What is Convex Finance? Convex Finance is a DeFi platform born with the purpose of optimizing profits for CRV and FXS holders and liquidity providers on these two platforms.

To better understand Convex Finance and its importance, people can refer to some of the articles below:

- Convex Wars & Investment Opportunities This Summer

- Curve Wars Is Coming Back. Which Projects Will Benefit & Grow?

- What is Curve Finance (CRV)? Curve Finance Overview of Cryptocurrencies

- Curve Finance (CRV) Operating Mechanism

What is Convex Finance?

Convex Finance is a platform launched during Curve Wars with the power to create more profits for holders of Curve Finance and Frax Finance tokens, CRV and FXS respectively. Besides, Convex also optimizes profits for LPs on Curve and Frax.

It can be said that Convex has been very successful with an operating model that is quite different from other platforms at the same time.

Convex Finance’s Operating Mechanism

Convex Finance and its relationship with Curve Finance

For Curve Finance, Convex has interaction with 2 objects including: CRV holders and people provide liquidity on Curve Finance. And now we will go into the operating mechanism of Convex with each of the above objects.

Convex Finance with CRV holders

Convex allows users to lock CRV on its platform for higher rewards compared to locking CRV on Curve Finance. And Convex’s operating mechanism for CRV holders is as follows:

- Step 1: Users will permanently lock their CRV to the Convex Finance platform.

- Step 2: Convex Finance will send cvxCRV back to the user. This cvxCRV represents the CRV that the user has deposited into the platform.

- Step 3: Convex’s holding of veCRV allows the platform to receive a portion of Curve Finance’s revenue, and this revenue is partially shared by Convex back to cvxCRV holders.

- Step 4: Besides sharing revenue from Curve, the Convex platform will also reward cvxCRV holders with CVX itself (this is the better part of Convex when directly compared to Curve Finance).

- Step 5: Users can exit cvxCRV positions by trading in the cvxCRV – CRV liquidity pair on Curve Finance.

Convex Finance with liquidity providers on Curve Finance

Not only CRV holders, but Convex also has interactions with liquidity providers on Curve Finance. And the operating mechanism between Convex Finance and liquidity providers on Curve Finance is as follows:

- Step 1: After providing liquidity on Curve Finance, LPs will receive LP Token representing their liquidity on Curve Finance. Then, users deposit and stake this LP Token into Convex Finance’s platform.

- Step 2: Convex Finance will reward a portion of the revenue of the Curve Finance protocol and some incentive tokens, if any, such as LDO, SNX,… Besides, the reward that LPs receive is the CVX token. In particular, deposit and withdrawal fees are zero.

- Step 3: Users can unlock their LP Token at any time.

Convex Finance and its relationship with Frax Finance

Similar to Frax Finance, Convex also has 2 products for FXS holders and also provides liquidity on Frax Finance.

Convex Finance with FXS holders

When a user locks FXS on the Convex platform, a series of following activities will take place such as:

- Step 1: Users will deposit FXS into the Convex platform, then Convex will permanently lock it on the Frax Finance platform to receive veFXS.

- Step 2: The user will be returned cvxFXS at a 1 to 1 ratio with the FXS the user deposited into the platform.

- Step 3: The reward the user receives is the platform’s CVX. In addition, if the user’s cvxFXS is used to provide liquidity on Curve for the cvsFXS – FXS pair, they will receive a reward when they directly stake FXS on Frax Finance. as FXS.

- Step 4: Users can exit cvsFXS positions through trading on Curve Finance through the cvsFXS – FXS pair.

Convex Finance with liquidity providers on Frax Finance

This mechanism is similar to the mechanism by which Convex interacts with LPs on Curve Finance. This mechanism of action takes place as follows:

- Step 1: If you are staking your LP Token on Frax Finance, you must take this amount of LP Token.

- Step 2: Send your LP Token to Convex Finance

Tokenomics

Information about Convex Finance tokens

- Token name: Convex Finance

- Code: CVX

- Blockchain: Ethereum

- Token classification: ERC 20

- Contract: 0x4e3fbd56cd56c3e72c1403e103b45db9da5b9d2b

- Total supply: 1,000,000,000

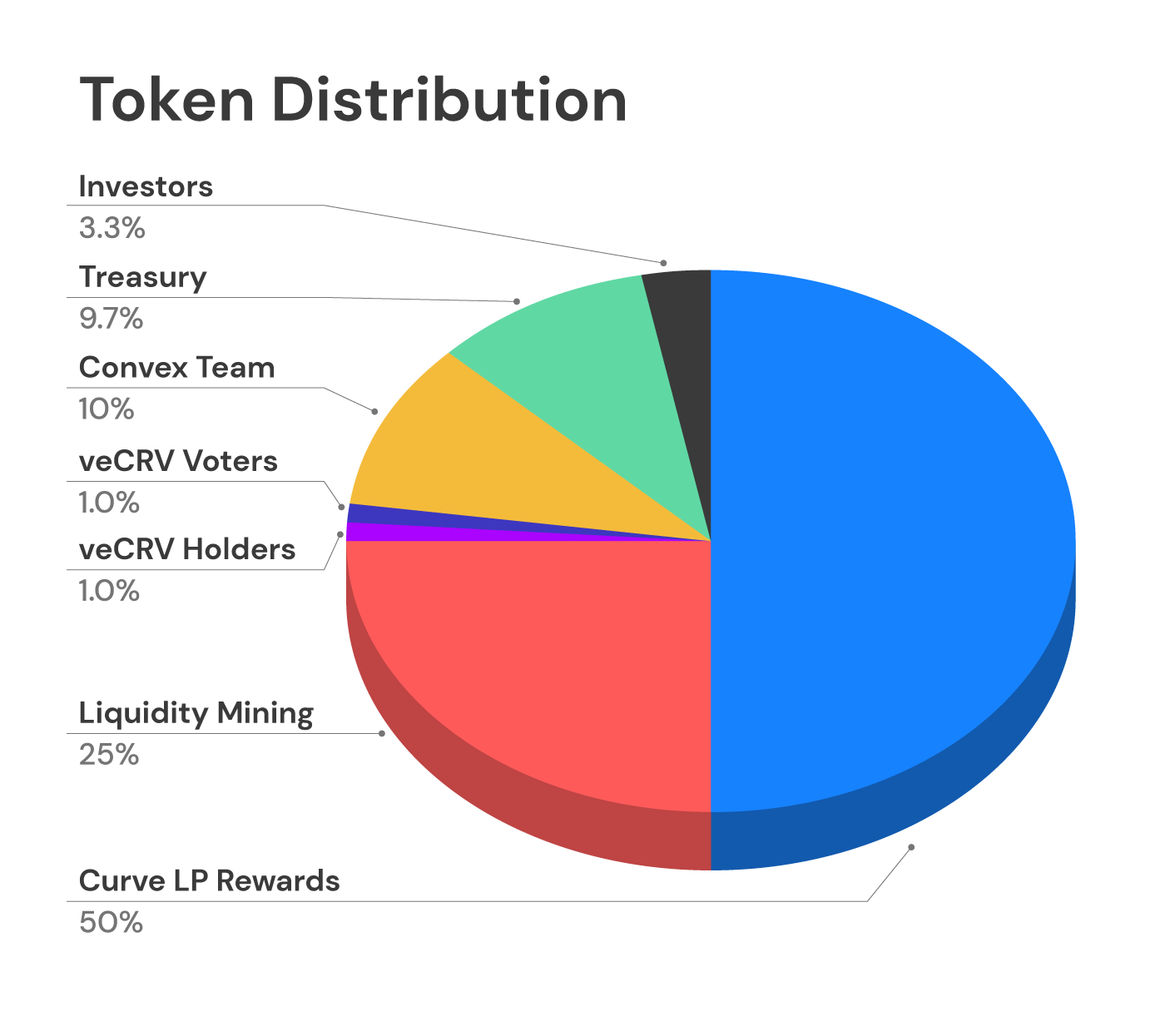

Token Allocation

- Investors: 3.3%

- Treasury: 9.7%

- Convex Team: 10%

- veCRV Voters: 1%

- veCRV Holders: 1%

- Liquidity Mining: 25%

- Curve LP Rewards: 50%

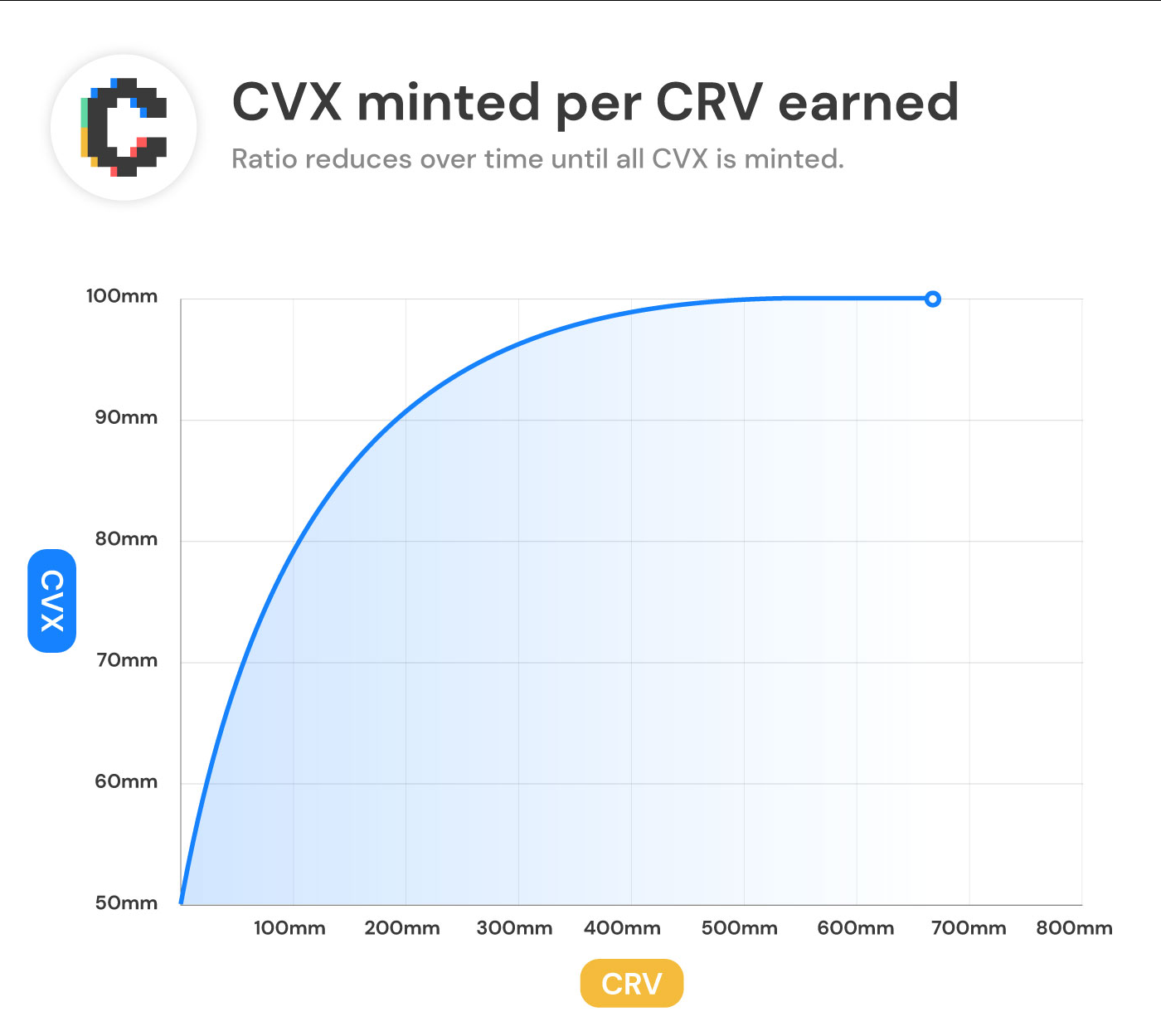

Token Release

- 25% for the Liquidity Mining program will be paid in installments over 4 years

- 9.7% for Treasury is paid in the first year

- 1% for veCRV Voters and veCRV Holders is paid at the time of TGE

- 3.3% for Investors is paid in installments over 1 year

- 10% for Convex Team is paid in installments over 1 year

Token Use Case

- CVX can be staked on Convex Finance to receive rewards of CRV and FXS from Curve and Frax LP.

- CVX can also be locked for additional rewards from Curve and Frax LP.

Convex Finance’s Information Channel

- Website: https://www.convexfinance.com/

- Twitter: https://twitter.com/convexfinance

- Github: https://github.com/convex-eth

- Blog:

Summary

Convex is a platform that was born when Curve Wars broke out and the project continues to grow based on the vitality of Curve Finance. After that, the project continued to build on Frax Finance.