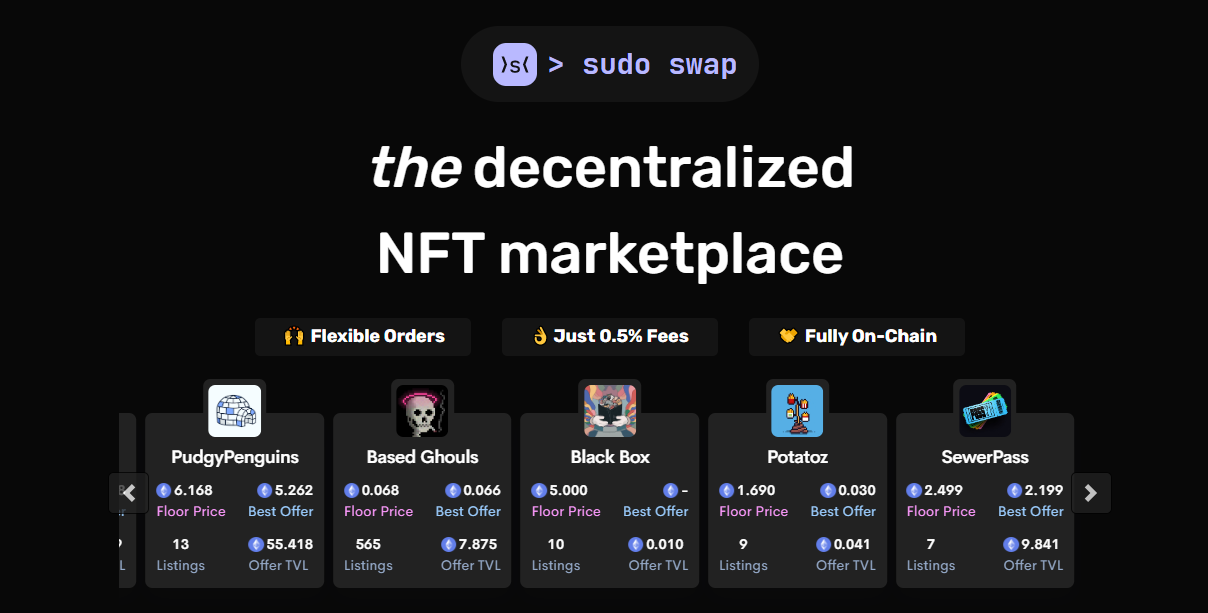

What is Sudoswap? Sudoswap is a decentralized AMM platform on Ethereum for NFTs that helps users save on gas fees, facilitates NFT to token swaps (and vice versa) using customizable bonding curves to determine the price of the asset.

Recently, the project made users very excited when announcing Airdrop to users. So what’s special about this project? Let’s find out with Weakhand in this article.

What is Sudoswap?

Sudoswap is a decentralized AMM platform on Ethereum for NFTs which means users buy or sell into liquidity pools instead of trading directly between them. This AMM model is quite familiar with token swaps with major platforms such as: Uniswap, Curve Finance, SushiSwap,… this is a similar concept but for NFTs.

If you don’t know what NFT is, you can refer to the following articles:

- What are NFTs? Criteria for evaluating an NFT project

- What is NFT Finance? The future of NFTs in the crypto market

What is Sudoswap?

Sudoswap uses bonding curves to determine the price of NFTs after the buying and selling fluctuation process. Sudoswap supports 3 types of bonding curves:

- Linear: The price of an NFT is increased by a fixed amount (called delta. delta) every time an NFT is purchased from the Pool. In contrast, the price of NFTs is reduced by the same fixed amount each time an NFT is sold in the Pool.

For example: Liquidity providers can create NFT<>ETH pools with Start Price 1 ETH and delta. delta 0.1 ETH. Assuming they provide enough liquidity, the price of an NFT will increase to 1.1 ETH once an NFT is purchased from the Pool. After the second NFT is purchased, the price will increase by 1.2 ETH, etc. At any given time, if an NFT is sold in the Pool, the price will decrease by 0.1 ETH.

- Logarithmically: The price of an NFT increases by a certain percentage (aka delta. delta) every time an NFT is purchased from the Pool. Conversely, the price of NFTs will decrease proportionately each time an NFT is sold in the Pool.

For example: Liquidity providers can create NFT<>ETH pools with Start Price 2 ETH and delta. delta 50%. Assuming they provide enough liquidity, the price of an NFT will increase by 2 + 50% = 3 ETH once an NFT is purchased from the Pool. At any point in time, if an NFT is sold in the Pool, the price will drop to 2 ETH.

- X * Y = K : The price of an NFT is adjusted each time an NFT is bought or sold in the Pool, so that their product remains the same after each transaction. These X, Y values correspond to the number and value of NFTs in the Pool.

Sudoswap Operating Model

Main components participating on Sudoswap:

- User: Participate in buying and selling NFTs on the Sudoswap platform

- Liquidity Provider (LP): Participate in liquidity provision to receive transaction fees. Anyone can participate in providing liquidity on Sudoswap.

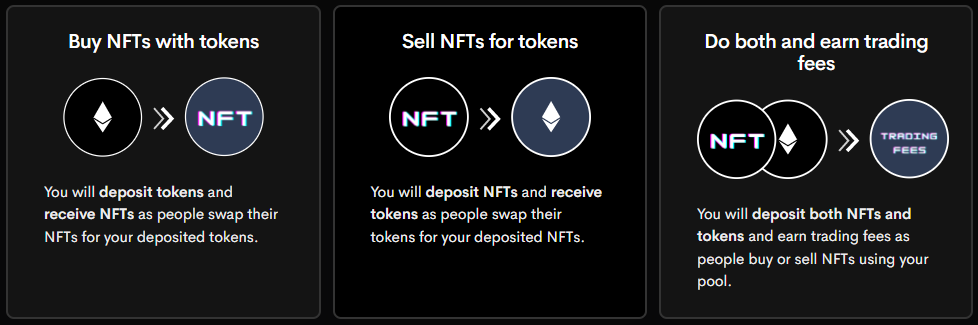

For Liquidity Providers, there will be 2 ways to provide liquidity:

Providing liquidity on Sudoswap

- One-sided liquidity provision: Deposit tokens into the Pool and receive NFTs or vice versa.

- Providing liquidity on both sides: Deposit both tokens and NFTs into the Pool and receive transaction fees when users Buy or Sell using your Pool.

Operating model on Sudoswap:

- Liquidity providers deposit NFTs and/or ETH (or ERC20 tokens) into the liquidity pool. They choose whether they want to buy or sell NFTs (or both) and specify the starting price and bonding curves parameters.

- Users can then buy or sell NFTs from these pools. Every time an NFT is bought or sold, the price to buy or sell another NFT in the Pool will change based on its bonding curves.

- At any time, liquidity providers can change the parameters of their Pool or withdraw assets.

What is the Difference of Sudoswap?

Sudoswap creates cheaper fees when users only pay 0.5% swap fee while other NFT Marketplaces such as: OpenSea (2% fee + 5% royalty fee),…

Users have many options to buy or sell NFTs such as being able to buy/sell immediately on the exchange or buy/sell at a certain price by providing liquidity.

Core Team

Sudoswap was founded by 0xmons , founder of the XMON NFT project. Other contributors include zefram.eth 0xhamachi and 0xacedia.

Investor

Update…

Tokenomics

Basic information about tokens

- Token Name: sudoswap

- Ticker: SUDO

- Blockchain: Ethereum

- Contract: 0x3446dd70b2d52a6bf4a5a192d9b0a161295ab7f9

- Token Type: Utility, Governance

- Total Supply: 54,907,497 SUDO.

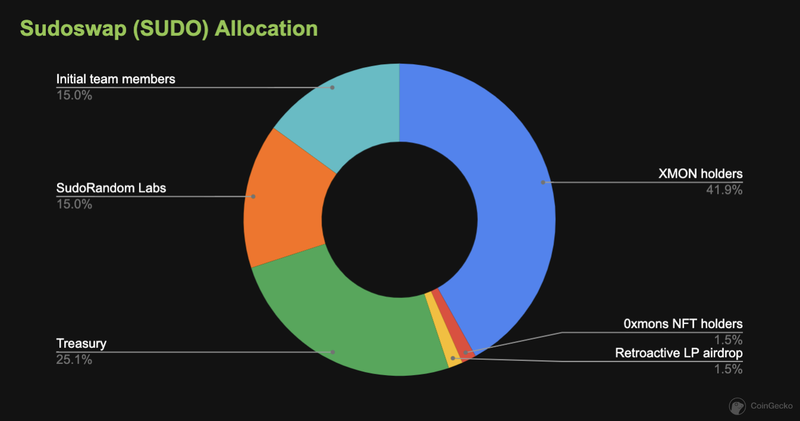

Token Allocation

Sudoswap Token Allocation

Token Release

- Team: Lock for 3 years and pay in installments in 1 year

- SudoRandom Labs: 3 year lock and 1 year installment payment

Information Channel of Sudoswap Project

- Website: https://sudoswap.xyz/#/

- Twitter: https://twitter.com/sudoswap

- Discord:

summary

Hopefully the information I provided above has helped you somewhat visualize What is Sudoswap? The AMM model with NFT is still quite new and contains many problems such as: NFT liquidity, NFT price fluctuations,… However, this is also a fertile ground for Sudoswap to expand. its position in the Crypto market.