The biggest difference between the Crypto market and the traditional financial market is that the information of every transaction on the blockchain is very transparent. That transparency is expressed through On-chain information, however, we quite difficult to access for newcomers. In this article Weakhand will bring everyone the 5 best On-chain Crypto tools to serve the investment process.

Some other articles for newbies that people can refer to:

- What is Arkham (ARKM)? Arkham Cryptocurrency Overview

- 5 Crypto Portfolio Management Tools

- 5 Best On-chain Crypto Tools

- 20 Essential Crypto Websites for Beginners

Why Is On-Chain Analysis Needed?

What is On-chain?

On-chain can be said to be all information stored on blockchains such as transaction data from wallet addresses and smart contracts. This is also the point that makes the Crypto or DeFi market different from traditional financial markets when anyone can access and view all this data.

However, basically, pure data in the form of programming language is quite difficult to access for users who do not have technology knowledge or are new to the market. Therefore, On-chain tools were born to help everyone access this data in an intuitive, easy-to-understand way.

Why is On-chain analysis necessary?

On-chain analysis is a very necessary action before investing in a coin or token, because the project or investment fund will often hold that token in its own wallet, so observing and analyzing the actions of These wallets are to be able to predict future trends through token movement actions.

In addition to helping people identify investment opportunities from an individual project, the On-chain model can also help people identify general trends in the entire market thanks to tools provided by projects. provide.

5 Best On-chain Crypto Tools

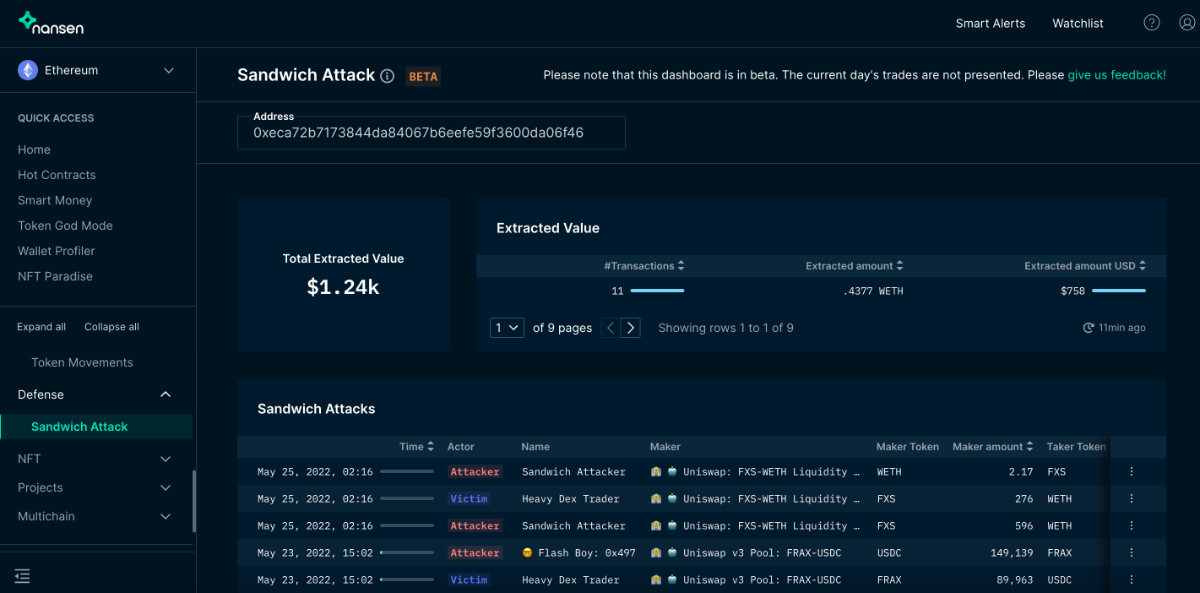

Nansen

Nansen is an On-chain tracking platform that helps users find a variety of information such as the activities of a wallet address or statistics on the general performance of a project, coin, token, NFT and display it as easy-to-understand information.

Features related to coins and tokens that Nansen provides include:

- Token Paradise: Displays coins and tokens that tend to be most active on a defined blockchain.

- Token God Mode: Displays a lot of information about a token such as price and trading volume, smartmoney wallets held, liquidity on DEX platforms,…

- Exchange Flows: Shows the overall inflow and outflow of all tokens on CEX exchanges.

- Token Moverments: Allows people to filter the fluctuations of a certain coin/token over a certain period of time.

- Token Overlap: Users can check the movement between 2 different tokens.

- Token Trends: Provides reference information about trading pairs with the largest volume of traders.

- Stablecoin Master: Allows users to check information about stablecoins on CEX and DEX exchanges.

However, to be able to use many functions, users need to pay certain fees according to each package:

- Standard: $100/month.

- VIP: $1000/month.

- Alpha: $2000/month.

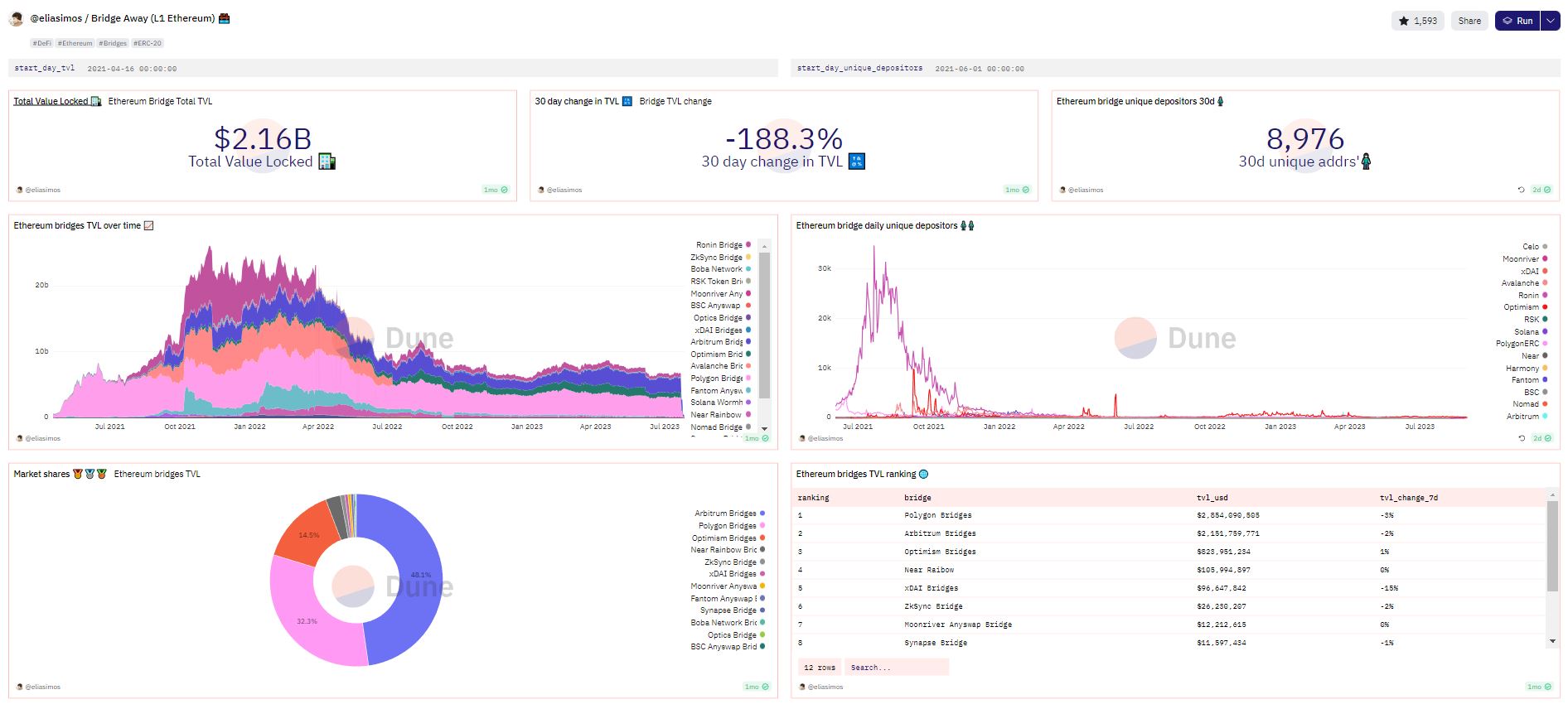

Dune Analytics

Dune Analytics is a data analysis platform for Blockchain projects including many different areas such as DEX, Lending & Borrowing, Bridge,… To be able to compile data from such large sources, it is necessary to Dune Analatics is completely Open Source so developers can develop it themselves and then provide it to the community completely free of charge.

The programming language used by Dune Analytics is SQL, allowing developers to easily query data on many different blockchains with ease. Thanks to that, the data brought to readers on this platform is also extremely diverse in many different forms such as:

- Numerical statistics pages.

- Circular distribution charts.

- Column or line growth charts.

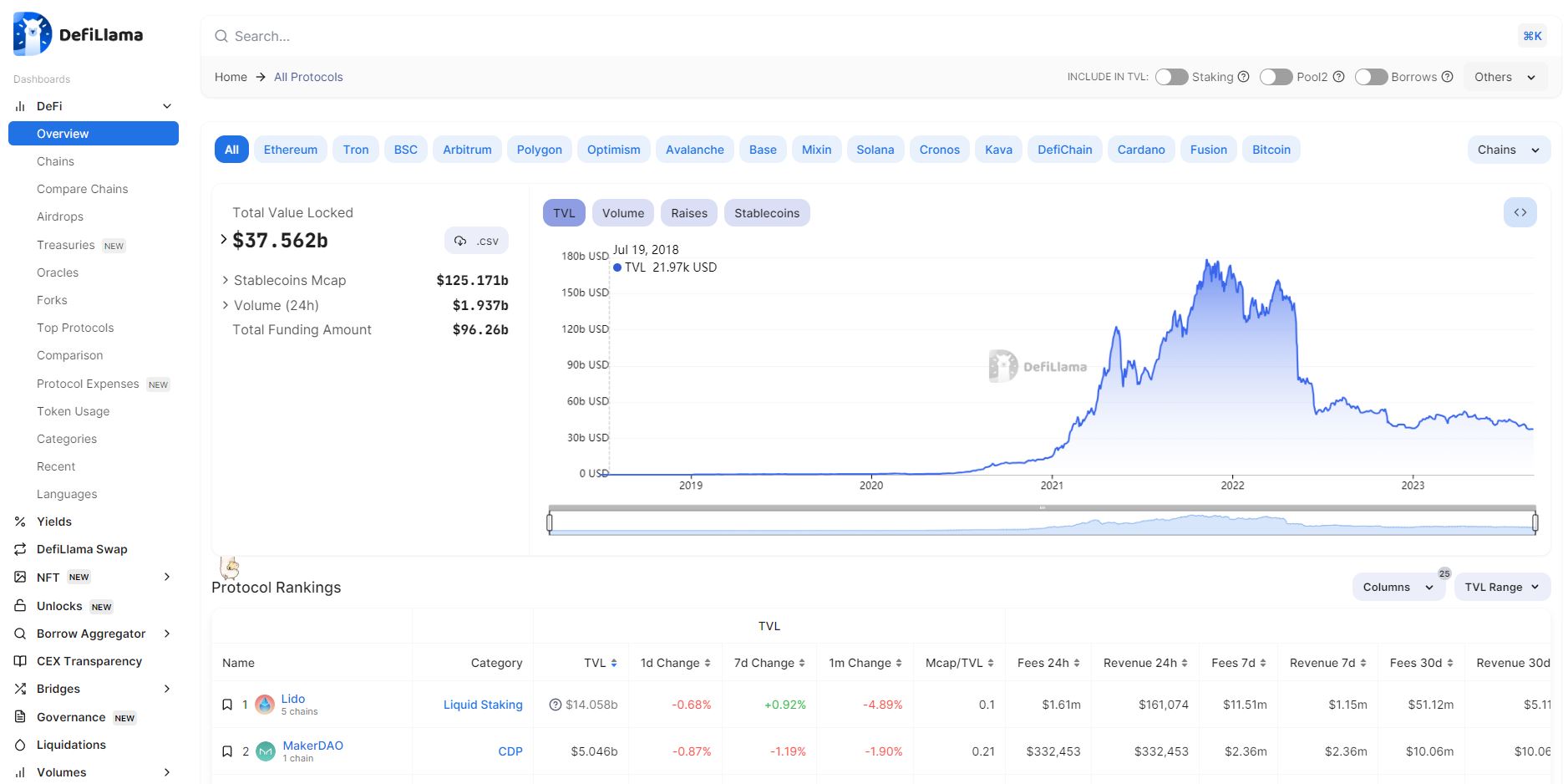

DefiLlama

DefiLlama became known to most people during DeFi Summer with its most prominent function being the Total Value Lock statistics of all projects on the market. TVL is often considered by users to be the lifeblood of the DeFi market as everyone relies on it to determine which blockchain is receiving cash flow.

In addition to information about TVL, currently Defillama also provides a lot of other On-chain information such as:

- Airdrops

- Orcale

- Forks

- Treasures

- NFTs

- Token Unlocks

- Fund Raising

- Bridge

- Volume

Based on the fluctuations of TVL, we can easily find projects with strong growth in a certain period of time. In addition, based on many other indicators related to the project such as Volume, Fees, Revenue,… can one evaluate whether the project is operating effectively or not?

Arkham

Arkham is also an On-chain tracking tool quite similar to Nansen, but instead of focusing on data statistics and then selling them to users, Arkham focuses on letting people search and set up their own data. Design different data files and keep track of them.

In addition, Arkham also has an exchange called Arkham Intel Exchange, allowing users to buy, sell or auction the data they hold. Some other very useful features that Akharm provides for free to users include:

- Dashboard: Allows people to easily track what assets one or more of their wallet addresses are holding.

- Alerts: Give users warnings via Gmail or Telegram immediately to the owner when the wallet address has interactions such as sending, receiving tokens, swapping,…

- Viasulizer: Allows anyone to trace every wallet address’s interactions with all other wallet addresses or protocols in an easy-to-understand diagram.

- Orcale: Integrates a chat bot with artificial intelligence to interrogate various information about the on-chain situation of any wallet address.

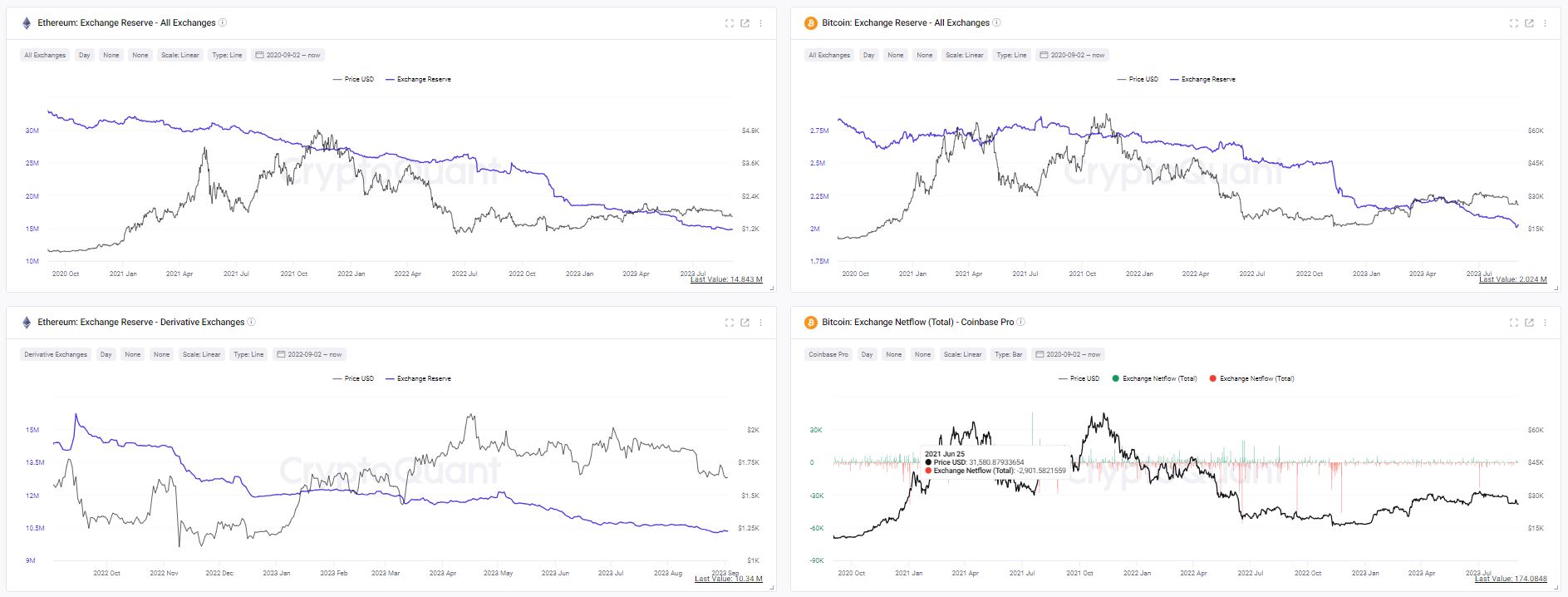

CryptoQuant

Cryptoquant is an On-chain data company established in 2018, the data this platform provides focuses on Bitcoin and projects with large market capitalization such as Ethereum, Solana, BNB, Avalanche ,…

The data that Cryptoquant provides is often in statistical form such as:

- ExchangeNetflow: Total deposit and withdrawal volume from CEX exchanges.

- Miner Flow: Miner movements on PoW blockchains like Bitcoin.

- Fees & Revenue: Overview of fees and revenue of blockchain operations.

- Derivatives: User derivatives trading data on CEX exchanges.

Because of the nature of the data provided, Cryptoquant is often used to observe the deposit and withdrawal situation from CEXs, the movement of Bitcoin whales,… so that it can determine market trends in a given period. long period of time is harmful.

Summary

Above are the 5 best On-chain Crypto tools at the present time as compiled by Weakhand. Hopefully, through this article, everyone will be able to find useful tools for the research process. save the market.