What is Tender Finance? Tender Finance is a lending protocol built on Arbitrum. Opening up liquidity for LP assets helps improve capital use efficiency. The new liquidation mechanism and associated risks have made Tender stand out from other projects.

As an active person in the Crypto market, wanting to make the most of your LP assets, to earn more profits, you should learn about this project. But it’s the same as using leverage with capital, when you let the mortgaged assets be liquidated, you’re in trouble. Please read the instructions carefully before using!

So what is Tender Finance? Let’s find out in this article!

What is Tender Finance?

Tender Finance is a lending protocol with a new collateral liquidation system. Utilize off-chain liquidity with support for collateral assets such as GMX and GLP. With plans to add other new assets in the future.

The protocol focuses on opening liquidity for LP Tokens and increasing borrowing limits for users. It’s solving a new problem. At the same time, it opens up new games for users as well as projects.

Operates according to the Peer to Pool model like the way Aave or Compound and many other protocols use.

Mechanism of Action

Products on Tender Finance

1. Loan

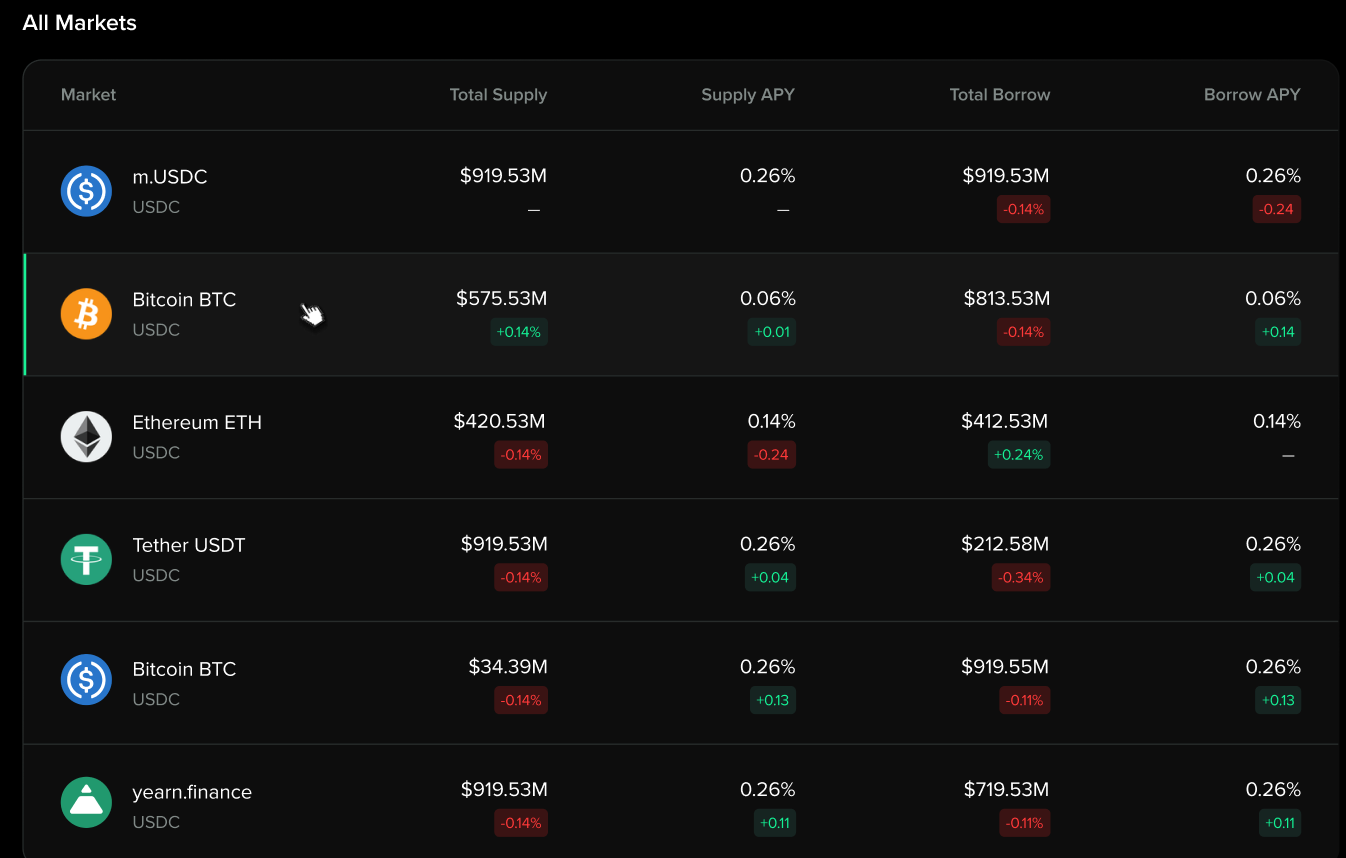

Like other Lending platforms, users deposit assets into a Liquidity Pool to earn interest from borrowers. Supported assets such as WBTC, ETH, USDT,…

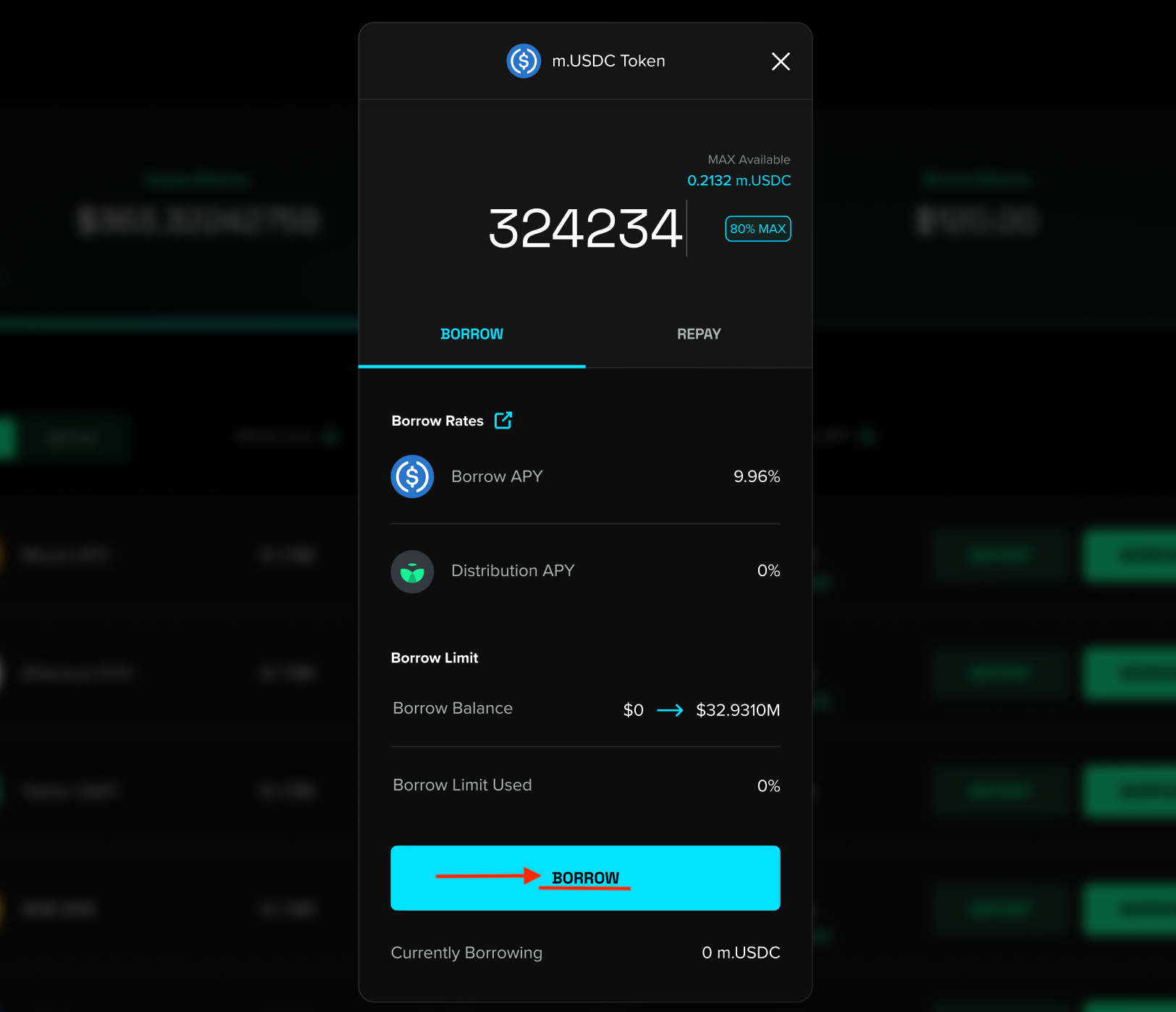

2. Borrow

Users can use deposited assets as collateral to borrow. The amount of money that can be borrowed in relation to collateral, depends on the type of asset used as collateral. CYou can find your borrowing limit in the dashboard. The asset to borrow depends on the liquidity of that asset pool. If there is no liquidity, one will need to wait for new users or another loan to be repaid.

Liquidation mechanism

Basically, the ratio of loan assets to mortgage ratio will determine the liquidation of the loan position. It is a visual indicator to help users determine how close or far away their liquidation is. The lower the utilization rate, the safer the user’s collateral.

- Loan utilization ratio <75%: Relatively safe

- Loan utilization ratio between 75% and 90%: Please pay closer attention to positions

- Loan utilization ratio between 90% and 95%: Please improve the loan utilization ratio

- Loan utilization rate >95%: High liquidation risk

To improve user loan utilization, consider the following options:

- Repay all or only part of the borrowed capital

- Increase collateral level

Development Roadmap

Core Team

Alex Gierczyk | Product and Strategy

Alex Gierczyk: Product and Strategy

A dedicated DeFi user and serial entrepreneur with over a decade of startup experience. Alex attended the University of Notre Dame and dropped out to start his own internet business. His most recent company, ANG Science, grossed more than $100 million and had a team of 60 employees.

Alex has been fully focused on cryptocurrency since 2017, running his own personal fund and generating millions through yield farming and token investments.

Eli Sakov | Engineering & Architecture

Eli Sakov: Engineering | Architecture

After more than 10 years as an engineer in Silicon Valley, Eli knows the ins and outs of running a tech startup. Eli started working very early thanks to graduating from university when he was 18 years old.

Before coming to Tender Finance, Eli was a #1 engineer at Kaliber Labs, a lead software engineer for Ondaka, and an advisor to many startups in both the Web2 and Web3 spaces.

Investors and Partners

Investors

Udating…

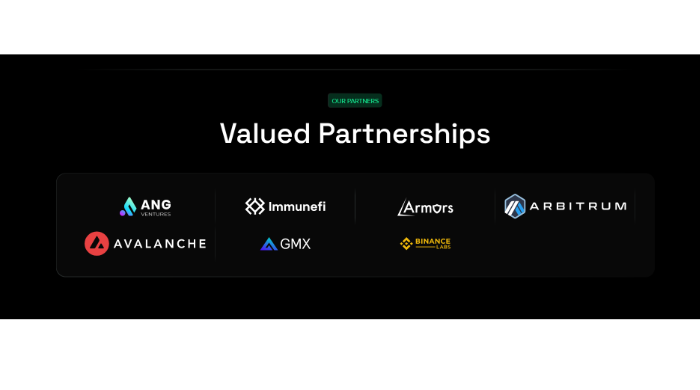

Partners

Tender Finance is a partner of Arbitrum, Avalanche, GMX,… especially supported by Immunefi in checking Smart Contract errors.

Tokenomics

Overview information about Token Tender Finance

- Token Name: Tender.fi

- Ticker: TND

- Blockchain: Arbitrum

- Standard: ERC-20

- Contract: 0xc47d9753f3b32aa9548a7c3f30b6aec3b2d2798c

- Maximum supply: 10,000,000

Token Allocation and Token Release

- Community Development-40%: Will release in 5 years depending on DAO

- Advisors-5%: Lock for 6 months, then pay in installments over 48 months

- DAO Treasury-20%: Fully unlocked

- Team-25%: Lock for 6 months, then pay in installments over 48 months

- Angel-10%: Lock for 6 months, then pay in installments over 48 months

Token Use Case

TND Token holders can participate in protocol governance and receive TND rewards.

Exchanges

TND tokens are traded on Uniswap.

Tender Finance’s Information Channel

- Website: https://tender.fi/

- Twitter: https://twitter.com/tender_fi

- Medium: https://medium.com/@tenderfi

- Discord:

Summary

Tender Finance helps users improve capital efficiency and utility for LP Tokens. But that comes with risks that are greater than normal. So you need to manage your assets well when using products like this.

So I have clarified what Tender Finance is? Hope this article provides you with a lot of useful knowledge!