What is Element Finance? Element Finance is a protocol that allows users to seek high fixed and variable yield income in the DeFi market.

So what is Element Finance? Let’s find out in this article!

What is Element Finance?

Element Finance is a decentralized finance protocol that allows users to search high fixed yield income in the DeFi market. The protocol is built and developed on Ethereum. The main assets supported on Element are DAI and USDC.

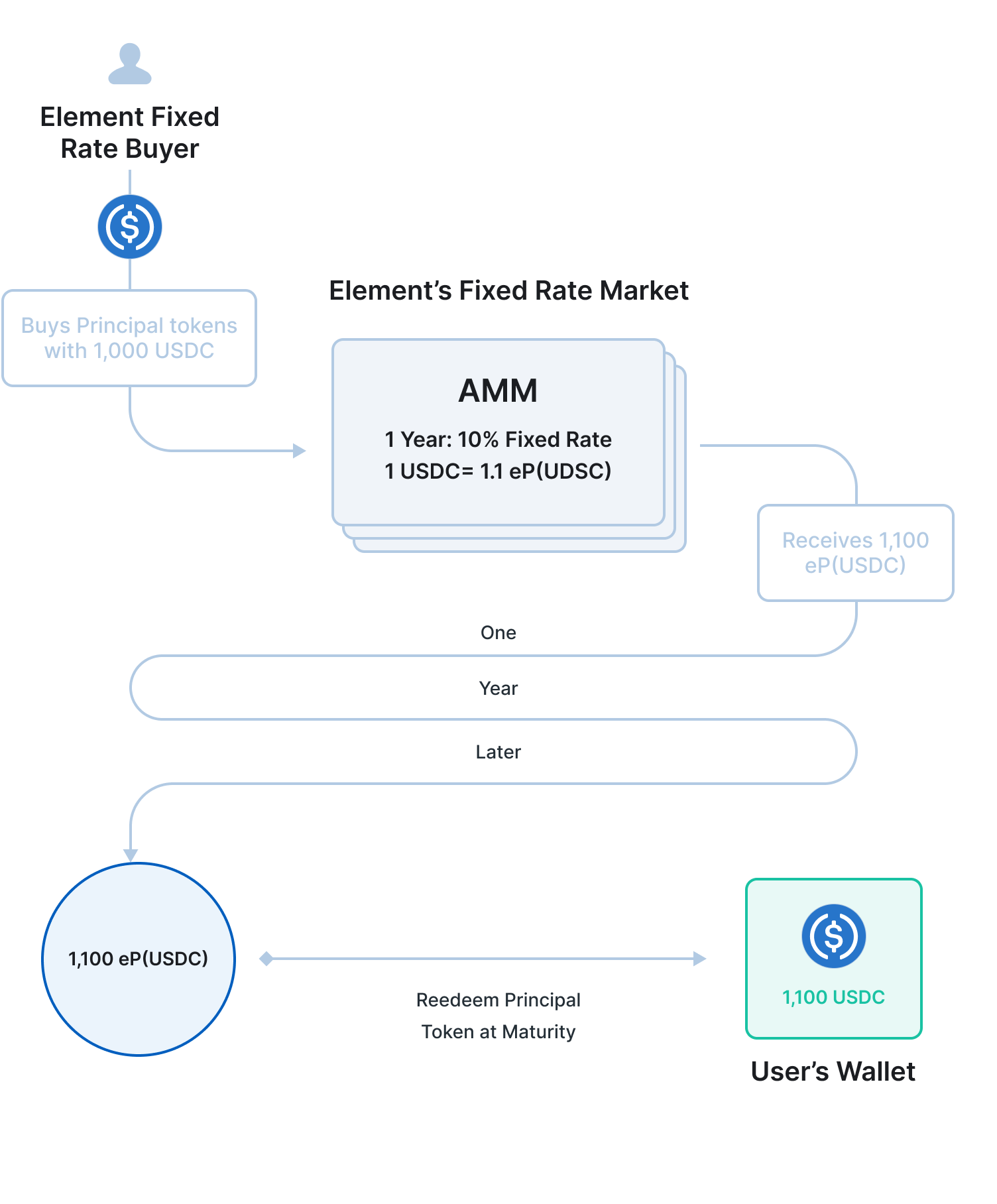

Users can access the existing ecosystem and AMM on Element at a discounted rate with no term constraints, allowing for the exchange of discounted and underlying assets anytime. The Element protocol requires no trusted intermediaries, allowing for fast and efficient trading of fixed and variable yields.

Assets deposited in Element Finance are transferred to the above Farm Curve Finance, Maker Knife, Balancer, Lido Finance to earn profits to pay users.

The Difference Of Element Finance

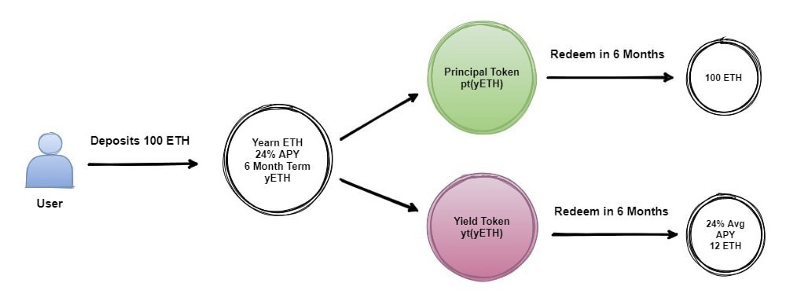

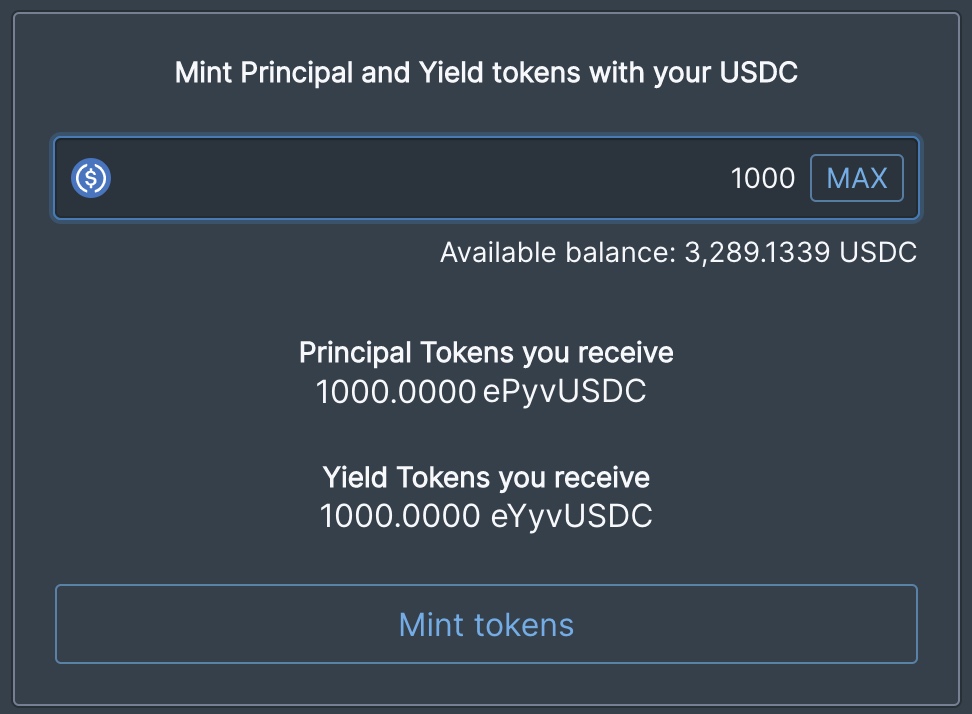

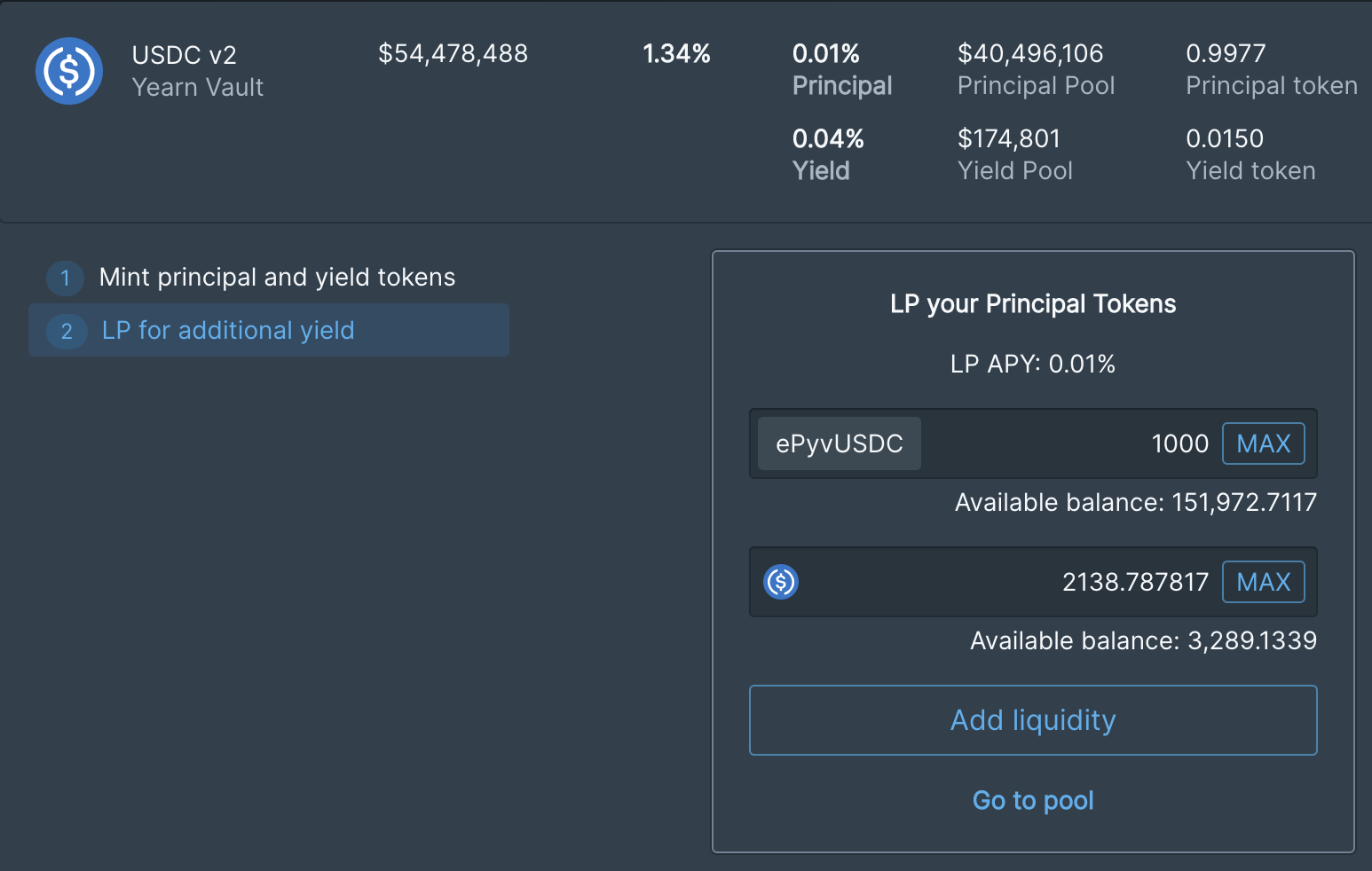

On Element Finance there are 2 types of Tokens:

Principal Tokens (PT): The primary token offers an asset such as BTC, ETH, USDC or DAI that is locked for a fixed term. At the end of the term, it can be redeemed for its full value.

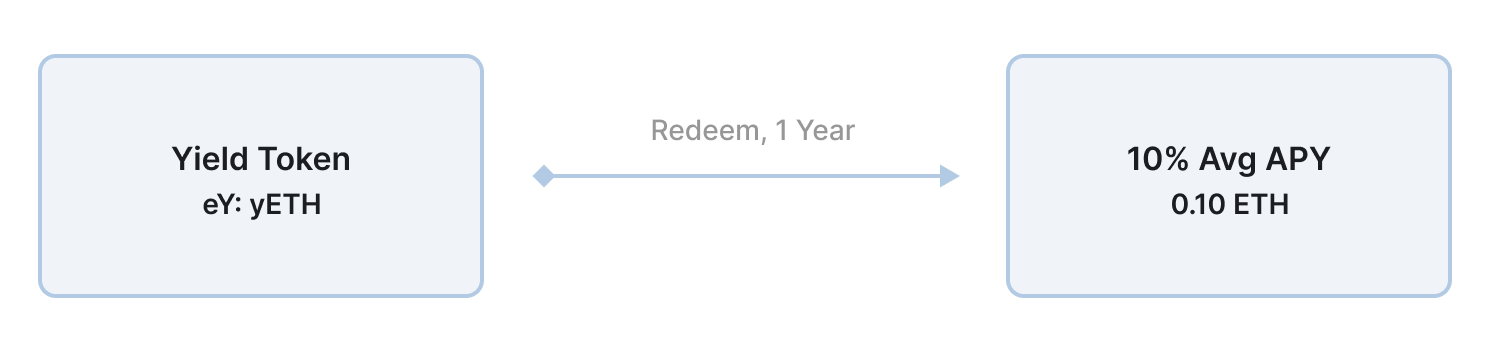

Yield Tokens (YT): The redemption value for a YT at the end of the specified term will be the average yield it earned during the term on the principal it represents.

Like most other Fixed Yield projects, profits are accumulated in the main asset. But with Element, the underlying asset and yield are separated, opening up the exchange between the underlying asset and the underlying asset in a fixed yield through AMM. Thanks to this, users can exit positions before the deadline.

Mechanism of Action

In Element Protocol, there are 3 types of Users:

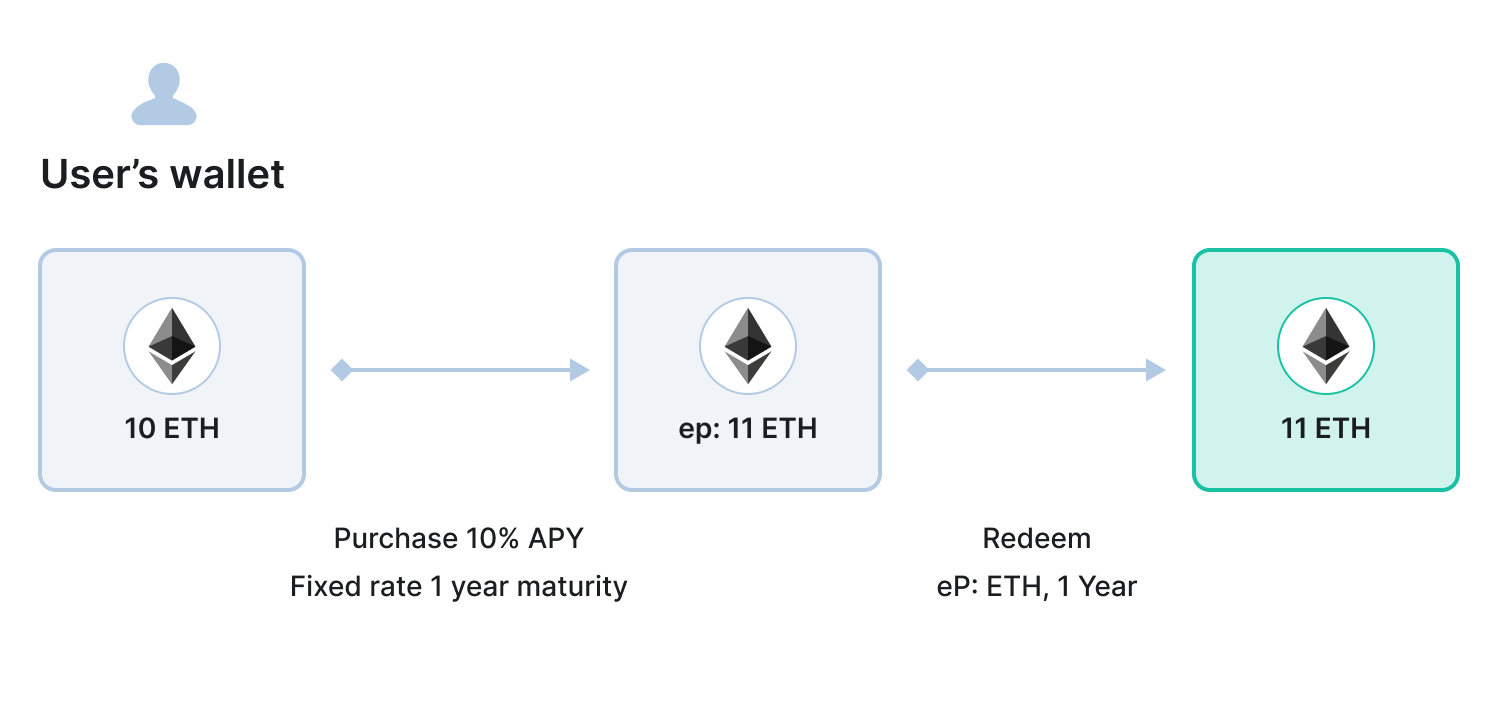

Fixed Rate Buyers: These are the users who buy the main Tokens at a discount decided by the AMMs on Element. User only earn profit fixed if they Buy the main Token at a discounted price. Users minting Native Tokens and Yield Tokens will not earn a Fixed Rate.

Variable Rate Depositors: These are users who submit assets Go to Element to mint Main Token and Productivity Token.

Liquidity Providers: These are the users who provide liquidity to Element AMM. Users require both native Tokens as well as underlying assets to provide liquidity to fixed-rate AMMs and earn transaction fees.

Core Team

Will Villanueva, CEO

Jonny Rhea, CTO

Charles St. Louis, COO

Will Villanueva: Chief Executive Officer & Co-Founder

- He graduated and successfully earned his Bachelor of Science degree in 2012 from New Mexico Institute of Mining and Technology. While going to school, he worked for New Mexico Tech with the highest title he held there being Editor-in-Chief.

- After a period of time working as an engineer at Pathbrite, Ask.com, Chegg Inc, he started his own business in 2015. At that time, he was a Co-Founder of ProcureNow.

- After more than 2 years working at ProcureNow, he moved to work for 6sense as Architect and Engineering Team. He participated in building Django, React, Redux, Saga applications with full data systems and created favorable conditions for building products from scratch. In addition, he also built web infrastructure to manage more than 200 million requests per day using cloud-based AWS, nginx, akamai/ CDN infrastructure and created ELBs with automated EC2 instances. scale and create analytics javascript tags placed on Dropbox.com, Salesforce.com.

- He continued to start a Startup called Bounties Network after 3 years working at 6sense. At Bounties Network he is Co-Founder and CTO. This startup supports building interfaces for open source applications.

- In early 2019, he became a Founding Researcher of ConsenSys, a famous company in the Blockchain industry.

- Currently he is Chief Executive Officer at Element Finance.

Jonny Rhea: Co-Founder & CTO

- He attended and successfully obtained a bachelor’s degree in Computer Science and Mathematics at the University of North Texas. He then continued to participate in scientific research at Southern Methodist University for 2 years.

- In 2002, he started working as a software consultant at Various. While working, he consulted software for many companies in the insurance, finance and manufacturing industries.

- After 3 years working at Various, he moved to Bell Helicopter. Here he has worked for more than 11 years and held positions such as Principal Control Law Engineer, Principal Simulation Engineer, and Software Engineering Specialist.

- He continued to work at ConsenSys with dozens of Lead Protocol Engineer cases. It was also here that he met Will Villanueva, and the two later founded Element Finance. At Element Finance he is Co-Founder and CTO.

Charles St.Louis: Chief Operating Officer

- He obtained an HBX CORe certificate while studying at Harvard Business School Online. And he successfully obtained a bachelor’s degree in science and mathematics at Queen’s University.

- His first job was Blockchain Implementation at RBC. But after five months he resigned and started HealthBlock Identity & HealthX Network.

- After more than 1 year working at HealthBlock Identity & HealthX Network, he moved to Polymath, which is a project to build next generation standards for blockchain-based security token and security token services. . At Polymath he worked as Developer Experience Lead.

- He then became a Core Contributor at Ethereum. He is an EIP process improver, technical audit coordinator, network upgrade coordinator, Ethereum.org advisor/editor, developer growth strategy initiatives, PM process creation, and Retroactive reporting as well as information relay between Ethereum Core Dev teams.

- In early 2021, he moved to work at MakerDao and experienced the positions of MakerDAO Governance, Decentralized Governance Architect, and Technical Consultant.

- Currently he is Chief Operating Officer at Element Finance. Element Finance is a protocol for fixed and variable yields.

Investors

- March 31, 2021: At the Seed round, Element Finance successfully raised $4.4M led by A16z and Placeholder Ventures along with a number of other funds such as SV Angel, A.Capital, Scalar Capital, Robot Ventures.

- October 19, 2021: The Series A round successfully raising $32M was led by Polychain with the participation of a number of funds Andreessen Horowitz, Placeholder, A_Capital, Scalar Capital, Advanced Blockchain, Republic, Rarestone, Yunt Capital, P2P Validator, Ethereal Ventures,.. .

Tokenomics

Updating…

Exchanges

Updating…

Information Channel of Element Finance

- Website: https://www.element.fi/

- Twitter: https://twitter.com/element_fi

- Discord:

Summary

Element Finance is one of the outstanding projects in the Fixed Yield segment when the product runs well, the team is strong, especially raising more than $36M from large funds such as A16z, Polychain. But the project only has a TVL of about $5M, this is a big question mark.

So I have clarified what Element Finance is? Hope this article provides you with a lot of useful knowledge.