LP (Liquidity Provider – Liquidity Provider), also known as farmers with farming work on DEX fields, Lending & Borrowing, Derivatives,… At the present time on KyberSwap is allowing LPs farming with a relatively high APR compared to the general market level.

So where is the profit? How risky? Let’s find out how to participate in the article below.

KyberSwap Overview

KyberSwap is a multichain AMM that stands out in the crypto market

- Ranked by trading volume in the past 24 hours, KyberSwap is currently ranked in the TOP 8 and there was a time when KyberSwap was in the TOP 4 AMMs with the largest 24-hour trading volume in the market.

- Ranked by TVL (Total Value Locked), KyberSwap is currently in the TOP 20 AMMs with the most TVL.

When the crypto market is having very bad fluctuations with the collapse of a series of exchanges (most notably FTX), centralized lending platforms (Celsius, Voyager,…),… then the DeFi market emerged as a worthy successor. With DeFi, users do not have to worry about the exchange collapsing and taking away users’ money.

However, leaving assets idle on DeFi is also a painful problem for users. There are many different ways to make money on DeFi, but the most outstanding one for those who are passionate about DeFi and like to strategize in investing is Farming.

At present, KyberSwap is offering users farming with an APR of up to hundreds of percent, a number that is hard to see on CeFi, but it also requires clear, specific strategies from users.

Instructions for participating in liquidity provision and farming on KyberSwap

Instructions for providing liquidity on KyberSwap

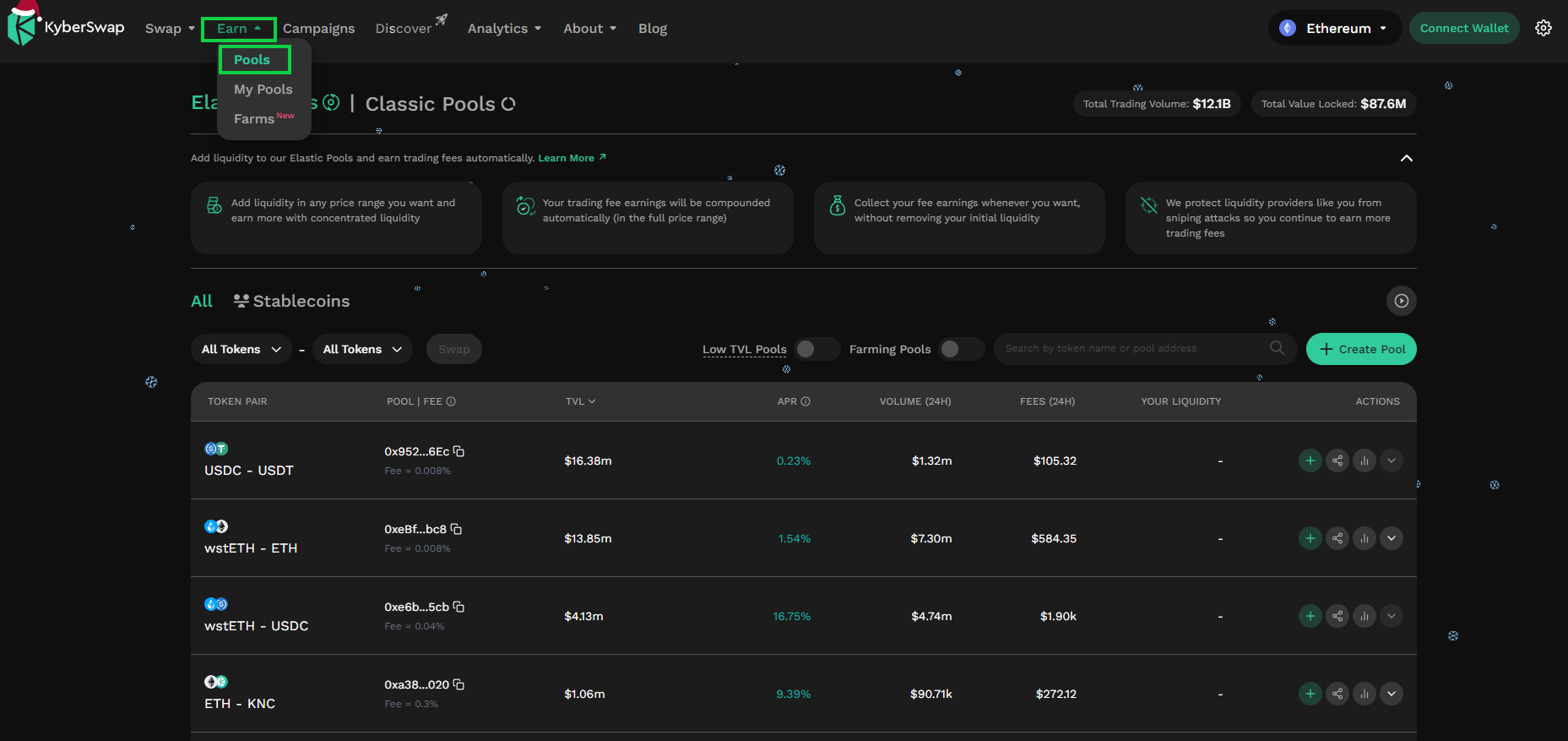

Step 1: Go to the website then click on Earn and select Pools

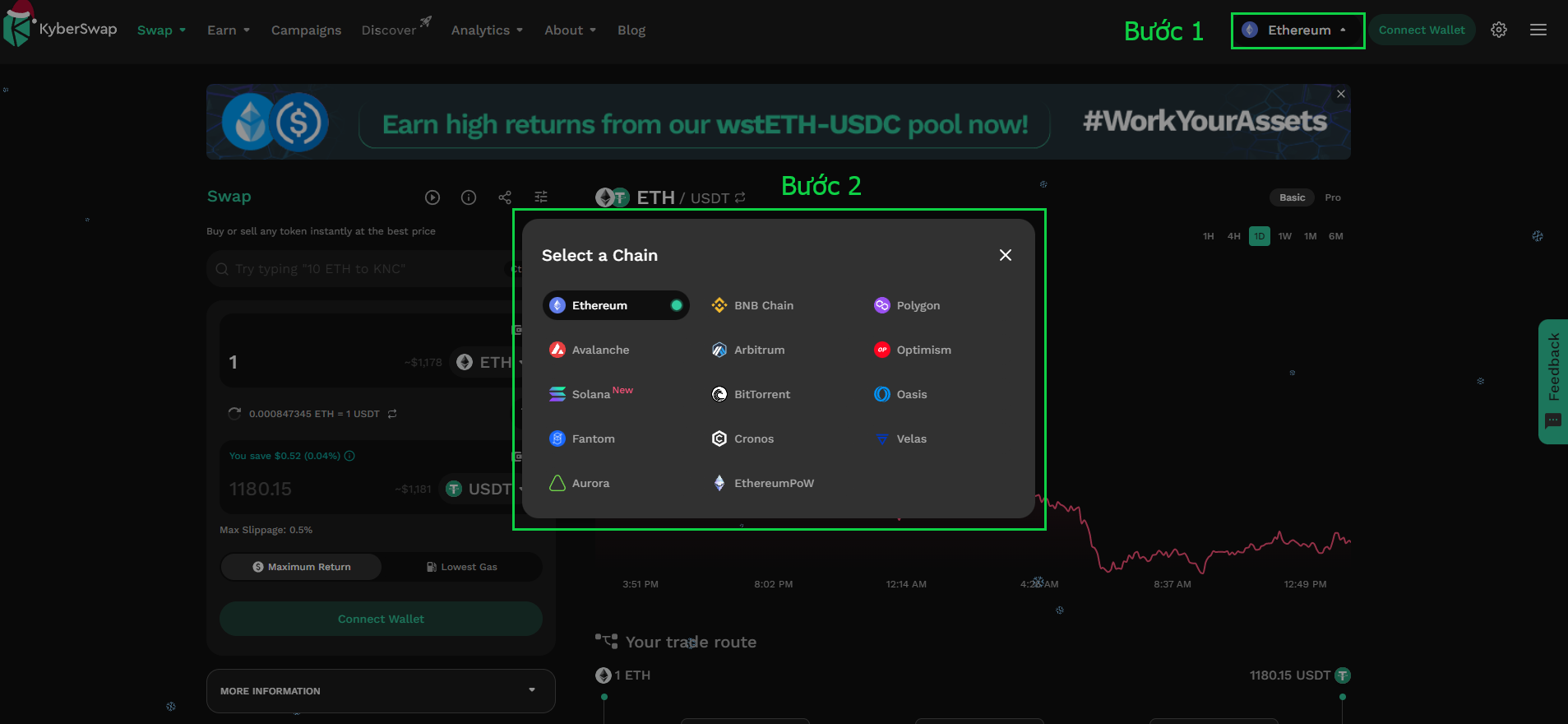

Step 2: Select blockchain to join. You can choose different participating chains to suit where your cash flow is.

Because my account only has USDC, I decided to buy more wstETH to have enough liquidity pair.

After selecting the amount, press Approve USDC. If Approve is successful, the next step is Swap. Then you successfully Swap from USDC to wstETH.

Step 3: Go back to Earn, select Pools and click on the wstETH – USDC liquidity pool.

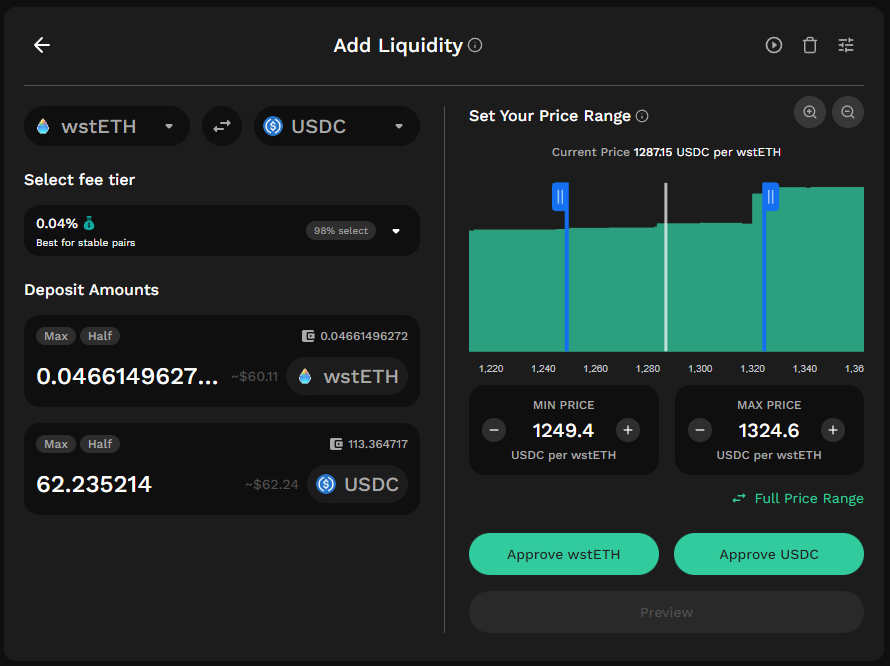

Here you have the right to choose the price range you wish to provide liquidity. Here you should strategize and predict the price of the token in the short term and adjust your strategy whenever the market changes. The wider the liquidity supply, the more price ticks, the less amount received per price tick. But if you provide a narrower liquidity range but are active, you get more, the APR is higher but it’s easy to go out of range.

Then select Approve wstETH and Approve USDC. Finally click Preview to complete the liquidity provision.

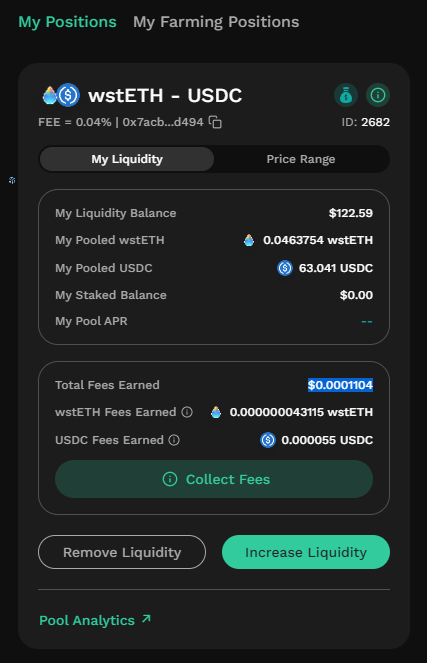

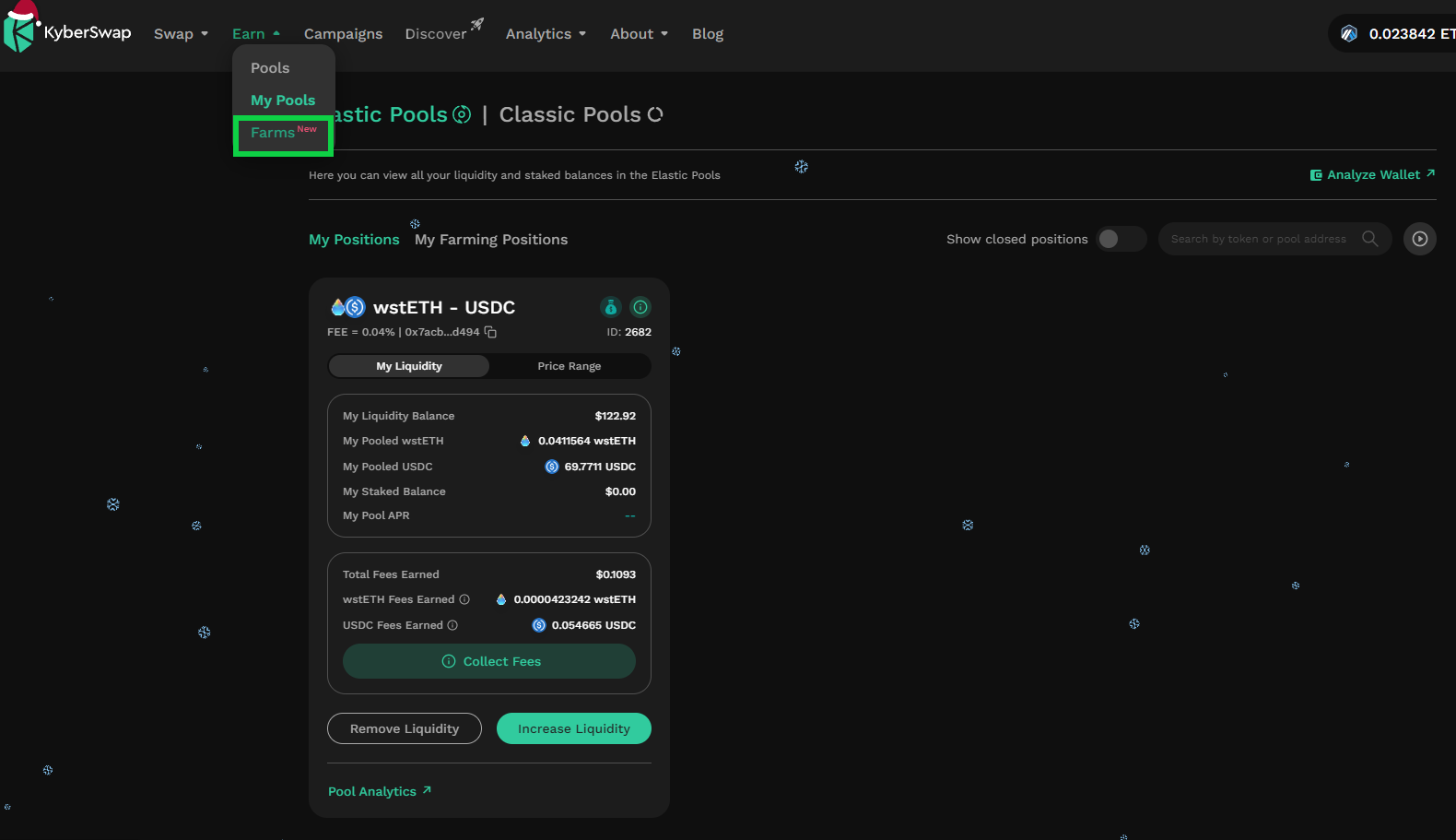

Click Earn and select My Pools to check your liquidity position. Some parameters you can check are the total $$ you are providing liquidity on KyberSwap, and the amount of wstETH and USDC you are holding in the pool. Ultimately there will be Total Fees you earn from the platform including USDC and wstETH.

Instructions for Farming on KyberSwap

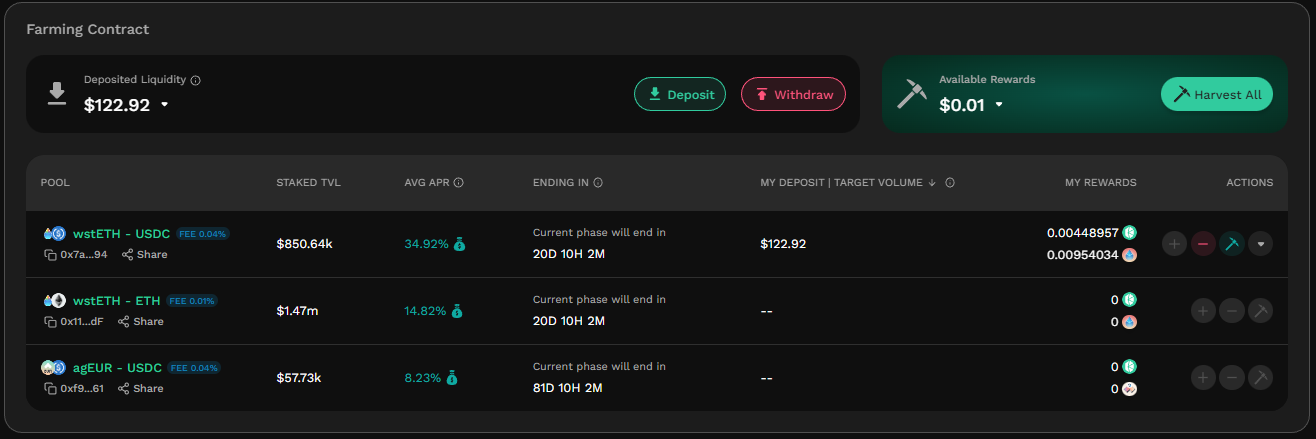

Step 4: After successfully providing liquidity for the wstETH – USDC trading pair. Then everyone will go to Earn and select Farms.

Step 5: After everyone provides liquidity to the wstETH – USDC pair, KyberSwap will return you 1 NFT representing your assets in the pool.

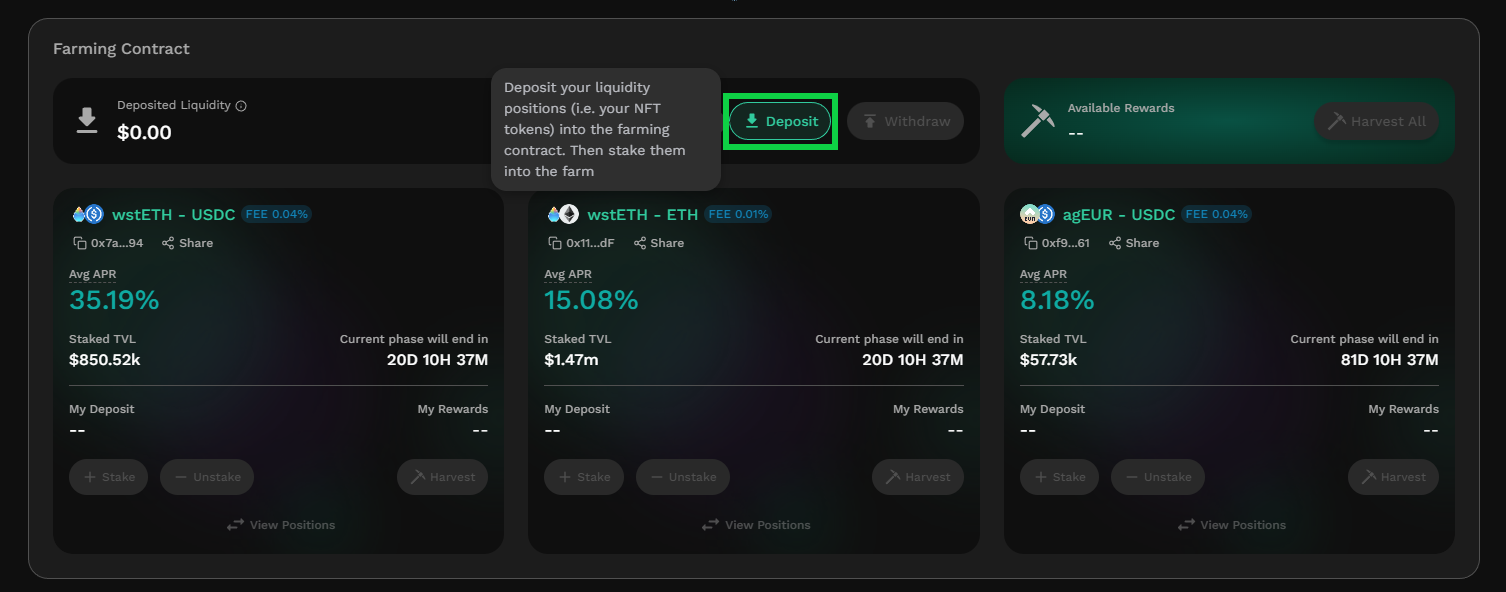

In the Farms section, select Deposit.

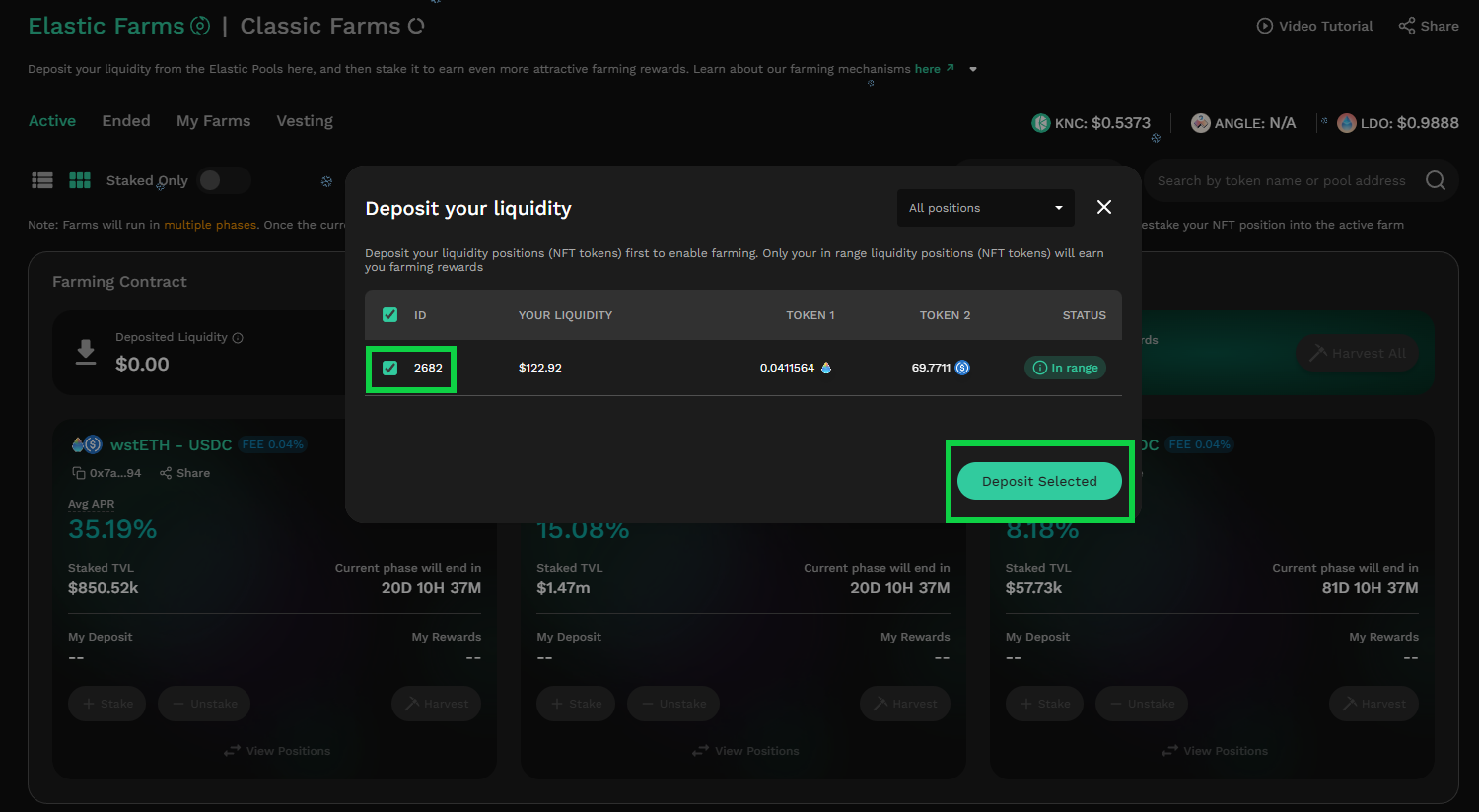

Step 6: In the Deposit section, check the liquidity pairs you are providing then click Deposit Selected.

Here, because above we only provide liquidity for the wstETH – USDC pair, so in the table below we can only add one pair. If you provide liquidity for multiple trading pairs, information for those pairs will also be displayed in the table below.

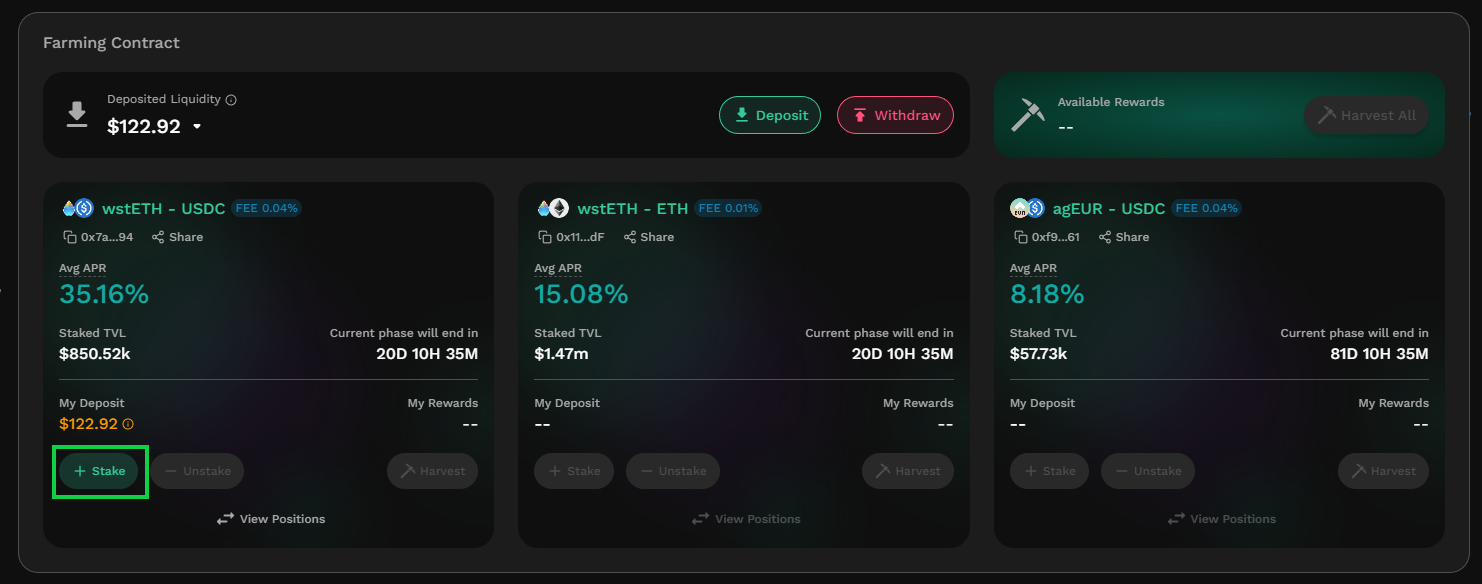

Step 7: After Deposit Selected successfully, you will choose to Stake into the Pool for which you are providing liquidity.

Note: Whichever liquidity pair you choose to add LP, remember to choose the pair to farm correctly.

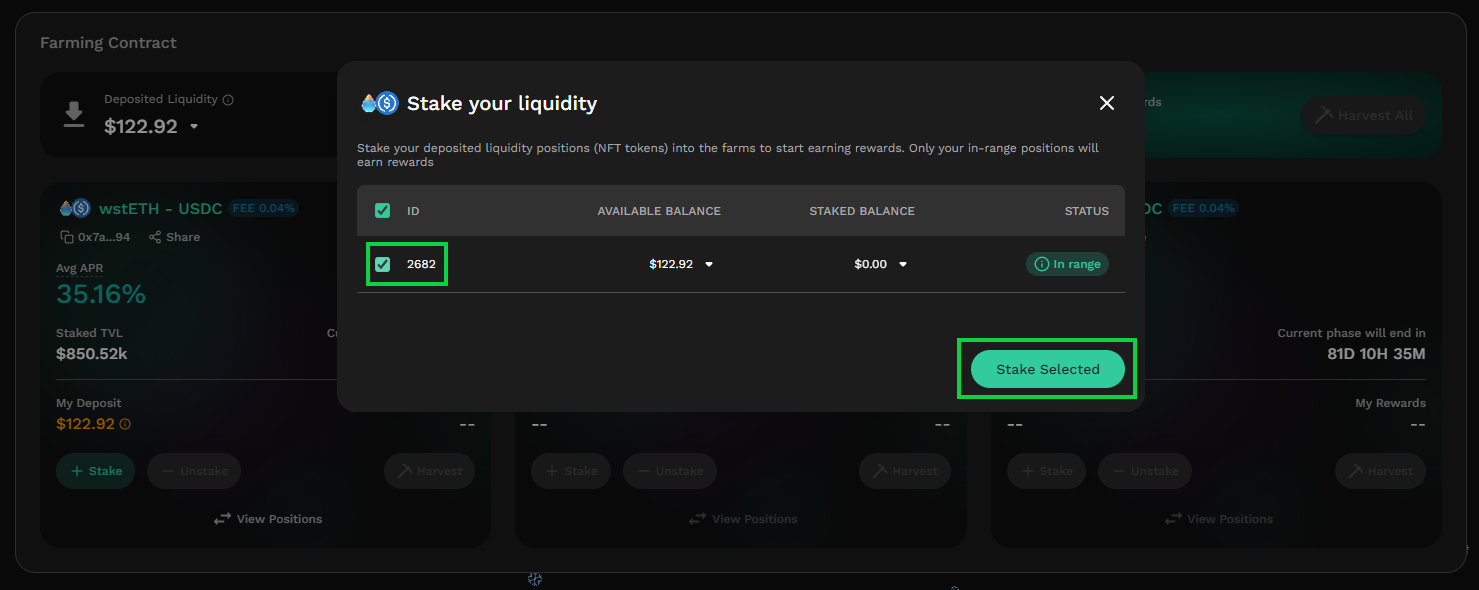

Step 8: After clicking Stake, a pop-up table will appear similar to when you Deposit, you will tick the pool where you provide liquidity then click Stake Selected.

And so you have successfully farmed on KyberSwap with a relatively high APR compared to the general market average.

Some Featured Farming Programs on KyberSwap

On each different blockchain, KyberSwap and its partners offer different farming events. So the important thing here is to find the right blockchain and the right trading pairs to participate in farming.

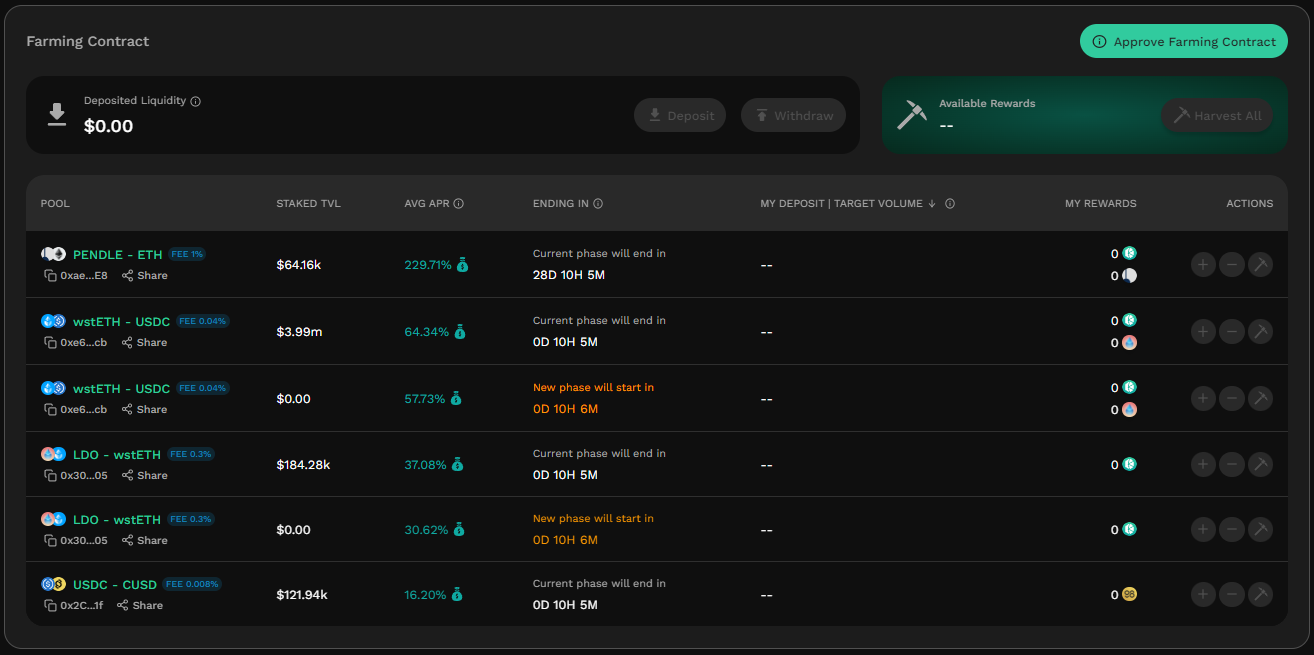

On the Ethereum network, there are trading pairs that offer APRs up to nearly 250% for LPs.

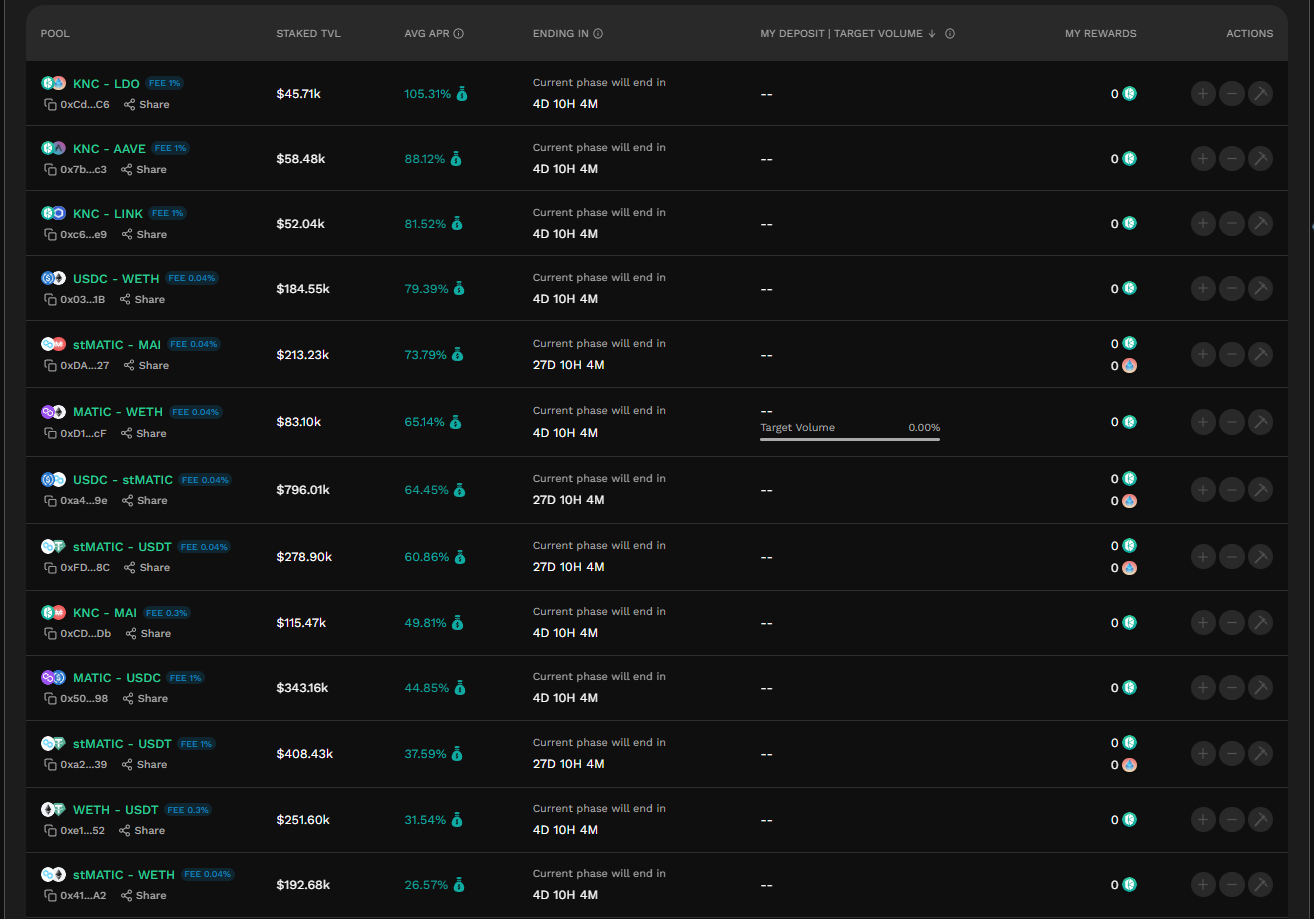

On the Polygon network, KyberSwap and its partners offer a variety of farming events with high APRs of over 100% across a wide variety of asset pairs.

The advantage of Polygon is that the network is very fast and cheap, so users almost do not need to worry about transaction fees when providing liquidity on Polygon.

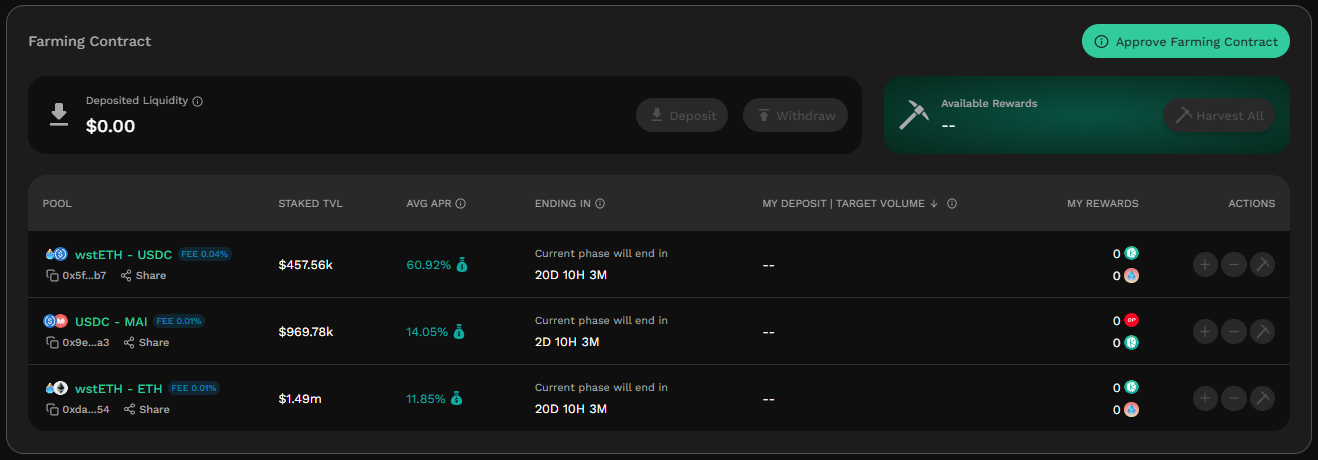

Especially on Optimism’s network, allowing users to farm the wstETH – ETH pair with an APR of up to nearly 12%. It can be said that this is a relatively high number compared to staking ETH on BeaconChain through Lido Finance with an APR of only about 5%.

With Arbitrum’s network, similar to the Optimism network, users can choose to provide liquidity for the wstETH – USDC or wstETH – ETH pair with high APR, especially for the wstETH – USDC pair (I am providing liquidity for this pair). ) with an APR of up to nearly 35%.

KyberSwap partners with Lido Finance to create Farming programs with high APR

KyberSwap recently partnered with Lido Finance to create multiple farming programs with high APRs that incentivize users to provide liquidity for trading pairs involving wstETH, ETH, USDC, and LDO.

What is wstETH?

Before participating in providing liquidity, you need to understand what the assets you buy to provide liquidity are and whether they are safe or not?

First, stETH is a derivative asset representing ETH participating in staking on BeaconChain through Lido Finance. And wstETH is stETH wrapped so it can be easily used on DeFi.

Choose farming according to risk appetite

If you are holding ETH, you can stake on Lido Finance through the Ethereum network to receive stETH with an APR of about 5%.

Then, bring in stETH with KyberSwap.

- If you are a person with risk appetite and you have a strategy for the price of ETH then you can give the wstETH – USDC pair with a very high APR of about 60% or the LDO – wstETH pair with an APR of nearly 30% plus APR Since staking on Lido is 5%, the total APR you earn is about 35 – 65%. It can be said that if calculated only on the Ethereum network, this is the most attractive APR for LPs at the present time

- If you are a safe person then you can choose to provide liquidity for the wstETH – ETH pair. With this trading pair, you do not need to worry much about IL (Impermanent Loss) because the price of wstETHh is pegged to ETH.

And if the user owns idle ETH in his wallet with this strategy, he can earn the following profits:

Summary

With the higher risk to money on exchanges or centralized lending platforms, transferring money to DeFi is difficult to avoid now and in the future. However, just leaving money alone is a waste, so becoming an LP and farming on DEX platforms to make money is considered one of the best ways to optimize assets during the dowtrend season.

However, every action in risk has different risks, so you should thoroughly research a platform before participating and have a clear strategy.

Note: All parameters are correct at the time of writing and may change or move at the time of reading!