If you still manage to laugh when providing liquidity and encounter temporary losses, then congratulations, you are an extremely lucky investor. In today’s volatile market, most investors find it difficult to earn profits when providing liquidity to certain projects, and the profits received cannot compensate for the temporary losses caused.

However, fortunately, now there is a solution to help you when experiencing temporary loss and still be able to laugh happily. That’s what Smilee Finance is doing. Join us to learn about this interesting project.

What is Smilee Finance?

Overview of Smilee Finance

Smilee Finance is a protocol that enables volatility, based on different products and strategies. They are creating a prototype with decentralized volatility products where you can sell your LP Positions and turn your Interim Losses into your own Interim Profits.

When you provide liquidity in the Pool, there will be cases where the Transaction Fees received back from the Pool cannot compensate for the temporary loss, or the best case scenario is that the transaction fee will be greater than the temporary loss. This depends on market fluctuations. Here we will call these possible scenarios your liquidity provision positions.

Smilee Finance’s operating mechanism

The protocol builds on the fact that an LP Position has a payoff structure exactly like selling a portfolio of Call or Put Options.

Liquidity providers are short-term volatile and they will experience temporary losses if the market price fluctuates.

As decentralized options protocols experience fragmented liquidity issues, Smilee can attract additional liquidity by providing additional Real Yield on top of the rewards from regular liquidity provision.

Smilee takes a different approach to volatility indices by providing them with leverage but without the risk of liquidation.

There are many products on Smillee and you can participate with different strategies:

- Real Yield: You can deposit tokens to earn more profits

- Impermanent Gain: You will pay a premium to be able to receive Impermanent Gain.

Options on Smilee Finance

A liquidity provider will experience temporary losses if the price of the asset pair in the Liquidity Pool fluctuates.

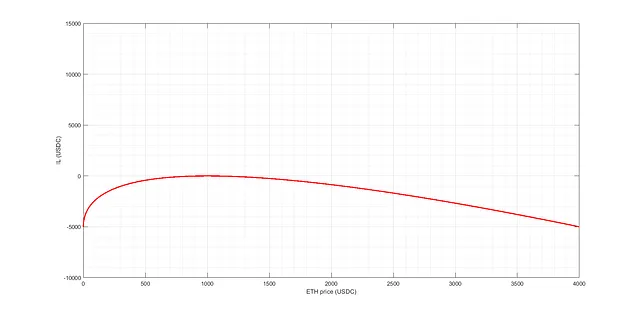

Looking at the chart below we can see that the temporary loss resembles a concave function. So you will experience temporary losses no matter how the market moves (Short Gamma).

The more the token pair changes in price, the greater the temporary loss. Liquidity providers hope profits from trading fees will offset this loss (Long Theta).

We can look at liquidity providers as Short Gamma and Long Theta.

The combination of Short Gamma and Long Theta creates a liquidity provider payoff for put options. So once someone sells the option, who will buy it?

No one, we will find out later.

The relationship between Impermanent Losses and options allowed Smilee to invent an entirely new prototype for decomposing Impairment Losses into options and re-arranging them to create variable payoffs. dynamic.

Decentralized Volatility Products (DVP)

Concept of DVPs: Vaults with different investment strategies.

Structure of a DVP:

- A pair of tokens (ETH/USDC, ETH/BTC,..).

- Payback formula: Calculated using the strategies behind those DVPs.

- Refund time

- An auction stage.

Classification: Here we will classify into 2 types of DVPs:

- Short Volatility DVP (Short Volatility Product): Those who “pay” the Temporary Loss (or part of it) in exchange for a premium (Premium)

- Long Volatility DVP (Long Volatility Product): Those who pay a premium to “earn” a Temporary Loss (or a portion thereof).

How it works: Smile Finance guarantees that:

The overall reward of short volatility DVPs is equal to the proceeds from providing liquidity on DEXs. We call the reward obtained from the liquidity provision process LP

The overall reward of long-term volatility DVPs corresponds to Impermanent Gain (= Impermanent Loss). We call temporary loss IL.

We have the formula to calculate temporary loss: IL = EW – LP. (first)

In which: EW: Is the total nominal amount if we leave the tokens in the wallet and do not participate in providing liquidity. LP: Transaction fee when providing liquidity. IL: Temporary loss.

From (1) => EW = IL + LP.

Therefore, by simply ensuring that there is liquidity in each Vault, Smilee can ensure that all DVP payments are fully covered.

Types of Vaults in the protocol:

- Imperative Gain.

- Options (call, put,…)

- Variance Swaps

- Certificates and Structured Products.

- Insurance (Deep protection, Impermanent Loss protection).

Smilee created a Defi model that allows other protocols to build DVPs on top of it to take advantage of the benefits that the model brings, so it is expected that in the future if Smilee’s model works effectively, we will will see projects begin to cooperate with Smilee to avoid experiencing temporary losses.

Now we will learn about the 2 main Vaults of the protocol:

Real Yield Vault

Real Yield Vaults: Provide liquidity like DEXs to earn trading fees and earn more profits in USDC from Impernament Gain Vaults.

How a Real Yield Vault works:

- A token pair (ETH/USDC, ETH/BTC)

- APY

- Choose an investment strategy (Deltra Neutral, Real Yield,…)

- One payment term

- An auction stage

During the auction, liquidity providers deposit liquidity into the Vault in the form of one or both tokens. At the same time, users also deposit insurance premiums (in USDC) into the Impermanent Gain Vault. At maturity, all Premium fees (minus Impernament Loss) will be transferred to liquidity providers in the form of APY.

Once the payout is due, liquidity providers can withdraw their liquidity and the accompanying APY.

To summarize, Vault’s APY will be calculated by the total Premium fees paid by users in Impermanent Gain Vault, but in the future it will be the sum of all Premiums coming from Long Volatility DVPs. Real Yield Vaults will feature additional strategies that users can choose from to receive different returns:

- Delta Hedged

- Up legs

- Delta Neutral

- Down leg

Depending on your investment taste, you use specific investment strategies.

Impermanent Gain Vaults (IG)

Impermanent Gain is the opposite of Impermanent Loss and it is a strategy designed to beat volatility. You can take advantage of it for different goals such as:

- Take a position against market-moving events.

- Hedging risks for investment portfolios

- Buy insurance for stablecoin depeg

- Arbitrage trading.

- DAOs and market makers hedge the risk of providing liquidity to the DEX with their own tokens or tokens they support (Protocol Owned Liquidity).

How an Impermanent Gain Vault works:

- A pair of tokens (ETH/USDC, ETH/BTC,…)

- Choose a trading strategy

- Pay the Premium fee

- At maturity: + If there is a price fluctuation and temporary loss > Premium -> You will win and make money.

- On the contrary, if the price remains the same, you will lose the Premium.

At the end of the auction period, Impermanent Gain Vault will pay the Premium fee to Real Yield Vault

Impernament Gain Vault has different strategies:

- Upside Only

- Downside Only

- Plain

Depending on your taste, you can use different types of strategies.

Have you ever asked how Smilee provides leverage from 500x – 1000x to Impernament Gain Vaults without the risk of liquidation?

Risk will be managed by allowing a small Premium fee for a large notional.

If Real Yield is 10% APY, We have premium fee per week: 10%/52 = 0.19%

Leverage will be calculated as 1/Premium = 1/0.19% = 520x.

So why do account providers allow someone to buy 1000x their position?

Let’s say you get a premium of $20/week, on $10k of liquidity provision. That’s an increase of 10% compared to the trading fees you earned before.

The time for a liquidity provision usually lasts months, while the time for Impermanent Vaults is usually one week.

Prices will frequently go up and down and temporary losses can be canceled out while you are still making more profits each week.

Development Roadmap

January 26, 2023: Launch of the project WhitePaper

Core Team

Update…

Investor

- Smilee Finance is an award-winning project in the Uniswap Grant Program, so it will receive a lot of support from Uniswap. In addition, on the project website, there are also a few names that are their names such as: Outlier Ventetures and NewOrder.

- May 11, 2023: Smilee Finance successfully raised $2M in funding led by Dialectic with participation from Synergis Capital, Concave Ventures, Owl Ventures, Yunt Capital, Dewhales Capital, Outlier Ventures,…

Tokenomics

Currently the project does not have tokenomics.

Information Channel of Smilee Finance Project

Summary

Impermanent loss is a core part of DEXs and will become more and more relevant over time as traditional assets are tokenized and trading activity moves onto the blockchain.

Smilee is the first platform to leverage Impermanence to build long- or short-term volatile products in an open, transparent, permissionless way. It opens up a new solution to the problem of unsustainable liquidity in the Defi market. If this is completely resolved, the project will attract a lot of liquidity into the market. If you are interested in the project, please Follow me to update the latest information.