Each of us participating in the DeFi market is tacitly accepting the trade-off of a high level of risk with extremely huge profits. If we know these risks in advance, we can limit them. somewhat. Join Weakhand to learn about the 5 risks of DeFi and how to limit them and achieve the highest profits.

Some other articles that can help people better understand the DeFi market:

- Episode 1: What is DeFi? The Puzzle Pieces That Make Up DeFi

- Episode 2: What is DEX? The Role Of DEX In DeFi

- Episode 3: What is Lending & Borrowing? The Essential Puzzle Piece in DeFi

DeFi Overview

DeFi market stands for Decentralized Finance, also known as a decentralized financial market, where everyone can buy, sell, trade and participate in general activities without having to go through any any intermediary.

DeFi first exploded with basic pieces serving minimal financial purposes such as DEX for buying and selling transactions, Lending for people to borrow and lend,… However, after After a long period of development, higher pieces of the puzzle also began to form to turn DeFi into a full market no different from finance such as Perpetual, Options,…

Because it is a relatively young market, the profit opportunity when participating is also very large when the price fluctuation range is very high. However, the risks of DeFi are therefore always hidden and do not ignore anyone’s negligence.

5 Risks of DeFi That Users May Encounter

Smart contract risks

Smart contract, also known simply as smart contract, is programmed to perform certain actions. If you compare the DeFi market to a living organism, smart contracts are the skeleton, playing the role of supporting and operating the entire system.

Basically, they are programmed with lines of code and must always try to ensure both requirements:

- Ensure the highest accuracy to avoid security problems.

- Most optimal to minimize the burden on the system and lower transaction costs.

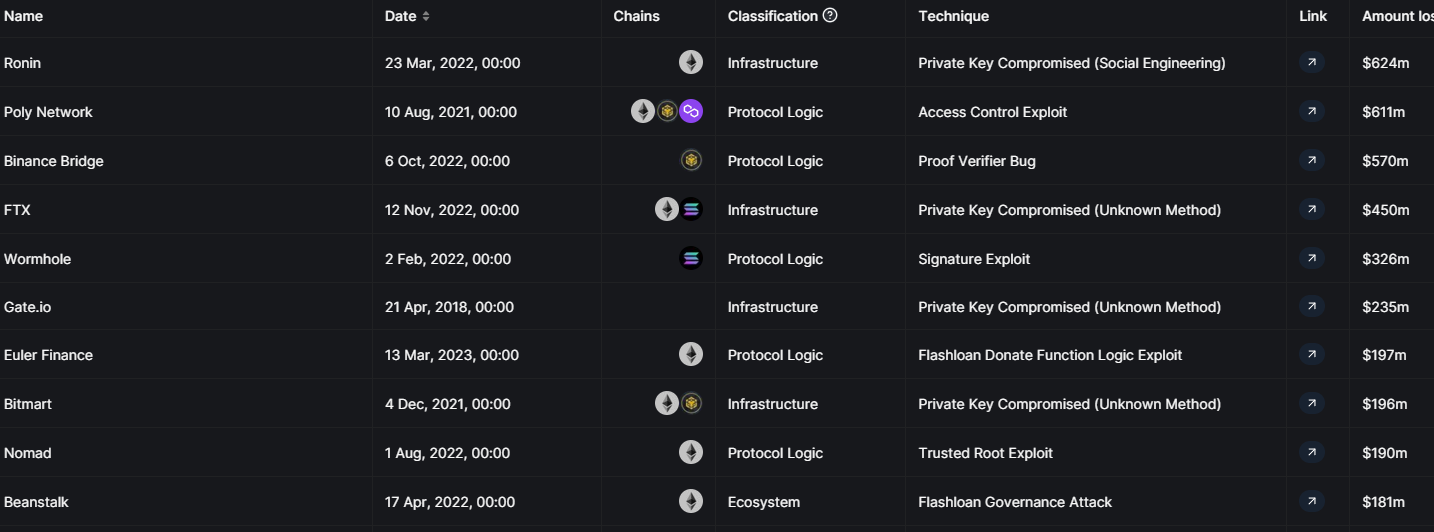

However, trying to balance between these two things creates security holes for smart contracts. Although they are very few, once exploited, a large amount of money will be stolen. Vulnerabilities appear especially in complex structures like Bridges that have been attacked by hackers and caused billions of dollars in damage.

In addition, the infrastructure of the DeFi market at the present time is not guaranteed to accommodate a large number of people trading at the same time. Therefore, DDoS attacks also frequently occur, causing network congestion and users cannot make transactions at this time to exit their positions.

Oracle service providers also frequently encounter some problems in providing prices and information from the real world. Therefore, loans and mortgages in Lending Protocols also face certain risks, although this number is not too large.

To limit risks related to smart contracts when using DeFi products, people can use the following measures:

- Limit depositing all assets to a single protocol.

- Check the reputation of the auditing parties before sending assets to the smart contract.

- When making a transaction, approve a sufficient number of tokens for that transaction.

- Regularly check and revoke asset usage rights from unused smart contracts through the Revoke Cash application.

- Do not use Lending too many different types of assets.

Rug Pull Risk

Whether in the traditional financial market or in DeFi, there are always developers with bad intentions, always deliberately using all tricks and forms to steal assets from users and then flee.

The common model of these subjects is to create a project with the same models as the trends going on at that time such as Real Yield, Yield Farming, Perp DEX,… and commit fraud. in 2 forms as follows:

- Creating fraudulent tokens: Provide a small amount of liquidity with a small amount of total token supply and let the community buy and supply more on its own. After the token price increased many times and there was a sufficient amount of tokens, the scammers sold or withdrew all liquidity to make a profit, causing the token price to drop to nearly zero.

- Creating fraudulent Liquidity Mining programs: Fraudsters create Yield Farming pools with interest rates up to tens of thousands of percent per year to attract users to deposit assets in BTC, ETH or stablecoins. These smart contracts often allow the owner the full right to withdraw assets. Once they see enough or no one deposits more, the fraudster will withdraw all the money and flee.

This form of Rug Pull fraud is quite popular in the uptrend market when the market welcomes an influx of new people, bringing a huge flow of money into DeFi. Fraudsters will take advantage of the Fomo mentality of wanting to get rich quickly to be able to appropriate assets.

To avoid the risk of Rug Pull, people can use a few of the following methods:

- Carefully check the project before investing through Website, Twitter,… reputable information sources from third parties before investing or sending assets.

- Check smart contracts with huge APY before using using tools like DEXScreener, PooCoin, …

Risk of fake links

In essence, the problem of fake links is also common in both traditional financial markets and DeFi, scammers will create many different websites with interfaces and links similar to large projects like Uniswap. , Pancakeswap, StarGate Finance,… When users access these websites, if they do not carefully check and perform transactions as usual, all assets in their wallet will be stolen.

Fake link scammers will often use the following ways for users to access the fake link:

- Run ads for fake websites to the top so users who don’t check carefully and click the link.

- Hack into the project’s social media channels then send fake links hidden under airdrop or IDO notifications.

The most recent example is the incident where Vitalik Buterin’s Twitter account was hacked and posted a message allowing users to mint NFTs related to Ethereum’s upcoming update. After users access the link and then connect the wallet and mint NFT, all assets in the wallet will be hacked. After just one hour of posting, about $600K of the user’s money was stolen.

To avoid accessing fake links, the first thing people need to prepare is to refer to websites that provide reputable information such as:

- Foundation from the construction project itself: Twitter, Discord, Link3, Linktree,…

- 3rd party platform: Coingecko, CoinMarketCap, Defillama,…

In addition, everyone also needs to have basic skills such as checking sponsored websites on Google or double checking any information unexpectedly released by projects such as conducting airdrops. , IDO,…

Impermanent Loss Risk

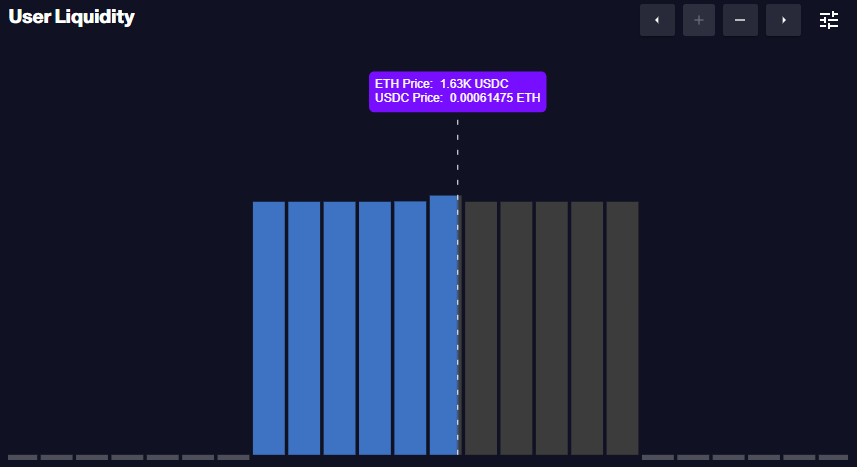

Unlike the risks mentioned above, the risk from Impermanent Loss comes from a more objective perspective when users provide their liquidity on the liquidity pools of the AMM DEX, Perp DEX, Options platforms. ,…

Impermanent Loss comes from the fluctuating value between tokens in the liquidity pool, causing them to automatically be transferred to each other to balance at a certain ratio, which can be 50-50, 30-70, 20-80, … This results in less profit than holding each type of asset separately.

To completely avoid Impermanent Loss is impossible if we provide liquidity between 2 different altcoins. However, we can also calculate the volatility value and the interest received then use centralized liquidity provision mechanisms on Uniswap or Maverick to automatically stop supply when the price fluctuates strongly.

Legal risks

Currently, the DeFi market in particular or Crypto in general is still very new compared to most people in the world. Therefore, countries have not placed much emphasis on research and development of laws specifically for the Crypto market.

In addition, using high-capacity excavators also consumes a large amount of electricity, which causes two problems:

- Lack of environmental sustainability because most of the world’s electricity today is produced from thermal or hydroelectric power and these are not environmentally friendly sources of electricity.

- For countries facing many energy problems, the wasteful use of electricity to operate excavators will be limited.

Therefore, the use of energy to operate excavators will be quite limited or prohibited in some countries with energy and environmental issues. Tightened policies will make it harder for people in these countries to access both the Crypto and DeFi markets.

This is the case for countries with strict laws, but if we look broadly at all the rest of the world, trading Crypto and using the DeFi market can also be said to be outlawed. the law. Being outside the law like this means that our assets will not be safely protected and managed by the state if any unforeseen events occur.

Summary

Weakhand has just brought to everyone 5 risks of DeFi that anyone participating in the market can encounter. Hopefully through this article, everyone will find useful information and avoid risks that may be encountered when participating in the DeFi market.