What is Contango? Is it too early to pioneer the Expirable niche in the DeFi market at the present time? Let’s find out through the following article.

What is Contango?

Contango is “time-limited” futures decentralized exchange (Expirable) first in DeFi.

To understand Contango we need to clarify the concept of Expirable. Accordingly, Expirable is a type of derivative contract that allows investors to buy/sell an asset at a future time at a predetermined price at the present time. Because it is a derivative product, investors can long/short Expirable with leverage to increase position profits.

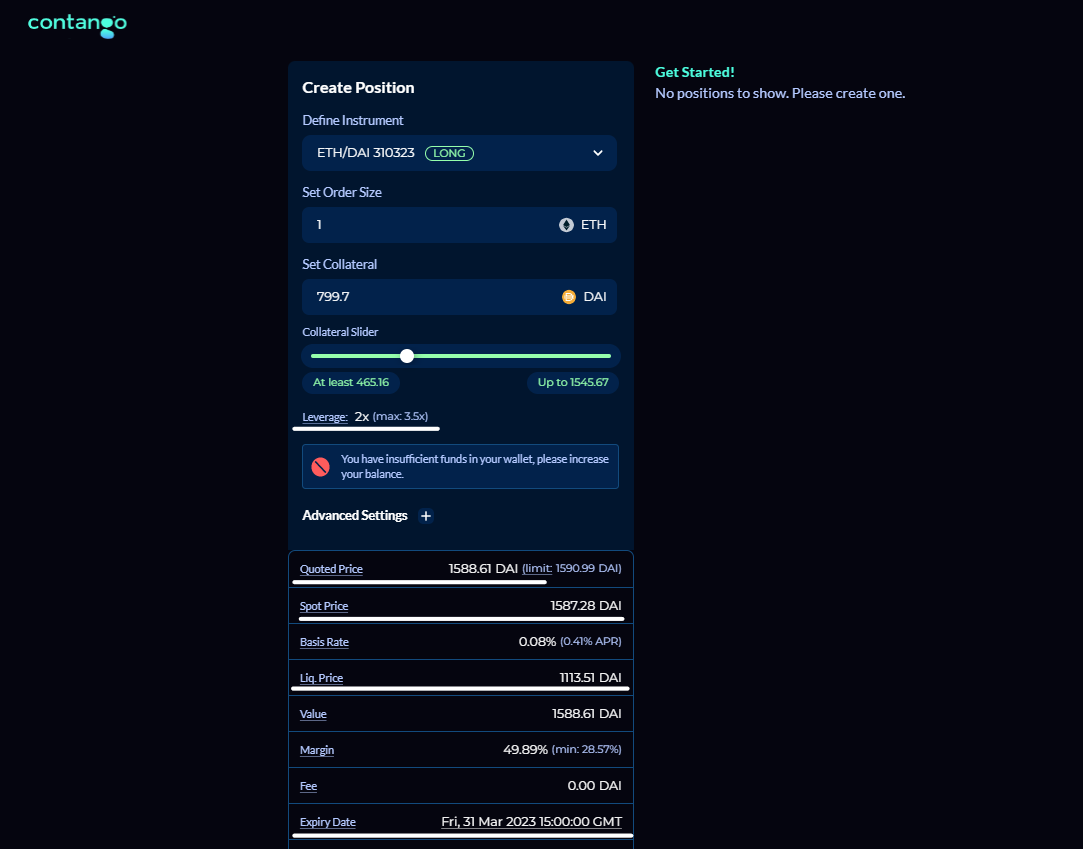

Expirable transaction example:

Current ETH/DAI spot price: 1587.28

I am optimistic about the future so: Do it LONG ETH/DAI March 31, 2023 (using x2 leverage) with the deposit amount for 1 ETH only 799.7 – equivalent ETH = 1588.6 DAI (do not have to pay any additional fees such as funding rate of futures contracts)

By Friday, March 31, 2023, I will receive 1 ETH back at the contract price of 1588.6 without caring about what the ETH spot price is at that time. But if:

- Spot price > 1588.6 – If you sell 1 ETH and enjoy the profit difference

- Spot price < 1588.6 – If I sell 1 ETH, I will have to bear the corresponding loss.

In addition, due to using leverage, I will also accept the additional risk of contract liquidation. In this case, if the ETH price drops below 1113.51, my position will be liquidated.

Compared to Perpetual contract trading, Expirable has the advantage of allowing users to calculate the full cost of a position before placing an order to avoid the risk of funding rate fluctuations affecting PnL. However, Expirable also has disadvantages related to the liquidity of the contract, which will be fragmented by term as well as order volume.

Contango Highlights

Herein lies the highlight of Contango the first protocol to develop the Expirable contract type on DeFi, thanks to which the project will have a huge advantage in receiving investment money, support from ventures and future users if this niche explodes.

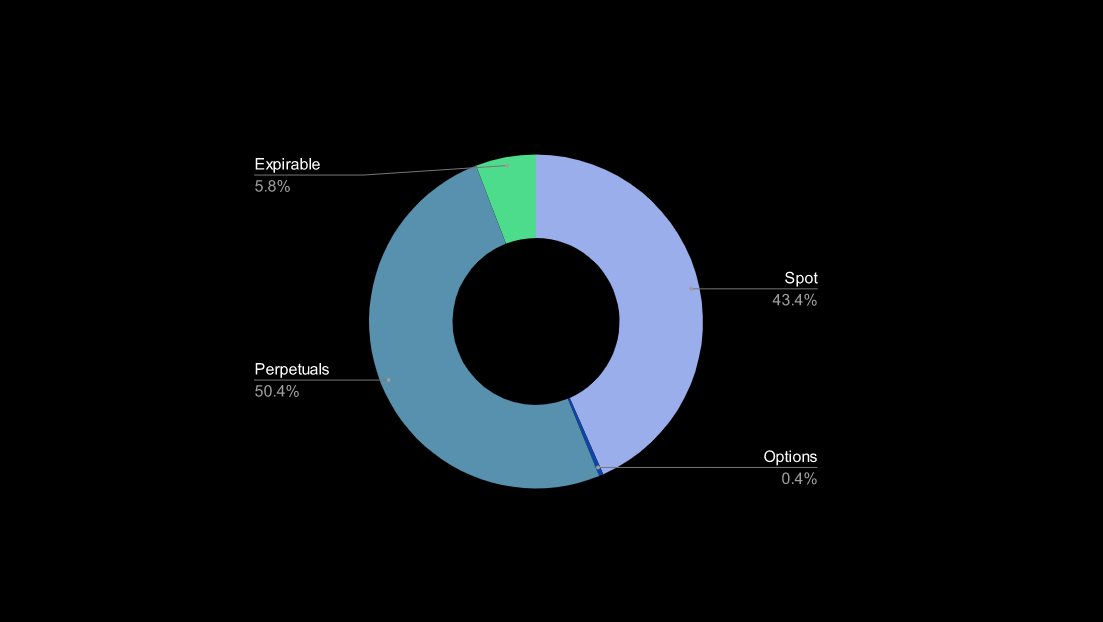

Especially according to some statistics, although Expirable holds a relatively modest market share, it is also making certain developments in CeFi. Specifically, in 2021 CeFi’s total trading volume is $116 trillion. Expirable accounts for 5.8%, equivalent to $6.6 trillion – but compared to 2020, this volume is 2.4 times higher.

Contango Use Case

- Speculative trading: Use long/short positions to profit from speculation on price fluctuations of derivative assets

- Hedge: Used to protect currently held spot positions from risks from price fluctuations. In this case, Mr. A is staking 1 ETH, A can short 1 ETH with the contract term equal to the staking term (short price = spot staking price). At the end of the period, A unstakes ETH + staking reward and closes the ETH short position without paying attention to the spot price at the time of closing.

- Arbitrage trading (price difference): More professional investors can profit from the price difference between Contango and CeFi, other DeFi applications or spot and Uniswap. (Detail)

Development Roadmap

Currently, Contango has launched the mainet beta on Arbitrum with 3 product pairs: ETH/USDC, ETH/DAI and USDC/DAI.

Core Team

Bruno Bonanno| Co-Founder: Bruno has nearly 19 years of experience as a software engineer at many different companies. He is fluent in many programming languages as well as understands the operating models of different platforms.

Kamel Aouane | Co-Founder: Kamel has more than 4 years of experience at Adaptive Financial Consulting company with many positions from QA, Senior Business Analyst to Program Manager – specializing in optimizing Order Management System for Crypto exchanges including Binance, Bitmex,. ..

Egill Hreinsson | Co-Founder: Egill is Kamel’s colleague at Adaptive Financial Consulting with 2 years of software engineering experience.

Investor

Contango has successfully raised capital $4M at Seed Round (valuation $45M) is led by ParaFi with participation from many large funds including Coinbase Ventures, Spartan Group, AngelDAO, Cumberland, GSR, Amber Group and CMS.

Currently the project is being incubated by Alpha Venture DAO.

Tokenomics

Overview information about Contango token

- Token Name: Contango

- Ticker: Updating…

- Blockchain: Updating…

- Token Standard: Updating…

- Contract: Updating…

- Token Type: Updating…

- Total Supply: 1,000,000,000

- Circulating Supply: Updating…

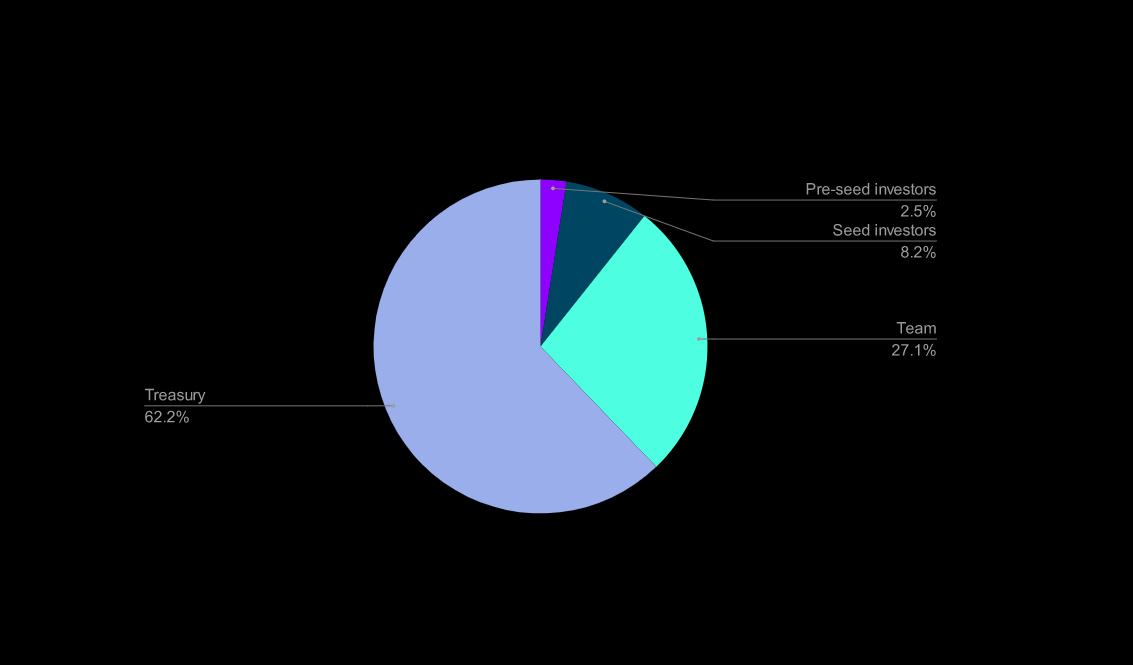

Token Allocation

Contango Sales token details are as follows:

|

Round |

Raised |

Token price |

% of total supply |

Cliff/Vesting |

|---|---|---|---|---|

|

pre-seed |

$0.3M |

$0.012 |

2.5% |

6 months/2 years |

|

Seed |

$3.7M |

$0.045 |

8.2% |

6 months/2 years |

|

Extention |

$0.46M |

$0.045 |

1.02% |

6 months/2 years |

Exchanges

Updating…

Contango’s Information Channel

- Website: https://contango.xyz/

- Twitter: https://twitter.com/Contango_xyz

- Discord: https://discord.com/invite/x3dync2edA

Summary

Hope this article has partly helped you understand What is Contango? Although the Expirable segment is almost completely new to the Crypto market and only accounts for a very small proportion in CeFi. However, with a leading project and great support from large funds and Market Maker, Contango will still be an unknown to monitor in the near future.