Volatile interest rates have become associated with DeFi finance, attracting investors to take high risks along with high returns. But to bring DeFi to the masses, there is a booming number of Dapps that specifically focus on fixed-rate yield services.

This strategy is called Bankless and below are 5 fixed rate DeFi yield opportunities you can consider today!

Introduction to Fixed-Rate (Fixed Interest Rate)

Fixed-Rate Yield Products (fixed interest rate products): One of the main pillars of the traditional financial system. These services allow people and organizations to earn a fixed amount of money over a fixed period of time such as 6 months or 12 months, by locking in interest rates ahead of time.

So, Fixed-Rate Great for determining your income in advance and managing your spending and savings. Now, with the DeFi ecosystem maturing, accessing DeFi is easier than ever.

5 Dapps That Help You Earn Stable Profits (Fixed-Rate)

Below is the order of 5 Dapps that help you earn a stable income based on the underlying assets:

1.BarnBridge

A.BarnBridge Overview

- BarnBridge is a decentralized protocol for risk tokenization.

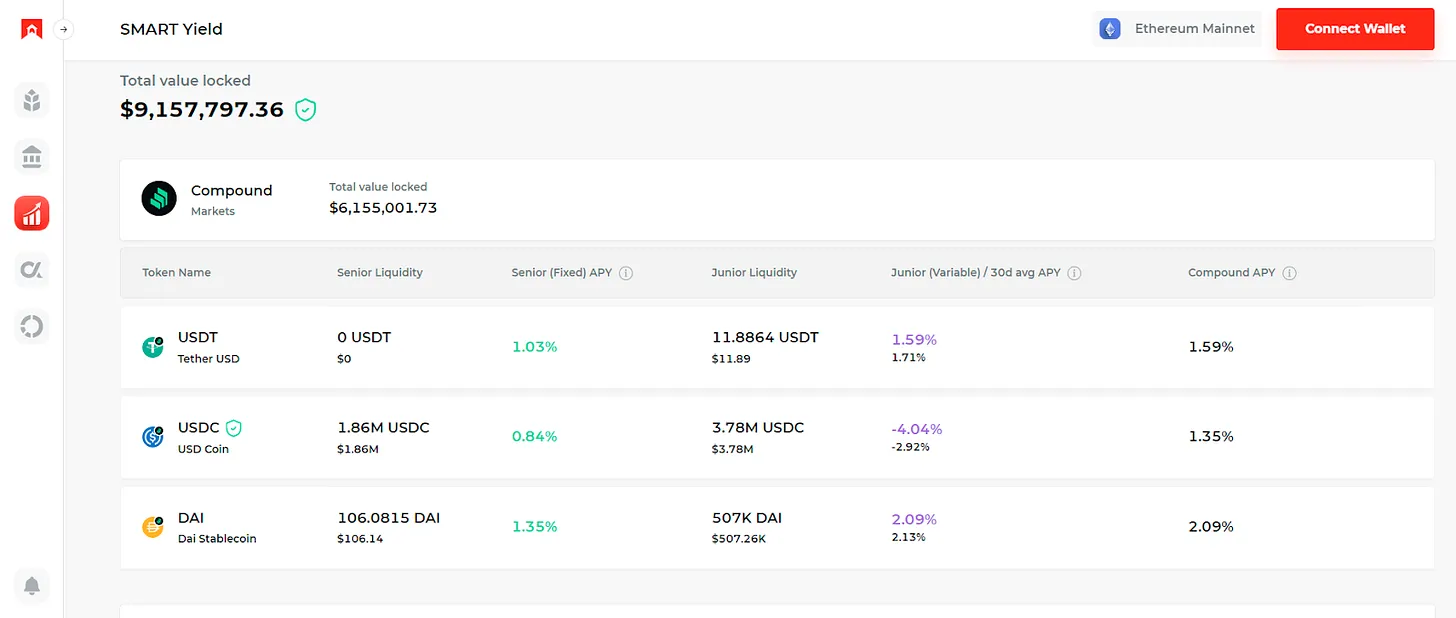

- SMART Yield BarnBridge’s flagship product, offers leveraged fixed or variable interest rates on Stablecoin deposits.

- SMART Yield lends these deposits across DeFi and splits the yield into premium bonds (NFTs called sBond) and underlying bonds (ERC-20s called jBond).

- Both sBond and jBond holders can profit simultaneously, although jBond holders are responsible for covering any shortfalls created by market fluctuations. Accordingly, sBond returns are fixed income, while jBond offers higher risk and higher reward opportunities.

Additionally, you can read more about BarnBridge here!

B.Earn fixed profits with SMART Yield (up to 1.7%)

- Step 1: Visit the Smart Yield dashboard and connect your wallet.

- Step 2: Choose from available markets (Aave and Compound) and click on the Stablecoin you want to deposit (USDC, DAI,…).

- Step 3: Click “Deposit”, select the Senior option and read the warning provided to ensure you understand the process.

- Step 4: Next, enter your deposit amount and desired maturity date, then click “Enable” to approve BarnBridge to access your funds.

- Step 5: Click “Deposit” to complete your deposit, then you will receive the sBond NFT and start earning fixed income. Note, this NFT is what you will use to redeem the principal and interest on the bond’s maturity date through the Smart Yield app.

2.Element Finance

A. Overview of Element Finance

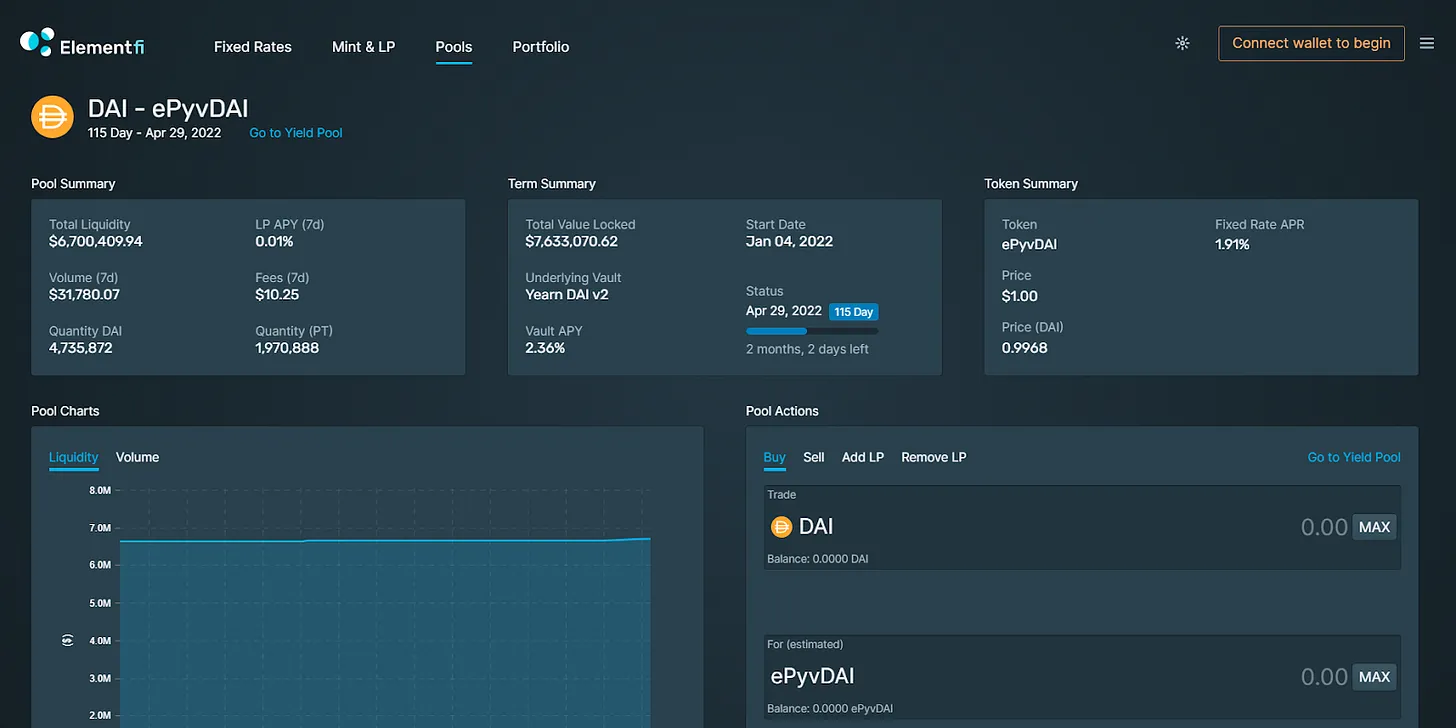

- Element Finance is a decentralized protocol for fixed and variable interest rate markets.

- Element allows users to divide underlying assets. For example, the ETH of a profit-generating position splits into two fungible tokens, Principle Token (PT) and Yield Token (YT).

- PT represents the value of the underlying principal (e.g. ETH) and is redeemable after the token’s term ends. Before this period ends, PT trades at a discount to its underlying asset.

- However, the value of a PT will eventually converge on a 1:1 basis with the underlying asset. Therefore, purchasing a discounted PT before maturity will yield a fixed rate of return if you hold the token until the redemption date.

Additionally, you can read more about Element Finance here!

B.Earn fixed profits with Principle Token (up to 14.6%)

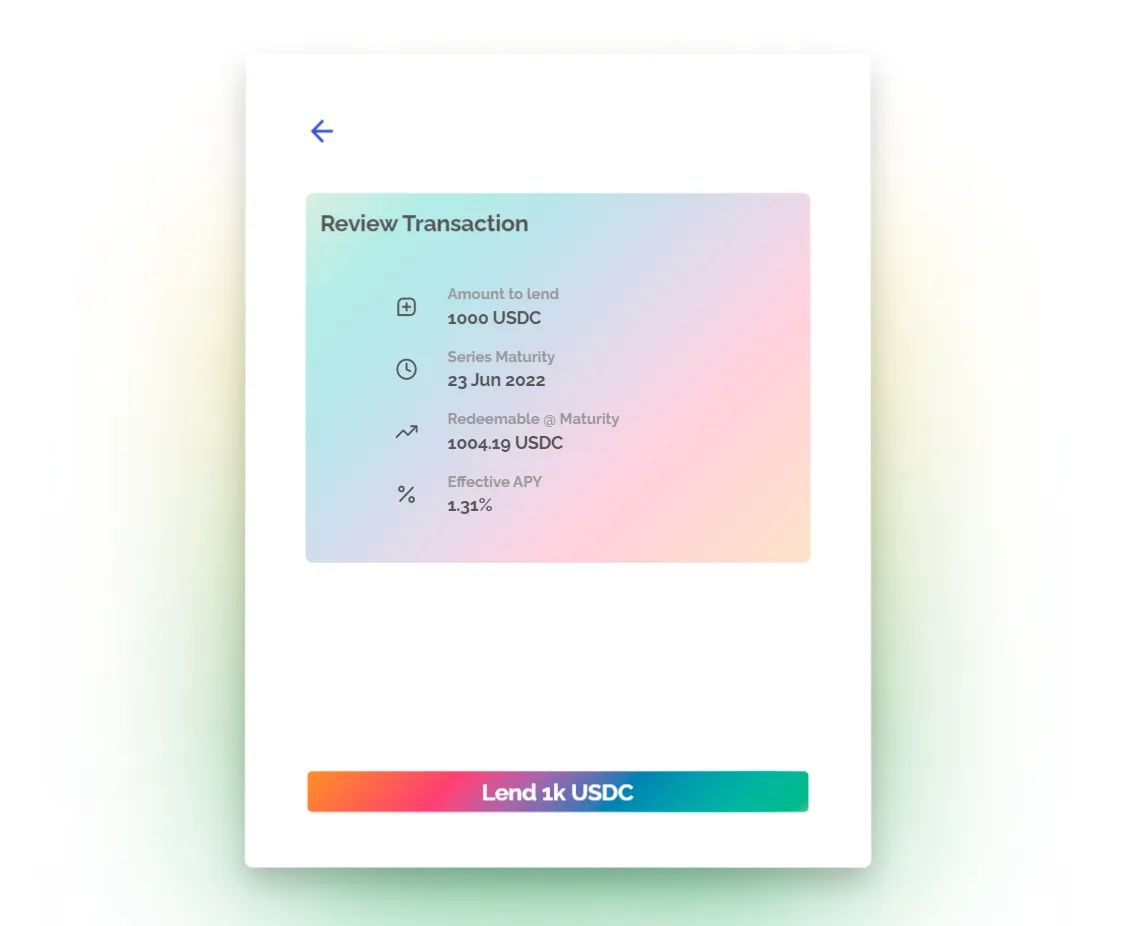

- Access Element’s Team page and connect your wallet.

- Review the available PT groups and click on your desired option.

- In the Purchase UI of the group operation menu, enter the amount of PT you want to purchase and press “Buy”.

- Confirm the purchase with your wallet.

- Now you can track your location via Element’s Portfolio page and then redeem your PT profitably after the maturity date.

3.Maple Finance

A. Overview of Maple Finance

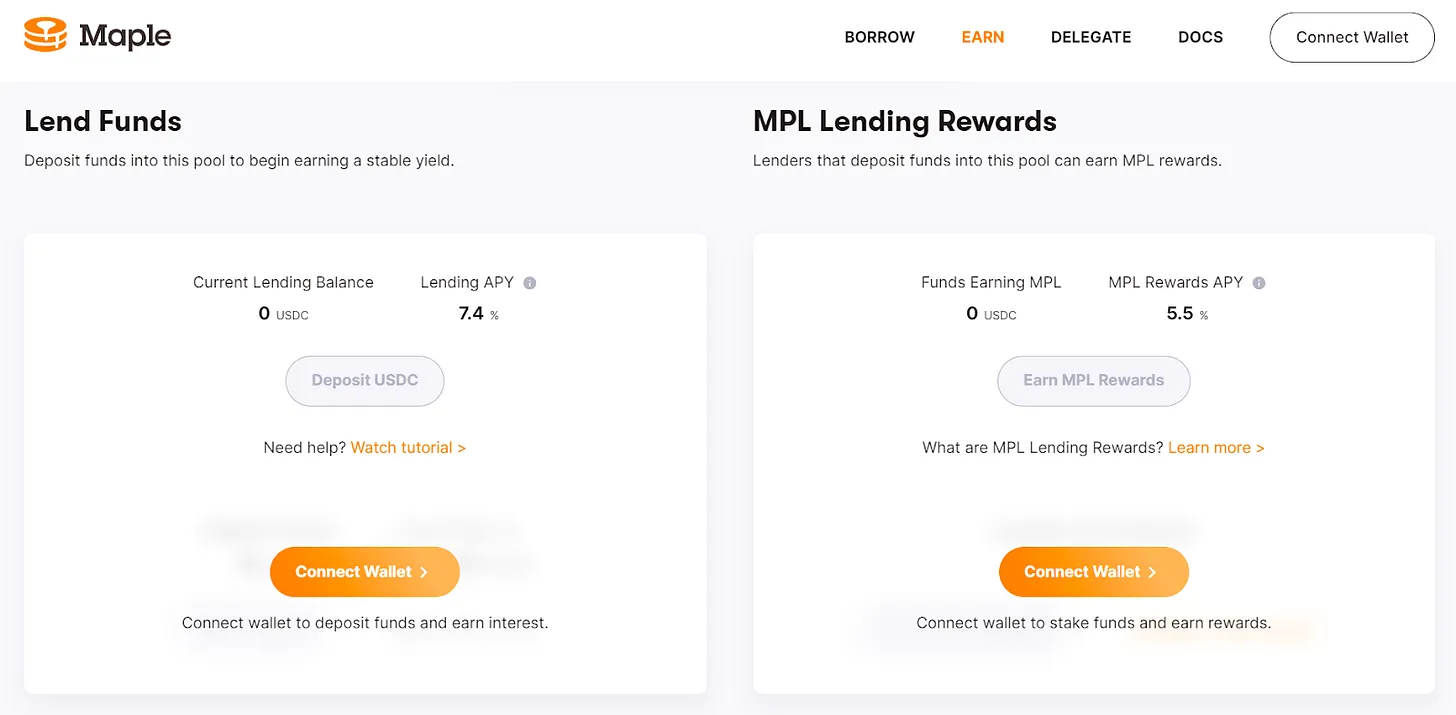

- Maple Finance is an unsecured corporate lending protocol.

- The project allows whitelisted companies to borrow from lending pools provided by public liquidity providers (LPs) without having to put up collateral first.

- Borrowers pay interest on their loans resulting in a fixed yield for Maple’s lenders.

- Maple’s liquidity pool is not always open for deposits. At the time of writing, group Orthogonal trading – USDC01 is the only group on Maple that accepts deposits.

Additionally, you can read more about Maple Finance here!

B.Earn fixed yields through Maple lending (up to 7.4%)

- Go to orthogonal trading group – USDC01 and connect your wallet.

- Click “Deposit USDC” and enable the approval transaction to allow Maple to access your funds.

- Next, enter your desired deposit amount and press “Deposit” to complete your loan transaction.

- You will then receive Maple (MPT) tokens, you can then consider staking them through the same orthogonal trading UI to earn additional lending rewards in MPL, tokens Maple root.

- Just remember that Maple lenders face a 90-day lock-in period, so don’t deposit any money you might need during the three-month period.

4.Notional Finance

A. Overview of Notional Finance

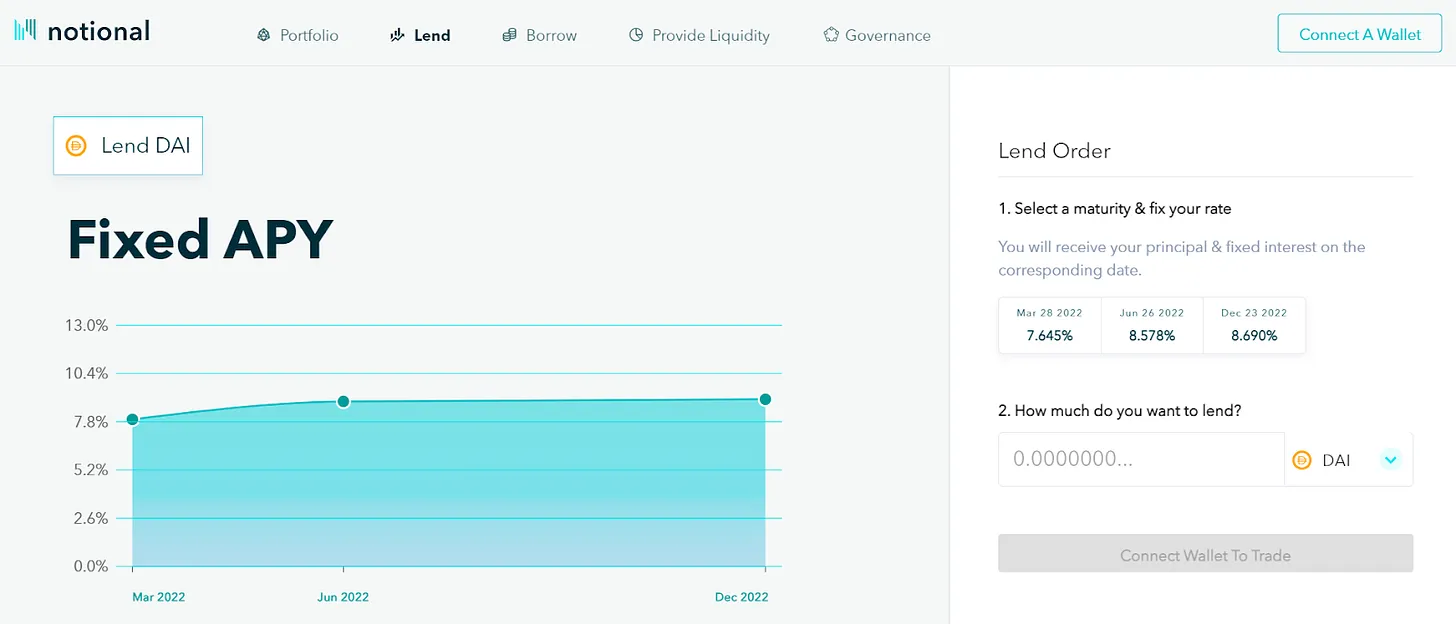

- Notional Finance is a decentralized fixed-rate borrowing and lending protocol.

- The project is underpinned by fCash tokens, which are used to track debt in the Notional ecosystem at any given time.

- Notional maintains its own liquidity pool, including fCash denominations and payment tokens (e.g. fDAI and cDAI).

- Therefore, those who want to lend their money to earn a fixed return can purchase fCash tokens from Notional, similar to how Element’s main token works.

Additionally, you can learn more about Notional Finance here!

B.Earn fixed profits with fCash (up to 8.7%)

- Go to the Notional Lend dashboard and connect your wallet.

- Click on the market of your choice for example DAI, then configure the maturity date and your desired deposit amount.

- Click “Confirm” then “Enable” and complete the approval transaction to allow Notional to access your funds.

- Then finish off by submitting your final deposit transaction and you’re done.

- Once the maturity date arrives, you can exchange your fCash for your underlying asset.

5.Yield Protocol

A. Yield Protocol Overview

- Yield Protocol is a decentralized fixed-rate borrowing and lending protocol.

- The project revolves around fyTokens, which are Ethereum-based ERC-20 that can be exchanged directly for an underlying asset after a predetermined maturity date. If you have a fyDAI token, you can redeem it for a DAI after the maturity date.

- To lend through Yield Protocol, you simply purchase the fyTokens of your choice.

- These special tokens do not inherently yield interest but are instead purchased at a discount, thus locking in fixed income if held until maturity.

Additionally, you can learn more about Yield Protocol here!

B.Earn fixed profits with fyTokens (up to 1.29%)

- Visit the Yield Lending dashboard and connect your wallet.

- Choose between the USDC or DAI market, enter the amount you want to buy, select the desired maturity date, then press “Next Step”.

- Review your transaction details, then click “Lend” and sign to confirm the next transaction.

- After depositing, you can manage your vault by clicking its icon on the bottom left of the Lend dashboard.

- You can redeem your fyTokens upon maturity or expand your position through your personal vault page.

summary

Variable interest rates are not the only option in DeFi, as there are a growing number of new protocols focused on offering fixed interest rate products that many traditional users and institutions prefer. The projects featured above deliver fixed income in their own unique ways, but they all point towards a future in which fixed interest will become a much larger part of DeFi.

Hopefully this article provides you with many good strategies to make stable profits, especially when the market is difficult.