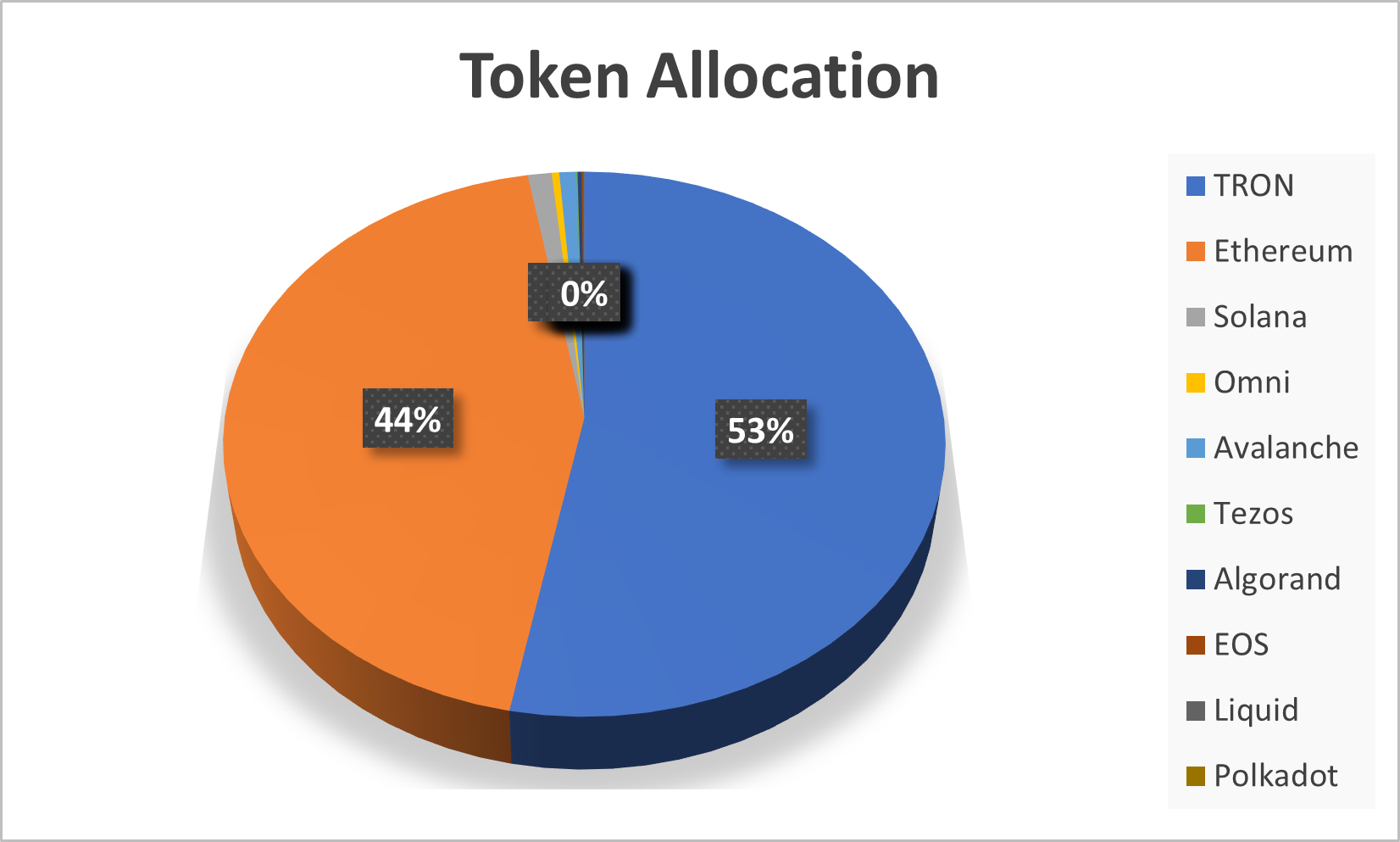

Token Allocation

The total supply of Tether (USDT) is currently about $67.8 billion and is distributed as follows:

- TRON: $36 billion accounts for 53%

- Ethereum: $30 billion accounts for 44%

- Solana: $794 million accounts for 1.17%

- Omni: $252 million accounts for 0.37%

- Avalanche: $562 million accounts for 0.83%

- Tezos: 40.8 million % accounting for 0.06%

- Algorand: $135 million accounts for 0.2%

- EOS: $67 million accounts for 0.098%

- Liquid: $11.7 million accounts for 0.0173%

- Polkadot: $4.5 million accounts for 0.0066 %

- SLP: 986 thousand $ accounts for 0.00145%

- Near: $2 million accounts for 0.00295%

- Kusama: $3.49 million accounts for 0.00515%

Exchanges

USDT is traded on most large and small exchanges such as: Binance, Coinbase, Kucoin, MEXC Global, Huobi, Bybit…

Project Information Channel

- Website: https://tether.to/en/

- Twitter: https://twitter.com/Tether_to/

- Telegram:

Summary

Tether (USDT) is a Stablecoin with a long history in the Crypto market, having won great trust in the user community. This stablecoin is being used in most cryptocurrency trading pairs and is always the top choice of users to hold when the market fluctuates.

However, in recent years, many formidable competitors have appeared such as: USDC, BUSD with clearer and more transparent financial reports, and have also occupied a certain market share in this Stablecoin segment.

This shows that Tether (USDT) needs to change to adapt if it does not want to lose market share to its competitors. Let’s look forward to the next improvements of Tether (USDT) in the future.